Retirement Planning

Developing a Realizable Vision for Retirement

By Richard Atkinson

Retirement is a totally new stage of life. With some careful prioritizing—and collaborating with your financial professional—you can design a working plan for retirement that may surpass all your expectations.

When most people think of retirement, they imagine leaving a job they’re tired of, getting out of the rat race, and leaving the pressures of employment behind. Often retirement is viewed as a reward for time in the workforce and successful financial planning.

But retirement is so much more than giving up a job and relaxing. Retirees are entering one of the most exciting and challenging stages of their life.

Although the opportunities are endless, a successful retirement doesn’t come without its hurdles. There are many things to consider in order to get it right, such as living on

a reduced income, creating a health and wellness strategy, and evaluating relationships. Also important is the allocation of personal time, determining living arrangements, and recognizing change in social roles.

During the first days, weeks, or maybe even months of retirement, people often experience a blissful honeymoon feeling. No boss, no job, no worries! Just time to sit around and do whatever crosses your mind.

But as the honeymoon period winds down, a number of retirees report a feeling of disenchantment.

Retirement no longer feels like an extended holiday. Time begins to weigh heavily on their shoulders.

There can be a feeling that causes retirees to ask the question, “Is this all there is?” Frustration and disappointment can mount.

The life we lead is a result of the choices we make. That means in pre-retirement and retirement years, it’s important to make choices that build a fulfilling and energized retirement. Successful retirees recognize the power of creating a realistic retirement vision and an action plan to achieve it. Armed with this mental

model, they make sound choices to get desired results.

Where You Come In

With help from a trusted professional, you can work in a systematic way towards formulating a clear and focused retirement vision. In a way, your experience in early and mid-life makes you more aware and articulate than ever before concerning your own priorities. Remember, it is equally important to consider how you will spend your time as how you will spend your money.

A good way to begin is by taking time to visualize what the word “retirement” means to you. What is it that attracts, scares, or excites you about this time of life?

Next, write out a description of your imagined retirement life. Consider the following questions as if you were in retirement:

- What makes me happy?

- How much money do I have?

- What possessions do I own?

- How am I spending my time?

- Who is in my retirement picture?

- How is my health? How do I feel?

- How are my relationships with my spouse or partner, children, other family members, and friends?

First, imagine yourself in your first six months of retirement, then, at one and two years out. You can then ask yourself to visualize the end of your retirement, when you are 90, 95, or 100+. What are you most proud of? What have you done that has brought happiness to you and to others? What legacy will you leave behind?

It’s important to communicate personal desires and goals to your financial professional. That way, he or she will be better equipped to help you develop a plan that strikes as close as possible to what will truly make you happiest.

Most people know someone who has made a successful retirement. What is it about those people that you admire? Is it family relationships, energy and enthusiasm, or perhaps an overall sense of well-being?

Think then of those challenged by retirement. In your opinion, what are those individuals doing or not doing that makes them less successful? Is it the exorbitant amount of time they spend watching television, their lack of adventure, or possibly a sense of helplessness toward this ever-changing world?

Once you’ve recorded a retirement vision, share it with a partner or spouse, close friends—and of course with your professional. This process of sharing will provide different perspectives and help shape your final vision.

Optimism is key throughout the retirement visioning process. It’s important to focus on the rewards of a balanced retirement; meditate on the feeling of being complete, enriched, and financially secure. Retirement visions should be reviewed and rewritten as often as necessary, until the vision feels right and is in line with your wants, needs, and beliefs.

Recently Frances, a busy 63-year-old supervisor, was encouraged by her financial professional to visualize retirement. Though for years she contributed to her retirement savings program, retirement wasn’t part of her everyday thinking. Together they explored her needs, wants, and beliefs. As a result, Frances began to visualize what she wanted from retirement. She imagined herself getting back into tennis, being fit, and exercising regularly. She visualized herself volunteering and giving back to her community.

Frances began taking the first steps to building her retirement future.

As you enter the second-longest phase in your life, take an informed, active role in getting it right. With appropriate guidance and thoughtful planning, you will be able to enjoy life after work, even relish it.

Richard Atkinson is president of RA Retirement Advisors, a firm specializing in retirement planning, and author of the book “Don’t Just Retire—Live It, Love It!”

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Financial Independence Blueprint ℠

Retirement Planning

Coaching and Consulting

2024 Corporate Transparency Act – Required Beneficial Ownership Information Reporting to FinCEN

Tax Planning Bradford Tax InstituteThe Corporate Transparency Act (CTA) is upon us. It took effect on January 1, 2024,...

13 Answers on the New 2024 CTA Required BOI Reporting to FinCEN

Tax PlanningBradford Tax InstituteIt’s here. The Corporate Transparency Act (CTA) became effective on January 1, 2024....

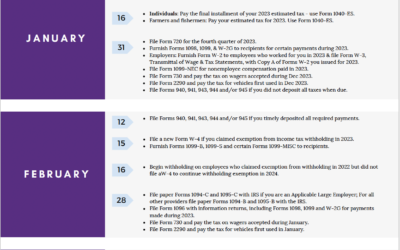

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.