Financial Guides

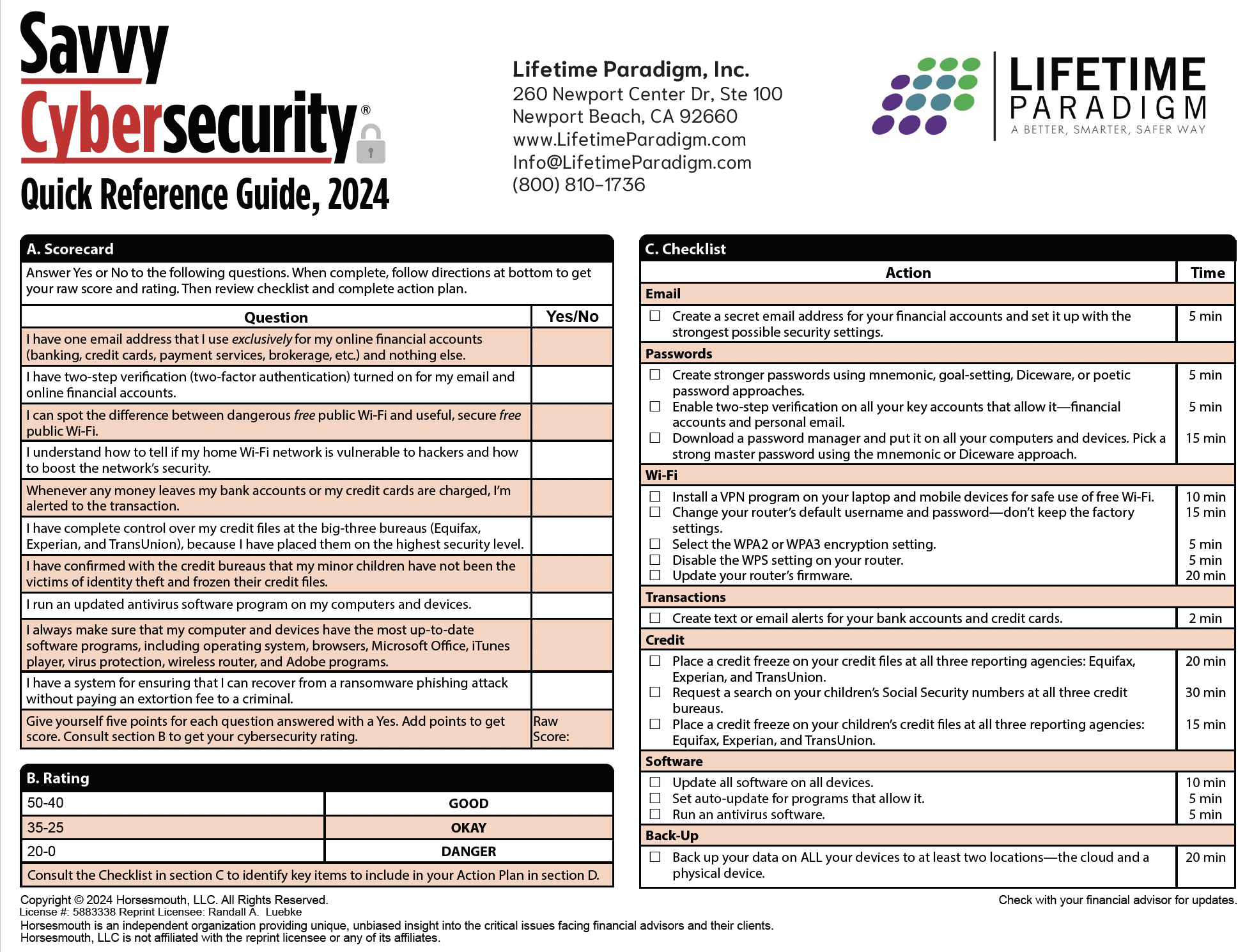

Savvy Cybersecurity Quick Reference Guide 2024

In today’s digital world, cybersecurity is a growing concern. With data breaches, scams, and identity theft on the rise, protecting your personal information is more important than ever. But the good news is, there are effective steps you can take right now to improve your security and keep your identity safe.

Our Cybersecurity Quick Reference Guide will help get you started —a practical tool designed to help you measure and enhance your cybersecurity levels. Here’s how it can help you stay secure:

1. Discover Your Cybersecurity Score

The guide includes a simple scorecard that allows you to measure your current cybersecurity status. By evaluating various aspects of your online habits and security measures, you can get a clear picture of where you stand. This score serves as a baseline, helping you identify areas that may need improvement.

2. Checklist

Once you’ve assessed your cybersecurity score, the guide provides a checklist of actions you can take to boost your online security. From strengthening your passwords to securing your devices, the guide offers practical advice to help you tackle potential vulnerabilities.

3. Take Action

After reviewing the checklist, the final step is to identify three actions you can implement right away to improve your digital safety. These could be simple changes like enabling two-factor authentication, updating software regularly, or using a password manager. By taking these steps now, you can make a significant impact on your online security.

Download the Guide

Cybersecurity Quick Reference Guide 2024

Your digital safety is in your hands. Download our Cybersecurity Quick Reference Guide today and take the first step towards a more secure online presence. Remember, small changes can make a big difference in protecting your personal information.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

Coaching and Consulting

You May Also Like…

Reduce Taxes by Using the Best Cryptocurrency Account Method

Tax PlanningBradford Tax InstituteLet’s say you purchased one Bitcoin 14 months ago for $15,000 and another Bitcoin...

Cybersecurity Business Protection Checklist 2024

Financial Guides In today's digital landscape, safeguarding your business from cybersecurity threats is more crucial...

Inherited an IRA? Four Things Every Beneficiary Should Know

Inherited IRA distribution rules have changed in ways that can significantly impact your taxes and tax...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.