Tax Planning

Deducting Meals and Entertainment in 2021 -2022

A special report by the Bradford Tax Institute

How much can you deduct for business meals and entertainment? 100 percent? 50 percent? 0 percent?

The answer is YES! (Or more precisely, depending on the circumstances, it may be all of the above.)

IRS Says TCJA Allows Client and Prospect Business Meal Deductions

Hip, hip, hooray for the IRS!

In Notice 2018-76, the IRS states that client and prospect business meals continue as tax deductions under the Tax Cuts and Jobs Act. (1)

This is very good news indeed.

You should have kept track of your business meals all year, so you now have the proof you need for the deductions.

Overview

Under this new IRS guidance, you may deduct 50 percent of your client and prospect business meals if (2)

- the expense is an ordinary and necessary expense under Internal Revenue Code (IRC) Section 162(a) that is paid or incurred during the taxable year in carrying on any trade or business;

- the expense is not lavish or extravagant under the circumstances;

- the taxpayer, or an employee of the taxpayer, is present at the furnishing of the food or beverages;

- the food and beverages are provided to a current or potential business customer, client, consultant, or similar business contact; and

- in the case of food and beverages provided during or at an entertainment activity, the food and beverages are purchased separately from the entertainment, or the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts. The entertainment disallowance rule may not be circumvented through inflating the amount charged for food and beverages.

Ordinary and Necessary

Black’s Law Dictionary defines “ordinary” as “occurring in the regular course of events; normal, usual.” (3)

Obviously, a business meal with a client, prospective client, or consultant can be normal and usual for most every business.

The Supreme Court noted that “necessary” means “appropriate and helpful.”(4)

The business meal with a client, prospect, or consultant generally is appropriate and helpful to most businesses.

In a nutshell, the ordinary and necessary test should give you no trouble in meeting this standard for your client, prospect, consultant, and similar business contact business meal tax deductions.

Lavish or Extravagant

The law does not define “lavish” or “extravagant,” and no court cases have applied the concept to deny business meal costs.

In Rev. Rul. 63-144, the IRS offers this question and its answer on the application of the lavish and extravagant rule to entertainment expenses: (5)

- Question: Will entertainment expenses be subject to disallowance on grounds of being lavish or extravagant merely because they exceed a .fixed dollar amount or are incurred at deluxe restaurants, hotels, night clubs and resort establishments?

- Answer: No. An expense for entertainment will not be considered lavish or extravagant merely because it involves first-class accommodations or services. An expense which, considering the facts and circumstances, is reasonable will not be considered lavish or extravagant.

You would be hard-pressed to have a business meal that would fail as a tax deduction because it was lavish and extravagant.

Presence

To qualify for the deduction, you or your employee has to be present during the business meal.

The being-present rule was developed originally to preclude deductions for business meals as business gifts. The being-present rule eliminates the gift idea and requires that the deduction be claimed as a business meal. This rule continues to reside in the IRC. (6)

Meal Separated from Entertainment

In Notice 2018-76, the IRS gives you three examples of how to deal with business meals that are incurred in combination with entertainment, as described below. (7)

Example 1. Taxpayer A invites B, a business contact, to a baseball game. A purchases tickets for A and B to attend the game. While at the game, A buys hot dogs and drinks for A and B.

The baseball game is entertainment, and thus the cost of the game tickets is an entertainment expense and is not deductible by A. The cost of the hot dogs and drinks, which are purchased separately from the game tickets, is not an entertainment expense and is not subject to the IRC Section 274(a)(1) entertainment expense disallowance. Therefore, A may deduct 50 percent of the expenses associated with the hot dogs and drinks purchased at the game.

Example 2. Taxpayer C invites D, a business contact, to a basketball game. C purchases tickets for C and D to attend the game in a suite, where they have access to food and beverages. The cost of the game tickets, as stated on the invoice, includes the food and beverages.

The game is entertainment, and thus the cost of the game tickets is an entertainment expense and is not deductible by C. The cost of the food and beverages, which are not purchased separately from the game tickets, is not stated separately on the invoice.

