Financial Guides

Fall 2023 Key Financial Deadlines

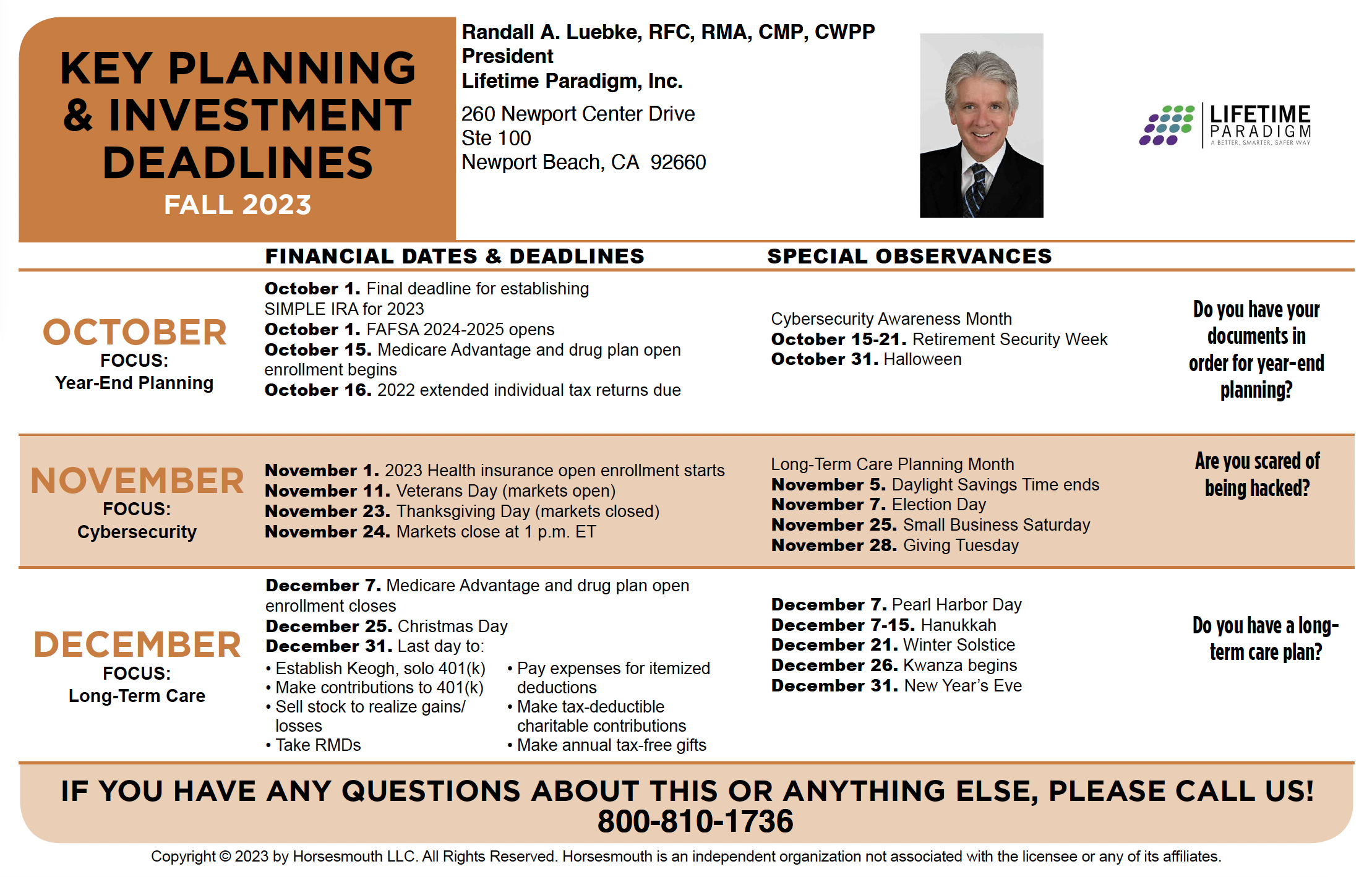

As we embrace the arrival of the fourth quarter, I am pleased to share with you our Fall Key Planning & Investment Deadlines guide. Each quarter, I find it valuable to send out a reminder of the significant financial milestones approaching in the next three months. Fall is a particularly busy time, filled with both festivities and important financial deadlines.

Here are some key dates to mark on your calendar:

October 15th – December 7th: Medicare Advantage and Drug Plan Open Enrollment

Don’t miss your opportunity to review and make changes to your Medicare coverage during this period.

October 16th: Extended Individual Tax Returns Due

If you filed for an extension, be sure to submit your individual tax returns by this date.

December 31: Year-End Financial Deadlines

This is the last day to take action on several critical financial matters, including:

- Establishing a Keogh or Solo 401(k)

- Selling stock to realize gains or losses

- Taking Required Minimum Distributions (RMDs)

- Paying expenses for itemized deductions

- Making tax-deductible charitable contributions

- Making annual tax-free gifts

You can conveniently access the full guide by downloading it from the link provided below.

If you have any questions, need assistance, or seek further clarification on any of these deadlines, please don’t hesitate to reach out to us by phone or email. We are always here to provide the guidance and support you require.

Wishing you a wonderful holiday season ahead. May it be filled with joy, warmth, and prosperity.

Fall 2023 Key Financial Deadlines

Download the guide so you are prepared for upcoming financial deadlines for Q4 2023.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.