Retirement Planning: Securities

A Securities Market Update for You – January 2023

Joseph Maas, Synergy Asset Management

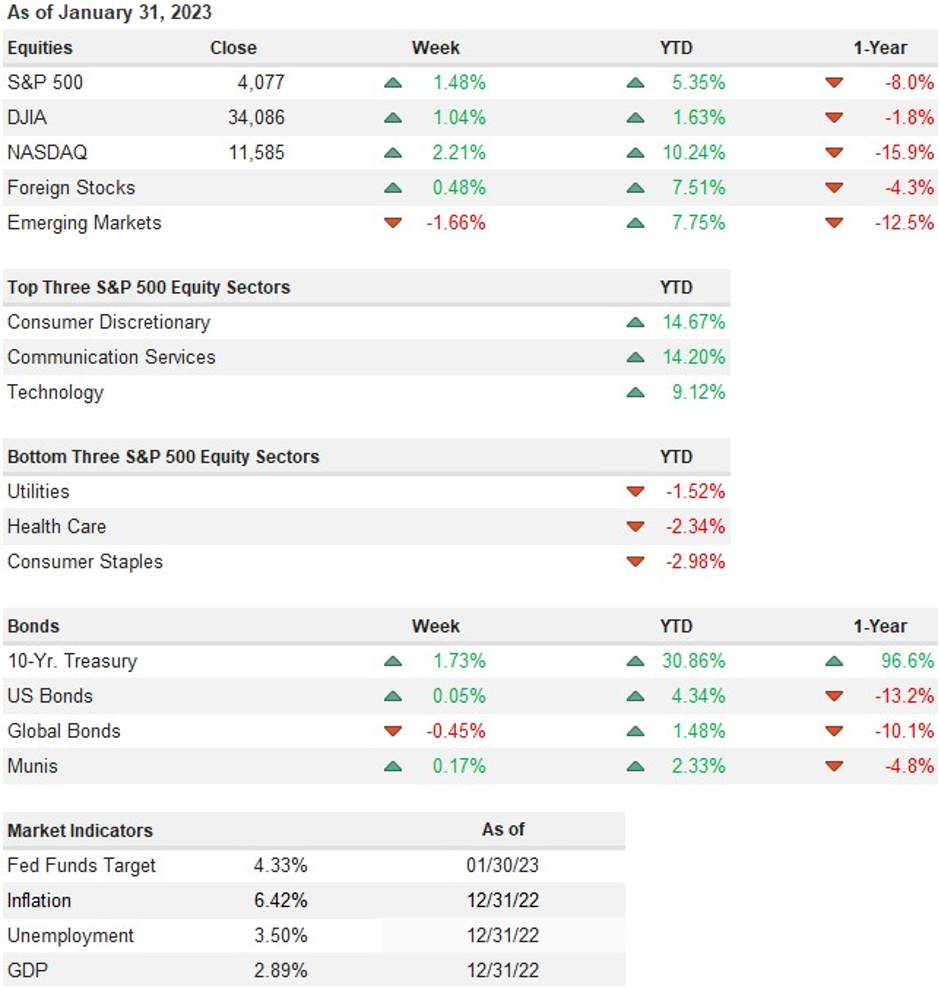

Market highlights

Inflation appears to be diminishing, but the FOMC is expected to raise interest rates a quarter-point at this month’s meeting. Because lending rates have increased, housing sales are slow due to mortgage costs. Large domestic, European, and Asian equity markets all gained value in the first month of the new year, as did Comex gold. The 10-Year Treasury yield curve rate declined, and domestic crude oil decreased slightly as unleaded retail gasoline increased $0.32.

U.S. Markets

January regained some of December’s losses as the Dow Jones Industrial Average rose +939 points to 34,086, a YTD increase of +2.8%. Similarly, the S&P 500 gained +237 points and closed at 4,076, +5.8% YTD. Gaining the most this month, the NASDAQ increased by 1,118 points to 11,584, with a +9.7% YTD. The Russell 2000 added +170 points, closing at 1,931, a YTD gain of +8.8%.

European and Asian Markets

London’s FTSE 100 picked-up +320 points and ended the month at 7,771, up +4.1% YTD. Frankfurt’s DAX 30 increased 1,205 points and saw the start of February at 15,128, up +8% YTD. Parisian investors applauded as the CAC 40 gained +609 points for a month-end close of 7,082, an increase of +8.6% YTD.

The Shanghai Stock Exchange gained +166 points by ending the month at 3,255, a YTD gain of +5.1%. The Hang Seng Index in Hong Kong ended January with gains not seen since summer, celebrating a January close of 21,842 and a gain of 2,061 points, up +9.5% YTD. Also in a good mood, Tokyo’s Nikkei Index gained +1,233 points and concluded the first of 12 months at 27,327 with a welcome YTD of +4.5%.