Thus, the cost of the food and beverages also is an entertainment expense that is subject to the IRC Section 274(a)(1) disallowance. Therefore, C may not deduct any of the expenses associated with the game.

Example 3. Assume the same facts as in Example 2, except that the invoice for the basketball game tickets separately states the cost of the food and beverages.

As in Example 2, the game is entertainment, and thus the cost of the game tickets, other than the cost of the food and beverages, is an entertainment expense and is not deductible by C. But the cost of the food and beverages, which is stated separately on the invoice for the game tickets, is not an entertainment expense and is not subject to the IRC Section 274(a)(1) disallowance. Therefore, C may deduct 50 percent of the expenses associated with the food and beverages provided at the game.

Documentation

The IRS has not listed any new or changed documentation standards, albeit the “directly related” rules that used to apply to business meals are no longer part of the tax code.

To prove your business meals, follow the two easy steps below:

- Keep the receipt that shows the name of the restaurant, the number of people at the table, and an itemized list of food and drinks consumed.

- On the receipt, record the name or names of the person or persons with whom you had the meal and also record the business reason for the meal.

In the event that the receipt is not available, such as with the purchase of hot dogs and drinks at the baseball game while sitting in the stands, make sure to make a written note of the expenditures immediately after the game.

If you charge a business meal to a credit card, the credit card statement provides your proof of payment. When possible, always pay by credit card or write a check so that you have clear proof of payment.

Key point. Proof of payment is not proof of what you purchased, so in addition to proof of payment, keep the receipt with the notations as described earlier. With this combination of proof of payment and receipt with notations, you have what we call audit-proof documentation.

When the IRS issues its proposed regulations on business meals, we’ll likely have more details on what the IRS expects in the way of proof. Meanwhile, by following the two steps above and maintaining proof of payment, you should be in excellent shape.

Takeaways

Thank goodness for the IRS guidance on business meals. Now you can relax and know that your business meals with clients, prospects, consultants, and similar business contacts are deductible.

Make sure to document the meal deductions as we explained above. Without the right documentation, you not only lose the meal deductions, but you also become suspect to the IRS— and that can lead to a full-blown audit (often known also as misery).

1 Notice 2018-76.

2 Ibid.

3 Black’s Law Dictionary, Ninth Edition, p. 1209.

4 Commr. v Heininger, 320 U.S. 467 (1943); Welch v Helvering, 290 U.S. 111 (1933).

5 Rev. Rul. 63-144, Q&A 42.

6 IRC Section 274(k) 2018.

7 Notice 2018-76.

Entertainment Facilities after the TCJA Tax Reform

Imagine this: your Schedule C business buys a home at the beach, uses it solely as an entertainment facility for business, pays off the mortgage, and deducts all the expenses.

Next, say. 10 years later, without any tax consequence to you, you start using the beach home as your own.

Is this possible? Yes. Are there some rules on this? Yes. Are the rules difficult? No.

Okay, so could I achieve the same result if I operate my business as a corporation? Yes, but the corporation needs to reimburse you for the facility costs, including mortgage interest and depreciation, because you want the title to always be in your name, not the corporation’s name.

Basic Rule

The beach home, ski cabin, or other entertainment facility must be primarily for the benefit of employees other than those who are officers, shareholders, or other owners who own a 10 percent or greater interest in the business, or other highly compensated employees. (1) In this situation, you create:

- 100 percent entertainment facility tax deductions for the employer (you, or, if incorporated, your corporation), and

- tax-free use by the employees.

If a beach home or ski cabin is not your thing, consider owning a swimming pool, baseball diamond, bowling alley, or golf course as your entertainment facility. (2)

Primarily for Employees Other Than You

Your facility qualifies as a tax-deductible employee entertainment facility when your employees make use of the facility more than you do. The IRS says that the facility has to primarily benefit your employees generally. (3)

This means that the rank-and-file employee group must use the facility on more days than the owner and the highly compensated groups do. Think of this as a 51-49 test.

To see if you pass the 51-49 test, look only at days of facility use. (4)

Example. Rank-and-file employees use the beach home 35 days during the year and you, the business owner, use it 21 days. The beach home passes the 51-49 test; accordingly, it’s deductible as an employee entertainment facility.

