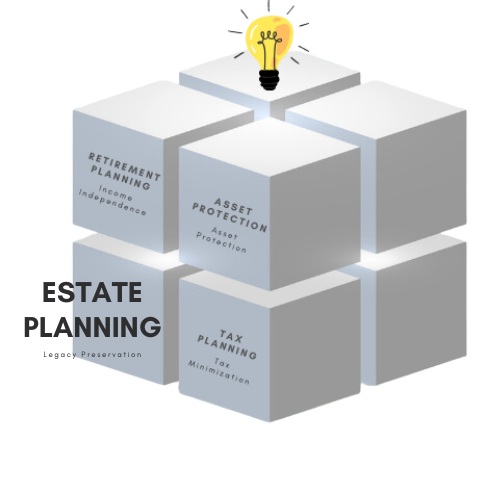

Estate Planning

We look at our financial life in two phases; one while we are living and the other when we are not. We refer to these two phases as, your life and your legacy. Think of estate planning as asset protection once you are no longer physically able to make choices and decisions. The goal of estate planning is to ensure that you will always be in control of your wealth, while you are living and to create your legacy.

Proprietary Services for Estate Planning

The Smart Legacy Plan Organizer ℠

The 4x4 Financial Independence Plan ℠

Products for Estate Planning

Annuities

Charitable Trusts & Annuities

Delaware Statutory Trusts

Insurance-Disability

Insurance-Life

Insurance-Long Term Care

Micro-Captive Insurance Companies

Mortgages-Forward

Mortgages-Reverse

No-Load Annuities

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Retirement Plans (Company Sponsored) Pension & Profit Sharing Plans - The Super(k) ℠

Retirement Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Coaching and Consulting

Why You Need an Estate Plan

You need an estate plan, regardless of whether or not you are among the ultra-rich. As recent news has shown, even those who have won the lottery or have substantial wealth can fall victim to poor estate planning.

While federal estate taxes may not concern you, you need a will to have your wishes honored after your death. Without a will, state law dictates the distribution of your assets, which may not align with your intentions. Additionally, if you have minor children, a will allows you to name a guardian to care for them in the event of your untimely passing.

Your heirs will want to avoid probate because it can be a costly and time-consuming legal process. A living trust gives you a valuable tool to avoid probate. By transferring legal ownership of your assets to the trust, you can ensure that your beneficiaries receive them without suffering through probate.

You can amend your living trust as circumstances change, providing flexibility and control over your assets.

It is also essential to keep your beneficiary designations up-to-date, as they take precedence over wills and living trusts regarding asset distribution. (Our Smart Estate Plan Protector ℠ will help you with this).

Additionally, if your estate will suffer from federal or state death taxes, you should plan to minimize your exposure.

Estate planning is not a one-time event but a process that you should review and update regularly to accommodate life changes and fluctuations in estate and death tax rules. We recommend checking your estate plan annually to ensure it aligns with your wishes and circumstances.

If you have any questions or concerns about estate planning, please do not hesitate to contact us.

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Estate Planning Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!

BLOG

Browse All Estate Planning Articles, Videos, Podcasts

The 10 Basic Questions of Estate Planning

Estate PlanningIt’s not easy to contemplate your own mortality, but a good estate plan can provide for your heirs, protect your assets, and promote family harmony once you’re gone.Estate planning is complex and because it involves facing your own mortality, it can be...

Family Loans: Only Path to a Decent Home Loan Interest Rate

Tax PlanningBradford InstituteYou may want to help a family member buy a home by making a loan to that person. That might to be the only way for a prospective homebuyer to get a decent interest rate these days. As this was written, the national average rate for a...

When a Bad Executor Ignores Your Will

Estate Planningby Elaine Floyd, CFPAn untrustworthy executor can foil even the most well-designed estate plan. Use these guidelines to select a reliable executor—one who will assure that assets pass to their rightful heirs.Think about what will happen to your assets...

Why You Need an Estate Plan

Estate PlanningWhoever won that ginormous $997.6 million cash value Powerball jackpot last November needs some serious estate planning advice. Ditto for the winner of the $724.6 million cash value Mega Millions jackpot in January.1 Sadly, you did not win either. Nor...

Tax Free Discount on Your Estate Tax Liability

Estate PlanningIf you have or will have an estate tax liability . . . watch this short video to learn how you avoid IRS seizure and liquidation of your assets, while paying the minimum estate tax with a tax free discounted settlement.You May Also Like...

8 Ideas That Help You Manage a Financial Windfall

Estate PlanningHave you ever dreamed of winning the lottery or inheriting a large sum of money? Most people have, at a minimum, thought about it. The interesting thing is that, even if you were to “hit the jackpot”, often riches that fall into our hands can...

Intergenerational Transfers: Helping Adult Children

Estate PlanningWhen a parent is considering giving or lending a child money, the key question is whether it’s empowering or enabling. You need to structure a transfer that is best for both generations.When my older daughter Meredith bought a house in Portland, Oregon,...

Financial Planning for the Generations

Estate PlanningIn most families, the needs and interests of family members overlap. Even if your money is separate, planning needs to happen for all.It is normal, when working with your financial advisor, to focus on the needs of your immediate family. If you are a...

Handling Key Non-Tax Financial Issues When a Loved One Passes Away (Part 3)

Estate PlanningA financially comfortable loved one has passed away. During this time of seemingly endless bad news, that's not an uncommon situation. Sad but true. The now-deceased loved one may have been single or married and may have been a relative or not. In any...