Tax Planning

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Bradford Tax Institute

Say you’re a co-owner of an existing business. Or you might be buying an existing business with some other owners. Or you might be founding a new business with some other owners. In these scenarios, consider the advantages of putting a buy-sell agreement in place. A well-drafted agreement can do these helpful things:

- Transform your business ownership into a more liquid asset

- Prevent unwanted ownership changes

- Save taxes and avoid hassles with the IRS

Read on to find out how buy-sell agreements work and the most important details to understand.

Buy-Sell Agreement Basics

Buy-sell agreements come in two basic flavors:

- Cross-purchase agreements

- Redemption agreements (sometimes called “liquidation agreements”)

For discussion purposes, we will assume that there are several other co-owners. But the same principles apply if there’s just one other co-owner.

Cross-Purchase Agreement

A cross-purchase agreement is a contract between you and the other co-owners. Under the agreement, the remaining co-owners must purchase the withdrawing co-owner’s ownership interest when a triggering event, such as death or disability, occurs.

Redemption Agreement

A redemption agreement is a contract between the business entity itself and its co-owners, including you. Under the agreement, the entity must purchase the withdrawing co-owner’s ownership interest when a triggering event occurs.

Buy-Sell Agreement Goals

Both types of agreements have three main goals:

- Goal No. 1. Ensure that there will be a buyer for each co-owner’s interest when a triggering event occurs.

- Goal No. 2. Restrict the co-owners from unilaterally transferring an ownership interest to someone outside the existing ownership group.

- Goal No. 3. Ensure favorable tax results.

Triggering Events

You and the other co-owners specify the triggering events that you want to include in the buy-sell document.

You want to include obvious events such as death, disability, and attainment of a stated retirement age. Other triggering events can be stipulated as the co-owners deem appropriate—such as loss of license to practice a profession, divorce, bankruptcy, or the simple desire to cash out of the business and move on.

Valuation and Payment Terms

It’s very important for your buy-sell agreement to stipulate an acceptable method for valuing ownership interests.

Common valuation methods include establishing a fixed price per share, using an appraised fair market value, or following a formula that values interests based on a multiple of earnings or cash flow.

As explained later, you also want to make sure that the price-setting method will be respected by the IRS for federal estate tax valuation purposes.

The agreement should also specify how and when amounts will be paid out to withdrawing co-owners or their heirs under various triggering events.

Most buy-sell agreements grant the remaining co-owners (in the case of a cross-purchase agreement) or the business entity itself (in the case of a redemption agreement) a right of first refusal to purchase the withdrawing or deceased co-owner’s interest. If that right is not exercised, the withdrawing co-owner, or his or her heirs, can sell to an outside party.

Bottom Line

By putting a buy-sell agreement in place, you establish a guaranteed market for each withdrawing co-owner’s interest coupled with control over who is allowed to join the ownership group. This is a beneficial deal for you— whether you turn out to be the first co-owner to withdraw or the last person standing.

Using Life Insurance to Fund the Buy-Sell Agreement

Cash will be needed to finance buyouts of co-owners when triggering events occur. The death of a co-owner is perhaps the most common (and most catastrophic) triggering event. So, you usually will want to use life insurance policies to form the financial backbone of the buy-sell agreement. Here’s how.

Funding the Cross-Purchase Agreement

In the simplest case of a cross-purchase agreement between two co-owners, have each co-owner purchase a life insurance policy on the other. When one co-owner dies, the surviving co-owner collects the life insurance death benefit and uses the cash to buy out the deceased co-owner’s interest from the estate, surviving spouse, or other heir.

The life insurance death benefit proceeds are free of any federal income tax hit, as long as the surviving co-owner was the original purchaser of the policy on the other, now-deceased co-owner.(1) But note that life insurance premiums are not tax-deductible.(2)

Warning. When attempting to fund a simple cross-purchase agreement, remember the following advice:

- Don’t swap your existing policy on your own life for another co-owner’s existing policy on his or her own life.

- Don’t designate a co-owner as the new beneficiary of your existing policy on your own life.

If you do either of these things, it can turn the life insurance death benefit proceeds from 100 percent tax-free into 100 percent taxable under the dreaded “transfer for value” rule.(3) That would be an expensive misstep!

When possible, have each co-owner buy a new policy on the life of each other co-owner. That way, you avoid the transfer-for-value problem and lock in federal-income-tax-free treatment for all life insurance death benefits received under the cross-purchase agreement.

If you must use existing policies to fund the cross-purchase deal (say, because one or more of the co-owners are uninsurable), there are several ways to avoid the transfer-for-value problem.

For instance, you may be able to transfer existing policies into a trust or a partnership owned by you and the other co-owners. When one co-owner dies, the trust or partnership distributes the life insurance death benefit proceeds tax-free to the remaining co-owners, who then use the cash to buy out the deceased co-owner’s interest.

But watch out: A seemingly simple cross-purchase arrangement between more than two co-owners can get complicated in a hurry. That’s because each co-owner must buy life insurance policies on all the other co-owners.

In this scenario too, you may want to use a trust or partnership to buy and maintain separate policies on each co- owner. Then, if a co-owner dies, the trust or partnership collects the death benefit proceeds tax-free and distributes the cash to the remaining co-owners, who use the money to fund their buyout obligations under the cross-purchase agreement. Using a trust or partnership also makes it much easier to ensure that all the life insurance premiums get paid.

Funding the Redemption Agreement

To fund a redemption agreement, the business entity itself buys policies on the lives of all the co-owners and then uses the death benefit proceeds to buy out deceased co-owners.