Primary Use (51-49 Test) Insights

In McReavy, the court noted that “actual use of the facility,” not availability of the facility for employee use, controls the employee entertainment facility deduction. (5)

In this case, the rank-and-file employees who worked in Minneapolis seldom used the lake cabin that was on a four-acre island in North Center Lake, Minnesota, about an hour or so north of Minneapolis. The owners used the lake cabin many more days than did the employees.

In f-Jilliker, the court denied the “employee entertainment facility deduction” because the rankand-file group of employees used the corporate yacht for only about two weeks, compared with the owner’s and highly compensated groups’ use of about six weeks. (6)

To deduct your employer entertainment facility, you need the rank-and-file employees to have majority use of the facility. In making this determination, you look at days of actual use. not days when the facility is available for use.

Rank and File

The facility exception applies only to expenditures made primarily for the benefit of your employees other than those who are officers, shareholders, owners with a 10 percent or greater interest in the business, or other highly compensated employees. (7)

For the 10 percent ownership test, the law treats an employee as owning any interest owned by a member of his or her tax law–defined family. (8) Family includes brothers and sisters, spouses, ancestors (such as parents and grandparents), and lineal descendants (such as children and grandchildren). (9)

For the facility exception, the highly compensated group consists of employees who earned more than $125,000 for the preceding year and, if elected by the employer, were in the top 20 percent of the employees when ranked by compensation for the year. (10)

Corporate Ownership

A corporation can reimburse an employee for all expenses allowable under sections 161 to 199 of the tax code—which includes mortgage interest and depreciation. (11)

Here’s what happens when your corporation properly reimburses you for the expenses:

- You, as the employee, do not have taxable income.

- The corporation gets the full deduction the law allows for the expenses.

- If the corporation is an S corporation, then those expenses reduce the corporate income and the corporation passes that reduced income to you—say, as the sole shareholder of your S corporation.

- You treat the beach home as if you deducted depreciation personally and recognize gain or loss on the sale using the beach home’s adjusted basis.

Rent to the Corporation

Yes, you could own the home personally and rent it to your corporation. We like reimbursement better because it does not trigger the self-rental rule and other complications.

Proof of Use

You need to prove who uses the facility and when. The simple way to do this is with a guest book.

Require every guest to sign the book and also have a column for the hours or days of use by the guest, depending on the type of facility (e.g., hours for a swimming pool, days for a beach home).

Takeaways

The employee facility deduction is straightforward. It has three splendid benefits for the small- business owner:

- You deduct the facility as a business asset.

- Your employees get to use the facility tax-free.

- You own the property and can use it personally without tax consequence once you no longer need it for business use. (Note that when you sell, you will have a gain or loss on the sale and some possible recapture of depreciation.)

1 IRC Section 274(e)(4); Reg. Section 1 .274-2(f)(2)(v).

2 Reg. Section 1 .274-2(f)(2)(v).

3 Ibid.

4 Rev. Rul. 63-144, Q&A 61. Robert R. Wottv Comrnr., T.C. Memo 1986-319.

5 William L. McReavy v Connnr., T.C. Memo. 1989-172.

6 Harlan H. f-filliker v Commr., T.C. 1972-183.

7 Reg. Section 1.274-2(f)(2)(v).

8 IRC Section 267(e)(4); Reg. Section 1.267(c)-1(a)(4).

9 Ibid.

10 TRC Sections 274(e)(4); 414(q); Notice 2018-83. For the employee entertainment facility exception, the 10 percent ownership rule in Section 274(e)(4) overrides the traditional highly compensated 5 percent rule in 414(q).

11 Reg. Section 1.62-2(d)(1).

Deduct 100 Percent of Your Business Meals under New Rules

As a subscriber (member), you know that we try to find multiple ways for you to legally deduct 100 percent of your business meal expenses versus the typical 50 percent.

Now, thanks to a new law enacted December 27, 2020, new IRS regulations, and a new IRS notice (yep, all three are new), you have fresh opportunities for writing off 100 percent of your business meals.

For 2021 and 2022, you can deduct 100 percent of your business meals by paying attention to a few new, easy rules.

