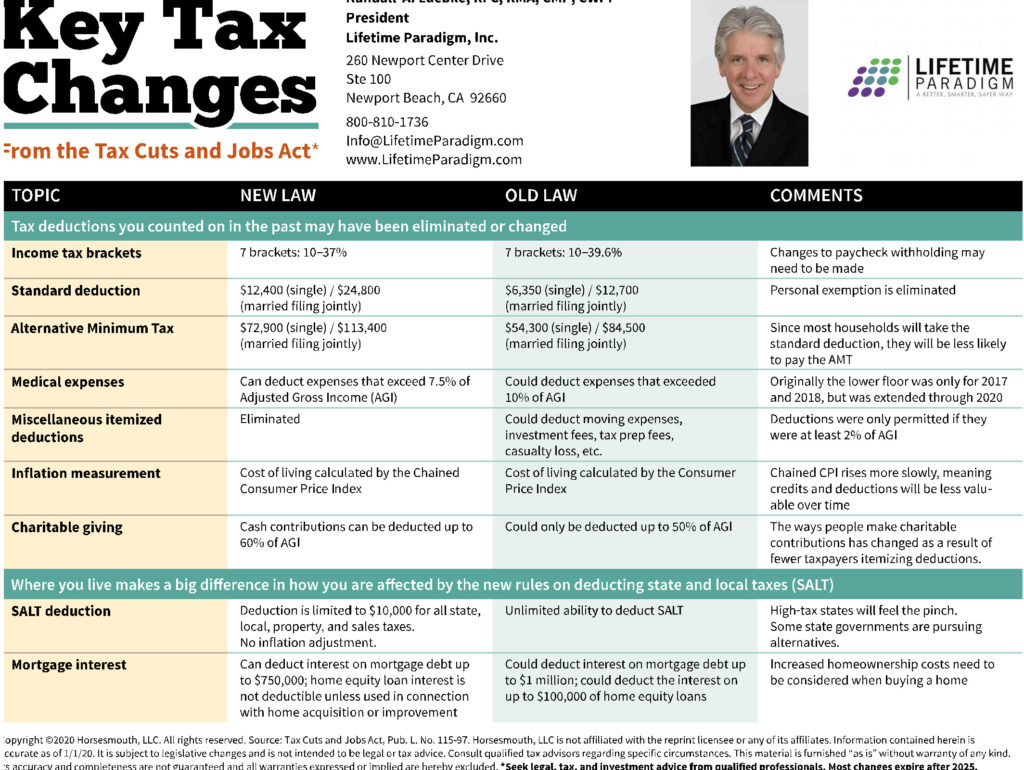

As financial professionals, we all have to deal with the fallout of the Tax Cuts and Jobs Act, so I’m enclosing a very handy reference card that I send to all of my clients which, I thought you might find beneficial as well. It’s called the Key Tax Changes From the Tax Cuts and Jobs Act financial guide, and it is a simple reference for understanding the major changes arising from this once-in-a-generation tax reform.

The Key Tax Changes guide is easy-to-read and it lays out all of the topics that were affected by the act: standard deductions, medical deductions, child tax credits and more. It makes it easy for you and your clients to see who needs to take action – those with children, those with a high net-worth, those divorcing, etc.

I hope you find the Key Tax Changes From the Tax Cuts and Jobs Act financial guide to be as useful as I do, and that you will share it with your clients or friends. As a Registered Financial Consultant and an Independent Fiduciary Advisor, I work primarily with business owners, real estate investors and last-stage pre-retirees. Give me a call if I can ever be of service.