The Smart Income Independence Planning

Protecting Portfolios From Black Swan Events

There is going to be a lot of Monday Morning Quarterbacking going on after the dust settles from this most recent stock market crash brought on by COVID-19. The Dow, S&P, just about everything was crushed as we shut-down the largest economy in the history of the world. That said, tomorrow is another day. The best thing you can do right now is to assess your situation. Make a plan to move on and then, get going!

What is a black swan event? It’s an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. The 2000 and the 2008 stock market crashes were arguably black swan events and our current crash is certainly a black swan event as well.

It’s very difficult for a money manager to avoid losing significant money during a black swan event (the nature of such an event is that it’s not foreseeable). However, there are choices and options available to you moving forward, that could leave you in a much better position when the next black swan lands in our pond again. I would like you to consider an annuity. Not just any annuity, however, as you will learn, there are 3 types of annuities. I refer to them as 3 Generations of annuities. Understanding the differences is critical. Below is a brief summary.

1st Generation Annuity (Fixed Annuity/FA) – A certificate of deposit (CD) like instrument where all elements of this type of annuity are protected and guaranteed. Like the CD, both the principle and earnings are protected from losses. Unlike a CD, where interest is taxed as earned, the earnings of the 1st Generation Annuity are tax-deferred until distributed. The primary method of distribution is called “annuitization”. Annuitization surrenders the principle and earnings in exchange for ongoing payments/distributions. The payments are made to the annuitant for a guaranteed period of time, ranging from a specific number of years to the lifetime of the annuitant. Once annuitized, the distributions cannot be changed or stopped and, the principle is no longer available for lump-sum withdrawals.

2nd Generation Annuity (Variable Annuity/VA) – An annuity that primarily invests in stocks, bonds or mutual funds to provide the opportunity for higher earnings and growth. Just like a 1st Generation Annuity, the earnings of a 2nd Generation annuity are deferred from taxes until distributed and the primary method of distribution is “annuitization”. Generally, the 2nd Generation Annuity has no guarantees to protect the principle or gains from potential losses. In addition, the 2nd Generation Annuity is often subject to higher fees than other types of annuities.

3rd Generation Annuity (3GA/Fixed Indexed Annuity/FIA) – The 3GA is a hybrid that combines the safety, security and guarantees of a 1st Generation Annuity with some of the upside earnings potential of a 2nd Generation Annuity. The 3GA is a safe, flexible and liquid annuity, that can be designed with low or even no fees. A 3GA can be annuitized to provide income, however, most often the annuitant will choose to exercise the more flexible “Income Rider” option instead. Similar to annuitization, the Income Rider is a private, personal and portable pension-like distribution plan that provides guaranteed ongoing distribution of money that one can never outlive. The significant difference between the income rider and annuitization is that the principle is never surrendered, making it possible to receive lump-sum withdrawals of money as needed. Additionally, the distributions can be increased, decreased or stopped altogether.

Using FIAs to Reduce Risk in a Financial Plan

You’d think that the use of an FIA in a financial plan might significantly reduce your ability to grow money over time. However, historically, using FIAs the conservative part of the portfolio has had a minimal effect on overall returns. You would be wrong. Let’s look at a few examples from the OnPointe Risk Analyzer Software.

Example #1—The S&P 500 vs. the 70% S&P 500 and 30% in an FIA with only a 5.5% annual cap over the last 10 years (month ending February 2020). You’d think with 30% of the money in an FIA with a 5.5% annual cap that the SPY would do much better because it was what most saw as a bull market. IT DOESN’T!

We’ll compare the CAGR (compound annual growth rate) and maximum drawdown (amount lost from the highest peak to the lowest point). The following charts come from the OnPointe Investment Risk Analyzer program.

When adding FIAs to a portfolio and the CAGR over the last ten years the return was nearly identical. And the drawdown was less using FIAs.

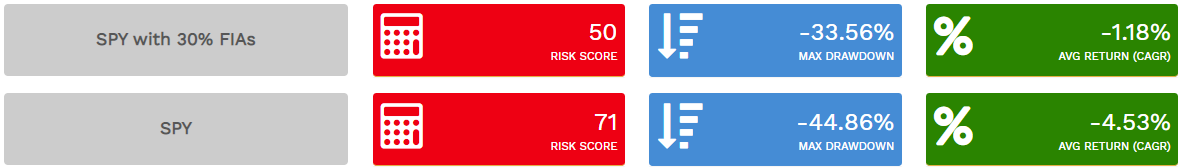

Example #2—The SPY vs. the 70% SPY and 30% in an FIA with only a 5.5% annual cap from 2000-2009 (a ten-year period with two crashes).

Now the portfolio with 30% FIAs did better than the SPY and the drawdown was 11% less

Are You Using FIAs in Your Financial Plan?

Most people are not. Why is that? The primary reason is that many advisors are not familiar with FIA’s or, they work for firms that restrict their advisors using them.

At our firm, we believe in the proper use of FIAs to help clients mitigate risks in stock market investments. While there is no such thing as “the perfect investment” and no one investment strategy is appropriate for every person, to dismiss the FIA completely as a viable investment strategy is simply ignorance.

We’ve shown you the facts. Reach out to us if you would like to learn more. Make up your own mind about FIA’s and see if they are a good solution for you.

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...