Regardless of whether the entity purchases new policies or the co-owners transfer existing policies on their own lives to the entity, there is generally no transfer-for-value problem. So, the death benefit proceeds will be free of any federal income tax.(4)

Be sure to specify in the agreement that any buyout that is not funded with life insurance death benefit proceeds will be paid out under a multi-year installment payment arrangement. This creates some much-needed breathing room for any co-owner(s) to come up with the cash needed to fulfill the buyout obligation.

Create Certainty for Your Heirs

The value of your share of the business in question may make up a big percentage of your estate. Without a buy- sell agreement, your heirs face two big potential problems:

- After you depart this cruel orb, there may be no market for your ownership interest. Even worse, your heirs might be forced to sell your ownership to pay the federal estate tax hit and/or the state death tax hit.

- Your heirs may also have to tangle with the IRS over valuing the ownership interest for federal estate tax purposes.

Having a buy-sell agreement in place can cure these problems. A properly drafted buy-sell agreement ensures that

- your ownership interest can be sold under financial terms that your now-departed self approved when the agreement was set up;

- your estate’s liquidity problem is eliminated; and

- the set price can be used to establish the value of your ownership interest for the purposes of calculating your estate’s federal estate tax bill, if applicable.

The buy-sell agreement must set a reasonable price for the business ownership interest. Otherwise, the IRS can completely disregard the agreement.(5)

Observation. For 2024, the unified federal estate and gift tax exemption is a whopping $13.61 million. So the federal estate tax may not be a concern right now. But after 2025, the exemption is scheduled to fall back to $5.49 million with a cumulative inflation adjustment for 2018-2025—figure somewhere in the $7 million to $8 million range. So federal estate tax worries can certainly come back into play.

Tax-Saving Specifics for Buy-Sell Agreements

So far, we’ve explained how to avoid federal income tax on life insurance death benefit proceeds used to fund buy- sell agreements. We also explained how these agreements can avoid estate tax headaches for your heirs. Now here’s the rest of the tax-saving story.

C Corporation

With a C corporation, you usually want to avoid setting up a buy-sell agreement that is a redemption arrangement. That’s because stock redemption payments are generally taxed as dividends.(6)

While qualified dividends are currently taxed at the same “low” federal rate as long-term capital gains (current maximum rate of 20 percent), the 3.8 percent net investment income tax (NIIT) may also be owed. And there’s no guarantee that this relatively benign federal income tax treatment for dividends will continue forever.

In contrast, when a C corporation buy-sell agreement is set up as a cross-purchase arrangement, it eliminates any risk of dividend treatment.(7)

- The withdrawing shareholder (or the heirs of a deceased co-owner) subtracts the tax basis of the shares being sold from the sale price.

- Any gain generally qualifies for the lower long-term capital gain tax rates (current maximum federal rate of “only” 20 percent plus the 3.8 percent NIIT, if applicable).

- The remaining shareholders receive additional tax basis in their stock equal to what they pay the withdrawing shareholder (or heirs) under the cross-purchase agreement.

Key point. With a redemption agreement, the remaining shareholders would receive no such basis increase. For these tax reasons, a C corporation buy-sell agreement should generally be set up as a cross-purchase deal rather than as a stock redemption deal.

S Corporation

An S corporation must meet special rules to maintain its S tax status and qualify for favorable pass-through taxation. So, it’s a good idea to include restrictions in an S corporation buy-sell agreement that will protect the corporation’s S status.

The agreement can include language prohibiting shareholders and/or the corporation from taking the following actions, any of which would terminate the company’s tax-favored S status:

- Transferring or issuing shares to a corporation, a partnership, an ineligible trust, or a non-resident alien individual

- Transferring or issuing shares to a new shareholder if that would cause a violation of the 100- shareholder limitation

- Shareholders giving up their U.S. citizenship (or, for resident alien shareholders, abandoning residence in the U.S.)

- Issuing a second class of stock (such as preferred stock)

-

Voluntary revocation by the corporation of its S status unless agreed to by all shareholders

Partnership or LLC Treated as a Partnership

If your business is a partnership or a multi-member LLC treated as a partnership for tax purposes, consider including a requirement to evaluate making a Section 754 election when an ownership interest is bought out.

Under complicated rules, making this election can allow the partnership or LLC to step up the tax basis of its appreciated assets. That means bigger depreciation and amortization deductions for the new owner, or the remaining co-owners, and lower taxable gains or income when the partnership or LLC sells off appreciated assets or collects receivables.(8)

Takeaways

A well-drafted buy-sell agreement provides financial protection for you and your heirs. Ditto for the other co-owners and their heirs.

The agreement can also help minimize income taxes and avoid estate tax hassles with the IRS.

Your clock is ticking. You don’t know when your time will run out. Therefore, it makes sense to set up a buy-sell agreement sooner rather than later.

Buy-sell agreements are not suitable do-it-yourself projects. Get legal and tax assistance from professionals experienced in setting up these agreements.

Need More Information?

If you have any questions regarding this article, please don’t hesitate to reach out to us at [email protected]. Alternatively, you can schedule a complimentary 15-minute consultation to inquire further and determine whether we align with your needs and expectations. We look forward to assisting you!

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (For Consumers and Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Tax Planning

Coaching and Consulting

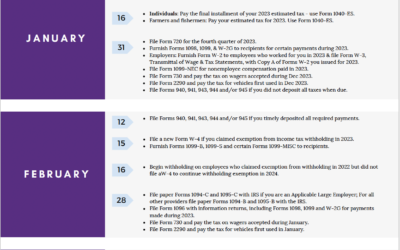

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of...

Cybersecurity Monthly Newsletter March 2024

Asset ProtectionIn this issue: How to beat the password paradox Cybersecurity Shorts Software Updates Welcome to your...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.