— Services

Retirement Savings Plans

If you have arrived on this webpage, it is highly likely that you fall into one of the following three categories:

Consumer

You are seeking to expand your knowledge about your existing IRA, 401(k), or another retirement savings plan, or you are contemplating opening a new one.

Business Owner

You are a business owner and considering implementing a retirement savings plan for your business or already have one in place.

Tax Professional

(CPA, ER, Attorney) or Financial Advisor

You work closely with clients and are evaluating the option of recommending a retirement savings plan, or your clients already have a plan in place. Alternatively, you are a financial advisor providing guidance on retirement savings plans.

If you find yourself fitting into any of these three categories, you have arrived at the right destination. Whether you are exploring the idea of a retirement savings plan or currently have one in place, there is a common thread among all scenarios – significant financial implications. It is only natural that you seek confidence in “your plan” or the plan you are recommending. You want assurance that it adheres to legal and compliance standards, is designed with optimal efficiency, and, if there are superior alternatives, you are aware of them.

Now, if you are a consumer, you can stop reading. Given your situation will vary widely, it is best to schedule a free consultation with us. This will allow us to become familiar with the specifics of your situation, enabling us to guide you toward the best choices and options to consider. Click here to be redirected to our online calendar and schedule your free consultation.

However, if you are a business owner, attorney, or financial professional, please continue reading. The information presented below holds significant importance for you and your objectives.

What You Need to Know

Definitions

Let’s start with some definitions.

Understanding different retirement savings plans can be overwhelming, but it’s essential to have a clear grasp of the basics. There are two major categories of retirement savings plans: Defined Contribution Plans and Defined Benefit Plans. Here’s a breakdown of each:

Defined Contribution Plans: Defined Contribution Plans, such as 401(k), IRA, SEP, SIMPLE, Profit Sharing, etc., are retirement savings plans where the IRS defines and limits the annual contributions that can be made into these types of accounts. While these plans play a vital role in retirement saving, they don’t guarantee a specific amount of money or a guaranteed income during retirement. Instead, they serve as tax-advantaged savings plans that accumulate assets for retirement in a tax-efficient manner.

Defined Benefit Plans: Defined Benefit Plans, including 412(e)(3), Cash Balance, 401(h), etc., are tax-advantaged retirement savings plans that provide specific and guaranteed benefits at retirement. Commonly referred to as “pensions,” these plans provide ongoing distributions of money throughout one’s retirement. Or, referred to as a “Cash Balance Plan”, the benefit could be a specific sum of money available at retirement. In some cases, they can combine both options. Annual contributions and corresponding tax deductions for defined benefit plans are usually substantially greater than those available through defined contribution plans, making them highly desirable for individuals with higher incomes.

The Super(k) ℠: The Super(k) ˢᵐ is a comprehensive retirement savings plan that combines a 401(k) and a Profit Sharing plan, a Cash Balance plan, a 401(h) plan, and a life insurance option. This plan is designed to maximize the total annual tax-deductible contributions while working and optimize the benefits at retirement.

Pension: Although not technically a retirement savings plan, it’s worth noting that a pension involves a guaranteed ongoing distribution of money paid during a person’s retirement from an investment fund to which the individual and/or their employer has contributed throughout their working years.

With numerous choices and options available, selecting the best plan for your specific situation can quickly become confusing. Additionally, it’s important to consider the compliance aspect with regulatory agencies such as the IRS, ERISA, the PBGC, and stay updated on potential changes made by Congress, as they often modify the laws, rules, and regulations governing these plans.

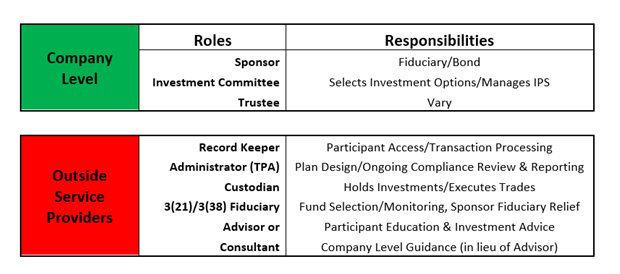

The “Players” In This Game

Now, let’s explore the various parties involved in a retirement savings plan. The specific players and their roles can vary significantly depending on the type of plan. However, let’s take a comprehensive look at all the parties and their duties and responsibilities for our purposes today.

