Tax Planning

The Practical Guide to S Corporation Taxes

An exclusive report from Bradford Tax Institute.

Topics Included in this Special Report:

- Lock in the Home-Office Deduction for Your S Corporation

- Avoid Trouble: Don’t Let the IRS Set Your S Corporation Salary

- Avoid this S Corporation Health Insurance Deductible Mistake

- Terminating Your S Corporation Election

- Deduction for Defunct S Corporation Expenses?

- 10 Ways to Slash S Corporation Taxes

Lock in the Home Office for your S Corporation

Question

I used to operate my business as a single-member LLC, but recently made an S corporation election. I never had an issue deducting my home-office expenses on my proprietorship tax return, but now that I’m operating as a corporation, I want to make sure I get the same benefit with my S corporation.

How can I make sure the IRS doesn’t “take away” the home-office tax deduction from me?

Answer

Welcome to your new S corporation world of tax strategy, where you encounter additional rules that you need to know and follow to ensure that home-office deduction.

Reimbursement—The One Right Way

There’s one right way to get the benefit of the home-office deduction for your corporation, and that’s by using the reimbursement method. The reason the reimbursement method is the one right way is simple—it’s the only way that works!

Let’s take a quick look at another method.

Why Rent Fails

Some taxpayers mistakenly use is renting the office to the corporation. This will provide you a tax benefit of exactly zero dollars.

The S corporation deducts the rent paid to you. You include the rent in your taxable income on your personal tax return. But the tax code does not allow you to claim tax deductions against this rental income.1

Result. You simply moved the money from one hand to the other, and that results in no tax benefit whatsoever!

Back to the One Right Way for Deductions

The one and only way to get your rightful home-office deduction is with the reimbursement method. Here’s how this works:

- As an employee of your corporation, you submit expense reports to your corporation for the expenses of your home office.

- The corporation reimburses you for the home office and claims 100 percent of the home-office deduction as office space.

- You receive the reimbursement as reimbursed employee business expenses. Such employee reimbursements are not taxable to you.

Why Reimbursement Works

The reason the reimbursement method works is simple—the IRS gives you a road map!

IRS Regulation Section 1.62-2(c) allows your S corporation employer to reimburse you (the employee) under an accountable plan for certain expenses.2 You, the employee, exclude from income all amounts reimbursed by your S corporation employer under an accountable plan, and the corporate employer gets a tax deduction for the full amount.3

The same IRS regulation further states that expenses that qualify for reimbursement under an accountable plan include those listed in part VI, subchapter B, chapter 1 of the code, as long as the employee pays or incurs the expense in connection with the performance of services as an employee for the employer.4

The tax code sections in part VI, subchapter B, chapter 1 include all the deductions that apply to the home office, such as depreciation, repairs, interest, utilities, and taxes.

Doing the Reimbursement Right (Audit-Proofing)

When you submit your expenses to the S corporation, you need to ensure that the expenses comply with tax law. For the home office, you have the following requirements:5

- Proof of the expense (e.g., photocopy of the utility bill)

- Proof of exclusive use (e.g., attesting to exclusive use; photo of exclusive use setup)

- Proof of regular use (e.g., attesting to regular use; submitting a document with hours of use)

- Proof of business use (e.g., adding the type of business use to the hours of use document)

- Proof that your employee use of the home office is for the convenience of your S corporation employer

Your employee use of a home office is for the convenience of your S corporation employer when your facts and circumstances satisfy any one of the following:6

- You must maintain the home office as a condition of employment.

- Your home office is necessary for the functioning of the S corporation’s business.

- The home office is necessary to allow you to perform your duties properly.

We recommend that you create a statement that satisfies the requirements above, submit it at least annually with your expense reports, and update it annually.

The home office must not be “purely a matter of personal convenience, comfort, or economy with respect to the employee.”7

Tax Return Preparation Tip

On the S corporation tax return, report the total reimbursement of the home office in the other deductions category in a line item labeled “office space” or something similar.

On your personal tax return, reduce your itemized deductions by the dollar amounts you received as reimbursements from the S corporation for the home-office mortgage interest and property taxes.

In the permanent file that you maintain for your personal taxes, make sure to track the straight-line depreciation that the corporation reimburses to you for the home office. You need to treat this depreciation as if you claimed it personally. This means the depreciation reduces your basis in the home. This also means that at the time of sale, the straight-line depreciation reimbursed to you is subject to taxation of up to 25 percent as unrecaptured Section 1250 gain.8

Takeaways

If you operate your business as an S corporation and you also want to benefit from the home-office deduction, you need to follow the accountable plan rules to accumulate your proper benefits.

The accountable plan is basically a fancy way of describing an expense report. To obtain your rightful home-office deduction benefits, you (the owner-employee) need to submit properly prepared expense reports to your S corporation.

The expense-report method is the only right way to achieve a full deduction for the home office. Using the rent strategy produces a zero deduction.

