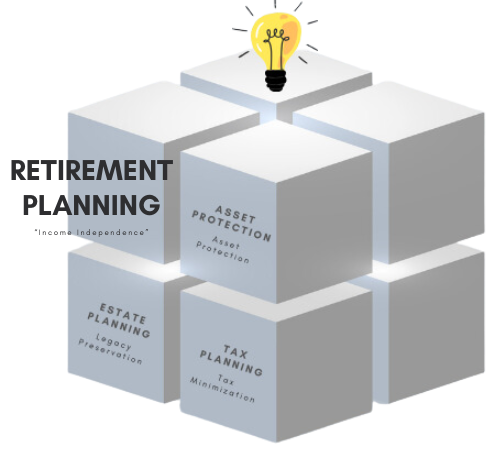

Retirement Planning

Our unique and proprietary systems and services will take you from where you are today, to your Financial Independence Day, so you can begin to live the life you really want. Select any of the headings below to learn more about them now.

Proprietary Services for Retirement Planning

The 4x4 Financial Independence Plan ℠

The Smart Financial Independence Blueprint ℠

Products for Retirement Planning

Annuities

Delaware Statutory Trusts

Coaching and Consulting

Insurance-Disability

Insurance-Life

Mortgages-Forward

Mortgages-Reverse

Notes

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Retirement Savings Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Securities (Provided Via Lifetime Financial)

