Retirement Planning

Health Care Checklist for Finding the Best Coverage

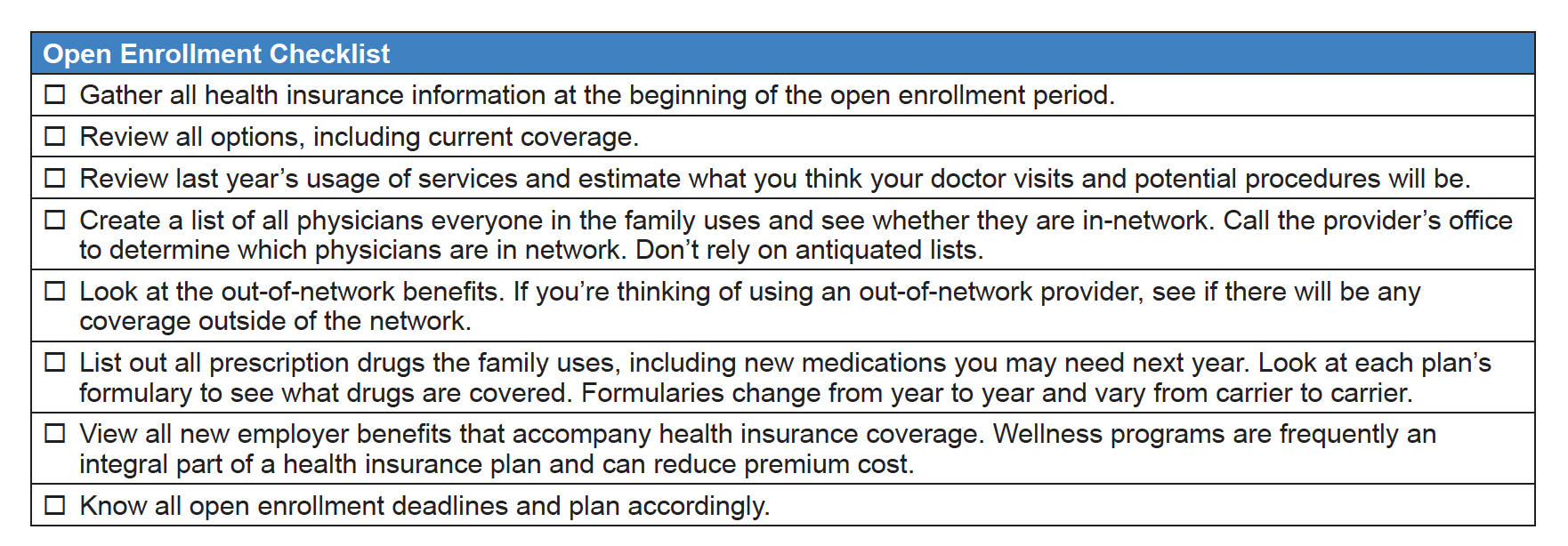

Medicare and health insurance open enrollment starts on October 15th. To help you find the best coverage for your money, here’s a step-by-step checklist of health care items to review annually.

Each fall, it’s important to review your health care needs and consider your available insurance options for the coming year. A recent survey found that 53% of respondents with employer-based coverage say they’re likely to keep their current plan. Only 37% review their health insurance costs annually.

Doing nothing can end up being an expensive proposition for you. Many plans change cost and benefit options, so you may pay more in your current plan or significantly less if you choose another plan.

Your decision during open enrollment will impact dependents for the upcoming year, so it’s important to review all options before making a selection.

With that in mind, use the following Open Enrollment Checklist with your financial advisor to fully review your employer-sponsored insurance options and benefits before making the most optimal coverage decisions for the upcoming year.

To begin, access the Summary of Benefits and Coverage (SBC) document from your employer. Required by the Affordable Care Act, SBCs are benefit plan summaries, intended to benefit employees by providing “clear, understandable, and straightforward information on what health plans will cover, what limitations or conditions will apply, and what they will pay for,” according to the Department of Health and Human Services.