Solution—the one right way: reimbursement!

1 IRC Section 280A(c)(6).

2 Reg. Section 1.62-2(c).

3 Reg. Section 1.62-2(c)(4).

4 Reg. Section 1.62-2(d)(1).

5 IRC Section 280A(c)(1).

6 Hamacher v Commr., 94 T.C. 348.

7 Ibid.

8 IRS Section 1(h)(6)(A).

Avoid Trouble: Don’t Let the IRS Set Your S Corporation Salary

You likely formed an S corporation to save on self-employment taxes.

If so, is your S corporation salary

- nonexistent?

- too low?

- too high?

- just right?

Getting the S corporation salary right is important. First, if it’s too low and you get caught by the IRS, you will pay not only income taxes and self-employment taxes on the too-low amount, but also both payroll and income tax penalties that can cost plenty.

Second, in most cases, the IRS is going to expand the audit to cover three years and then add the income and penalties for those three years.

Third, after being found out, you likely are now stuck with this higher salary, defeating your original purposes of saving on self-employment taxes.

Fourth, your tax advisor can get slapped with preparer penalties.

Saving on Self-Employment Taxes

For 2021, self-employment taxes are assessed as follows:

- The first $142,800 of self-employment income is taxed at 15.3 percent.1 To get to self-employment income, you multiply net income by 92.35 percent. Planning note. This means that your potential savings at the maximum self-employment tax rate occurs on up to $154,629 of your 2020 net income ($142,800 ÷ 92.35 percent).

- For amounts of self-employment income between $142,800 and $200,000, you get hit with the 2.9 percent Medicare tax.

- For amounts of self-employment income in excess of $200,000 ($250,000 on a joint return), you get hit with a 3.8 percent tax (2.9 percent for Medicare and 0.9 for Obamacare).2

Self-employed. Your biggest savings occur when you can encroach on the 15.3 percent. You trigger these savings at the rate of 14.13 percent for every dollar below $154,629.3 This is how you should think as a self-employed person who is considering becoming an S corporation.

S corporation. But once you are an S corporation, you save on payroll taxes with salary below $142,800, which are assessed at 7.65 percent on the employee (you) and 7.65 percent on your corporation, for a total savings of 15.3 percent.

Example. Sam takes a cash salary of $37,700 and an S corporation distribution of $100,000. His payroll tax savings are $15,300.

Don’t judge Sam’s cash salary as too low yet. It might be okay, as you will see later in this article.

Do This

Put yourself in the IRS examiner’s chair. You ask an S corporation owner-employee, for example, “What’s your basis for the $63,231 salary?”

What would you (remember, you are the IRS examiner) like to hear and see so you can accept the salary as reasonable?

We don’t know for sure because, as the IRS says in its Fact Sheet “Wage Compensation for S Corporation Officers:”4

There are no specific guidelines for reasonable compensation in the Code or the Regulations. The various courts that have ruled on this issue have based their determinations on the facts and circumstances of each case.

But you have to believe that having the dollar amount of the reasonable compensation in a written document that’s included in the corporate minutes creates a great first and perhaps lasting impression.

The minutes take on additional meaning if they contain a reasonable compensation document that’s updated annually.

Getting to the Number

The IRS did you a big favor when it released its “Reasonable Compensation Job Aid for IRS Valuation Professionals.”5

The IRS states that the job aid is not an official IRS position and that it does not represent official authority. That said, the document is a huge help because it gives you some clearly defined valuation rules of the road to follow and takes away some of the gray areas.

Three approaches. The job aid lists three general approaches to reasonable compensation:

- Market approach

- Income approach

- Cost approach

Market Approach

The market approach to reasonable compensation compares the S corporation’s business with others and then looks at the compensation being paid by those businesses to employees who look like you, the shareholder-employee who is likely the CEO.

The question to be answered is, how much compensation would be paid for this same position, held by a non-owner in an arm’s-length employment relationship, at a similar company?

In its job aid, the IRS states that the courts favor the market approach, but because of challenges in matching employees at comparable companies, the IRS developed other approaches.

For how the market approach works, see David E. Watson, P.C. v. United States6. In this case, you see the following:

- Watson’s S corporation paid him a salary of $24,000 and distributions of $222,000.

- The IRS audited Mr. Watson’s S corporation tax return, disallowed the $24,000, and asserted $199,000 as the reasonable salary.

- Watson took the IRS to court.

- Watson left the courthouse with $91,000 as salary, leaving $155,000 in profit distributions.

Mr. Watson saved big on his payroll taxes.

Income Approach

The IRS says the income approach, which is based on the independent investor test, can be correctly applied only when the fair market value of the company is available for each year that compensation is being examined. As a result, the market approach is generally more useful than the income approach in a reasonable compensation analysis.

For how the independent investor test works, see Brinks Gilson & Lione A Professional Corp. v. Commissioner7. This case involved a law firm that operated as a C corporation and bonused out the profits each year.