Helpful Guides

FREE GUIDE

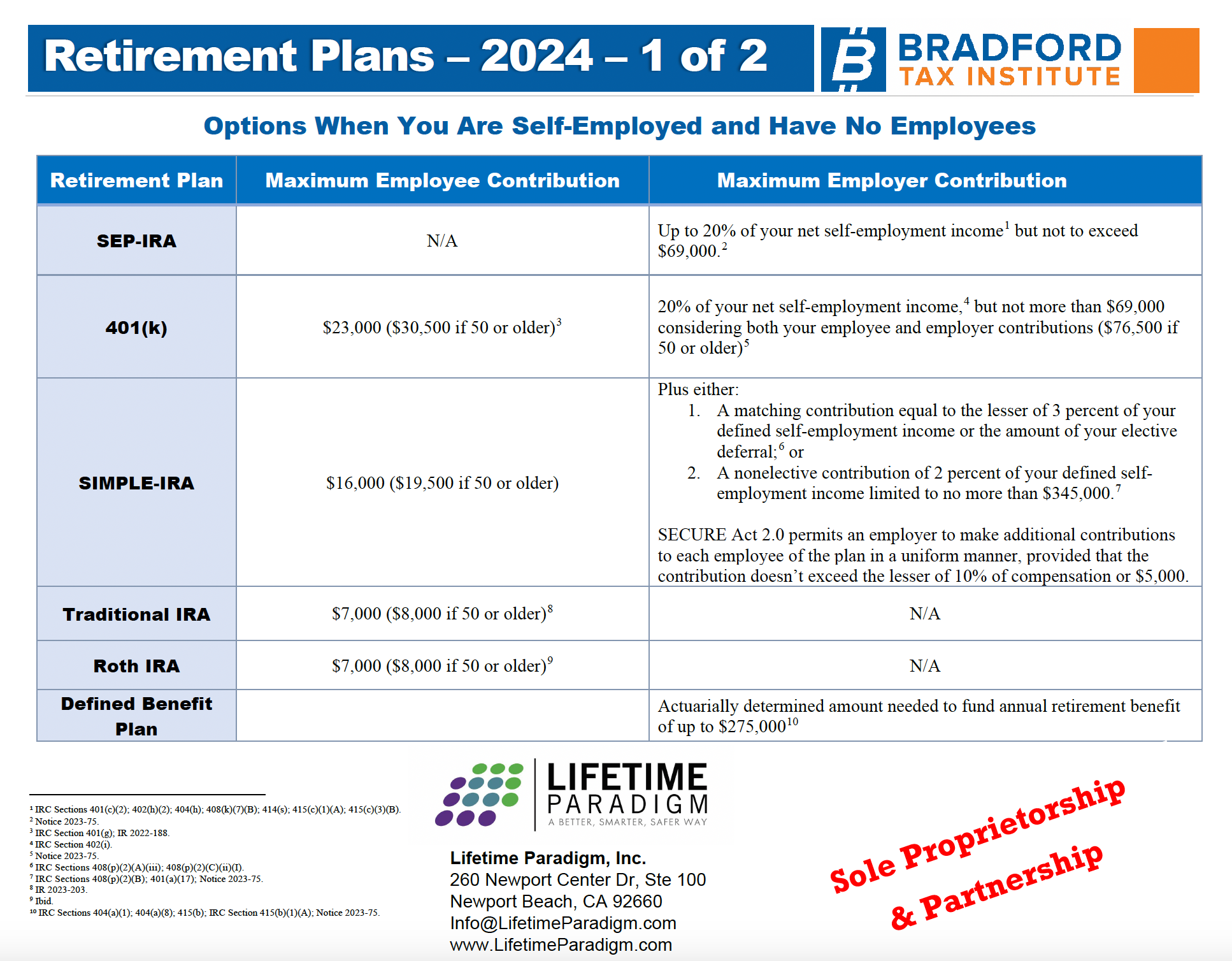

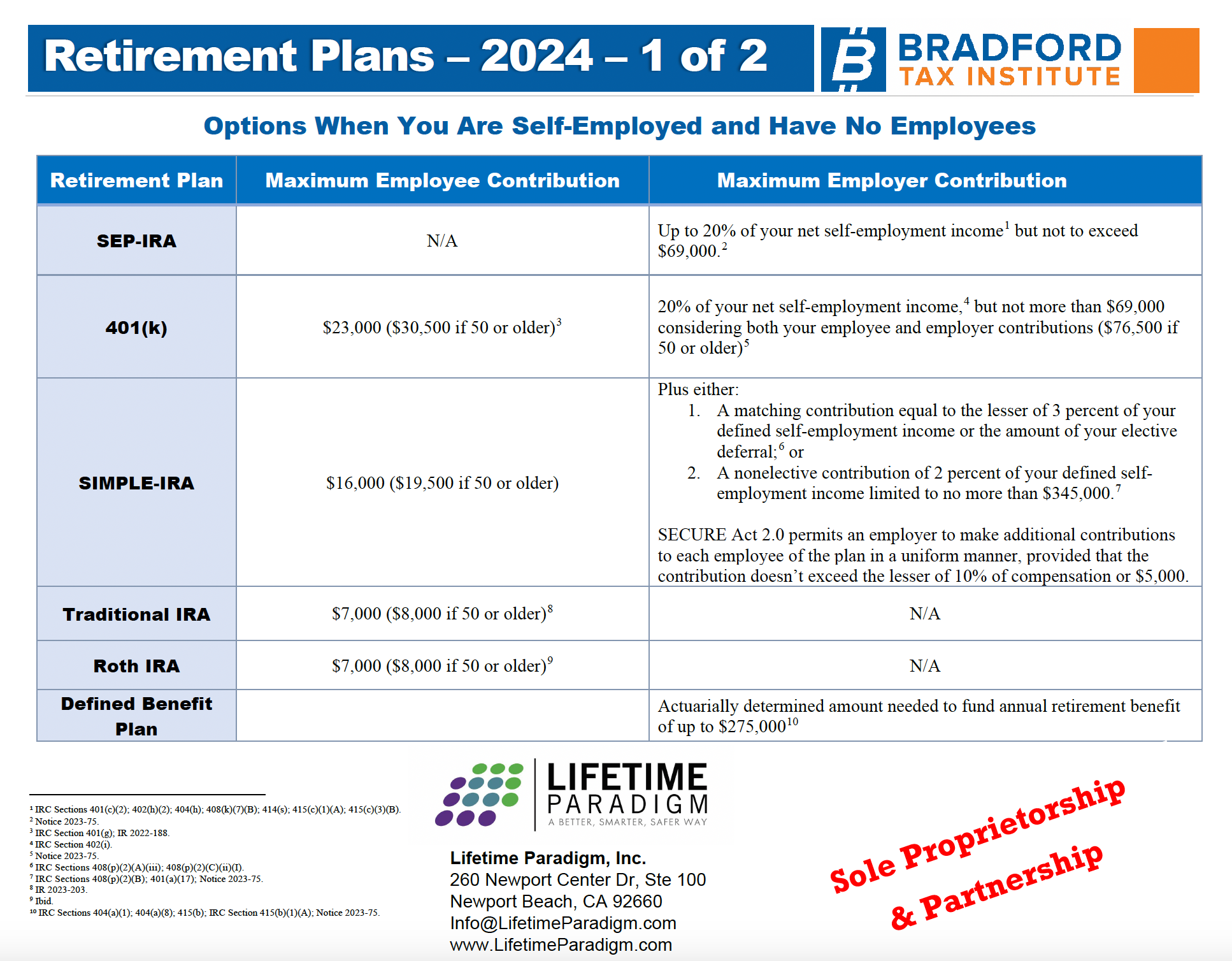

2024 Retirement Plans Reference Guide

Gain instant access to this invaluable reference guide by downloading and saving the PDF directly to your computer or smartphone.

In just two concise pages, you’ll discover essential information regarding contributions and elective deferrals for a variety of one-person retirement plans tailored for both corporate owners and proprietorships, including:

- SEP-IRA

- 401(k)

- SIMPLE IRA

- Traditional IRA

- Roth IRA

- Defined Benefit Plan

Download now to streamline your retirement planning process and make informed decisions about your financial future.

“Quick Guide to Retirement Plans for Small Business Owners”

Learn about the major features of each kind of retirement plan, including SIMPLE, SEP, 401(k), defined-benefit, and profit-sharing plans.

“Choosing a Retirement Solution for Your Small Business”

This publication is a joint project of the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) and the Internal Revenue Service.

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Retirement Planning Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!

BLOG

Browse All Retirement Planning Articles, Videos, Podcasts

2024 Key Planning & Investment Deadlines for Q3

Financial GuidesSummer is upon us! And it's time for your Summer Key Planning & Investment Deadlines guide. Every quarter, I like to send clients, family, and friends a reminder of all the key financial deadlines heading our way over the next three months....

Did You Overfund a Section 529 Plan? Consider a Roth IRA Rollover

Tax Planning Bradford Tax Institute Have you established, or are you considering, a Section 529 savings plan for a child, grandchild, or other family member?Such plans are a great way to help pay for a person’s college education. Contributions are not federally tax...

Consider a Roth IRA Rollover for an Overfunded Section 529 Plan