We’ll explain how this new, favorable rule works. It’s easy—that’s good. Of course, there a few potholes to beware of. All will be revealed when you read this article.

New 100 Percent Meal Deduction

Since 1986, lawmakers have limited business meal deductions: first to 80 percent, and then to 50 percent (unless an exception applies).(1)

But on December 27, 2020, in an effort to help the restaurant industry due to the COVID-19 pandemic, lawmakers enacted a new, temporary 100 percent business meal deduction for calendar years 2021 and 2022. (2)

To qualify for the 100 percent deduction, you need a restaurant to provide you with the food or beverages.

Planning point. The law requires only that the restaurant provide the food and beverages. You don’t have to pay the money directly to the restaurant. For example, you qualify for the 100 percent deduction if you order a restaurant meal that’s delivered by Uber Eats or Grubhub.

In other words, you can dine in the restaurant, order takeout, or use delivery.

Key point. You need a qualifying business meal for the 100 percent deduction.

Business Meal Rules

Rule 1. Your deductible business meals must be tax code Section 162 ordinary and necessary business expenses, and they must not be subject to disallowance under tax code Section 274. (3) (Not to worry—we’ll make this easy.)

Rule 2. Per IRS regulations, you may not deduct lavish or extravagant business meals. (4) You are not likely to have this problem, regardless of what you spend. Here’s why:

- In its publication on entertainment expenses, the IRS states: “Meal expenses won’t be disallowed merely because they are more than a fixed dollar amount or because the meals take place at deluxe restaurants, hotels, or resorts.” (5)

- The Bloomberg BNA Tax Management Portfolio on entertainment deductions states: “No reported case to date has ever upheld a disallowance of a taxpayer’s travel, entertainment, or meal expenses on the grounds that they were ‘lavish and extravagant under the circumstances. (6)

Rule 3. You must be present at the business meal, and you must provide the business meal to a person with whom you could reasonably expect to engage or deal with in the active conduct of your business, such as a customer. client, supplier, employee, agent, partner, or professional advisor, whether established or prospective. (7)

What’s an IRS-Defined Restaurant?

Remember, to qualify for the 100 percent deduction, you need a restaurant. The IRS recently provided definitions and examples of what is and is not a restaurant. (8)

A restaurant is “a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether the food or beverages are consumed on the business’s premises.” (9)

A restaurant is not “a business that primarily sells pre-packaged food or beverages not for immediate consumption,” including, but not limited to, the following: (10)

- Grocery stores

- Specialty food stores

- Beer, wine, or liquor stores • Drug stores

- Convenience stores

- Newsstands

- Vending machines or kiosks

In general, the 50 percent limitation applies to business meals from the sources listed above. (11)

Examples

Assume each of the examples below occurs during tax year 2021.

Example 1. You are out of town on business and stay at a hotel where you have a kitchen in your room. You go to the grocery store and buy food and beverages to consume while in the hotel room.

You can deduct 50 percent of the expense because the grocery store primarily sells pre-packaged food or beverages not for immediate consumption.

Example 2. You are out of town on business and stay at a hotel for five days. You go to the Starbucks across the street from the hotel each day to get breakfast and your morning coffee prior to your work meetings.

You can deduct 100 percent of the expense because Starbucks prepares and sells food or beverages to retail customers for immediate consumption.

Example 3. You meet for lunch with a customer at your office. You order food from a local Italian restaurant and have it delivered to your office.

You can deduct 100 percent of the expense because the restaurant prepares and sells food or beverages to retail customers for immediate consumption.

You can include the delivery fees and tip as a food and beverage expense. (12)

Example 4. You meet with a prospective client at a local restaurant to discuss working together on a business deal. You order food and beverages for both yourself and the prospect.

You can deduct 100 percent of the expense because the restaurant prepares and sells food or beverages to retail customers for immediate consumption.

Example 5. You are driving from your home to an out-of-town business destination for a two- day, overnight business seminar. On your way, you stop at a small-town gas station convenience store and buy a hot dog and coffee for lunch.

You can deduct only 50 percent of the expense because the convenience store primarily sells prepackaged food or beverages not for immediate consumption.