COMPANY LEVEL

At the company level, there are essentially 3 Roles to address:

- The Plan Sponsor

- The Investment Committee

- The Trustee

First, the Plan Sponsor: The plan sponsor is the company offering the retirement savings plan to its employees. As the sponsor, the company acts as a fiduciary to the plan, holding a high legal standard of responsibility. They must provide a fair and functional plan without excessive fees. If employees feel otherwise, the plan sponsor can face significant financial consequences. However, often the employer sponsoring the plan may have limited knowledge about these plans, making it challenging to choose the right plan design and manage fiduciary responsibilities effectively.

Second, the Investment Committee: The investment committee, typically comprised of individuals appointed by the plan sponsor, is responsible for selecting the investment options available to employees within the plan. Even if the employer has limited knowledge about securities, someone within the committee must make these investment decisions on behalf of the employees.

Finally, the role of the Trustee: The trustee primarily handles administrative duties related to the retirement savings plan. They execute plan documents, open investment accounts, and manage other administrative tasks. The Trustee is a fundamentally simple role, but very important role which, again, will generally ride on the shoulders of the business owner.

OUTSIDE SERVICES

In addition to these company-level roles, there are external service providers involved in the retirement savings plan. Here are 5 key roles to consider:

- The Record Keeper

- The Administrator (TPA)

- The Custodian(s)

- The 3(21) or 3(38) Fiduciary

- The Plan Financial Advisor or Plan Consultant

Record Keeper: The record keeper provides employees with access to their plan assets, allowing them to track their payroll deferrals and will provide the employee with the ability to make trading and investment decisions. They play a crucial role in facilitating employees’ interaction with the plan.

Administrator (TPA – Third-Party Administrator): The administrator handles various administrative functions of the retirement savings plan. They ensure compliance with regulatory requirements, perform necessary calculations, and assist with reporting and recordkeeping.

Custodian(s): Custodians hold and safeguard the plan’s assets, ensuring their security and proper management. They may also handle transactions and provide reporting related to the plan’s investments.

3(21) or 3(38) Fiduciary: A 3(21) or 3(38) fiduciary provides investment advisory services within the retirement savings plan. Their role may involve selecting and monitoring the plan’s investment options and offering guidance to the plan sponsor and investment committee.

Plan Financial Advisor or Plan Consultant: A plan financial advisor or consultant provides expertise and guidance to the plan sponsor, investment committee, and employees. They help determine the best retirement savings plan option, provide a roadmap for implementation, and offer ongoing support and resources.

It’s important to note that not all plans require all of these parties. The challenge for professionals in tax, legal, or financial advisory roles is identifying the most suitable options for their clients, including the business owner. Similarly, for business owners themselves, understanding where to begin can be overwhelming. How do you know which plan is best for the business owner? If you are a business owner, how do you even know where to begin?

To simplify the process, we invite business owners to click on the “Business Owner’s” link below to access a short questionnaire about your business. Upon completing the questionnaire, you will be redirected to our online calendar to schedule a free interview to discuss the specifics of your situation.

We offer various ways to work together with you and/or your clients, ranging from our full-service model, to serving as your client’s plan consultant, or simply working with you and your client to provide guidance on the best retirement savings plan option to implement, while supporting you with a roadmap and resources throughout the process.

If you’re a professional (an attorney, tax or financial advisor), please click on the “Professionals” link below to schedule a 25-minute meeting via our online calendar. We can discuss the services we provide to both you and your clients in more detail.

What is a Retirement Savings Plan?