Tax Planning Bradford Tax Institute Section 529 college savings plans are a great way to help pay for a child’s or other family member’s college education. Contributions are not federally tax-deductible (they are deductible in many states), but they grow federally...

Developing a Realizable Vision for Retirement

Retirement PlanningBy Richard AtkinsonRetirement is a totally new stage of life. With some careful prioritizing—and collaborating with your financial professional—you can design a working plan for retirement that may surpass all your expectations.When most people...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these developments to ensure compliance and make the most of available opportunities.Here are Some of the Key Topics Covered in this Report: SECURE 2.0 Adds New...

2024 Key Planning & Investment Deadlines for Q2

Financial GuidesSpring is coming and to keep you financially organized for Q2, we are providing you with our Spring Key Planning & Investment Deadlines Guide. Every quarter, I like to send clients, family, and friends this guide to remind them of all the key...

Social Security, Medicare, and HSAs

Retirement PlanningBy Elaine Floyd, CFPIf your employer health plan is a health savings account (HSA) paired with a high-deductible health plan (HDHP), you may have a problem when you turn 65.Why? Because once you enroll in Medicare at 65, you (or your employer) may...

4 Keys to the Millennial Balancing Act of Paying Off Student Debt and Saving for Retirement

Retirement PlanningBy Debra Taylor, CPA/PFS, JD, CDFAThe financial puzzle for millennials: What’s the best way to pay off student debt while saving toward retirement? Here are four steps to a sustainable planMillennials really like the idea of retiring early. In fact,...

2024 Key Financial Data Guide

Financial GuidesAs we step into the new year, it's wise to review your tax plan in light of recent changes. Our 2024 Key Financial Data Guide is your go-to resource, providing quick access to this year’s critical figures covering Social Security, taxes, health...