Fixed Income

The Federal Open Market Committee (FOMC) met on January 31 – February 1, but this meeting did not include a Summary of Economic Projections (SEP). SEP is expected at the March 15 – 16 meeting. According to market analysts, “US Federal Reserve’s inaugural Federal Open Market Committee (FOMC) meeting of 2023 will begin on Tuesday, 31 January 2023. The two-day meeting will be followed by a press conference by Fed Chair Jerome Powell where he is expected to announce a 25bps interest rate hike along with guidance on inflation and US GDP. The 12-member committee is likely to tone down pace of interest rate hike, a glimpse of which was seen in the December Monetary Policy where the US Central Bank had raised rates by 50bps to bring the range at 4.25-4.50 per cent, in line with the street’s expectations. Powell had then indicated that the Fed could consider raising interest rates by 75bps through 2023. A quarter percentage increase will take the range to 4.50-4.75 per cent.” (Zeebiz, January 30, 2023)

The 10-Year Treasury Rate is at 3.55% compared with 3.88% last December. This is lower than the long-term average of 4.26%. On December 31, the rate was 3.88%.

Commodities

Comex gold rose from $1,822 per ounce on December 31 to $1,929 per ounce, up $107 and +5.5% YTD. West Texas Intermediate Crude oil declined -58 cents in January, from $80.26 a barrel to $79.68 a barrel, down almost -1% YTD. The national average for an unleaded retail gallon of gasoline was $3.505 on January 31, up +32.6 cents from the December 31 close of $3.179, a YTD of +9.5%.

U.S. Economy

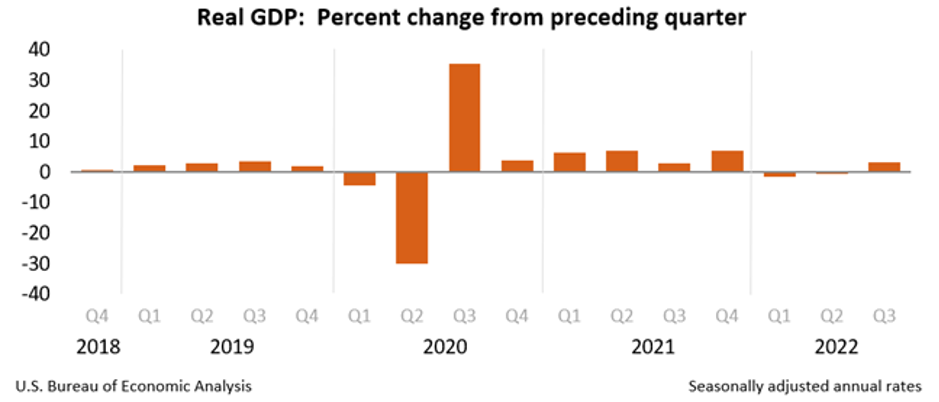

GDP: The Bureau of Economic Analysis (BEA) reported “Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022 according to the “third” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent. The 3.2 percent increase in third-quarter real GDP was 0.3 percentage point higher than previously estimated in the “second” estimate. Upward revisions to consumer spending, nonresidential fixed investment, and state and local government spending were partly offset by downward revisions to private inventory investment and exports.

The increase in real GDP for the third quarter reflected increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, that were partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased.

The increase in exports reflected increases in both goods and services. Within exports of goods, the leading contributors to the increase were industrial supplies and materials (notably nondurable goods), “other” exports of goods, and nonautomotive capital goods. Within exports of services, the increase was led by “other” business services and travel.

Within consumer spending, an increase in services (led by health care and “other” services) was partly offset by a decrease in goods (led by motor vehicles and parts as well as food and beverages). Within nonresidential fixed investment, increases in equipment and intellectual property products were partly offset by a decrease in structures. The increase in state and local government spending was led by increases in investment in structures and in compensation of state and local government employees. The increase in federal government spending was led by defense spending.

The decrease in residential fixed investment was led by new single-family construction and brokers’ commissions. Within private inventory investment, the decrease was led by retail trade (mainly other general merchandise stores). Within imports, the decrease primarily reflected a decrease in imports of goods (notably consumer goods).

Real GDP turned up in the third quarter, increasing 3.2 percent after decreasing 0.6 percent in the second quarter. The upturn primarily reflected accelerations in nonresidential fixed investment and consumer spending, a smaller decrease in private inventory investment, and upturns in state and local as well as federal government spending that were partly offset by a larger decrease in residential fixed investment. Imports turned down.

Current-dollar personal income increased $283.1 billion in the third quarter, a downward revision of $8.1 billion from the previous estimate. The increase primarily reflected increases in compensation (led by private wages and salaries), personal interest income, and nonfarm proprietors’ income (table 8).

