Tax Planning

5 Rules for Turning Your Vacation – Even a Luxurious One – Into Tax-Deductible Business Travel

Bradford Tax Institute

Estimated tax tip savings: When you convert your vacation into a business trip, your transportation expenses suddenly become deductible. Consider that $1,200 business-class plane ticket back home to see your parents— with the right tax planning, you can deduct 100 percent of the cost.

Isn’t it about time you took a vacation?

Maybe you don’t think you have the time or the extra cash?

You could solve both the time and cash problems when you make the vacation a business trip and deduct your travel expenses.

What kind of travel are we talking about? In general, business travel can be about as luxurious as you can dream up! For example, all of the following can qualify as deductible business travel expenses:

⦁ Airfare, including first-class tickets.

⦁ The presidential suite in your favorite hotel.

⦁ Rental car expenses for a Rolls-Royce.

⦁ Boat tickets—and yes, this includes cruise travel. 1

So whether you are planning to stay in a luxury resort in the Caribbean or you simply need to visit the in-laws two states over, you could save yourself a boatload in taxes when you turn your vacation into a business trip and deduct most or all of the cost.

Types of Travel Expenses

When you travel for business, you can deduct two big types of expenses:

1. Transportation expenses. The cost of transportation in the 50 states and Washington, D.C., is an all-or-nothing expense. If you spend the majority of your trip days on business, you deduct 100 percent of your direct-route transportation expenses. If the majority of your days are personal days,

you get zero deductions.

2. Life expenses. During travel, you can deduct the cost of sustaining life—these expenses include lodging and meals. You can deduct these expenses on business days but not on personal days.2

The Basic Rule on Business Travel

According to the tax code, you can deduct your travel expenses as long as your trip is an “ordinary and necessary” cost of doing business.3

The courts have interpreted this rule extremely broadly. For example, an “ordinary” expense does not have to be a common practice in the industry.4 “Necessary” does not refer to a business need but rather to something that is “appropriate and helpful.”5

As a result of this broad interpretation, the tax code rule isn’t very helpful unless you know more. That’s okay. We know it’s hard for our friends in Congress to come up with simple, clear rules.

To get the real story on business purpose, you have to sift through case law and see what the courts say in particular cases—which we do for you beginning with the next section.

The Real Test

When courts decide business purpose cases, they consider all the relevant “facts and circumstances,” which for our purposes means we have to compare and contrast each case to find the overarching, guiding principles we can use in practice.

We have summarized the case law into five rules that you can use to justify a business purpose for your trip:

1. Profit motive. You need to have a reason why the trip will help your business make money. You don’t have to show an immediate profit, but you must expect the trip to create profit for you at some point in the future. Write this reason down in your records.

2. Stay overnight. Remember the overnight rule. You get deductions only for business trips on which you stay overnight away from your tax home.6

3. Apply the “for only” test. When you plan your trip, ask yourself whether a rational businessperson would travel for only the business reason—or is the personal element so important that the trip does not make sense without it?

4. Primary purpose test. For travel in the United States, you need to pass the primary purpose test. The easy way to do this is to make a majority of your days business days.

5. Maintain good records. This may be the most important step for your business travel deductions. You must keep the right records, as we explain below.

The Cases

Since courts decide cases based on the specific facts, it’s helpful to hear the details of some actual cases.

The next few sections summarize some relevant cases, starting with the winners and then showing you some losing arguments that cost business owners their deductions.

Board Meetings in Resort Locations

Charles Hinton Ill was the sole owner of United Title Company, a C corporation based in North Carolina. Each year, Hinton sponsored an out-of-state board meeting, the first year in New Orleans, then the next year in Las Vegas, and then in Puerto Rico.

Hinton invited:

⦁ the 11 to 14 corporate board members (the “board members”) and

⦁ select North Carolina real estate attorneys, developers, real estate agents, bankers, lenders, and their spouses or friends (the “business guests”).

During the trips, the corporation conducted the annual board meeting, and then the corporate employees met with their business guests to discuss underwriting policy and other topics related to the business.

