— Services

The Smart Social Security Benefits Maximizer/ Retirement Healthcare Expense Estimator ℠

A full analysis and comprehensive strategies to help you maximize the Social Security benefits you receive.

What’s at stake?

$106,442

The difference between a good decision and a poor one is often surprising. Let us help you make the best decision.

What if I live longer than average?

What if my spouse lives longer than average?

What if we both live longer than average?

What to Know

Social Security serves as a crucial pillar of reliable, steady, and enduring income throughout retirement.

Navigating the process of claiming Social Security benefits can be intricate and multifaceted. The choices you make when claiming benefits are irreversible, shaping your financial future for both you and your spouse.

Using The Smart Social Security Benefits Maximizer/Retirement Healthcare Expenses Estimator ˢᵐ, we help guide individuals through the intricacies of the Social Security system, equipping them with the knowledge to optimize their Social Security benefits for the entirety of their retirement.

Overview

The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ˢᵐ strategies can significantly influence the potential Social Security income you may receive throughout your lifetime.

Our in-depth analyses provide you with precise instructions to help you implement optimal Social Security claiming strategies that can maximize your lifetime benefits.

Given the multitude of Social Security claiming strategies available, making an informed choice without a thorough analysis, like The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ˢᵐ (SSSBM/RHEE), can be challenging. Our SSBM/RHEE report delves into your past and future Social Security contributions, factors in inflation, and considers your estimated life expectancy to calculate the best claiming strategy for you.

The good news is that we are living longer lives. However, the downside is the rising costs of healthcare. While healthcare expenses can be daunting, being aware of these costs today allows you to make adjustments to your retirement planning, ensuring you’ll have the necessary funds when required. The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ˢᵐ is equally invaluable in helping you anticipate potential healthcare expenses during your retirement.

The Process

The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ˢᵐ, you will have a dedicated independent fiduciary advisor who will serve as your personal guide and mentor. To tailor the program to your unique situation, we’ll pose essential questions like:

- What is your Primary Insurance Amount (PIA) Full Retirement Age (FRA)? (You can find this information directly on the Social Security Benefits Administration website, and we’ll assist you in obtaining it.)

- Are you still employed, and if so, how many more years do you plan to work?

- Have you ever been married?

- Will you have dependent children in your care when you retire?

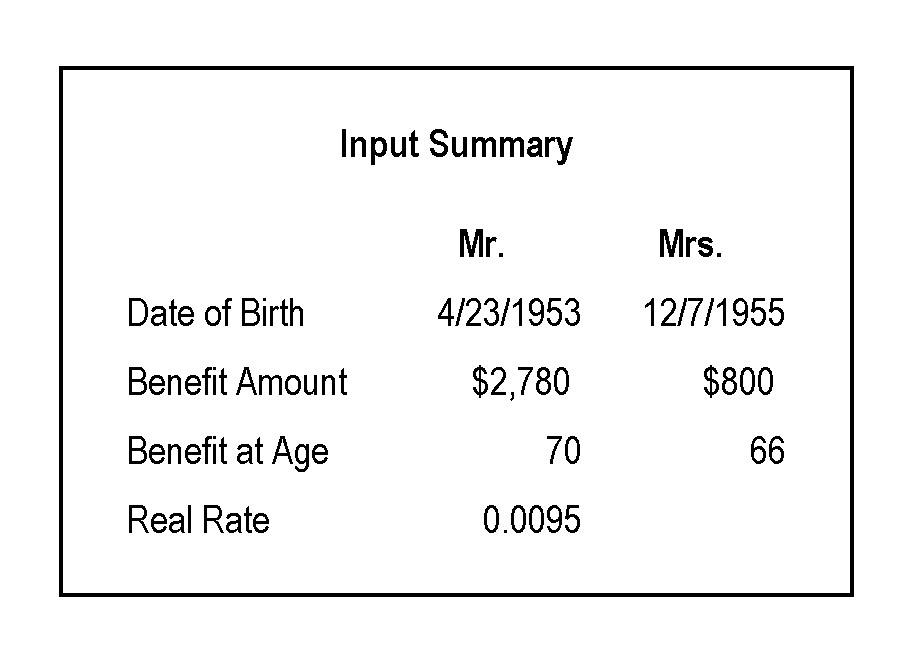

Based on your responses, we’ll create a graphical representation that highlights the breakeven age for various claiming strategies, including early claiming, delaying benefits, or following our distinctive approach, which might involve a range of well-timed claiming scenarios. As a result, we’ll furnish you with a comprehensive analysis of your specific circumstances and a detailed strategy—precise instructions that you can confidently present to the Social Security Administration and put into practice.

What You Get:

Independent Fiduciary Advisor

Receive extensive advice and guidance with one of Lifetime Paradigm’s Independent Fiduciary Advisors.

Detailed Analysis

We will provide a detailed analysis with graphical representation.

Ideal Strategy

We will help you make an informed decision as to the optimal claiming strategy. Choose the best strategy for your specific situation.

Instructions

Receive a detailed strategy with precise instructions that you can take to the Social Security Administration.

Health Care Planning

Estimate out-of-pocket costs of healthcare over retirement and advise on strategies

Continued Reassurance

Reassurance knowing we will continue to review decisions and strategies implemented and advise on adjustments needed based on changes, such as changes to the law, taxes, and your health and family situation.

Success Story

Here is an example of how our system is working for one of our clients.

Our client, who is currently employed but eager to retire as soon as possible, found herself facing financial challenges. After years of raising her daughters as a single parent, she realized that her current income wouldn’t sustain her desired lifestyle in retirement. She sought advice from friends, consulted with her CPA, and spoke to a couple of financial advisors. While she was aware that claiming benefits at 62 while still working was not advisable, the consensus shifted as she reached the age of 66, which marked her full retirement age. At this point, everyone was urging her to consider claiming her benefits.

Upon completing our comprehensive questionnaire, we made a significant discovery: our client had been previously married, and her husband, who had passed away several years prior, had contributed to the Social Security system during his working years. This revelation meant that she was eligible for a survivor’s benefit, a consideration she had never explored before.

Our analysis revealed a promising strategy: if she claimed her survivor’s benefit while continuing to work, her own Social Security benefit would grow substantially. Waiting until she turned 70 to claim her benefits would result in nearly a 40% increase in her benefit amount. While the prospect of working for another four years wasn’t met with enthusiasm, the additional income from the survivor’s benefit brought her immediate financial relief. Additionally, knowing that her benefits would continue to grow while she worked allowed her to plan more confidently.

This strategy also provided her with an extra four years to save and invest in her company’s 401(k) plan. By combining these three strategies, we significantly reduced the stress in her life. Now, with the assurance that she could retire and fulfill her dreams, her only remaining task was to negotiate a reduced workload with her boss, making her retirement plans closer to reality.

Did You Know…

Every year, 73.7% of seniors make massive mistakes on their Social Security claims, leaving on average $9,201 UNCLAIMED because they don’t understand the rules and the most effective claiming strategies available.

Social Security employees cannot give advice on how to increase monthly benefits.

There are literally hundreds of choices and options available to you when you apply for your Social Security benefits.

The choices and decisions you make when applying for your Social Security benefits are generally permanent and cannot be changed or undone.

Making the optimal choices when applying for Social Security benefits can increase the amount of money you could receive over your lifetime by hundreds of thousands of dollars?

Listen To This Important Message

Get Started

Enroll now to get started with The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ˢᵐ. Discover a better way to maximize your social security benefits, and implement and Better, Smarter, Safer Way to pay for healthcare during retirement.