Disposable personal income increased $242.4 billion, or 5.4 percent, in the third quarter, an upward revision of $6.6 billion from the previous estimate.

Real disposable personal income increased 1.0 percent, an upward revision of 0.1 percentage point.

Personal saving was $507.7 billion in the third quarter, a downward revision of $12.9 billion from the previous estimate. The personal saving rate—personal saving as a percentage of disposable personal income—was 2.7 percent in the third quarter, a downward revision of 0.1 percentage point.” (BEA, December 22, 2023)

Industrial Production: “Industrial production decreased 0.7 percent in December and 1.7 percent at an annual rate in the fourth quarter. In December, manufacturing output fell 1.3 percent amid widespread declines across the sector. The index for utilities jumped 3.8 percent, as cold temperatures boosted the demand for heating, while the index for mining moved down 0.9 percent. At 103.4 percent of its 2017 average, total industrial production in December was 1.6 percent above its year-earlier level. Capacity utilization dropped 0.6 percentage point in December to 78.8 percent, a rate that is 0.8 percentage point below its long-run (1972–2021) average.” (Federal Reserve, January 18, 2023)

Trading Economics commented, “Industrial production in the US fell by 0.7% mom in December of 2022, following an upwardly revised 0.6% decrease in November and more than market expectations of a 0.1% loss. It was the biggest drop in industrial activity since September 2021, as higher interest rates and prices weighed on demand. Manufacturing output dropped 1.3%, way more than expectations for a 0.3% decrease.

The indexes for durable and nondurable manufacturing dropped 1.1% and 1.5%, respectively, while the index for other manufacturing (publishing and logging) stepped down 0.9%. Meanwhile, mining was down 0.9% while utilities rose 3.9%, driven by increases for both electric and natural gas utilities.

Capacity utilization dropped 0.6 percentage point in December to 78.8%, a rate that is 0.8 percentage point below its long-run (1972–2021) average. Considering Q4, industrial production declined 1.7%. Source: Federal Reserve.” (Trading Economics, December 2022)

Exports and Imports: “The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $65.1 billion in November, down $16.3 billion from $77.8 billion in October, revised. November exports were $251.9 billion, $5.1 billion less than October exports. November imports were $313.4 billion, $21.5 billion less than October imports. The November decrease in the goods and services deficit reflected a decrease in the goods deficit of $15.3 billion to $84.1 billion and an increase in the services surplus of $1.0 billion to $22.5 billion. Year-to-date, the goods and services deficit increased $120.1 billion, or 15.7 percent, from the same period in 2021. Exports increased $439.4 billion or 18.9 percent. Imports increased $559.5 billion or 18.1 percent.” (U.S. Census Bureau and the U.S. Bureau of Economic Analysis, January 5, 2023)

Job Growth: “Payroll growth decelerated in December but was still better than expected, a sign that the labor market remains strong even as the Federal Reserve tries to slow economic growth. Nonfarm payrolls increased by 223,000 for the month, above the Dow Jones estimate for 200,000, while the unemployment rate fell to 3.5%, 0.2 percentage point below the expectation. The job growth marked a small decrease from the 256,000 gain in November, which was revised down 7,000 from the initial estimate.

Wage growth was less than expected in an indication that inflation pressures could be weakening. Average hourly earnings rose 0.3% for the month and increased 4.6% from a year ago. The respective estimates were for growth of 0.4% and 5%. By sector, leisure and hospitality led with 67,000 added jobs, followed by health care (55,000), construction (28,000) and social assistance (20,000). “From the market’s perspective, the main thing they’re responding to is the softer average hourly earnings number,” said Drew Matus, chief market strategist at MetLife Investment Management. “People are turning this into a one-trick pony, and that one trick is whether this is inflationary or not inflationary. The unemployment rate doesn’t matter much if average hourly earnings continue to soften.”

The relative strength in job growth comes despite repeated efforts by the Fed to slow the economy, the labor market in particular. The central bank raised its benchmark interest rate seven times in 2022 for a total of 4.25 percentage points, with more increases likely on the way. Primarily, the Fed is looking to bridge a gap between demand and supply. As of November, there were about 1.7 job openings for every available worker, an imbalance that has held steady despite the Fed’s rate hikes. The strong demand has pushed wages higher, though they mostly haven’t kept up with inflation.

December’s wage data, though, could provide some encouragement that the Fed’s efforts are impacting demand. “There’s some indication that things are moving in the right direction. We’re seeing the impact of the blunt tools of monetary policy take effect,” said Mike Loewengart, head of model portfolio construction for Morgan Stanley’s Global Investment Office. “I don’t think this is going to sway the Fed from a few additional raises going forward, but it no doubt is encouraging to see a moderation in wages.”

