The Smart Income Independence Planning Newsletter

How Parent & Child Assets Impact Financial Aid Packages

Parents with big investments and home equity generally find it harder to get financial aid for their college-bound children. But if you understand how assets are assessed on the FAFSA and CSS Profile, you can improve your chances for getting the best financial aid package possible.

Do you know how your investments might reduce your chances for financial aid?

And what about the role that your family’s home equity plays in determining whether your child will receive financial help from a college?

When their children are little, parents often feel virtuous about saving for college, but when the college years are approaching, they often begin to view their college accounts and other investments as if they were time bombs with short fuses. Parents frequently assume that their assets will wreck their chances for financial aid.

But parental fears about their investments are usually worse than the reality behind the role that assets play in their financial aid determinations.

Assets and Financial Aid Applications

Whether your assets will hurt your financial aid prospects depends in part on what financial aid application(s) each school uses.

There are the two main applications:

1) The free application for Federal Student Aid (FAFSA)

All colleges and universities use the Free Application for Federal Student Aid (FAFSA) to determine if a student qualifies for federal and/or state financial aid.

Most schools also use FAFSA to decide if a

student qualifies for financial help from their own institutions. Nearly all public institutions and many private colleges find it sufficient to rely solely on the FAFSA.

2) CSS Profile

Roughly 229 colleges and universities (nearly all of them private) require families seeking financial aid to complete an additional aid application called the CSS Profile. Highly selective schools, such as the Ivy League, Stanford, MIT, and Amherst, use the CSS Profile.

How FAFSA Treats Assets

Let’s first take a look at how assets fare under the FAFSA aid calculations.

Many families will be pleasantly surprised that with the FAFSA, their investments make little or no impact on their children’s chances for need-based help. That’s because FAFSA ignores some assets, including the two biggest for many families: home equity and qualified retirement accounts.

Here are the assets that FAFSA ignores and parents do not need to include in their application:

- Equity in a primary home

- Qualified retirement assets, including:

- Traditional and rollover IRAs

- Roth IRAs

- SEP-IRAs

- 401(k), 403(b), 457(b)

- SIMPLE

- KEOGH

- Pension plans

- Annuities (qualified and nonqualified)

- Cash value in life insurance

The FAFSA directions aren’t as clear as they could be, so some families mistakenly include their retirement accounts, which, depending on their size, can kill their chance for financial aid.

While retirement accounts are safe, other assets are not. The following are those assets FAFSA does assess in determining eligibility for financial aid:

All taxable accounts including:

- Stocks

- Bonds

- Mutual funds

- Certificates of deposit

- Savings and checking accounts

- Commodities

- Equity in property other than primary residence

- College Accounts

- 529 college plans

- Coverdell Education Savings Accounts

- UGMA/UTMA custodial accounts (considered children’s assets)

How Parents’ vs. Children’s Assets Are Assessed

The FAFSA formula assesses relevant parent assets at a maximum of 5.64%. The federal formula assesses child assets, which would include all custodial accounts as well as a child’s own savings/checking, at 20%. The federal formula treats child assets more harshly because students are expected to contribute more of their money to pay for their college years.

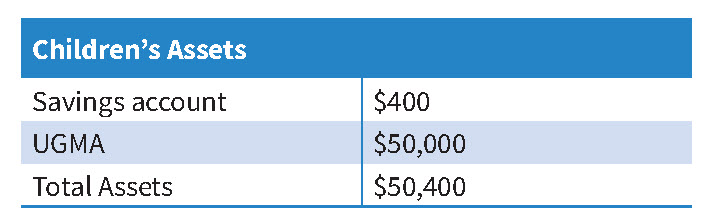

Let’s look at a couple of examples on how the children’s versus the parents’ assets come into play when calculating financial aid.

In this example, the child’s assets ($50,400) are assessed at the FAFSA rate of 20%. The child’s eligibility for need-based aid drops by $10,080, which is a significant hit.

For financial aid purposes, it’s better to have money held in the parents’ names rather than the child’s. However, the child assets shouldn’t pose a problem if a family isn’t going to qualify for need-based aid because of high parental assets and income. Wealthy clients will want to look for schools that provide merit scholarships for high-income students—and luckily most do.

