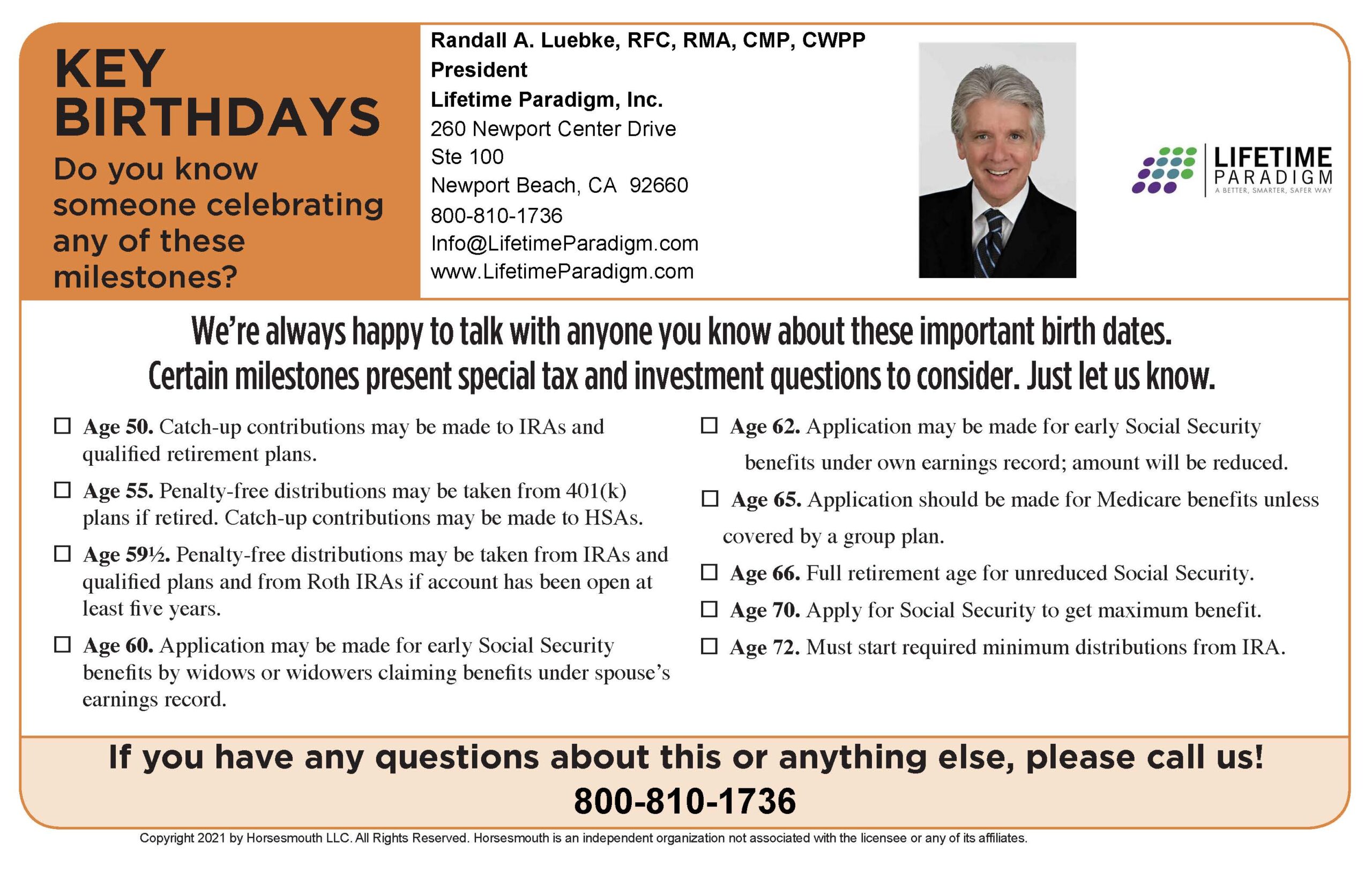

Key Birthdays

Birthday Milestones Present Special Tax and Investment Questions to Consider

Let’s make sure that all of us retire as well as we possibly can and make those “golden years” that much more enjoyable. Certain milestones in our lives present special tax and investment opportunities to consider, so, we’re providing you with a handy “Birthdays” guide to help you to recognize them and to take action.

Also, to paraphrase a popular saying, friends don’t let friends retire badly. Do you know someone celebrating any of these milestones? If someone you know has a “key” birthday this year, forward this article and the reference card on to them. We are always happy to talk you and your family or friends about these important birth dates: retirement planning, Social Security, 401(k)s, or other retirement, tax, asset protection and estate planning issues.

It’s a good life!

You May Also Like…

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...