The drop in the unemployment rate came as the labor force participation rate edged higher to 62.3%, still a full percentage point below where it was in February 2020, the month before the COVID-19 pandemic hit. A more encompassing measure of unemployment that takes into account discouraged workers and those holding part-time jobs for economic reasons also declined, falling to 6.5%, its lowest-ever reading in a data set that goes back to 1994. The headline unemployment rate is tied for the lowest since 1969. The household count of employment, used to calculate the unemployment rate, showed a huge gain for the month, rising 717,000. Economists have been watching the household survey, which has generally been lagging the establishment count.

The U.S. heads into 2023 with most economists expecting at least a shallow recession, the result of Fed policy tightening aimed at tamping down inflation still running near its highest level since the early 1980s. However, the economy closed 2022 on a strong note, with GDP growth tracking at a 3.8% rate, according to the Atlanta Fed. Fed officials at their last meeting noted that they are encouraged by the latest inflation readings but will need to see continued progress before they are convinced that inflation is coming down and they can ease up on rate hikes. As things stand, markets are largely expecting the Fed to increase rates another quarter-percentage point at its next meeting, which concludes Feb. 1.” (CNBC, January 6, 2023)

Existing Home Sales: The National Association of Realtors (NAR) reported “Existing-home sales retreated for the eleventh consecutive month in December. Three of the four major U.S. regions recorded month-over-month drops, while sales in the West were unchanged. All regions experienced year-over-year declines.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 1.5% from November to a seasonally adjusted annual rate of 4.02 million in December. Year-over-year, sales sagged 34.0% (down from 6.09 million in December 2021). “December was another difficult month for buyers, who continue to face limited inventory and high mortgage rates,” said NAR Chief Economist Lawrence Yun. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

Total housing inventory registered at the end of December was 970,000 units, which was down 13.4% from November but up 10.2% from one year ago (880,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.3 months in November but up from 1.7 months in December 2021. The median existing-home price for all housing types in December was $366,900, an increase of 2.3% from December 2021 ($358,800), as prices rose in all regions. This marks 130 consecutive months of year-over-year increases, the longest-running streak on record. “Home prices nationwide are still positive, though mildly,” Yun added. “Markets in roughly half of the country are likely to offer potential buyers discounted prices compared to last year.”

Properties typically remained on the market for 26 days in December, up from 24 days in November and 19 days in December 2021. Fifty-seven percent of homes sold in December 2022 were on the market for less than a month. First-time buyers were responsible for 31% of sales in December, up from 28% in November and 30% in December 2021. NAR’s 2022 Profile of Home Buyers and Sellers – released in November 2022 – found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.15% as of January 19. That’s down from 6.33% last week, but up from 3.56% one year ago.

Single-family home sales declined to a seasonally adjusted annual rate of 3.60 million in December, down 1.1% from 3.64 million in November and 33.5% from the previous year. The median existing single-family home price was $372,700 in December, up 2.0% from December 2021.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 420,000 units in December, down 4.5% from November and 38.2% from one year ago. The median existing condo price was $317,200 in December, an annual increase of 3.3%. (NAR, January 20, 2023)

New Home Sales: “The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announce the following new residential sales statistics for December 2022: New-home sales of new single-family houses in December 2022 were at a seasonally adjusted annual rate of 616,000, according to estimates released jointly today. This is 2.3% above the revised November rate of 602,000 But is 26.6% below the December 2021 estimate of 839,000. An estimated 644,000 new homes were sold in 2022. This is 16.4% below the 2021 figure of 771,000.

Sales Price: The median sales price of new houses sold in December 2022 was $442,100. The average sales price was $528,400.

Inventory: The seasonally-adjusted estimate of new houses for sale at the end of December was 461,000. This represents a supply of 9.0 months at the current sales rate.” (U.S. Census Bureau and the U.S. Department of Housing and Urban Development, January 26, 2023)

Retail Sales: “Retail spending fell in December at the sharpest pace of 2022, marking a dismal end to the holiday shopping season as rising interest rates, still-high inflation and concerns about a slowing economy pinched American consumers. Purchases at stores, restaurants and online, declined a seasonally adjusted 1.1% in December from the prior month, the Commerce Department said Wednesday. Sales were also revised lower in November and have fallen three of the past four months. The department seasonally adjusts monthly data to make it comparable over time. On an unadjusted basis, December is typically the peak sales month for the year.

A Federal Reserve report Wednesday found economic activity was relatively flat at the start of the year and businesses are pessimistic about growth in the months ahead. A separate Fed report showed U.S. industrial production slumped in December, led by weakness in manufacturing. A Labor Department report showed inflation was cooling.