Retirement savings plans, such as 401(k), IRA, SEP, SIMPLE, 401(b), 457, and others, are familiar to most individuals seeking financial security for their retirement years. Regardless of the specific name, all retirement savings plans serve one specific primary purpose: to provide a tax-efficient means of saving for one’s retirement.

Saving for retirement is a smart and proactive choice, regardless of one’s financial status. However, significant changes in the retirement landscape occurred with the passage of the Employment Retirement Income Security Act (ERISA) in 1974, impacting both employers and employees.

In the not-so-distant past, planning for retirement was relatively straightforward. Let’s consider a simplified scenario with Grandpa and Grandma as examples. Like many of their peers, Grandpa worked for a company for over three decades. Upon retirement, he received a pension—an ongoing and assured income for both his and Grandma’s lifetime. Additionally, they received Social Security, providing another lifetime income source.

Benefiting from these two secure and continuing income streams, along with modest savings and likely a mortgage-free home, Grandpa and Grandma could enjoy a comfortable retirement.

Fast-forward to the present, and, wow, how things have changed!

ERISA’s introduction precipitated the swift decline of company-sponsored pensions. Today, except for public sector employees like teachers, firefighters, policemen, and other public servants, individuals are predominantly responsible for funding their retirement. The good news, this shift grants individuals greater control over their retirement savings and investments, but it also exposes the challenge that many are ill-equipped to make the necessary financial decisions for adequate retirement planning.

As a result, a significant portion of the population is ill-prepared for a financially secure retirement. They have underestimated the amount needed to save, they’ve suboptimal investment choices, and overlook the costs associated with funding retirement—especially since they lack the guaranteed income safety nets Grandpa and Grandma once enjoyed.

Small business owners, in particular, face even greater obstacles. Their daily focus centers on surviving, growing, and thriving in their businesses. Although they may desire to invest time and resources into creating a robust retirement savings plan for themselves and their employees, they often find themselves in the same predicament as others—ill-prepared.

In the face of these challenges, individuals and business owners alike require expert guidance to navigate the intricacies of retirement planning effectively. That’s where our expertise at Lifetime Paradigm comes into play. We are committed to helping you develop a comprehensive retirement savings plan tailored to your unique circumstances and goals.

In the subsequent sections, we will delve into our Retirement Savings Plan platform, which addresses the multifaceted needs of both employees and business owners. Our goal is to empower you with the right tools and strategies, so you can confidently embark on the journey to a secure and prosperous retirement.

Lifetime Paradigm’s

Retirement Savings Plan Platform

At Lifetime Paradigm, our Retirement Savings Plan platform is designed to tackle essential challenges in retirement planning.

To address these diverse needs, we have developed two unique Retirement Savings Plan systems:

EMPLOYEES

For employees who have limited options beyond their employer-sponsored retirement plans, we aim to optimize these plans and explore additional opportunities to enhance retirement savings.

The 401(k) Super-Charger sm presents our distinctive approach to help them maximize all of their employer’s company-sponsored benefits. We often find that employees miss out on the full potential of these plans or over-contribute without exploring other, potentially more advantageous, retirement savings options.

BUSINESS OWNERS

For business owners, our goal is to create a plan that aligns with their objectives and financial capacity. Business owners wear two hats—owner and employee—leading to differing goals when designing a Retirement Savings Plan.

In addition to saving for retirement, business owners may seek to attract and retain top talent through their plan. However, concerns about plan costs may arise. Regardless of your role as employer or employee, our objective is to support you in achieving your retirement goals.

We offer The Super(k) sm strategy—a comprehensive plan that integrates five different retirement savings options into one efficient and coordinated structure. The Super(k) sm empowers business owners to contribute significantly more towards the plan, resulting in substantial tax deductions as well.

Our Super(k) sm strategy is not a cookie-cutter approach to retirement savings. Instead, it prioritizes cost-efficiency and plan design optimization to maximize benefits for all participants.

ALTERNATIVE INVESTMENTS

Furthermore, our retirement savings plan platform supports alternative investments, including gold, crypto, real estate, and more. Almost any investment can be used from within our unique platform. This flexibility allows you to explore innovative investment avenues.

