Certificates of deposit (CDs) are intended for the ultra-conservative investor. Why are they appealing to so many? They are touted as the “safe” investment option with essentially no risk as they are not tied to the stock market. However, how “safe” are they really if, when you do a little math, you are actually losing out on money due to inflation and taxation?

Certificates of deposit (CDs) are intended for the ultra-conservative investor. Why are they appealing to so many? They are touted as the “safe” investment option with essentially no risk as they are not tied to the stock market. However, how “safe” are they really if, when you do a little math, you are actually losing out on money due to inflation and taxation?

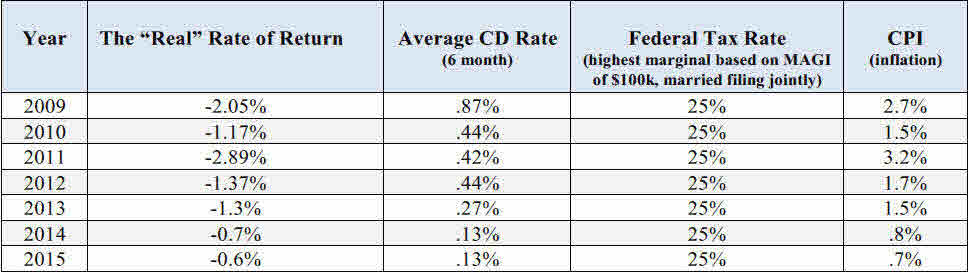

Knowing the truth about CDs is very important. You can lose purchasing power with a CD when you factor in inflation and taxes. Most banks don’t talk about this aspect and we believe CD owners have a right to know what they really own. The bottom line is, “safety” doesn’t matter a whole lot if your overall rate of return is negative. The “real” rate of return on a CD requires you to factor in inflation (based on the Consumer Price Index [“CPI”]) and your real tax rate.

Here are the hard facts:

- For the past 7 years in a row, the average six month CD rate has been less than 1%.

- For the past 7 years in a row, CDs have earned a negative “real” return.

- CDs have had a negative “real” return for 16 out of the past 30 years.

This is what SEVEN YEARS of bad luck looks like…