The latest data add to signs that the U.S. economy is slowing as the Fed pushes up interest rates to combat inflation. Hiring and wage growth eased in December, U.S. commerce with the rest of the world declined significantly in November, and existing-home sales have fallen for 10 straight months. S&P Global downgraded its estimate for fourth-quarter economic growth Wednesday by a half percentage point to a 2.3% annual rate. Economists surveyed by The Wall Street Journal this month expect higher interest rates to tip the U.S. economy into a recession in the coming year.

“The lag impact of elevated inflation weighs heavily on U.S. households, it’s very clear that the median American consumer is still reeling from the loss of wages in inflation-adjusted terms,” said Joseph Brusuelas, chief economist at RSM US LLP. “We’re moving towards what I would expect to be a mild recession in 2023,” he added.

On Wednesday, two Fed officials said they would favor quarter-percentage increases, echoing other officials who have said slower rate hikes would be appropriate. That is at odds with the position of Federal Reserve Bank of St. Louis President James Bullard, who said Wednesday at a Wall Street Journal Live event that he supported a half-point increase at the next meeting.

Inflation, while still historically high, is showing signs of cooling as demand eases. Unlike many government reports, retail sales aren’t adjusted for inflation. Consumer prices advanced 6.5% from a year earlier in December, the sixth straight month of deceleration. The producer-price index, which generally reflects supply conditions in the economy, fell in December from the prior month, an increased at the slowest annual pace since March 2021, the Labor Department said Wednesday.

The National Retail Federation said Wednesday holiday sales were disappointing. The trade group said November and December sales rose 5.3% compared with the same period last year to $936.3 billion. In November, the NRF said it expected holiday sales to rise between 6% and 8%. The NRF figures aren’t adjusted for inflation and exclude fuel, auto and restaurant spending.

Somewhat slower inflation at the end of the year didn’t offset weaker demand, said NRF Chief economist Jack Kleinhenz. Consumers are “hit with higher food prices, they are getting hit with higher service prices and they are having to make choices,” he said. Some spending was likely pulled into October as retailers kicked off deals early this year, he added. Retailers discounted heavily and early to clear excess stock from their shelves and warehouses.

The retail sales report showed spending declined in a number of gift-giving categories in December, including at electronics, clothing and department stores, and with online retailers, a category which includes companies such as Amazon.com Inc. Dining out at bars and restaurants dropped 0.9% in December. Sales of furniture and vehicles, which are sensitive to higher borrowing costs, both fell sharply. The only categories to post slight growth in December were grocery, sporting goods and home improvement stores, as winter storms battered many parts of the U.S.

Many retailers had benefited from surging sales earlier in the pandemic as shoppers stocked up on everything from toilet paper to home electronics and furniture, supported by government stimulus dollars. Those tailwinds have cooled, leaving retailers and product manufactures to confront slower spending in some categories and the longer term dynamics of the industry, such as a gradual shift to online spending.

Apparel retailers are especially exposed to the current pullback in discretionary spending, said Kelly Pedersen, the U.S. retail leader at PwC, a consulting firm. “Buying fashion items at department stores is discretionary,” said Mr. Pedersen. Many apparel retailers are still working to sell through excess inventory and offering deep discounts amid weak demand, he said.

Department stores, which saw a 6.6% sales drop in December, struggled to boost sales before the pandemic quickly shifted buying habits. In 2020, a string of department stores filed for bankruptcy, including Lord & Taylor, J.C. Penney Co., Neiman Marcus Group Ltd. and Stage Stores Inc.

The retail sales report offers a partial picture of consumer demand because it doesn’t include spending on many services such as travel, housing and utilities. The Commerce Department will release December household spending figures covering goods and services later this month. Corporate reports out in February will add to that picture. Walmart Inc., Target Corp. and other large retailers—which sell a variety of goods such as food, clothes and décor—report quarterly earnings next month, which will include December sales.” (Wall Street Journal, January 18, 2023)

Producer Price Index: “The Producer Price Index for final demand declined 0.5 percent in December, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.2 percent in November and 0.4 percent in October. On an unadjusted basis, the index for final demand increased 6.2 percent in 2022 after rising 10.0 percent in 2021. In December, the decrease in the final demand index can be attributed to a 1.6-percent decline in prices for final demand goods. In contrast, the index for final demand services rose 0.1 percent. Prices for final demand less foods, energy, and trade services edged up 0.1 percent in December after increasing 0.3 percent in November. The index for final demand less foods, energy, and trade services advanced 4.6 percent in 2022 following a 7.0-percent rise in 2021.