Then, review with your financial advisor what is changing and where costs will increase. The best way to evaluate the plans is to do a side-by-side comparison of the plans that are being offered. Check premiums, deductibles, co-insurance, and out-of- pocket maximums. The cost of health insurance includes out-of-pocket expenses like co-payments

for doctor visits, so these expenses should be incorporated into the comparison. Frequent visits to the doctor can add up.

NETWORK PROVIDERS

A key component to any health insurance is the network of providers. These networks are often narrow and can change. The best way to be sure that a physician is an in-network provider is to contact

the doctor’s office and find out if the doctor is still a network provider. Often network lists are outdated. Physicians who are part of more than one practice or have more than one office may not be in-network in all locations.

If you or your family members expect a surgical or other procedure, find out if that physician or hospital is in-network. Depending on the plan coverage, out- of-network providers may or may not be covered at all, so it is particularly important to verify before an anticipated procedure.

PRESCRIPTION DRUG COVERAGE

Another critical decision in selecting health insurance is prescription drug coverage. All plans vary in relation to what drugs are covered and when a participant may be eligible to obtain certain prescription drugs.

Most health insurance plans have a tier program on prescription drugs, and the cost of drugs depends on where they fall on the tier program. Most generic drugs are in the first tier, and are therefore less expensive.

Most plans have three tiers, but it is not unusual to find a plan with five tiers.

What makes the tier programs even more important are the drugs that may not appear in any tier: specialty drugs. How does a participant qualify for these medications? The ability to access these drugs at a reasonable cost can be an essential component when selecting the best health insurance plan.

In order to determine the best prescription drug coverage, prepare a list of medications used by all family members on a regular basis. This is particularly crucial where adult children are covered by a plan, and the parent may not be aware of all medications. Certainly where a participant is considering or takes a specialty drug, the plan coverage parameters for these drugs are critical.

HEALTH CARE SPENDING, SAVINGS, AND REIMBURSEMENTS

During open enrollment, it is often possible to establish a health care account. Traditionally, large employers have offered Flexible Spending Accounts (FSAs) or Health Reimbursement Accounts (HRAs). FSAs and HRAs allow individuals to reimburse deductibles, co-payments, co-insurance, and other out-of-pocket expenses with pretax dollars.

Another account to consider is the Health Savings Account (HSA), which was introduced with high- deductible health care plans. If a high-deductible plan is selected, an HSA can allow an individual to accrue funds to pay unreimbursed medical expenses in the upcoming year and beyond. HSAs frequently include an employer contribution, making them an extremely attractive vehicle for paying out-of-pocket health care expenses.

The rules for FSAs, HRAs, and HSAs are different, so understanding the parameters of the accounts is vital before participation. Also, check www.healthcare.gov for a list of expenses that qualify for reimbursement.

EMPLOYER WELLNESS PROGRAMS

Wellness incentives are becoming commonplace as a component of employer-sponsored health insurance plans. More employers than ever before are offering incentives to employees and their families for health improvement.

These incentives may come in the form of premium discounts, access to certain lower-deductible plans, or even prizes. Some employers will put money into an HSA as an incentive. Understanding what constitutes a wellness component of a health insurance program can result in additional savings. Gym memberships

or participation in a weight-loss program may qualify for an incentive in an employer-sponsored wellness program.

Open enrollment periods often last for several weeks. It’s easy to lose track of the deadline for changes in plan selection. Frequently, if no election of benefits is submitted, an employer will assume the same benefit elections you made for this year. It’s important to be cognizant of the deadlines and submit all enrollment materials on a timely basis.

Choosing an great health insurance plan can be tricky due to the complexity of the system. Following the eight points of this health care checklist will help you lower health care expenses by finding the right coverage to fit your needs.

Ellen Breslow is the managing director of www.eabhealthworks.com. She is a graduate of Lehigh University and holds NASD Series 6, 7, 24, and 51 registrations

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ℠

Retirement Planning

Tax Planning

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.