Retirement Planning

6 Factors That Predict a Student’s College Success

Some parents are obsessed with getting their children into top-ranked schools no matter the cost. You can save a lot of money by understanding what truly leads to the best outcomes for your children.

With some schools now costing more than $300,000 for a single bachelor’s degree, it’s incredibly easy to overspend and think such an expenditure is absolutely essential. And this just isn’t true, even for the most highly ranked schools such as the Ivy League institutions and such vaunted institutions as Massachusetts Institute of Technology, Stanford University and Duke University, which is now just a few hundred dollars shy of $80,000 for one year!

Further down on U.S. News & World Report’s college rankings, plenty of universities in cities on the coasts charge more than $70,000 a year. These schools can charge more largely because of their location, location, location!

Here are some cost-of-attendance examples:

- Fordham University: $80,801

- New York University: $80,878

- George Washington University: $79,410

- Santa Clara University: $76,497

- Emerson College: $76,754

- Drexel University: $76,524

- Loyola Marymount University: $74,309

Consequently, spending an obscene amount of money on a bachelor’s degree is a temptation and a possibility for all parents, not just those with the most brainiac and ambitious kids, who think they have a shot at Harvard.

I understand, however, that it can be hard to convince yourself that overspending isn’t necessary. After all, choosing colleges is an emotional decision tied up with ego. People also mistakenly believe that schools with higher rankings represent the only source of “golden tickets”—that they will get a dream job and salary just because they went to that particular school. Actually, high-income students already possess their golden tickets because of the way they were raised.

But when you broaden your college searching horizons, you can save yourself a significant amount of money and be positioned for a more secure retirement and possibly a greater financial legacy for your heirs.

The Best Arguments in One Report

The good news is that the very best arguments against focusing exclusively on the most expensive college’s net price are cogently summarized in an invaluable report published by Challenge Success, a highly regarded nonprofit affiliated with Stanford University’s Graduate School of Education.

I would urge you to Google and read the 22-page report. I firmly believe there is no other single document that tackles the two most stubborn myths that parents and their teenagers believe as they start their college hunt.

The report summarizes well-regarded research that obliterates these two beliefs:

- Schools with higher U.S. News rankings and higher rejection rates are the only schools worth attending.

- Students must attend highly selective schools because they are the only ones that can bestow golden tickets—excellent, high-paying careers.

In their words:

Rankings are problematic.

Many students and families rely on college rankings published by well-known organizations to define quality. The higher the ranking, the logic goes, the better the college must be and vice versa. We find that many of the metrics used in these rankings are weighted arbitrarily and are not accurate indicators of a college’s quality or positive outcomes for students.

College selectivity is not a reliable predictor of student learning, job satisfaction or well-being.

We explore the research on whether attending a selective college predicts important life outcomes and find no significant relationship between a school’s selectivity and student learning, future job satisfaction, or well-being. We find a modest relationship between financial benefits and attending more selective colleges, and that these benefits apply more to first-generation and other underserved students. We also find that individual student characteristics (such as background, major, ambition) may make more of a difference in terms of post-college outcomes than the institutions themselves.

What Does Matter In College Outcomes

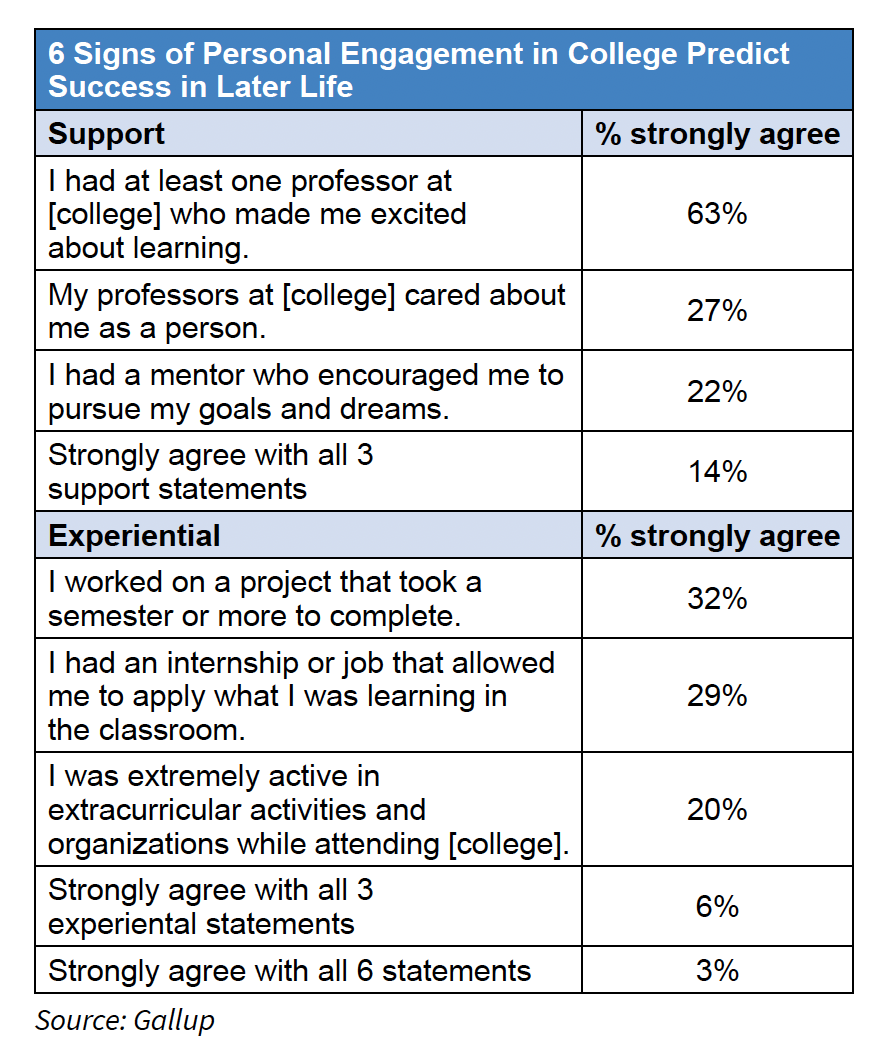

The College Success Report also looked at what does matter in terms of having a successful college outcome. The report nicely summarizes a much- publicized survey conducted by Gallup and Purdue in 2014 that indicated that the key to happiness in graduates’ lives and careers is not the colleges they attended but their level of engagement at whatever school they ended up at.

The Gallup-Purdue results illustrated that the more engaged a student was, as measured by six factors, the more likely he or she would be successful in life. Sadly, only three percent of graduates with a bachelor’s degree could answer yes to the following six statements!

My daughter is a perfect example. Caitlin would have been one of the three percenters. A former marketing director for a toy company, Caitlin launched a start-up in early 2018, moved to the Silicon Valley, and is happy in her career and her personal life.

She went to a school hardly anybody has heard of— Juniata College in Pennsylvania—with the help of two merit scholarships. We didn’t pay more than we had budgeted for and Caitlin graduated with no debt.

Keeping Your Options Open

I am definitely not suggesting that families must avoid prestigious schools, but I do not think these institutions are worth going into deep debt for or paying full price for when there are many schools which will offer merit scholarships like the ones my daughter received.

Families will never know what kind of aid their child could receive—and thus how much money they could save—if they don’t look past the Ivy League schools and the rankings darlings.

Lynn O’Shaughnessy is a nationally recognized college expert, higher education journalist, consultant, and speaker.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart College Cost Eliminator ℠

Retirement Planning

Tax Planning

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.