Final demand goods: Prices for final demand goods moved down 1.6 percent in December, the largest decrease since falling 1.8 percent in July. Leading the December decline, the index for final demand energy dropped 7.9 percent. Prices for final demand foods decreased 1.2 percent. Conversely, the index for final demand goods less foods and energy advanced 0.2 percent. Product detail: Nearly half of the December decrease in the index for final demand goods can be traced to a 13.4-percent decline in prices for gasoline. The indexes for diesel fuel; jet fuel; fresh and dry vegetables; canned, cooked, smoked, or prepared poultry; and basic organic chemicals also fell. In contrast, prices for carbon steel scrap increased 8.3 percent. The indexes for chicken eggs and for electric power also moved higher.

Final demand services: Prices for final demand services edged up 0.1 percent in December after rising 0.2 percent in November. The December increase can be traced to margins for final demand trade services, which advanced 0.3 percent. Conversely, the index for final demand transportation and warehousing services fell 0.2 percent, while prices for final demand services less trade, transportation, and warehousing were unchanged. Product detail: A major factor in the December increase in prices for final demand services was a 17.6 percent jump in margins for fuels and lubricants retailing. The indexes for deposit services (partial), airline passenger services, inpatient care, and professional and commercial equipment wholesaling also moved higher. In contrast, prices for truck transportation of freight decreased 1.7 percent. The indexes for residential real estate loans (partial), machinery and vehicle wholesaling, and guestroom rental also fell.” (U.S. Bureau of Labor Statistics, January 18, 2023)

Consumer Price Index: “The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment. The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The food index increased 0.3 percent over the month with the food at home index rising 0.2 percent. The energy index decreased 4.5 percent over the month as the gasoline index declined; other major energy component indexes increased over the month. The index for all items less food and energy rose 0.3 percent in December, after rising 0.2 percent in November.

Indexes which increased in December include the shelter, household furnishings and operations, motor vehicle insurance, recreation, and apparel indexes. The indexes for used cars and trucks, and airline fares were among those that decreased over the month. The all items index increased 6.5 percent for the 12 months ending December; this was the smallest 12month increase since the period ending October 2021. The all items less food and energy index rose 5.7 percent over the last 12 months.

The energy index increased 7.3 percent for the 12 months ending December, and the food index increased 10.4 percent over the last year; all of these increases were smaller than for the 12-month period ending November.” (Bureau of Labor Statistics, January 12, 2023)

Consumer Sentiment: “For the second month in a row, consumers said they are feeling better about the economy. The University of Michigan’s closely watched consumer sentiment index measured 64.9 for January, according to data released Friday. That’s up slightly from the preliminary reading of 64.6 earlier this month and 9% higher than December’s final reading. But it’s still historically low: The index measured 101 in February 2020, and it had an average reading of 86 between that date and the first-ever reading in November 1952.

A separate report released earlier on Friday showed that consumers cut back on their spending in December and started stashing more in their savings as they prepare for a potential recession. That caution was also reflected in the Michigan surveys. “There are considerable downside risks to sentiment, with two-thirds of consumers expecting an economic downturn during the next year,” said Joanne Hsu, director of the university’s Surveys of Consumers. “Notably, the debt ceiling debate looms ahead and could reverse the gains seen over the last several months; past debt ceiling crises in 2011 and 2013 prompted steep declines in consumer confidence.”

Year-ahead inflation expectations declined for the fourth consecutive month, falling to 3.9% in January from 4.4% in December. Long-run inflation expectations held at 2.9%, according to the report. It has been hovering at around 3% for the past year and a half. “Consumers continued to exhibit considerable uncertainty over both long- and short-term inflation expectations, indicating the tentative nature of any declines,” Hsu said in comments accompanying the report.” (CNN, January 27, 2023)

News from China

China’s Dominance in Battery Manufacturing: “With the world gearing up for the electric vehicle era, battery manufacturing has become a priority for many nations, including the United States. However, having entered the race for batteries early, China is far and away in the lead. Using the data and projections behind Bloomberg NEF’s lithium-ion supply chain rankings, this chart visualizes battery manufacturing capacity by country in 2022 and 2027, highlighting the extent of China’s battery dominance.

In 2022, China had more battery production capacity than the rest of the world combined.

|

Rank |

Country |

2022 Battery Cell |

% of Total |

|

#1 |

China |

893 |

77% |

|

#2 |

Poland |

73 |

6% |

|

#3 |

U.S. |

70 |

6% |

|

#4 |

Hungary |

38 |

3% |

|

#5 |

Germany |

31 |

3% |

|

#6 |

Sweden |

16 |

1% |

|

#7 |

South Korea |

15 |

1% |

|

#8 |

Japan |

12 |

1% |

|

#9 |

France |

6 |

1% |

|

#10 |

India |

3 |

0.2% |

|

|

Other |

7 |

1% |

|

|

Total |

1,163 |

100% |

With nearly 900 gigawatt-hours of manufacturing capacity or 77% of the global total, China is home to six of the world’s 10 biggest battery makers. Behind China’s battery dominance is its vertical integration across the rest of the EV supply chain, from mining the metals to producing the EVs. It’s also the largest EV market, accounting for 52% of global sales in 2021.