After negotiations, the IRS and the law firm entered into a closing agreement that, among other things, disallowed those year-end bonuses and recharacterized them as non-deductible dividends. This resulted in tax underpayments of $1,109,652 and $1,015,776, respectively, for each of the two years under examination.

S and C corporations. The reasonable compensation issue applies to both the S and C corporations, albeit there will likely be fewer C corporation issues now that the C corporations have a top tax rate of 21 percent. But the following applies, in general:

- The owner of an S corporation wants a low salary.

- The owner of a C corporation wants a high salary. The IRS job aid deals with both the too-low and the too-high salary issues.

Cost Approach

The cost approach breaks your employee activities into their components, such as management, accounting, finance, marketing, advertising, engineering, purchasing, janitorial, bookkeeping, clerking, etc.

The IRS, in Appendix H to its job aid, lists five court cases wherein the courts agreed with the IRS’s cost approach in finding the compensation to the C corporation shareholder-employees too high, but disagreeing on the dollar amount of the reasonable compensation.8

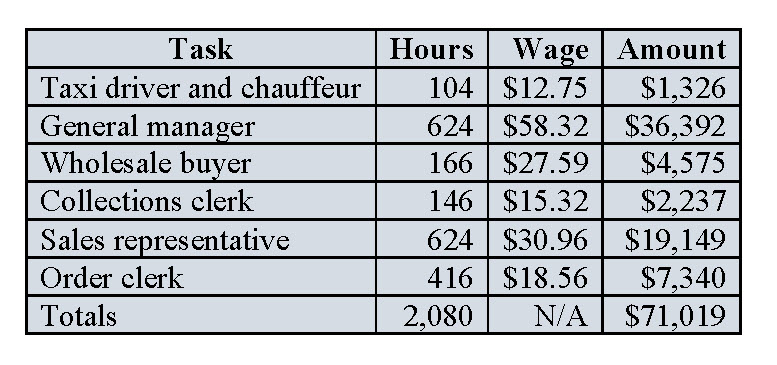

With the S corporation, you are generally looking for the low salary to save on payroll taxes. The cost approach can provide excellent proof for the various jobs that you perform as a shareholder-employee of your S corporation.

We found a resource at https://rcreports.com/ that could prove valuable in establishing a reasonable salary for the shareholder-employee. We have no relationship with this resource, but we are familiar with some tax professionals who use it to assist their clients. We are also familiar with the databases it uses to generate the compensation levels.

Here’s an example of how the cost approach works to support a $71,019 salary as reasonable compensation for this S corporation owner whose corporation had $3.5 million in revenue and 19 employees:

Health Insurance

The S corporation’s payment or reimbursement of health insurance for the shareholder-employee and his or her family goes on the shareholder’s W-2 and counts as compensation, but it’s not subject to payroll taxes so it fits nicely into the payroll tax savings strategy for the S corporation owner.

Pension

The S corporation’s employer contributions on behalf of the owner-employee to a defined benefit plan, simplified employee pension (SEP) plan, or 401(k) count as compensation but don’t trigger payroll taxes. Such contributions further enable the savings on payroll taxes while adding to the dollar amount that’s considered reasonable compensation.

Planning note. Your S corporation compensation determines the amount that your S corporation can contribute to your SEP or 401(k) retirement plan. The defined benefit plan likely allows the corporation to make a larger contribution on your behalf.

Section 199A Deduction

The S corporation’s net income that is passed through to you, the shareholder, can qualify for the 20 percent Section 199A tax deduction on your Form 1040.

Takeaways

If you want your S corporation salary to hold up in an IRS audit, do two things:

- Make sure the corporate minutes name your salary.

- Have documents that prove your salary is reasonable.

The question is, who will set your salary—you or the IRS? With documentation, you put yourself in the driver’s seat.

Both you and the IRS have two viable approaches (from the three in the job aid) to finding the reasonable salary for the S corporation owner-employee:

- Market approach

- Cost approach

Regardless of the approach used, if you have (1) the salary in the S corporation minutes and (2) documentation that proves your salary is reasonable, you can sleep well at night.

1 Social Security Administration Fact Sheet 2020 Social Security Changes.

2 IRC Section 1401(b)(2).

3 To find self-employment income, you multiply net income by 0.9235 percent. 15.3 percent x 0.9235 percent = 14.13 percent.

4 FS-2008-25, last reviewed or updated: Mar. 4, 2020.

5 “Reasonable Compensation Job Aid for IRS Valuation Professionals” (Oct. 24, 2014).

6 David E. Watson v U.S., 107 AFTR 2d 2011-311 (DC IA, 12/23/2010).

7 Brinks Gilson & Lione A Professional Corp. v. Commr., T.C. Memo 2016-20.

8 Appendix to “Reasonable Compensation Job Aid for IRS Valuation Professionals.”

Avoid This S Corporation Health Insurance Deduction Mistake

If you have family members working for you in your S corporation, stop and read this article now.