Court ruling: All travel expenses were deductible (except for those for non-business spouses and friends). The corporation needed to hold the meetings in interesting locations to ensure that their business guests would attend. The corporation benefited through the business discussions and by strengthening their relationships with other business people in their field.7

Trips to Expand Business

Raymond Jackson won his travel deductions for trips he took outside his normal sales territory to pursue new client accounts. The trips gave him the opportunity to expand his business by finding new clients.8

Note that if you are creating a new business and it does not yet exist, you have to treat these expenses as start-up expenses, which are subject to special tax treatment.

Justifying Travel with a Convention or Seminar

Conventions are a great reason to travel, since they often take place in areas that double as nice vacation spots. Here are a few points to remember with regard to conventions:

⦁ Travel expenses to conventions inside the North American area are deductible if the convention advances the interests of your business.

⦁ Conventions outside the North American area must relate directly to the conduct of your business, and it must be reasonable for the event to take place in the chosen location.

⦁ If the convention provides videotaped lectures, you can deduct travel expenses only if you could not view the lectures from any other location. In other words, if you could have viewed the streamed lecture from home, no travel deductions.9

⦁ You cannot deduct the expenses when the seminar relates to one of your investment activities and not to your trade or business.10

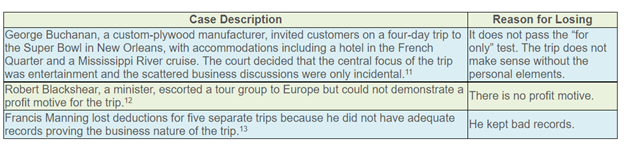

Examples of Losing Arguments

You need to do better than the people on this next list.

These taxpayers lost their travel deductions because they could not prove a strong business reason for their trip.

Bad Records Will Sink You

Tax law requires you to keep records of the following elements as proof of your business travel:14

- The amount of each separate expenditure for traveling away from home.

- The date of departure and return for each trip, and the number of days during the trip spent on business.

- The name of the city or town you visited.

- The business reason for the travel or the nature of the benefit you expect to gain from the travel. For more on this important requirement, see How to Prove Expenses for Tax-Deductible Business Travel.

Takeaways

If you are thinking of going on a vacation, try mixing in some business. If you find the right business reason and spend enough time on business during the trip, you can make your travel expenses deductible.

With regard to the business reason, remember these five key principles:

1. Profit motive. You need to have a reason why you expect the trip will make money for your business, whether immediately or sometime in the future.

2. Stay overnight. Remember the overnight rule. You get deductions only for business trips on which you stay overnight away from your tax home.

3. Apply the “for only” test. When you plan your trip, ask yourself whether a rational businessperson would travel for only the business reason—or is the personal element so important that the trip does not make sense without it?

4. Primary purpose test. For travel in the United States, your easy way to pass the primary purpose test is to make a majority of your days business days.

5. Maintain good records. This may be the most important step for your business travel deductions. You must keep records with all the elements the law requires.

1. Cruise travel is subject to the luxury water travel limits. For 2015, these limits range from $678 to $810 per day, depending on the time of year you travel.

2. For more on how to distinguish between personal and business days, see Supercharge Travel Deductions by Knowing the Business Day Rules.

3. IRC Section 162(a)(2).

4. See, for example, T.J. Enterprises, Inc. v Commr., 101 TC 581.

5. Welch v Helvering, 290 U.S. 111.

6. Barry v Commr., 54 TC 1210, aff’d 435 F.2d 1290.

7. United Title Insurance Co., TC Memo 1988-38.

8. Jackson v Commr., TC Memo 1975-301.

9. See Why This Travel Deduction to Cancun, Mexico, for an Online CE Course Fails.

10. IRC Section 274(h)(7).

11. Danville Plywood Corp. v U.S., 899 F.2d 3.

12. Blackshear v Commr., T.C. Memo 1977-231.

13. Robinson v Commr., T.C. Memo 1963-209.

14. Reg. Section 1.274-5T(b)(2).

Related Newsletter: 14 Tax Reduction Strategies for the Self-Employed

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (For Consumers & Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Tax Planning

Retirement Planning

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...