Poland ranks second with less than one-tenth of China’s capacity. In addition, it hosts LG Energy Solution’s Wroclaw Gigafactory, the largest of its kind in Europe and one of the largest in the world. Overall, European countries (including non-EU members) made up just 14% of global battery manufacturing capacity in 2022.

Although it lives in China’s shadow when it comes to batteries, the U.S. is also among the world’s lithium-ion powerhouses. As of 2022, it had eight major operational battery factories, concentrated in the Midwest and the South.

China’s Near-Monopoly Continues Through 2027. Global lithium-ion manufacturing capacity is projected to increase eightfold in the next five years. Here are the top 10 countries by projected battery production capacity in 2027:

|

Rank |

Country |

2027P Battery Cell |

% of Total |

|

#1 |

China |

6,197 |

69% |

|

#2 |

U.S. |

908 |

10% |

|

#3 |

Germany |

503 |

6% |

|

#4 |

Hungary |

194 |

2% |

|

#5 |

Sweden |

135 |

2% |

|

#6 |

Poland |

112 |

1% |

|

#7 |

Canada |

106 |

1% |

|

#8 |

Spain |

98 |

1% |

|

#9 |

France |

89 |

1% |

|

#10 |

Mexico |

80 |

1% |

|

|

Other |

523 |

6% |

|

|

Total |

8,945 |

100% |

China’s well-established advantage is set to continue through 2027, with 69% of the world’s battery manufacturing capacity. Meanwhile, the U.S. is projected to increase its capacity by more than 10-fold in the next five years. EV tax credits in the Inflation Reduction Act are likely to incentivize battery manufacturing by rewarding EVs made with domestic materials. Alongside Ford and General Motors, Asian companies including Toyota, SK Innovation, and LG Energy Solution have all announced investments in U.S. battery manufacturing in recent months.

Europe will host six of the projected top 10 countries for battery production in 2027. Europe’s current and future battery plants come from a mix of domestic and foreign firms, including Germany’s Volkswagen, China’s CATL, and South Korea’s SK Innovation.

Regardless of the growth in North America and Europe, China’s dominance is unmatched. Battery manufacturing is just one piece of the puzzle, albeit a major one. Most of the parts and metals that make up a battery – like battery-grade lithium, electrolytes, separators, cathodes, and anodes – are primarily made in China. Therefore, combating China’s dominance will be expensive. According to Bloomburg, the U.S. and Europe will have to invest $87 billion and $102 billion, respectively, to meet domestic battery demand with fully local supply chains by 2030. (Visual Capitalist, January 18, 2023)

Featured News:

The Electric Vehicle Market. “While Tesla’s stock is tanking, the electric vehicle industry appears to have achieved a key milestone ahead of schedule last year, and it could be poised to surpass even more expectations in the decade ahead. There were 7.8 million electric vehicles sold worldwide in 2022, a 68% increase from 2021, the Wall Street Journal reported, citing preliminary research from the automotive research groups LMC Automotive and EV-Volumes.com. The uptick helped electric vehicles achieve a roughly 10% global market share in the automotive industry for the first time, WSJ reported.

While 10% is only a modest share of the total market, the industry is growing faster than some had predicted. In 2021, for instance, the International Energy Agency projected that it would take until 2030 for the EV industry to reach between 7% and 12% of global auto sales. Europe and China have led the way, where electric vehicles already account for 11% and 19% of total car sales respectively, WSJ reported, citing data from LMC Automotive. “Last year, every fourth vehicle we sold in China was a plug-in, and this year it will be every third auto,” Ralf Brandstätter, the head of Volkswagen AG’s China business, told WSJ. “We haven’t reached the tipping point yet, but we’re expecting to get there between 2025 and 2030.”

More recent projections expect the EV market to make even more headway in the years ahead. CBInsights Auto and Mobility Trendsestimated that its global market share could reach 22% by 2030. BloombergNEF projected the industry’s market share could reach nearly 40% by the end of the decade. The Biden Administration, which included a $7,500 tax credit for purchasing an electric vehicle in last year’s Inflation Reduction Act, is aiming for half of US vehicle sales to be electric by 2030.

Despite these projections, there are signs of slowing EV demand, particularly in the US. Tesla, for instance, has cut prices on some of its top models by up to 20% as rising interest rates have deterred potential customers. “Softening demand for the global EV market” is also contributing to the price cuts, Simon Moores, CEO of Benchmark Mineral Intelligence, a price reporting agency for the EV supply chain, previously told Insider.

