Tax Planning

At the core of our financial philosophy lies the awareness that taxes represent life’s most significant expense. Although paying taxes is not optional, the power to optimize how you manage them lies in your hands. This principle, known as “The Net,” underscores the importance of what you keep, not just what you make. Making better, smarter, and safer tax-efficient financial decisions is key to preserving your hard-earned wealth. We are here to empower you with the knowledge and expertise to navigate the complexities of taxation, ensuring you make informed choices that lead to a brighter financial future. Let us guide you on this journey of financial optimization, helping you secure a more prosperous and fulfilling life.

Proprietary Services for Tax Planning

The Smart Tax Minimizer ℠ (For Consumers and Home-Based Businesses)

The 4x4 Financial Independence Plan ℠

Specialty Proprietary Services for Tax Planning

The Smart Tax Planning System for Business Owners ℠

Products for Tax Planning

Annuities

Charitable Trusts & Annuities

Delaware Statutory Trusts

Employee Retention Tax Credit (ERTC)

In-Service Alternative Rollovers

Insurance-Disability

Insurance-Life

Insurance-Long Term Care

Micro-Captive Insurance Companies

Mortgages-Forward

Mortgages-Reverse

No-Load Annuities

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Research & Development Tax Credits (R&D, etc.)

Retirement Plans - Pension & Profit Sharing Plans - The Super(k)

Retirement Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Self-Directed Brokerage Accounts

Coaching and Consulting

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Tax Planning Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!

BLOG

Browse All Tax Planning Articles, Videos, Podcasts

Tax Rules for Providing Free Meals and/or Lodging to Employees

Tax Planning Bradford Tax Institute Here’s the good news: Section 119 of our beloved Internal Revenue Code allows your business to provide free meals and/or lodging to employees on a tax-free basis in limited circumstances. “Tax-free” means no federal income tax for...

Did You Overfund a Section 529 Plan? Consider a Roth IRA Rollover

Tax Planning Bradford Tax Institute Have you established, or are you considering, a Section 529 savings plan for a child, grandchild, or other family member?Such plans are a great way to help pay for a person’s college education. Contributions are not federally tax...

Consider a Roth IRA Rollover for an Overfunded Section 529 Plan

Tax Planning Bradford Tax Institute Section 529 college savings plans are a great way to help pay for a child’s or other family member’s college education. Contributions are not federally tax-deductible (they are deductible in many states), but they grow federally...

Rules for Turning Your Vacation – Even a Luxurious One – Into Tax-Deductible Business Travel

Tax Planning Bradford Tax Institute When you convert your vacation into a business trip, your transportation expenses suddenly become deductible. And when you travel for business, you deduct the expenses. Think of the tax deduction as a travel discount. The size of...

2024 Corporate Transparency Act – Required Beneficial Ownership Information Reporting to FinCEN

Tax Planning Bradford Tax InstituteThe Corporate Transparency Act (CTA) is upon us. It took effect on January 1, 2024, and imposes a new federal filing requirement for most corporations, limited liability companies (LLCs), and other business entities.Corporations,...

13 Answers on the New 2024 CTA Required BOI Reporting to FinCEN

Tax PlanningBradford Tax InstituteIt’s here. The Corporate Transparency Act (CTA) became effective on January 1, 2024. The law will create a massive government database containing the identities and contact information of defined small corporate and LLC “beneficial...

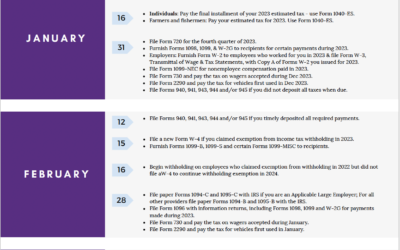

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of your tax deadlines is no easy task. Here’s a helper for those deadlines from the Bradford Tax Institute, the 2024 Federal Tax Calendar, tailored for...

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing business with some other owners. Or you might be founding a new business with some other owners. In these scenarios, consider the advantages of putting...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax Reporting Rules Coming Soon IRAs for Young Adults As we navigate the complexities of financial planning, one opportunity stands out for young adults:...