Example 6. You drive six hours away from home for a two-day, overnight business trip. On your way, you stop at McDonald’s and buy a hamburger and coffee for lunch.

You can deduct 100 percent of the expense because McDonalds prepares and sells food or beverages to retail customers for immediate consumption.

Example 7. You take two clients to a baseball game. You buy food and drinks from a hot dog stand inside the stadium, for yourself and your clients.

You can deduct 100 percent of the expense because the stand prepares and sells food or beverages to retail customers for immediate consumption.

This expense isn’t a non-deductible entertainment expense because you purchased the food and drinks separately from the baseball game tickets. (13)

Example 8. You take two clients to a baseball game. You buy a suite that provides food and beverage service, including cooked foods and prepared alcoholic beverages. The invoice separately states the food and beverage expense.

You can deduct 100 percent of the expense because the suite prepares and sells food or beverages to retail customers for immediate consumption.

This expense isn’t a non-deductible entertainment expense because you purchased the food and drinks separately from the baseball game tickets. (14)

Example 9. You provide a break room for your employees, with coffee, bagels, and assorted snacks that you buy in bulk from a wholesale retailer such as Costco.

You can deduct 50 percent of the expense because the store primarily sells pre-packaged food or beverages not for immediate consumption.

Example 10. You provide a break room for your employees with coffee, bagels, and assorted snacks that you have delivered daily from a local restaurant using a food delivery app.

You can deduct 100 percent of the expense because the restaurant prepares and sells food or beverages to retail customers for immediate consumption.

You can include the delivery fees and tip as a food and beverage expense. (15)

Per Diem Problem

If you simply deduct a per diem meal expense for out-of-town business travel, or pay your employees a per diem, you can deduct only 50 percent of that expense.

We don’t like the per diem method for deducting your business meals.

If you deduct your actual expenses instead of the per diem, you can shift your expenses to being 100 percent deductible for the next two years.

Example 11. You are out of town overnight on business. You spend $10 for breakfast, $20 for lunch, $30 for dinner, and $5 for coffee during the day. You buy these items from locations that qualify as restaurants.

- If you use the per diem method, you can deduct only 50 percent of the $56 per diem. Or $28.

- If you deduct your actual expenses, you can deduct 100 percent of the $65 you spent on food and beverages.

And because each of your meal expenses was under $75, you don’t face a tax record-keeping difference because you don’t need to keep receipts for business meals that are less than $75. (16) (However, you do need to make a record of them.)

Takeaways

For 2021 and 2022, Congress gave businesses large and small an incentive to buy business-meal food and beverages from restaurants, because such purchases are 100 percent deductible.

Be sure every business meal you buy is from an IRS-approved restaurant location, which is a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether you consume the food or beverages on the business’s premises.

This new rule is another reason to move away from deducting a per diem for your business travel meals. You’ll almost always get larger tax deductions by deducting 100 percent of your actual restaurant expenses versus 50 percent of the per diem amount.

1 IRC Section 274(n).

2 IRC Section 274(n)(2)(D).

3 IRC Sections 162; 274.

4 Reg. Section 1.274-12(a)(1).

5 IRS Pub. 463, Travel, Gift, and Car Expenses, p. 5.

6 Portfolio 520-2nd: Entertainment, Meals, Gifts and Lodging Deduction and Recordkeeping Requirements, Detailed Analysis, E. Restrictions Upon the Deductibility of Entertainment and Meal Expenses That Otherwise Conform to the Substantive and Recordkeeping Requirements.

7 Reg. Section 1.274-12(b)(3).

8 IRS Notice 2021-25.

9 Ibid.

10 Ibid.

11 Ibid.

12 Reg. Section 1.274-12(b)(2).

13 Reg. Section 1.274-1 1(d)(2).

14 Ibid.

15 Reg. Section 1.274-12(b)(2).

16 Reg. Section 1 .274-5(c)(2)(iii)(A)(2).

Deduct 100 Percent of Your Employee Recreation and Parties

You take Bill, your best customer, to the local country club and treat him to 18 holes of golf. The golf produces a zero deduction.

