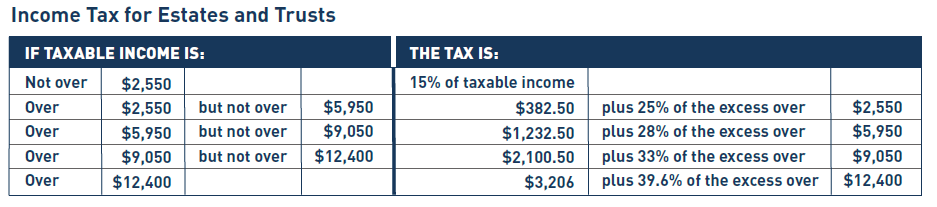

In a recent study, we found that nearly 75% of tax & financial advisors use trusts for “Legacy Planning” initiatives. While trusts are an important tool for transferring wealth to future generations, tax rates for trust income are very high. As of the date of this article’s posting, at just $12,400 of trust income the maximum tax rate of 39.6% comes into play. To put that into perspective, an individual can make as much as $466,950 per year before being taxed at the maximum rate!

In a recent study, we found that nearly 75% of tax & financial advisors use trusts for “Legacy Planning” initiatives. While trusts are an important tool for transferring wealth to future generations, tax rates for trust income are very high. As of the date of this article’s posting, at just $12,400 of trust income the maximum tax rate of 39.6% comes into play. To put that into perspective, an individual can make as much as $466,950 per year before being taxed at the maximum rate!

Do you own assets in a trust and the trust is paying the income taxes?

Do you want to fix that problem?

Wrap those trust assets in a “No-Load” and tax-deferred annuity that gives you 100% access to these assets at any time without any penalties for a very low flat fee per month. Wrapping trust assets into a low-cost, tax-advantaged investing solution helps assets accumulate tax-deferred – leaving a larger legacy for heirs. Trust assets and income will most likely not be recognized until the beneficiary begins making withdrawals, allowing lose assets to grow tax deferred until payments are made from the trust.