Save for your retirement in a Better, Smarter, Safer Way!

The landscape of retirement planning has evolved significantly over the past few decades, and it will continue to evolve in the future. As an employee or business owner, you need a retirement savings plan that adapts to these changes. Although Grandpa and Grandma’s retirement may have been simpler, the current opportunities for a long, healthy, and well-financed retirement have never been better. We are committed to showing you a better, smarter, and safer way to plan for your retirement. Let us show you how!

Select from one of the options below.

Getting Started

To get started, first determine if you are a Consumer, Business Owner, or Professional.

Consumers

Those Employed as W-2 Employees

Select the link below to be directed to our Retirement Savings Plan webpage for Consumers. On the next page, you will find more specific information about how we can help, and a link to schedule an initial 15-minute interview.

We encourage you to listen to our webinar for more detailed information on retirement savings plans, why they are important, and how to implement these strategies to help you save for your retirement and to reduce the taxes you pay.

Business Owners

1-Person Operation to Large Corporations

Select the link below to be directed to our Retirement Savings Plan webpage for Business Owners. On the next page, you will see more specific information about how we can help. To schedule an initial 25-minute minute interview, please complete the Fact-Finder form. After you have completed the form you will be directed to our online calendar to schedule your interview.

Professionals

CPAs, Attorneys, and Advisors

Select the link below to be directed to our Retirement Savings Plan webpage for Professionals. On the next page, you will see more specific information about how we can help, as well as a link to schedule an initial 25-mininute interview.

Why Partner With Us?

We are experts in Retirement Savings Plans

Our services can help consumers, business owners, and professionals

We provide a full-range of services, from comprehensive to consultative

The Process

1. Engagement

2. Client Consultation

3. Design Phase

4. Refinement

5. Action Plan Timeline Preview

6. Implementation and Ongoing Management

Client Consultation. Following our initial interview, there will be a 1-hour meeting with the business owner and/or Advisor and their client to discuss the details and facts about the specific situation. We dig deep to get an understanding of how the business is structured, and most importantly, clarify the goals of implementing a retirement savings plan in the business.

Design Phase. Next, our designers take the information gathered in the consultation phase and put together a proposal to help the business owner meet their individual goals. This involves a semi-feasibility study, sample documents, proformas, and illustrations of how the plan will work for them.

Refinement. After the business owner or Advisor and their client take time to digest the proposal, we will meet again to discuss any unanswered questions and the level of financial commitments needed. These details are then incorporated into a formal proposal.

Action Plan Timeline Preview. The business owner and/or Advisor and their client will receive an Action Plan that will illustrate the amount of time needed to complete each step of the implementation process. As there can be many steps and many outside parties involved with implementing a retirement savings plan, having a timeline will help to understand all these details and, more importantly, outline who is responsible for what activities and by when they need to be completed.

Implementation and Ongoing Management. This ongoing process keeps everyone informed and updated about the relevant and needed information concerning retirement savings plans. Changes in the business owner’s needs and goals for these plans are addressed. Changes in the laws that relate to retirement savings plans are also addressed. Then, we will help the business owner or the Advisor and their client to implement any modifications to their plan accordingly.

