Tax Planning

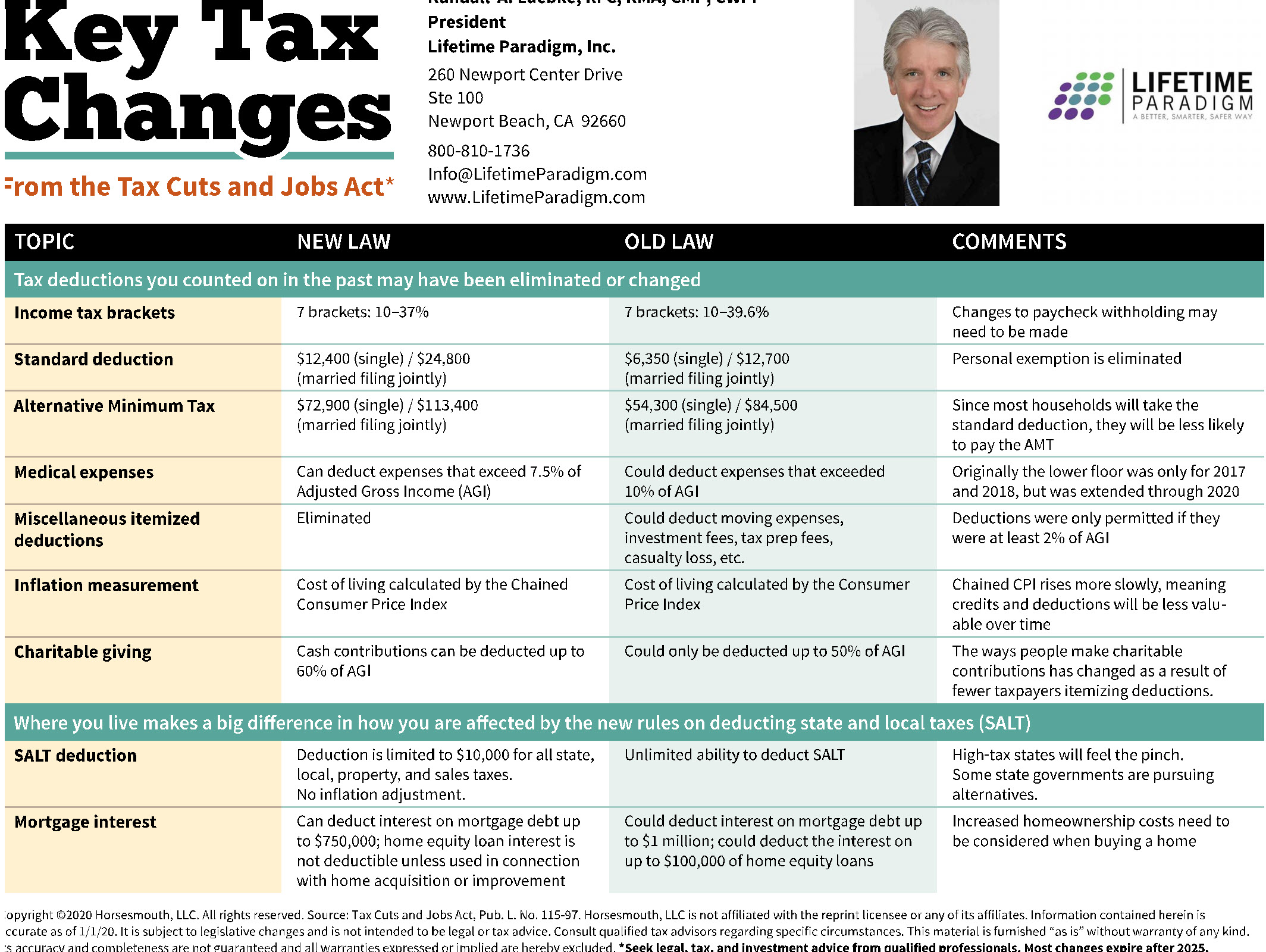

Key Changes to the Tax Cuts & Jobs Act

It’s a good life!

You May Also Like…

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

2024 Key Planning & Investment Deadlines for Q2

Financial GuidesSpring is coming and to keep you financially organized for Q2, we are providing you with our Spring...