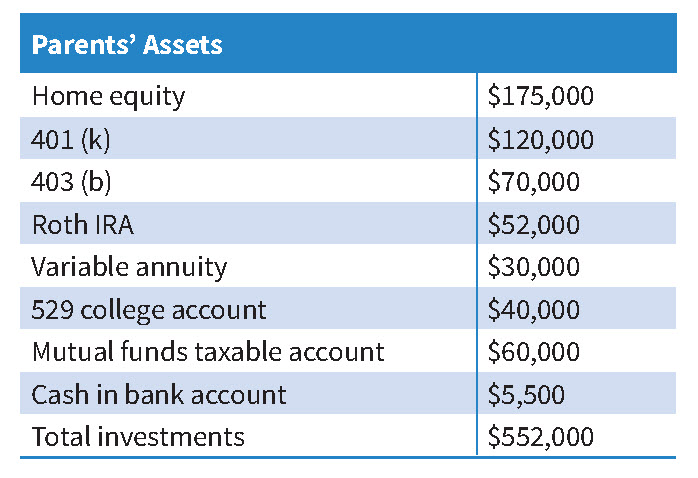

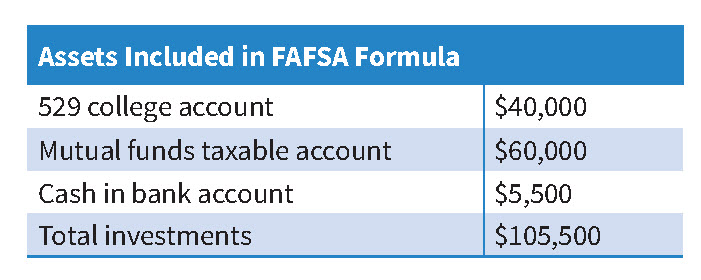

While this hypothetical couple has $552,000 in assets, the FAFSA formula would only consider a fraction of the investments when calculating aid eligibility:

To see what impact the above assets would have on aid eligibility, multiply the amount by 5.64%. It would appear that this family’s eligibility for financial aid would drop by $5,922, but the federal formula has one more step.

Parents’ Education Savings and Asset Protection Allowance

The financial aid hit in this hypothetical example ($5,922) would actually be lower because the FAFSA formula automatically shelters a portion of the parents’ nonretirement assets.

Just how much you can shield will depend on the age of the oldest parent as of the last day of the most recent calendar year. The closer the oldest parent is to retirement age, the more the family can shelter.

A couple in which the oldest parent is 50 years old, for instance, could shelter $12,500 in taxable assets based on the current formula.

The U.S. Department of Education releases the formula every year in its annual publication entitled “The EFC (Expected Family Contribution) Formula.” The asset protection table is on page 19 of The EFC Formula, 2020-2021. So not all of your taxable assets will hurt your aid chances.

Low Income but higher Assets

FAFSA also allows parents with a low enough income to avoid divulging any of their assets through something called a “simplified means test.” If the parents’ adjusted gross income is less than $50,000 a year and the parents were eligible to file IRS Form 1040A or 1040 EZ, they should not include their assets on the FAFSA.

People who may qualify for a simplified means test could include a divorced parent who has considerable assets through a divorce, but who makes a modest salary. An unemployed client might also qualify.

Because the FAFSA formula only considers taxable and college assets when determining aid eligibility, the financial aid impact often won’t be as punitive as parents assume. In fact, it may not be an issue at all, so it’s always smart to save for college.

How CSS Profile Treats Assets

Schools that use the CSS Profile delve deeper into a family’s finances, so this aid application will include significantly more questions. In fact, schools that use the CSS Profile can select from hundreds of different supplemental questions.

You can find the list of CSS Profile institutions on the College Board’s website. If your children are aiming for prestigious private schools and seeking financial aid, they will be completing the CSS Profile.

What the CSS Profile ignores:

- Qualified retirement accounts (see list above in FASFA section)

- Qualified annuities

- Life insurance cash value (although some CSS Profile schools will inquire about the cash value of life insurance.)

The CSS Profile does ask about the family’s retirement assets, but it’s considered rare for a school to use those assets in the aid calculations. However, the CSS Profile does consider the following assets:

- Equity in primary home

- Taxable accounts

- Custodial accounts

- Nonqualified annuities

- Equity in investment property

- Assets in family business or farm

Parents’ vs. Children’s Assets

The CSS Profile formula, which you’ll also see referred to as the institutional formula, assesses parent assets at 5% compared to the FAFSA’s maximum of 5.64%. The CSS Profile does not provide parents with an asset protection allowance.

The institutional formula assesses child assets, which would include all custodial accounts, at 25%.

The CSS Profile does require parents to share their estimated home equity on the aid application. What schools do with the home equity information will vary by institution, so at some schools, the chance of getting financial aid could plummet while at other institutions the odds wouldn’t be jeopardized even if a family were living in an exclusive zip code.

There are three ways that a CSS Profile school can assess home equity in its formula:

- Ignore home equity entirely

- Use full value of the home equity

- Link home equity to the parents’ income

Suppose a family has $400,000 in home equity.

This equity is treated the same as parental taxable investments and college accounts and assessed at 5%. In this example, eligibility for financial aid drops by $20,000. That’s a significant hit.

Some schools that assess home equity limit the pain by linking it to the family’s income. In some cases, the school may tie the home equity assessment to no more than two times the family’s income.

Say, for example, the family’s income is $60,000 with home equity of $400,000. The school would only use $120,000 ($60,000 x 2) of home equity in the aid calculation that assesses parent assets at 5%. The family’s eligibility for financial aid would only drop by $6,000 rather than $20,000.

The CSS Profile does not require parents to use a specific source when calculating home equity. Parents may want to look at the assessed property valuation from their local taxing authority, Zillow, other house comp websites, or recent sales in the neighborhood.

Ask potential schools how they handle home equity. It can be a financial aid deal breaker. Some schools that use the full value of home equity in calculating a student’s aid package say they will accept appeals from parents.

Lynn O’Shaughnessy is a nationally recognized college expert, higher education journalist, consultant, and speaker.

For help with your estate plan or to create verified beneficiary documents, check out The Smart Estate Plan Protector. It’s like a mini-estate that will ensure your assets pass quickly and easily to your heirs.

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...