Professionals

A Quick Guide to Retirement Plans for Small Business Owners

As a business owner, you may be surprised to find that offering the right retirement plan may significantly benefit both you and your employees. Here’s an overview of all the major features of each kind of retirement plan, including SIMPLE, SEP, 401(k), defined-benefit, and profit-sharing plans.

The vast majority of businesses in the U.S. employ fewer than 100 workers, yet these employees have less access to retirement planning vehicles and other benefits than those who work for larger companies. That means about 50% of Americans don’t have the same opportunity to save for retirement via tax-advantaged vehicles that many others have.

In fact, a recent survey of small business owners reveals that only about half of all small businesses offer a retirement plan, although that number has been steadily increasing. It’s likely that those businesses would be more attractive to potential employees if they offered a retirement plan. And many small business owners may not realize that retirement plan options have become more affordable in recent years, as more options have become available. Additionally, the SECURE Act of 2019 created or expanded several tax credits that can total up to $5,500 per year ($16,500 for 3 years) for small business that create or enhance their retirement plans.

Overview of small business retirement plans

In choosing the right plan, it pays to have a working familiarity with the different kinds of retirement options. Below, we’ve compiled the major features of each type of plan, along with an overview of benefits.

Another good source of information on retirement plans can be found at the Department of Labor’s website. And, of course, the plan providers you work with should be able to provide you with educational materials.

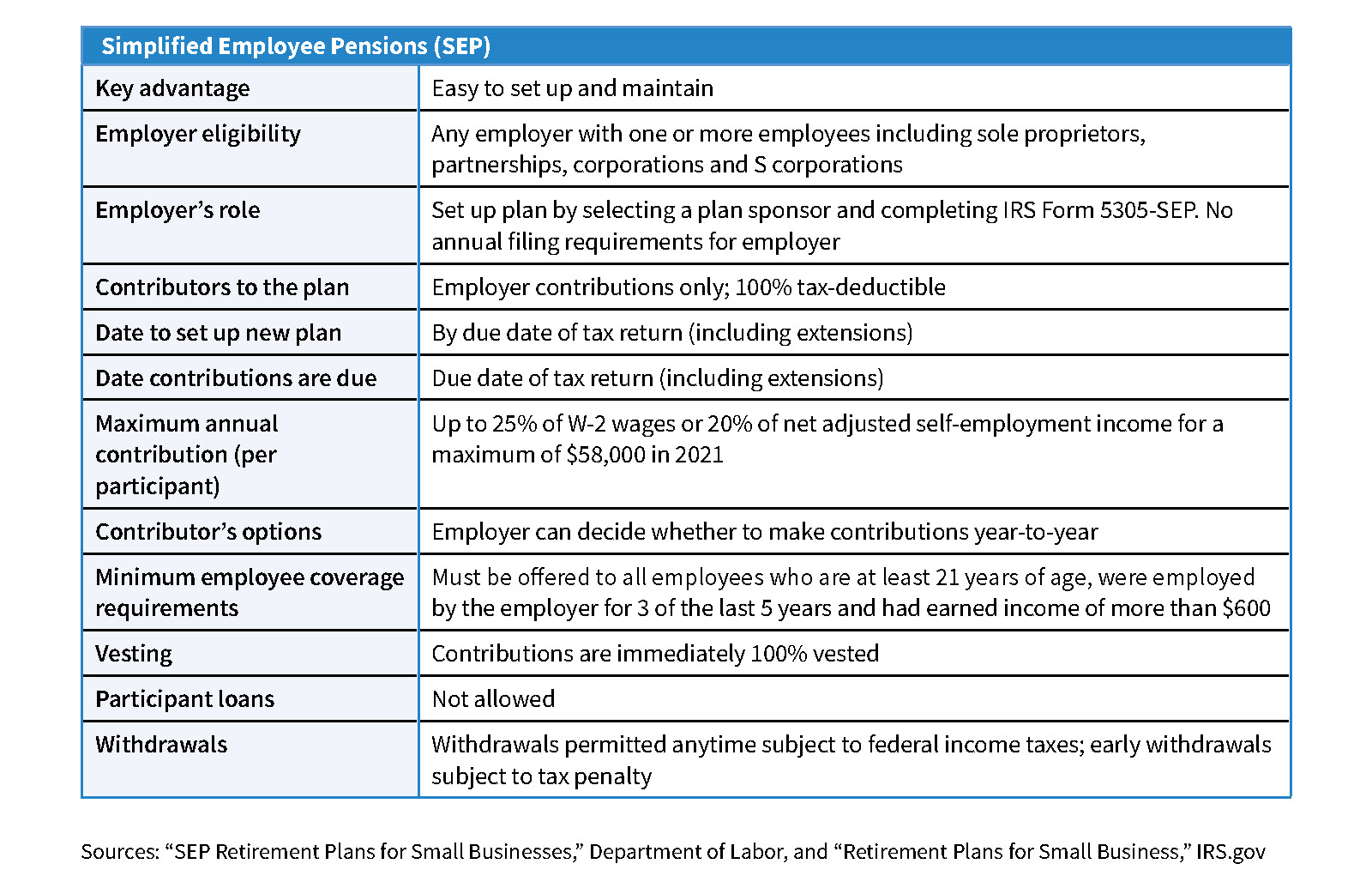

Simplified Employee Pension (SEP)

A SEP will allow you to set up a type of IRA for yourself and each of your employees. You must contribute a uniform percentage of pay for each employee, although you won’t have to make contributions every year. SEPs have low startup and operating costs and can be established using a two-page form. As a small employer, you can also decide how much to put into an SEP each year, offering flexibility when business conditions vary.