Think of this: You own 100 percent of your S corporation. Your 30-year-old daughter works for your S corporation. She owns no stock. Your S corporation covers her with a group health policy.

Did your S corporation claim an insurance deduction for the cost of the premiums attributable to your daughter? If yes, that’s wrong. The health insurance is not deductible by the S corporation as health insurance. The S corporation must treat it as W-2 wages as we explain.

And with the incorrect setup, your family is simply out the money it paid for the health insurance. This is bad. It means a zero deduction for the S corporation and a lost health insurance deduction for your daughter.

Let’s fix this mess. Let’s get a corporate tax deduction. And let’s get a Form 1040 tax deduction for the daughter.

S Corporation Owner Insurance 101

If you own more than 2 percent of an S corporation, you need to follow three steps to deduct your health insurance premiums.1

Step 1. Get the cost of the insurance on the S corporation’s books.

To do this, the S corporation first establishes a health insurance plan for you in one of two ways:

- The S corporation makes the premium payments for the accident and health insurance policy covering you (and your spouse or dependents, if applicable).

- You make the premium payments to the insurance company and then furnish an expense report with proof of the premium payments to the S corporation, which in turn reimburses you for the premium payments.

Step 2. The S corporation includes the health insurance premiums on your W-2 as taxable income. But this income is not subject to payroll taxes (Social Security and Medicare). In other words, the S corporation includes the additional compensation in box 1 of the W-2 but not in boxes 3 or 5.

Step 3. You claim the health insurance deduction as an above-the-line self-employed health insurance deduction on Form 1040, provided you otherwise qualify for the deduction by overcoming the two hurdles below.

You have two qualification hurdles to claiming the self-employed health insurance deduction on your Form 1040:

- You cannot take this insurance deduction if you or your spouse is eligible for employer-subsidized health insurance. Thus, if your spouse can get family health insurance as a tax-advantaged fringe benefit through his or her employer, you lose your eligibility for this deduction—even if your spouse does not actually accept the employer-sponsored insurance.2

- Your deduction for the insurance premiums cannot exceed the amount of your salary from the S corporation.3

Family Member Surprise

The self-employed health insurance rules explained above apply to each shareholder-employee who owns more than 2 percent of the S corporation.

The surprise is that your family members who work for your S corporation are deemed by the attribution rules under tax code Section 318 to own the same percentage of stock as you own. And this means that the rules you face to deduct your health insurance also apply to certain family members.

Under the attribution rules for family members, the tax law deems you to own the stock owned by your4

- spouse,

- children,

- grandchildren, and

- parents

Example 1. Your parents collectively own 100 percent of an S corporation, and you work for that S corporation. The S corporation covers you under its group health insurance policy.

The tax law considers you (even though you do not own a single share of stock) to own 100 percent of the S corporation, under the Section 318 attribution rules.

Because of the attribution rules and your status as a shareholder-employee who owns more than 2 percent of the company, the S corporation must include the value of your health insurance as W-2 income to you so that the S corporation can deduct the health insurance expense on its tax return as a wage expense.

Example 2. Your spouse owns 5 percent of an S corporation, and you work for that S corporation. The S corporation covers you under its group health insurance policy.

The tax law considers you a more than 2 percent S corporation shareholder under the Section 318 attribution rules. (You are deemed to own 5 percent.)

Let’s say the S corporation doesn’t include the value of your health insurance as wages on your W-2 because it didn’t realize it had to do so. Because of this mistake, the S corporation can’t deduct the value of your health insurance on its tax return.

Attribution Deduction

In recent guidance, the IRS concluded that you can take the self-employed health insurance deduction if you own the stock solely by attribution, provided you meet all the other requirements.5

Example 3. You own 100 percent of your S corporation business.

You employ your daughter as a manager in the business and pay her $70,000 per year. You also provide her health insurance as part of your group plan, at a cost to your S corporation of $6,000 per year.

Since the tax law attributes your S corporation stock ownership to your daughter, she is a more than 2 percent S corporation shareholder. As such, your S corporation must

- include $6,000 as income on your daughter’s W-2 as box 1 wages, and

- deduct the $6,000 as a wage expense.

If your S corporation did this, good for you. You secured the S corporation’s tax deduction for the insurance.

Also, good for your daughter. She can claim the self-employed health insurance deduction on her Form 1040, offsetting the $6,000 of W-2 income (provided she meets the other requirements for the self-employed health insurance deduction).

Did you get this correct? If not, check out how to fix it below.

How to Fix It

This isn’t new law. The IRS is interpreting existing law.

But we’re guessing that as you read this article, you might see a boo-boo in your handling of this issue.

But don’t worry—you can fix the errors.

Fix Error 1: No Attribution

You need to do three things to correct an attribution failure:

- Amend the S corporation tax return to claim the insurance expense as a wage expense.

