How To Get Tax Savings On Charitable Contributions After 2018

Qualified charitable distributions from an IRA provide individuals over 70½ with a way to receive income tax savings on charitable gifts—even if they decide to take the newly increased standard deduction.

The proportion of individuals who claimed charitable deductions on their taxes fell to 8.5 percent in 2018, compared with 24 percent in 2017, according to “Giving USA 2019: The Annual Report on Philanthropy.” Clearly, this is a drastic decrease. So what happened?

This decline is mainly the result of the Tax Cut and Jobs Act (TCJA) of 2017. The Tax Policy Center had estimated that the law would cut the number of households itemizing deductions from about 37 million in 2017 to 16 million in 2018.

The TCJA made many changes, but the two most critical ones in terms of charitable giving are (1) limiting the itemized tax deduction for state and local taxes (SALT) to $10,000 per return and (2) increasing the standard deduction drastically, from $6,350 in 2017 to $12,400 in 2020 for individuals and from $12,700 to $24,800 for married couples filing joint returns. This makes it much more beneficial for most taxpayers to take the standard deduction (as opposed to itemizing their deductions), a switch that will cause an estimated 90% of taxpayers to simply take the standard deduction in years to come.

The increased use of the standard deduction disincentivizes charitable contributions, as taxpayers often will not get deductions for charitable contributions. Conservative think tank AEI reports that “Many taxpayers who otherwise would have deducted their charitable donations as itemizers will now claim the standard deduction and not receive a tax incentive for charitable giving.”

Thankfully, there is good news for those over 70½ who want to donate to charity and still obtain tax relief when doing so. This is because no change was made to the law permitting people over 70½ to make charitable gifts from their retirement accounts, specifically their IRA, directly to the charity of their choice, without recognizing taxable income. This means that those individuals are still eligible to get a tax break for donating, even if they take the standard deduction.

It is called a qualified charitable distribution, or a QCD, and is defined by the IRS as “an otherwise taxable distribution from an IRA…owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity.” QCDs allow you to donate up to $100,000 annually from your retirement accounts, which is more than enough for most taxpayers.

Why QCDs have become more useful

Although QCDs have been around for a while, the passage of the TCJA in 2017, with its contingent increase in the standard deduction, has made them much more relevant for the foreseeable future. This year and going forward, it will be much more beneficial for those who take the standard deduction to use their IRA to make charitable gifts. For example, by using a QCD, it is possible for an individual to make a charitable gift from her IRA and apply the gift to satisfying her required minimum distribution for the year—but she will pay no income tax on the IRA distribution because the money is going directly to a charity.

This works because the law permits those over 70½ to make charitable gifts directly from their IRAs to eligible charities and excludes the distributions from their gross income. This strategy hasn’t been as widely used in the past because there was no itemized charitable income tax deduction for such an IRA gift; thus it made more sense for those who itemized to simply donate to charity and then deduct the donation. But since almost everyone will be taking the increased standard deduction in years to come, QCDs have become much more helpful to the typical donor.

But wait, there’s more!

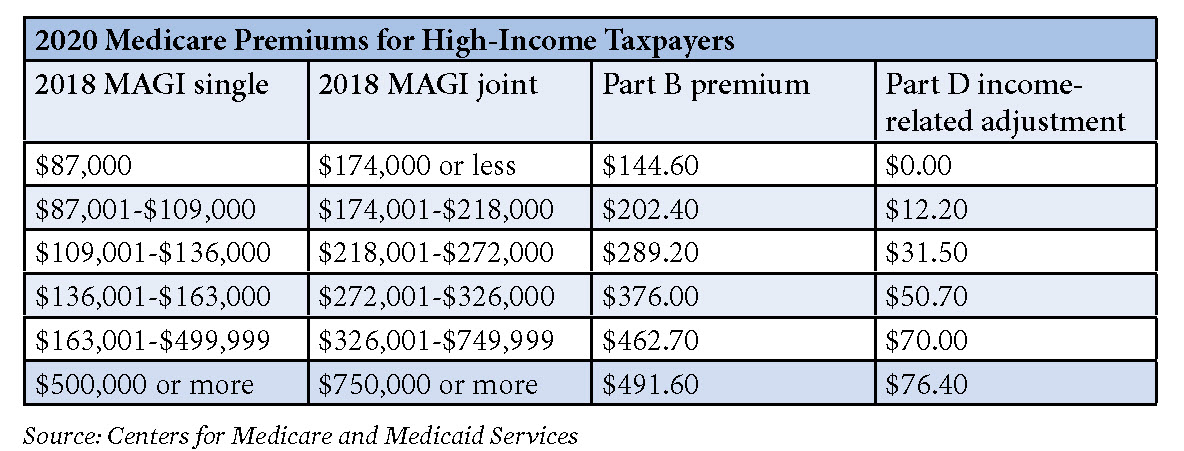

QCDs may also provide a double benefit—they can potentially reduce Medicare premiums, too. High-income earners can see their Medicare premiums increase by thousands of dollars each time their income rises just $1 above any of the multiple predetermined income levels. For a couple in their 70s whose income exceeds the Medicare income threshold levels (see next page), a QCD can be used to reduce premiums in future years.

For example, take a couple making a combined $214,000 per year. If their last withdrawal from, say, their IRA put their modified adjusted income over the threshold of $218,000, their Medicare premiums would spike drastically, increasing by over $2,500 for one year. However, if they make a $5,000 charitable donation through a QCD, their modified adjusted gross income is lowered by $5,000, taking it from $219,000 to $214,000. In turn, their Medicare premiums will potentially be lowered, which could save them $2,500 per year. (Note: Your Medicare premiums are based on tax returns from two years prior.)

Technical QCD requirements

Remember, when attempting to make a QCD, there are some technical requirements that must be met to ensure that the contribution qualifies for special treatment.

- The QCD check must be payable directly to the charity from the IRA account: it can’t be distributed to the taxpayer first and then donated later. However, if the IRA owner has check-writing privileges on her traditional IRA, she might be able to write out the check directly to the charity herself.

- The charity must be a 501(c)(3) organization, meaning that private foundations and donor-advised funds don’t qualify for the QCD.

- Also be sure to check with the IRA custodian to see if there are any other specific requirement or forms that are necessary to make a successful QCD.

Overall, although QCDs have been a somewhat niche strategy in the past, the enactment of the TCJA has really brought them into the spotlight and will make them much more useful to taxpayers as we go forward. Those who are taking the standard deduction and are over the age of 70½ but still want a tax break for donating to charity can use a QCD to give money directly from their IRA to the charity of their choice, killing two birds with one stone. And if they are strategic with that donation, they might even get some Medicare-premium relief as well!

Debra Taylor, CPA/PFS, JD, CDFA, writes on tax and retirement planning for Horsesmouth, an independent organization providing unbiased insight into the critical issues facing financial advisors and their clients.

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

2024 Key Planning & Investment Deadlines for Q2

Financial GuidesSpring is coming and to keep you financially organized for Q2, we are providing you with our Spring...