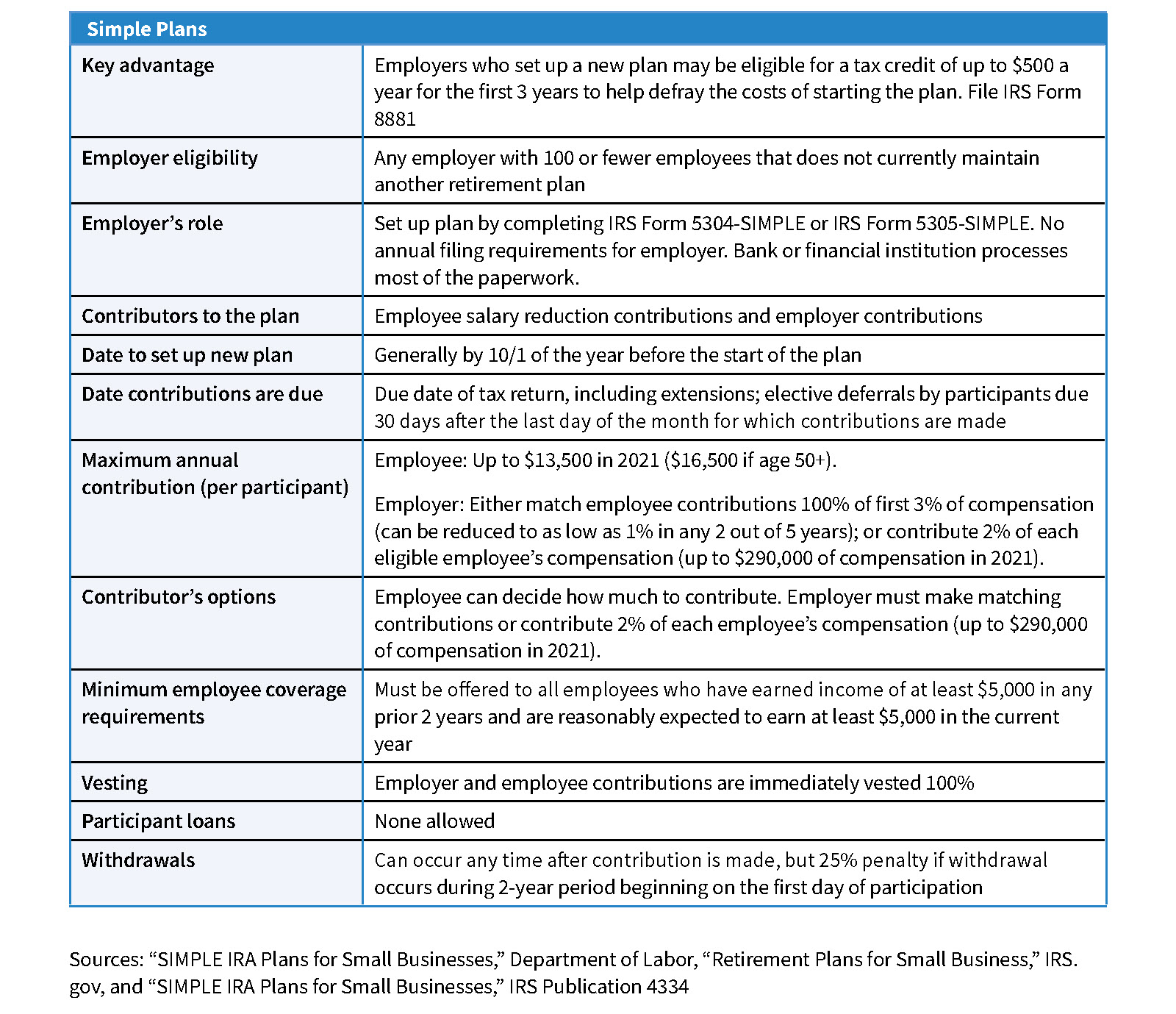

SIMPLE

SIMPLE (Savings Incentive Match Programs for Employees of Small Employers) plans are usually set up as IRAs. They are easy to establish and inexpensive to administer. Your contributions as an employer are flexible: you can either match employee contributions dollar for dollar—up to 3% of an employee’s compensation—or make a fixed contribution of 2% of compensation for all eligible employees.