- Amend the family member’s W-2s to include the insurance amounts as box 1 wages.

- Amend the family member’s Form 1040 to correct wages and claim the self-employed health insurance deduction (if he or she qualifies).

Fix Error 2: Attribution, but No 1040 Deduction

This fix is simple: amend the family member’s Form 1040 to claim the self-employed health insurance deduction (if he or she qualifies).

Warning. If the amended Form 1040 shows a refund, you have a limited time to file it and timely claim a refund. You must file the amended return by the later of6

- three years from the filing date of the tax return, or

- two years from the date you paid the tax.

Takeaways

If you own more than 2 percent of an S corporation, you have to do three things to claim a deduction for your health insurance:

- You must get the cost of the insurance on the S corporation’s books.

- Your S corporation must include the health insurance premiums on your W-2 form.

- You must (if eligible) claim the health insurance deduction as an above-the-line deduction on Form 1040.

The three-step procedure also applies to your spouse, children, grandchildren, and parents if they work for your S corporation and get health insurance coverage, even if they don’t own a single share of S corporation stock directly.

Note. Your spouse and your child under age 27 could be included in a family plan, and thus the premium cost for them would be added to your W-2.7

You need to get this right. Without the W-2 treatment, the S corporation does not get a tax deduction.

With the correct W-2 treatment, the more than 2 percent shareholder who finds the health insurance premiums on his or her W-2 can claim the self-employed health insurance deduction on Form 1040, provided he or she is not eligible for employer-subsidized health insurance through another job or a spouse’s job.

If your S corporation did not handle this correctly in the past, get busy amending those returns.

1 Notice 2008-1.

2 IRC Section 162(l)(2)(B).

3 IRC Section 162(l)(5).

4 IRC Section 318(a)(1).

5 Chief Counsel Advice 201912001.

6 IRC Section 6511.

7 IRC Section 105(b); Note: The under-age-27 rule is for tax-deduction purposes; for excise tax purposes, the magic age is 26. See Reg. Section 54-4980H-1(a)(12) for the under-age-26 rule.

Terminating Your S Corporation Election

If you’re reconsidering your business’s choice of entity due to tax reform, then the C corporation, partnership, or even sole proprietorship may be on your list.

If you are an S corporation currently, then you’ll have to terminate your S corporation election to switch to another business type.

With the switch, you need to consider:

- How do I terminate the S corporation election correctly?

- What are the tax consequences to me?

We’ll give you a detailed explanation of both.

And we’ll tell you a little-known way you can undo your S corporation with absolutely no tax consequence to you. (Yes, really!)

If You Are a Corporation

If you want to turn your S corporation into a C corporation, you file an S corporation election revocation statement with the IRS.1 Your corporation is then a C corporation for federal tax purposes.

If you don’t want your business to be either an S or a C corporation, you liquidate the S corporation and contribute the assets to a new business entity.

If You Are an LLC

If you chose S corporation taxation for your limited liability company (LLC), changing that election is a little more complicated.

First, you must file the S corporation election revocation statement with the IRS. The tax law then treats your LLC as a C corporation for federal tax purposes.2

If that’s what you want, stop there.

If you want a disregarded entity (single-member LLC) or a partnership (multi-member LLC), you also need to file Form 8832, Entity Classification Election, to revoke the C corporation election.3

Rules of the LLC Road

A single-member LLC cannot be a partnership.4

A multi-member LLC cannot be a sole proprietorship.5

One exception. If you and your spouse are the sole owners of your LLC and live in a community property state, then you can elect single-member LLC treatment, which means taxation as a proprietorship.

Another exception. If you and your spouse are the sole owners of your LLC and live in a community property state, then you can elect “qualified joint venture” status and report the business on two separate Schedule Cs instead of being taxed as a partnership.6

Revocation Timeline

You can precisely determine the date you revoke your S corporation election—and it does not have to coincide with the end of the corporation’s tax year:7

- If you want a January 1 revocation date for your calendar-year S corporation, make your revocation before January 1 or by the 15th day of the third month of the desired revocation year.

- If you specify an exact date for the revocation to take effect, and if that date is on or after the date you file the revocation, then the IRS considers your S corporation election terminated on that date. If the exact date is not the beginning of the tax year, you divide the tax year into two tax periods: (1) an S corporation short year, and (2) a C corporation short year (assuming no further elections are made).

Example 1. You are a calendar-year corporation. You file the revocation statement on June 1, 2021, with no specific date indicated. The IRS will terminate your S corporation election effective January 1, 2022.

Example 2. Same as above, except in your revocation statement, you specify the termination to take effect on July 1, 2021. The IRS will terminate your S corporation election effective July 1, 2021.

Revocation Process

There’s no official form to revoke the S corporation election. You mail a letter to the IRS at the service center where you sent your Form 2553.

