Having the Force of Law On Your Side for Significant Asset Protection

It’s sad but true, if you have something of value, someone may try to take it from you. Sometimes this can be the result of malice. Other times, we could bring these problems upon ourselves. Either way, the good news is you have something of value that people want. Even better, I’m going to share some great ways to protect some of the assets you have from others.

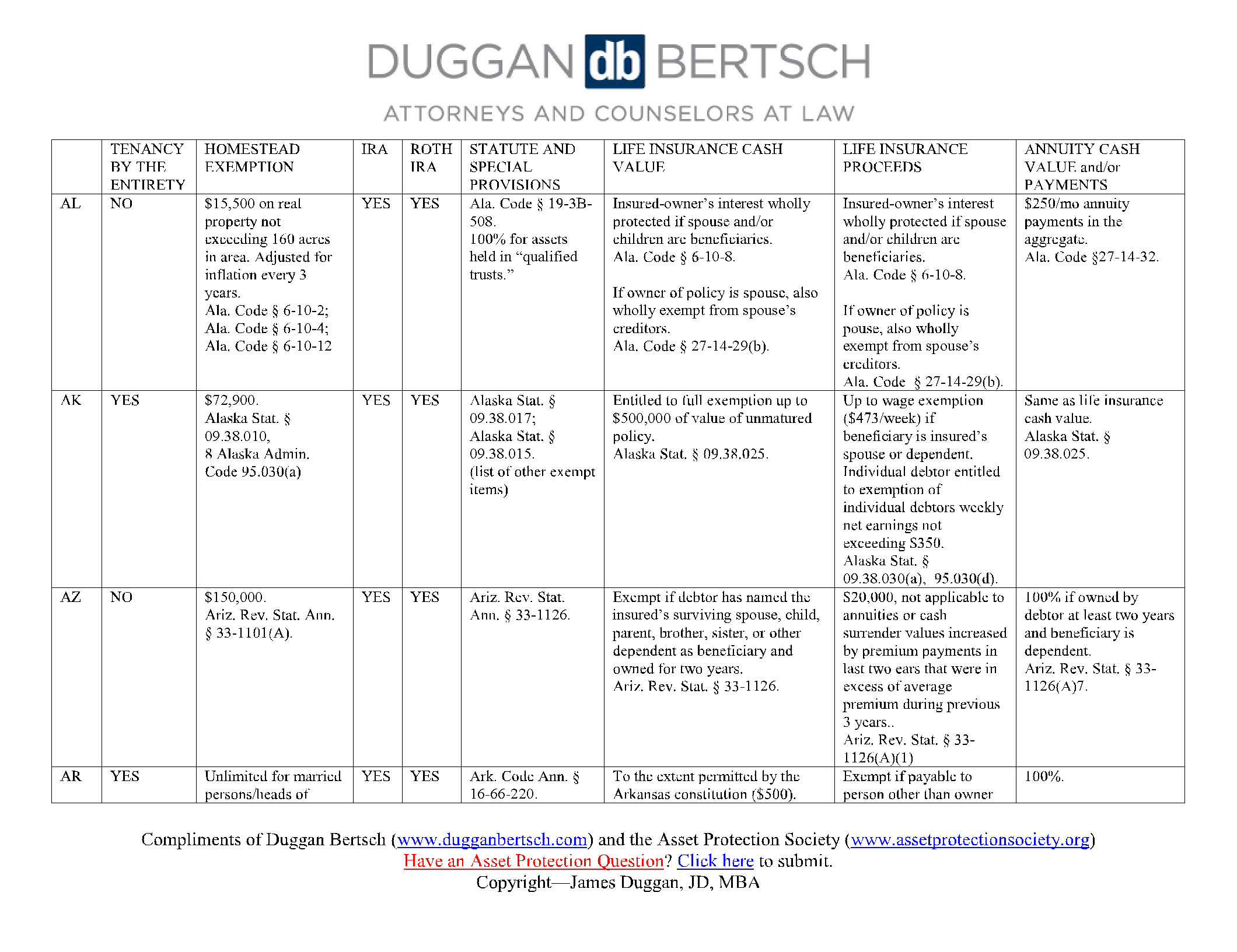

Generally referred to as “Asset Protection”, as the name implies the goal is to keep the bad guys away from your stuff. In this article I’m going to address several assets that we can protect easily and extremely well: Real Estate, IRA’s, Life Insurance and Annuities. In future articles we will address how to protect even more assets like your identity, your income and your health.

Asset Protection from 60,000 Feet

I like to start from the top down when discussing asset protection with my clients. At the very highest level, asset protection falls into just two basic categories:

- You can hide your assets

- You can shield your assets

Think of hiding your assets as wearing camouflage. The goal is to make those assets less visible, possibly invisible, thus protecting them from others. Obviously, if you do a really good job hiding things, they will be safe. On the other hand, you would be naive to believe that a good detective, be that an attorney or just someone with the time, passion and smarts, could uncover even the best hidden treasure chest.

Put the Law on Your Side Instead

Hiding your assets would be akin to planting trees and bushes around your castle to obscure its view from your would-be enemies. On the other hand, by shielding your assets you can create some much more formidable defenses. In fact, shielding them could leave your castle in full view of your enemies, but shielding it with a mote and armed guards posted on the building walls will provide an excellent deterrent from prospective perpetrators.

When most people think of shielding their assets, they first consider using entities like corporations, LLC’s and the like. We will discuss the use of entities in future articles. Today, the shield we are going to address is simply using “the law”.

State laws, Federal laws, even local city or HOA CC&R’s can provide you with some remarkable protection. For example, if you are a resident of Florida your life insurance can be 100% legally protected from creditors. This is true in many other States. Conversely, the State of California provides very little protection for your life insurance, and potentially even less protection for your home.

As you can see, the legal protection of assets varies wildly from state to state. Fortunately, the law firm of Duggan & Bertsch has published a comprehensive list in a very easy to read and useful grid. You can download a copy for yourself by clicking on the button below.

Finally, I must share our disclaimer below to help me to protect my company’s assets. That said, and in all seriousness, take what this disclaimer says to heart because, while articles like this are easy to read and very useful as well, you should always seek advice from qualified professionals before making any important decisions in all areas of your life.

Disclaimer

Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...