Business leaders have taken notice. In a KPMG survey released late last year of over 900 auto industry executives, the median expectation was for electric vehicles to reach a 37% market share in the US by 2030 — down from 62% in 2021. KPMG attributed the decline to production issues and affordability challenges that could slow EV adoption. (Business Insider, January 16, 2023)

Interesting News:

Biggest Sources of Electricity by U.S. State and Canadian Province. “On a national scale, the United States and Canada rely on a very different makeup of sources to generate their electricity. The U.S. primarily uses natural gas, coal, and nuclear power, while Canada relies on both hydro and nuclear. That said, when zooming in on the province or state level, individual primary electricity sources can differ greatly.

Here’s a look at the electricity generation in the states and provinces of these two countries using data from the Nuclear Energy Institute (2021) and the Canada Energy Regulator (2019).

Natural Gas:

Natural gas is widely used for electricity generation in the United States. Known as a “cleaner” fossil fuel, its abundance, coupled with an established national distribution network and relatively low cost, makes it the leading electricity source in the country. In 2021, 38% of the 4120 terawatt-hours (TWh) of electricity generated in the U.S. came from natural gas. Not surprisingly, more than 40% of American states have natural gas as their biggest electricity source.

Here are some states that have the largest shares of natural gas-sourced electricity.

|

State/Province |

% of Electricity from Natural Gas |

|

Rhode Island |

90.9 |

|

Delaware |

85.8 |

|

Massachusetts |

76.9 |

|

Florida |

73.9 |

|

Mississippi |

72.1 |

In Canada, natural gas is only the third-biggest electricity source (behind hydro and nuclear), accounting for 11% of the 632 TWh of electricity produced in 2019. Alberta is the only province with natural gas as its main source of electricity.

Nuclear:

Nuclear power is a carbon-free energy source that makes up a considerable share of the energy generated in both the U.S. and Canada. 19% of America’s and 15% of Canada’s electricity comes from nuclear power. While the percentages are close to one another, it’s good to note that the United States generates 6 to 7 times more electricity than Canada each year, yielding a lot more nuclear power than Canada in terms of gigawatt hours (GWh) per year. Many states and provinces with nuclear as their main source of electricity are concentrated in the eastern half of the two countries.

In the U.S., Illinois, Pennsylvania, and South Carolina are top producers in terms of GWh/year. Illinois and South Carolina also have nuclear as their primary electricity source, whereas Pennsylvania’s electricity production from natural gas exceeds that from nuclear.

The vast majority of Canada’s nuclear reactors (18 of 19) are in Ontario, with the 19th in New Brunswick. Both of these provinces rely on nuclear as their biggest source of electricity.

Renewables: Hydro, Wind and Solar

Out of the different types of renewable electricity sources, hydro is the most prevalent in North America. For example, 60% of Canada’s and 6% of the U.S.’s electricity comes from hydropower.

Here are the states and provinces that have hydro as their biggest source of electricity.

|

State/Province |

% of Electricity from Hydro |

|

Manitoba |

97 |

|

Newfoundland and Labrador |

95 |

|

Quebec |

94 |

|

British Columbia |

87 |

|

Yukon |

80 |

|

Washington |

65 |

|

Idaho |

51 |

|

Vermont |

50 |

|

Northwest Territories |

47 |

|

Oregon |

46 |

Wind and solar power collectively comprise a small percentage of total electricity generated in both countries. While no state or province relies on solar as its biggest source of electricity, Iowa, Kansas, Oklahoma, and South Dakota rely primarily on wind for their electricity, along with Canada’s Prince Edward Island (PEI).

Coal and Oil:

Coal and oil are emission-heavy electricity sources still prevalent in North America.

Currently, 22% of America’s and 7% of Canada’s electricity comes from coal, with places such as Kentucky, Missouri, West Virginia, Saskatchewan, and Nova Scotia still relying on coal as their biggest sources of electricity.

Certain regions also use petroleum to generate their electricity. Although its use for this purpose is declining, it is still the biggest source of electricity in both Hawaii and Nunavut.

Over the next few years, it will be interesting to observe the use of these fossil fuels for electricity generation in the U.S. and Canada. Despite the differences in climate commitments between the two countries, lowering coal and oil-related emissions may be a critical part of hitting decarbonization targets in a timely manner. (Visual Capitalist, January 12, 2023)

Final Reflections

Now that the seasonal celebrations are behind us and the new year’s challenges and opportunities are beginning to form and take shape, this is a good time to remember the resolutions earnestly made in the glow of warm optimism amidst the embers of December’s last days, and stock this year’s plans with activities that set the fullness of the harvest now being planted to receive.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

Coaching and Consulting

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...