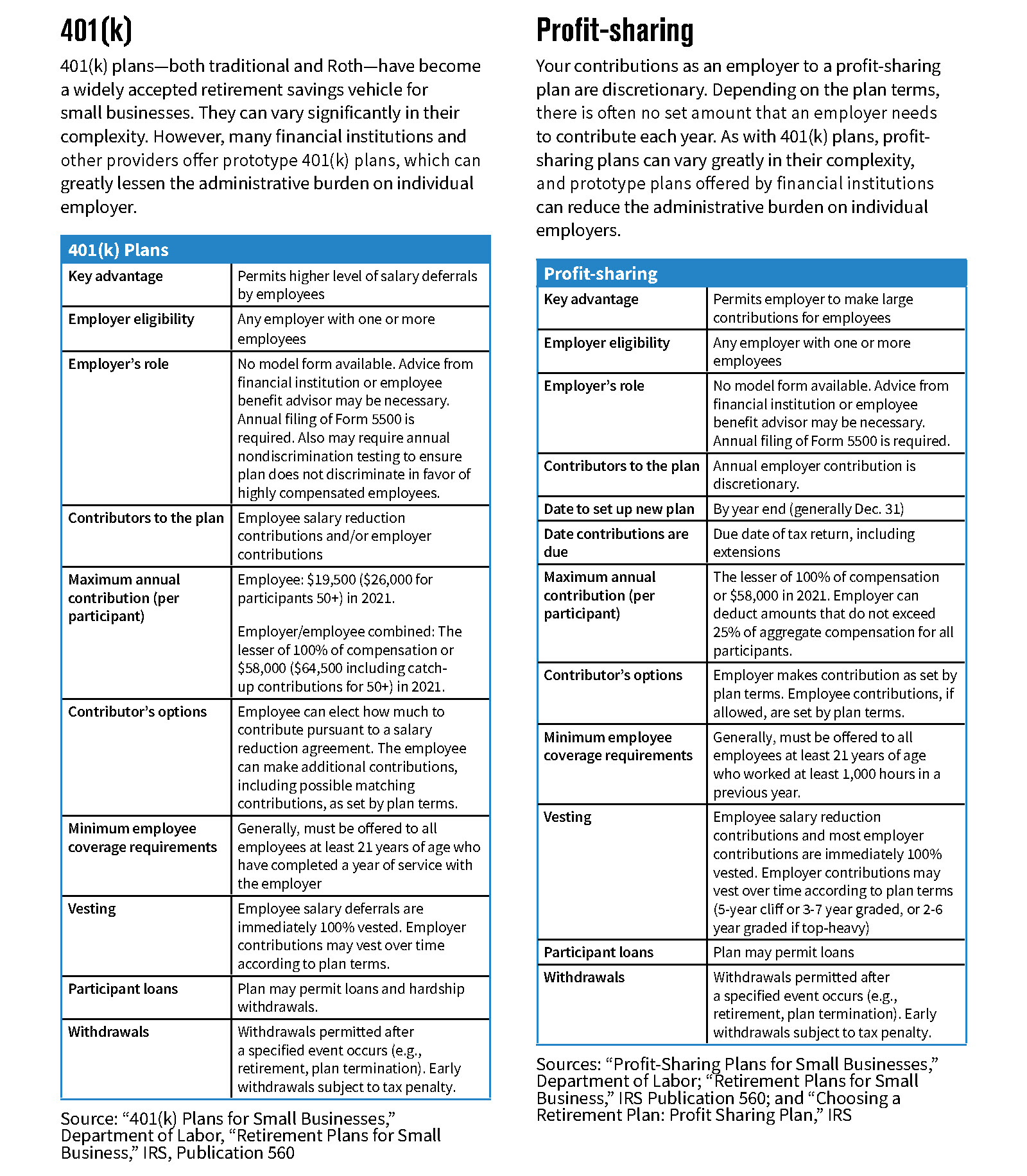

401(k) and Profit Sharing

Defined benefit

Defined benefit plans provide a fixed, pre-established benefit for employees. This traditional type of pension plan is often viewed as having more value by employees and may provide a greater benefit at retirement than any other type of plan. However, defined benefit plans are more complex and therefore costlier to establish and maintain than other types of plans.

A final word

Of all the retirement planning vehicles available for small business owners, SEP and SIMPLE plans offer the easiest solutions for those looking to quickly, inexpensively and easily start a retirement plan for themselves and their employees. Both 401(k) and defined benefit plans are more complex, but also have advantages for employers and employees.

Before deciding whether to offer a plan or what kind of plan to offer, consult with several plan sponsors to determine the best plan for the business and the employees.

As Director of Retirement and Life Planning for Horsesmouth, Elaine Floyd helps financial professionals better serve their clients by understanding the practical and technical aspects of retirement income planning. A former wirehouse broker, she earned her CFP® designation in 1986.

Amy Buttell earned an accounting certificate from Mercyhurst University in 2009 and has written about retirement planning for several major publications.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (for Consumer and Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Retirement Planning

Tax Planning

Coaching and Consulting

Need More Information?

If you require additional details regarding these services, please don’t hesitate to reach out to us at [email protected]. Alternatively, you can schedule a complimentary 15-minute consultation to inquire further and determine whether we align with your needs and expectations. We look forward to assisting you!

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

2024 Key Planning & Investment Deadlines for Q2

Financial GuidesSpring is coming and to keep you financially organized for Q2, we are providing you with our Spring...