The Smart Income Independence Planning

RMD Conversion

Passing On Your IRA Money Tax Free

If you have accumulated a substantial sum in your tax deferred retirement account, and you want to leave that money to your family without losing up to 50% in taxes, watch this video to learn how you can convert any IRA, 401k or 403b account into a tax free bequest or inheritance.

In this video, you will learn:

- The restrictions of a Required Minimum Distribution (RMD)

- How the IRS will tax all of your IRA, even if you don’t spend it

- How you can leverage the RMD to recover the tax money for your family

- Why section 101 of the tax code enables tax exempt transfers

- How you can convert your taxable IRA into a tax exempt inheritance

Developing a Realizable Vision for Retirement

Retirement PlanningBy Richard AtkinsonRetirement is a totally new stage of life. With some careful prioritizing—and...

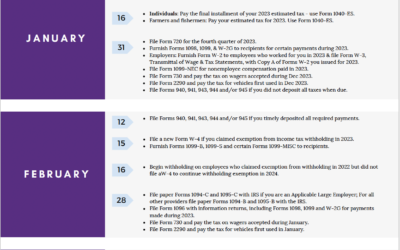

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of...

Cybersecurity Monthly Newsletter March 2024

Asset ProtectionIn this issue: How to beat the password paradox Cybersecurity Shorts Software Updates Welcome to your...