For a valid revocation, your letter must include the following elements:8

- the name, address, and taxpayer identification number of the corporation;

- a statement that the corporation is revoking its S corporation election under Code Section 1362(a);

- the effective date the revocation is to be effective (for revocations that specify a prospective date);

- the number of shares of stock (including non-voting stock) issued and outstanding at the time of the revocation;

- a statement of consent by shareholders holding more than 50 percent of the issued and outstanding stock (including non-voting stock); and

- the signature of a person authorized to sign the annual S corporation return.

We’ve got a sample revocation letter (click here) and sample consent form (click here) for your use.

Deemed Revocation

There’s another way out of S corporation treatment if the formal revocation process is a problem for you—for example, if you can’t get the written consent of all required shareholders within your preferred time frame.

If your S corporation fails to meet the S corporation requirements, then there is a deemed revocation of its S corporation election on the first day it was ineligible.9

Your S corporation is ineligible if it has10

- more than 100 shareholders,

- ineligible shareholders, or

- more than one class of stock.

Certain members of the same family are considered one shareholder for purposes of the number limitation.11 This includes

- spouses and their estates, and

- all members of a family and their estates, with “members of a family” meaning family members within six or less generations, their lineal descendants, and the current and former spouses of any members of a family.

Ineligible shareholders include nonresident aliens, partnerships, and corporations.12

Revocation Consequences

Before you revoke your S corporation election, be sure to consider the following three issues:

- You won’t be able to re-elect S corporation status for five years without IRS consent.13

- If you previously chose S corporation status for your LLC, the revocation of the S corporation is a complete liquidation of the corporation.14

- The C corporation election revocation is deemed a liquidation of the C corporation.

Rescind Instead, If You Can

If you have remorse either for revoking your S corporation status or for electing it in the first place, you can hit the do-over button with no penalty to you.

You can rescind your S corporation election or revocation if the IRS receives your request by the due date of your original election or revocation.15

If you can rescind it, it never happened taxwise.

And the best news is, the five-year wait for S corporation re-election doesn’t apply on a rescinded election. 16

Example 3. You elect S corporation status for your corporation, effective January 1, 2021. You have until March 15, 2021, to rescind the election, and you treat your corporation as a C corporation for tax year 2021. You can re-elect S corporation status at any time.

Takeaways

Tax reform might have you ready to change your S corporation to another tax structure. If so, you can terminate your S corporation election by either

- revoking it within the required time frame(s), or

- making the corporation ineligible to be an S corporation.

If you want to undo an election or a revocation, the best option is to rescind, as you’ll have zero negative tax consequences for doing so, whereas revoking your S corporation election can cause you problems now and down the road.

1 IRC Section 1362(d)(1).

2 Reg. Section 301.7701-3(c)(1)(v)(C).

3 Ibid.

4 Reg. Section 301.7701-3(a).

5 Ibid.

6 IRC Section 761(f).

7 Reg. Section 1.1362-2(a)(2).

8 Reg. Section 1.1362-6(a).

9 IRC Section 1362(d)(1).

10 IRC Section 1361(b)(1) 2018.

11 IRC Section 1361(c)(1) 2018.

12 IRC Section 1361(b)(1) 2018.

13 IRC Section 1362(g).

14 Reg. Sections 301.7701-3(g)(1)(ii); 301.7701-3(g)(1)(iii).

15 IRM Section 3.13.2.22.7, para. 17 (Last Revised: 08-20-2018); Reg. Section 1.1362-6(a)(4)(i).

16 Ibid.

Deduction for Defunct S Corporation Expenses

Question

I officially closed my S corporation with the state in 2019.

I’ve had unexpected expenses from the defunct S corporation in 2020 and 2021 that I’ve paid personally as the S corporation’s president and sole shareholder.

Where can I deduct those expenses? Do I file Form 1120S for tax years 2020 and 2021? I marked the 2019 return as “final.”

Answer

Your S corporation gets no deduction for the expenses.

You likely can get a limited tax benefit for the expenses.

No Deduction for the S Corporation

The law is clear: for Section 162 ordinary and necessary business expenses, making a payment on behalf of your S corporation is different from one made by the S corporation itself.1

In Cocke, the court said it is a “general tax principle, that deductions for expenses can be taken only by the party who actually ‘paid or incurred’ them.”2

In H.W. Nelson Co., the court said: “There are no provisions in the tax laws whereby one taxpayer can deduct from his gross income expenses incurred and defrayed (paid) by another.”3

Since your S corporation (1) is defunct and (2) didn’t actually pay the expense, it gets no ordinary deduction for these expenses.

Limited Deduction for Owner

You may not personally deduct the expenses as ordinary business expenses because you did not incur them in your trade or business.4

But under the Arrowsmith Supreme Court decision, you can deduct the expenses as capital losses.5

The key to the Arrowsmith treatment is that you, the S corporation owner, must be legally required to pay the post-liquidation corporation expenses.