Compare this.

You take your employees and their spouses and children to the local country club, where they play golf and tennis; swim; and enjoy lunch, dinner, and snacks.

The cost of the country club meals and activity produces a 100 percent tax deduction. (1)

In this article, you will learn the following:

- What it takes to qualify an employee party for the 100 percent deduction

- What types of employee entertainment qualify for this 100 percent deduction

- How tax law defines entertainment that’s primarily for the benefit of employees

Deduction for Employee Entertainment

The IRS says that the following types of entertainment qualify for the 100 percent employee entertainment tax deduction: (2)

- Holiday parties, annual picnics, and summer outings

- Maintaining a swimming pool, baseball diamond, bowling alley, or golf course

The IRS makes it clear that the above are examples, and that other types of entertainment also qualify for the 100 percent deduction. The tax code states that “expenses for recreational, social, or similar activities (including facilities therefor) primarily for the benefit of employees” qualify for the 100 percent deduction. (3)

Employees on a Powerboat

Here is how the tax court treated a case that’s broader in scope than one involving a holiday party or summer picnic.

During one tax year, American Business Service Corporation rented a powerboat 41 times at a cost of $1,000 a day for daylong recreational cruises for its employees and their guests. The company had roughly 100 employees, but the boat would accommodate only about 30 people at a time.

All employees, including owners, managers, and rank-and-file personnel, were eligible to take these cruises, but they had to sign up in advance on a first-come, first-served basis.

The court allowed the full $41,000 deduction for the 41 cruises because the cruises: (4)

- were primarily for the employees,

- did not discriminate in favor of the owners and highly compensated employees,

- were documented as to who cruised and when, and

- passed the “ordinary and necessary” business purpose test.

Some time ago, we wrote about the insurance agent who took his staff to Atlantic City, N.J., for a boondoggle. Obviously, this is not the traditional holiday party, but it qualifies for the 100 percent deduction.

Who Are These Employees?

In this party section of the tax law, you (as an owner) belong to the “tainted group.”

Technically, the law requires that the entertainment expenses be primarily for the benefit of employees other than a tainted group, which consists of any of the following: (5)

- A highly compensated employee (an employee who is paid more than $130,000 in 2021) (6)

- Anyone (this likely includes you) who owns at least a 10 percent interest in your business, i.e., a “10 percent owner”

- Any member of the family of a 10 percent owner, i.e.. brothers and sisters (including half-brothers and half-sisters); spouses; ancestors (parents, grandparents, etc.); and lineal descendants (children, grandchildren, etc., including adoptees) (7)

Remember, as the business owner, you belong to the tainted group. That’s not a big deal. You just need to make sure that partying with the employees is primarily for the benefit of the employees.

“Primary” Means “More Than 50 Percent”

In tax law, the words “primary” and “primarily” mean more than 50 percent.” (8) For employee recreation, that means the untainted group of employees has to have more than 50 percent use of the entertainment facility—or in the case of a party, a majority of the attendees must come from the untainted employee group.

Documentation tip. You can measure “primary” by days of use, time of use, number of employees, or any other reasonable method. Regardless of how you measure use, the key to your deductions is the records that prove the uses.

Easy-to-Meet Business Purpose Requirement

As you may remember, the Tax Cuts and Jobs Act eliminated deductions for business entertainment, but not for entertainment primarily for the benefit of employees. (9)

You still need to satisfy the overriding standard for business expense deductions, which is the ordinary and necessary business purpose test. (10) Fortunately, this test is easy to pass.

Basically, an ordinary and necessary expense simply means an expense that is “appropriate and helpful” for your business. To meet the test, the expense does not have to happen often or be a recurring expense. (11)

What’s your ordinary and necessary reason for partying with your employees?

Your reason might be as simple as improving employee morale and loyalty to your business. Or you may want to ensure that your business is more fun and has better working conditions than the competition has.

Documentation

You must document your 100 percent deductible employee entertainment expenses, just as you must document other expenses. (12)

Documentation tip. When recording the expenses for an employee party, outing, or other type of entertainment, be sure to note your business reason for the entertainment.