Webinars

Consumers

Professionals

Business Owners

Helpful Guides

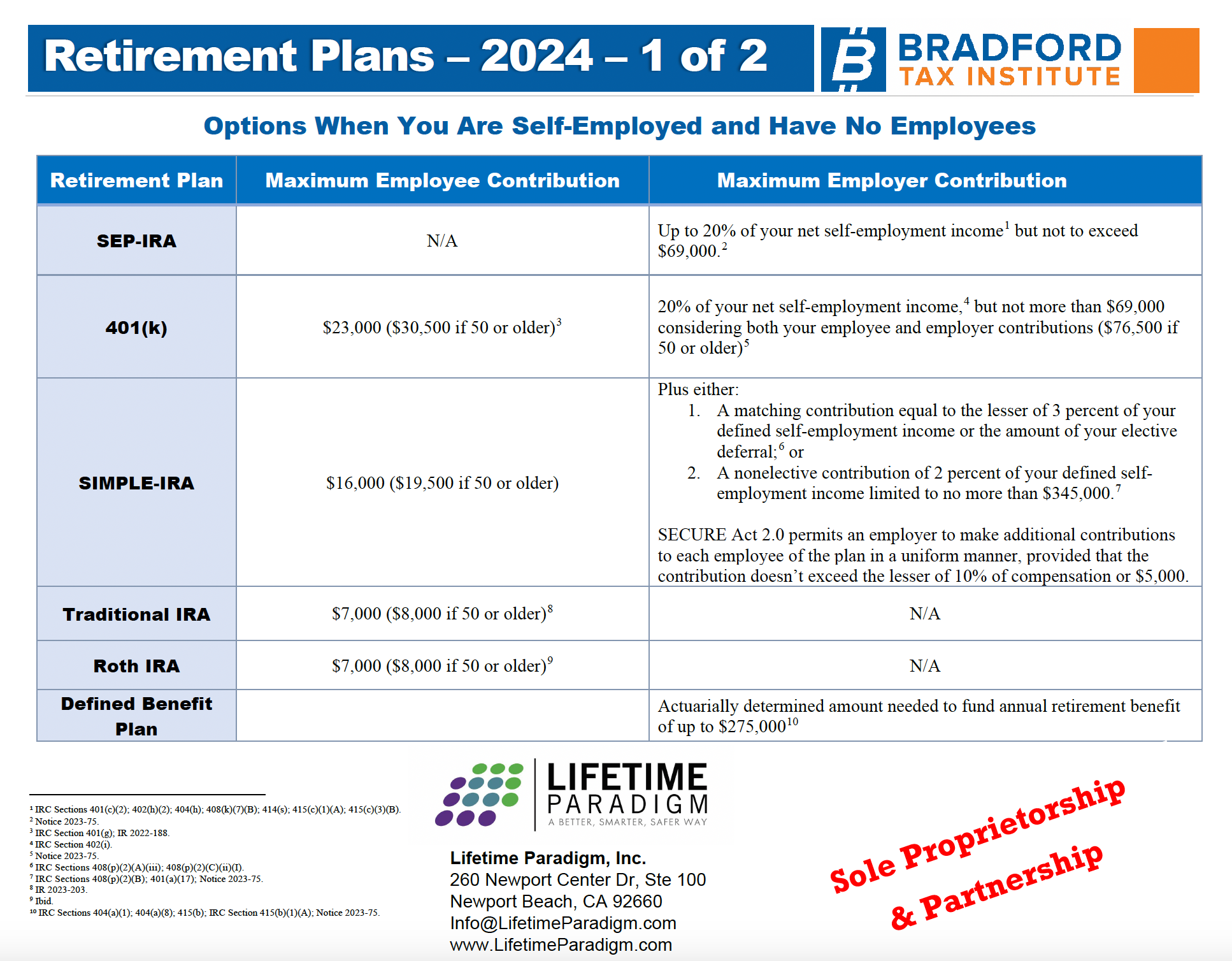

2024 Retirement Plans Reference Guide

Gain instant access to this invaluable reference guide by downloading and saving the PDF directly to your computer or smartphone.

In just two concise pages, you’ll discover essential information regarding contributions and elective deferrals for a variety of one-person retirement plans tailored for both corporate owners and proprietorships, including:

- SEP-IRA

- 401(k)

- SIMPLE IRA

- Traditional IRA

- Roth IRA

- Defined Benefit Plan

Download now to streamline your retirement planning process and make informed decisions about your financial future.

“Quick Guide to Retirement Plans for Small Business Owners”

Learn about the major features of each kind of retirement plan, including SIMPLE, SEP, 401(k), defined-benefit, and profit-sharing plans.

“Choosing a Retirement Solution for Your Small Business”

This publication is a joint project of the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) and the Internal Revenue Service.