When the expenses are capital losses, you can deduct them only to the extent of your capital gain income and, once you have exhausted your capital gain income, against your ordinary income, but only up to $3,000 for the year. If you have leftovers, you carry them to the next year and start this process over again.

Example. John liquidated his S corporation in 2020. In 2021, he paid a $30,000 legal settlement from a lawsuit against the S corporation and against him personally.

If John has no capital gain income, then John can deduct $3,000 of the losses against his income each year for 10 years.

Hindsight Is 20/20

If you had left the S corporation open with some cash, then the S corporation could deduct the amounts as ordinary expenses, even if the S corporation paid the expenses after it ended its business activities.6

The loss would then pass through the S corporation to you as its owner.

Takeaways

If you dissolve your S corporation and later have corporate expenses, you’re stuck with capital loss treatment if you are legally required to pay those expenses personally.

Ordinary loss deductions beat capital losses, but here something is better than nothing. If you decide to close your S corporation, consider

- keeping the corporation open for extra time to ensure you receive all income and pay all expenses, or

- resolving all potential accounts payable and other potential liabilities before closing the business.

Since you incur costs for keeping the S corporation open (tax return filings, state franchise taxes, etc.), you need to weigh this cost against any lingering accounts payable, and any other liability issues your S corporation has.

1 Brown v Commr., T.C. Memo 2017-18.

2 United States v Cocke, 399 F.2d 433, 447 (5th Cir. 1968).

3 H.W. Nelson Co. Inc. v United States, 158 Ct. Cl. 629, 637 (1962).

4 IRC Section 162(a).

5 Arrowsmith v Commr., 344 US 6 (1952).

6 Rev. Rul. 67-12; Dowd v Commr., 68 T.C. 294, 301 (1977).

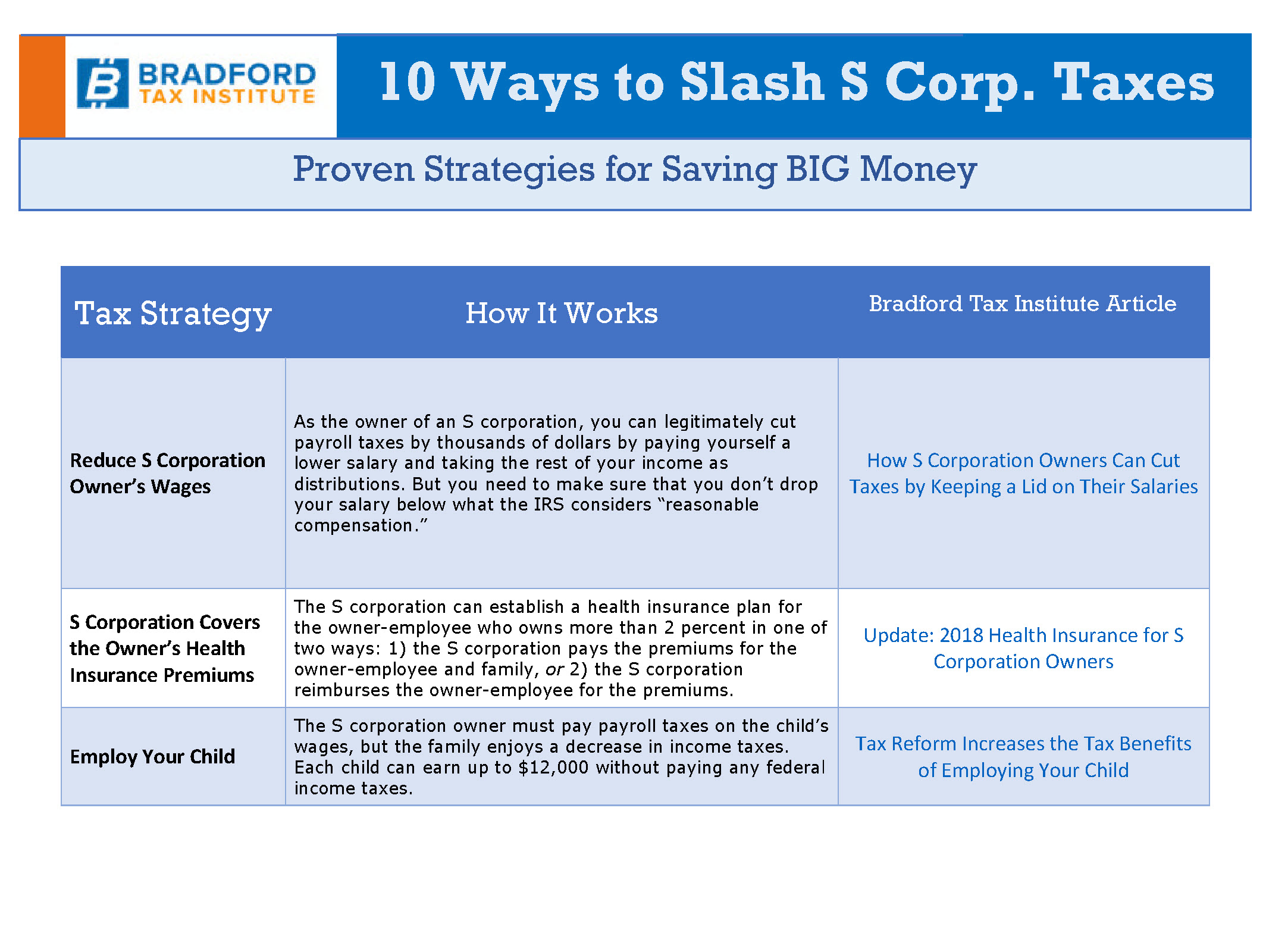

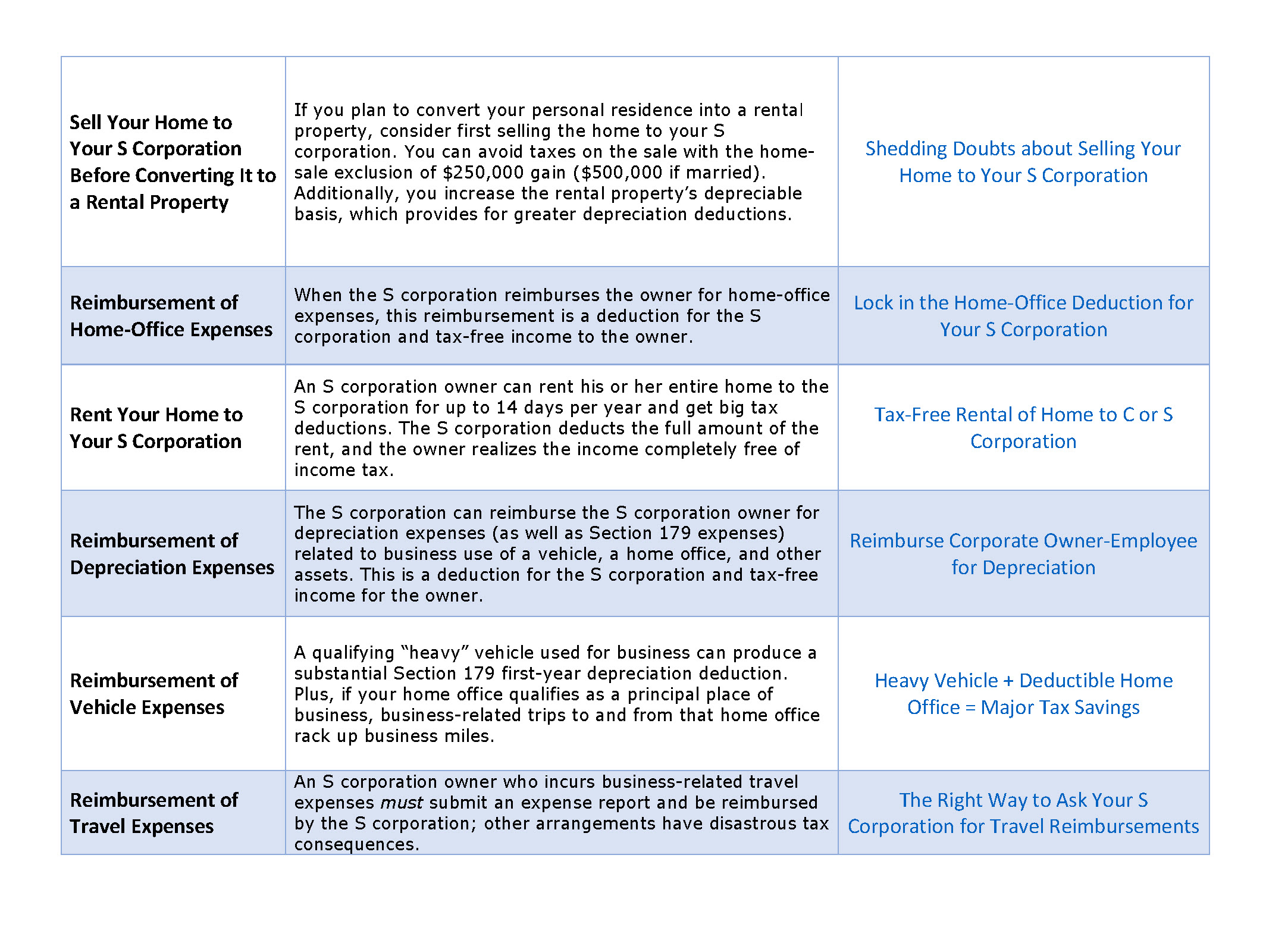

10 Ways to Slash S Corporation Taxes

Exclusive report provided by bradfordtaxinstitute.com

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (For Consumers & Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Tax Planning

Retirement Planning

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...