Tax Planning

Hire Your Kids to Work In Your LLC or Sole Proprietorship and Put a Huge Chunk of Their Pay Back in Your Pocket

Bradford Tax Institute

Estimated tax tip savings. Pay your child $8,000, for example, to work in your LLC or sole proprietorship and you could save $3,042. Your exact savings will vary depending on your tax bracket and several other factors.

Children are expensive.

The IRS has a solution to this problem: Put your children to work in your business and make them earn their money. The IRS gives you payroll tax deductions for hiring family members, making this an extremely attractive government subsidy.

You’re in the best position to benefit from this rule if you operate your business as an LLC or a sole proprietorship. If you operate as an S corporation or a C corporation, you can also create tax savings by hiring your child—just not nearly as much.

Since this clever tax-cutting strategy does not apply to everyone—even all husband-and-wife owners—you need to know some basic rules before you dive in.

Tax Breaks for Family Members

If you operate a qualifying LLC or a sole proprietorship, you get a break on payroll taxes when you employ certain family members.

Normally when you hire an employee, you must pay payroll taxes on their wages, which include:

FICA (Social Security and Medicare taxes) and

unemployment taxes.

Your employees also pay a share of FICA taxes but not unemployment taxes.

When you hire family members, the IRS gives you a break on these payroll taxes, depending on your relation to the employee:

Kids. When you hire your child

under the age of 21, you don’t pay unemployment taxes.1

under the age of 18, you don’t pay any payroll taxes (Social Security, Medicare, or unemployment taxes).2 Your kids do not have to pay FICA or Medicare taxes on their wages either.

Spouses and parents. For wages paid to a spouse or a parent, you don’t pay unemployment taxes. However, the wages are subject to FICA and Medicare taxes.3

Example

You operate a single-member LLC, and you hire your 12-year-old daughter to work in your office during the summer and occasionally during the school year, paying her a total of $8,000 for her work.

You deduct the $8,000 of compensation as a business expense, and you pay nothing in payroll taxes. If you are in the 28 percent tax bracket, this gives you $3,212 of extra cash at the end of the year.4

Your daughter takes the standard deduction ($6,300) and then pays tax on the remaining income in the 10 percent bracket, for a total tax of $170.5

Thus, the total tax savings between you and your daughter is $3,042 ($3,212 -$170). (You can use some of your tax savings to pay your daughter’s tax for her, as a gift.)

Permanent LLC Benefit

There were times when it was doubtful that LLC owners could qualify for the employing-family-members tax break. The law flip-flopped a couple of times since 2008.

But since June 2014, the rule is solid and set in stone: If you own a single-member LLC taxed as a disregarded entity, you can take advantage of the family tax breaks just as if you were a sole proprietor.6

If you operate a husband-and-wife-owned LLC and both spouses have membership in the LLC, you likely have a partnership.7 You can still take advantage of the tax break for hiring family members. The only limitation is that the family relationship has to apply to all partners.8

Example. You and your wife are the only members of your LLC. You hire your child. Since your child is a child of all partners—you and your spouse—you get the family tax break.

Corporation Owners Get a Smaller Benefit

If you own a corporation, you don’t get the family tax break for payroll taxes. This significantly reduces the tax benefit of hiring your children. Compared with the sole proprietorship or LLC, your tax savings disappear because of:

New payroll taxes that you have to pay for your child employee

No reduction in employment taxes on your own income (unlike with a sole proprietorship)

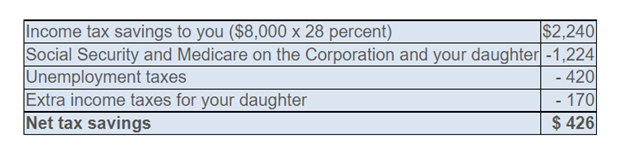

Example. You operate an S corporation and you hire your child, paying her $8,000. Your net savings are only $426 (compared with $3,042 in the example above):

As you can see, corporate ownership is not as beneficial when it comes to hiring your children. Nevertheless, you still save money compared with a gift of $8,000 to your child, which gives you zero tax benefit.

No Kiddie Tax Troubles

If you’re worried about the kiddie tax, don’t be. The kiddie tax doesn’t apply to earned income. In other words, if your child works in your business to earn his or her dollars, there is no kiddie tax on the income.

Takeaways

Hiring your kids has a number of advantages outside of tax. You can help your child develop a good work ethic, you can teach him or her the value of money, and you get to see your kids during your workday.

But this strategy also creates great tax savings, particularly if you operate your business as a:

Sole proprietorship

Single-owner LLC

Husband-and-wife-owned LLC

By operating in one of the above forms of business, you are exempt from payroll taxes on the wages you pay your children, and you get a business deduction for their compensation, which reduces your income taxes and self-employment taxes.

The total tax savings make it extremely attractive to hire and pay your under-age-18 children. Your children win. You win. And the government pays you for this with tax benefits.

1. IRC Section 3306(c)(5).

2. IRC Section 3121(b)(3)(A).

3. IRC Section 3306(c)(5).

4. SE tax savings = .153 x .9235 x $8,000 x .28 = $1,130. This savings reduces your income tax deduction for SE taxes by $565. Thus, income tax savings are

($8,000 – $565) x .28 = $2,082. Total tax savings are $2,082 + $1,130 = $3,212.

5. $8,000- $6,300 = $1,700. $1,700x .10= $170.

6. Reg. Sections 31.3121(b)(3)-1(d) (with regard to FICA); 31.3306(c)(5)-1(d) (with regard to FUTA).

7. In community property states, you could have a disregarded entity treated as a sole proprietorship. Rev. Proc. 2002-61.

8. Reg. Sections 31.3121(b)(3)-1(c) (FICA); 31.3306(c)(5)-1(c) (FUTA).

Related Newsletter: 14 Tax Reduction Strategies for the Self-Employed

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

For more information on tax planning, visit our Tax Planning page to see our list of services.

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...