- If it’s an annual event to improve employee morale and loyalty, write that down.

- If there’s a more specific reason, such as an office party to celebrate a fat new contract, write that down.

The point is, you need a reason, and you need to write it down. This test is easy to meet, but like all deductions, you can’t nail it down without writing it down.

Chart of Accounts

In your chart of accounts, make sure you have a category for the 100 percent deductible employee functions.

Without a category, you could mistakenly put the company picnic in the non-restaurant business meals category and lose 50 percent of the deduction when you file your tax return.

“Employee welfare benefits” has a logical ring to it as a chart of accounts category for the 100 percent employee entertainment deductions. It also matches a category in most business tax returns.

Takeaways

You have to appreciate that the tax code favors your employee outings and grants you a 100 percent tax deduction for such outings.

Make sure you document that your outings primarily benefit the employees and not the tainted group. Also, make sure to put the expenses into a chart of accounts category where you will realize the full 100 percent deduction.

1 Reg. Section 1 .274-2(f)(2)(v).

2 Ibid.

3 IRC Sections 274(n)(2) 2018; 274(e)(4) 2018.

4 American Business Service Corp. v. Commr., 93 T.C. 449.

5 IRC Section 274(e) 2018.

6 IRC Sections 274(e)(4) 2018; 414(q); Notice 2020-79. For the employee entertainment facility exception, the 10 percent ownership rule in Section 274(e)(4) 2018 overrides the traditional highly compensated 5 percent rule in 414(q).

7 IRC Sections 274(e)(4) 2018; 267(c)(4).

8 For example, see Rev. Rul. 63-144, Questions and Answers 60 through 66.

9 Reg. Section 1 .274-2(f)(2)(v).

10 IRC Section 162(a) 2018.

11 E.g., Capital Video Corporation v Commr., 90 AFTR 2d 2002-7429 (CA]) Nov. 27, 2002.

12 Reg. Section 1 .274-5T(a)(2), referring to items in IRC Section 274(e) 2018, which includes employee entertainment expenses.

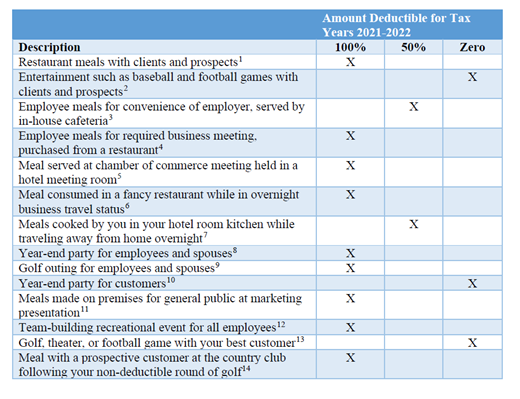

Helicopter View of Meals and Entertainment (2021-2022)

Have you missed partying and having business meals with your prospects, customers, and employees?

Well, get ready to start again. Soon, COVID-19 will behind us. It could be just a few short months away.

To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:

Takeaways

The table in this article gives you a usable helicopter view of how the rules set various business meals and entertainment tax deductions for 2021 and 2022.

1 IRC Section 274(n)(2)(D); IRS Notice 2021-25.

2 IRC Sections 274(a); 274(d).

3 IRC Sections 274(n)(2)(D); 274(e)(1).

4 IRC Sections 274(n)(2)(D); 274(e)(5).

5 IRC Sections 274(n)(2)(D); 274(e)(6).

6 IRC Sections 162(a)(2); 274(n)(2)(D).

7 IRC Sections 162(a)(2); 274(n)(1); IRS Notice 2021-25.

8 IRC Sections 274(n)(2); 274(e)(4).

9 Ibid.

10 IRC Section 274(a), assuming the new law treats this party as entertainment.

11 IRS Notice 2021-25; IRC Section 274(e)(7).

12 IRC Section 274(e)(4).

13 IRC Section 274(a).

14 IRC Section 274(n)(2)(D); IRS Notice 2021-25.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

The Smart Tax Minimizer (For Consumer and Home-Based Businesses) ˢᵐ

The Smart Tax Planning System for Business Owners ˢᵐ

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...