Professionals

Financial & Legal Professionals

We collaborate with financial and legal professionals to provide tailored support for their clientele. Our team offers expert advice and strategic guidance aimed at optimizing tax savings and facilitating the journey towards financial independence.

If you are interested in learning about the ways we can assist, we invite you to schedule a complimentary 15-minute consultation. During this session, we can discuss your specific needs and those of your clients.

If you have any questions regarding our services, please don’t hesitate to reach out to us at [email protected].

Latest News

Browse All Articles, Videos, Podcasts for Professionals

Tax Rules for Providing Free Meals and/or Lodging to Employees

Tax Planning Bradford Tax Institute Here’s the good news: Section 119 of our beloved Internal Revenue Code allows your business to provide free meals and/or lodging to employees on a tax-free basis in limited circumstances. “Tax-free” means no federal income tax for...

Consider a Roth IRA Rollover for an Overfunded Section 529 Plan

Tax Planning Bradford Tax Institute Section 529 college savings plans are a great way to help pay for a child’s or other family member’s college education. Contributions are not federally tax-deductible (they are deductible in many states), but they grow federally...

13 Answers on the New 2024 CTA Required BOI Reporting to FinCEN

Tax PlanningBradford Tax InstituteIt’s here. The Corporate Transparency Act (CTA) became effective on January 1, 2024. The law will create a massive government database containing the identities and contact information of defined small corporate and LLC “beneficial...

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing business with some other owners. Or you might be founding a new business with some other owners. In these scenarios, consider the advantages of putting...

New IRS Crypto Tax Reporting Rules Coming Soon

Tax PlanningBradford Tax InstituteMarch 2024The IRS released over 280 pages of proposed regulations intended to implement the congressional mandate that the broker reporting rules apply to those who facilitate the transfer of digital assets such as Bitcoin and other...

Real Estate Rentals: Recent Tax Insights

Tax PlanningAn Exclusive Report fromBradford Tax InstituteKey Topics Include: How to Project If a Rental Property Is a Winner Defining “Real Estate Investor” and “Real Estate Dealer” Real Estate Investment Boot Camp Holding Real Property in a Corporation: Good or Bad...

Holding Real Property in a Corporation: Good or Bad Idea?

Tax PlanningBradford InstituteReal estate prices have cooled off in many parts of the country. In some areas, values are actually dropping after reaching all-time highs in the middle of last year. Gasp! Even so, real property is still probably a wise investment over...

The Smart Tax Planning Newsletter January 2022

Tax PlanningEvery month we provide you with a fairly detailed review of several Important Tax Topics. Scan through the highlighted topics noted below. In This Month's Newsletter We Review: Is Your Sideline Activity a Business or a Hobby? Self-Directed IRAs Using a...

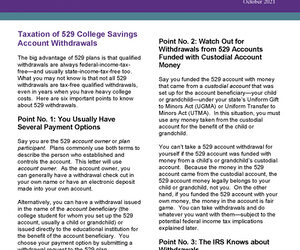

The Smart Tax Planning Newsletter October 2021

Tax-Saving TipsTaxation of 529 College Savings Account Withdrawals The big advantage of 529 plans is that qualified withdrawals are always federal-income-tax-free—and usually state-income-tax-free too. What you may not know is that not all 529 withdrawals are...