Retirement Planning

Our unique and proprietary systems and services will take you from where you are today, to your Financial Independence Day, so you can begin to live the life you really want. Select any of the headings below to learn more about them now.

Proprietary Services for Retirement Planning

The 4x4 Financial Independence Plan ℠

The Smart Financial Independence Blueprint ℠

Products for Retirement Planning

Annuities

Delaware Statutory Trusts

Coaching and Consulting

Insurance-Disability

Insurance-Life

Mortgages-Forward

Mortgages-Reverse

Notes

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Retirement Savings Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Securities (Provided Via Lifetime Financial)

Helpful Guides

FREE GUIDE

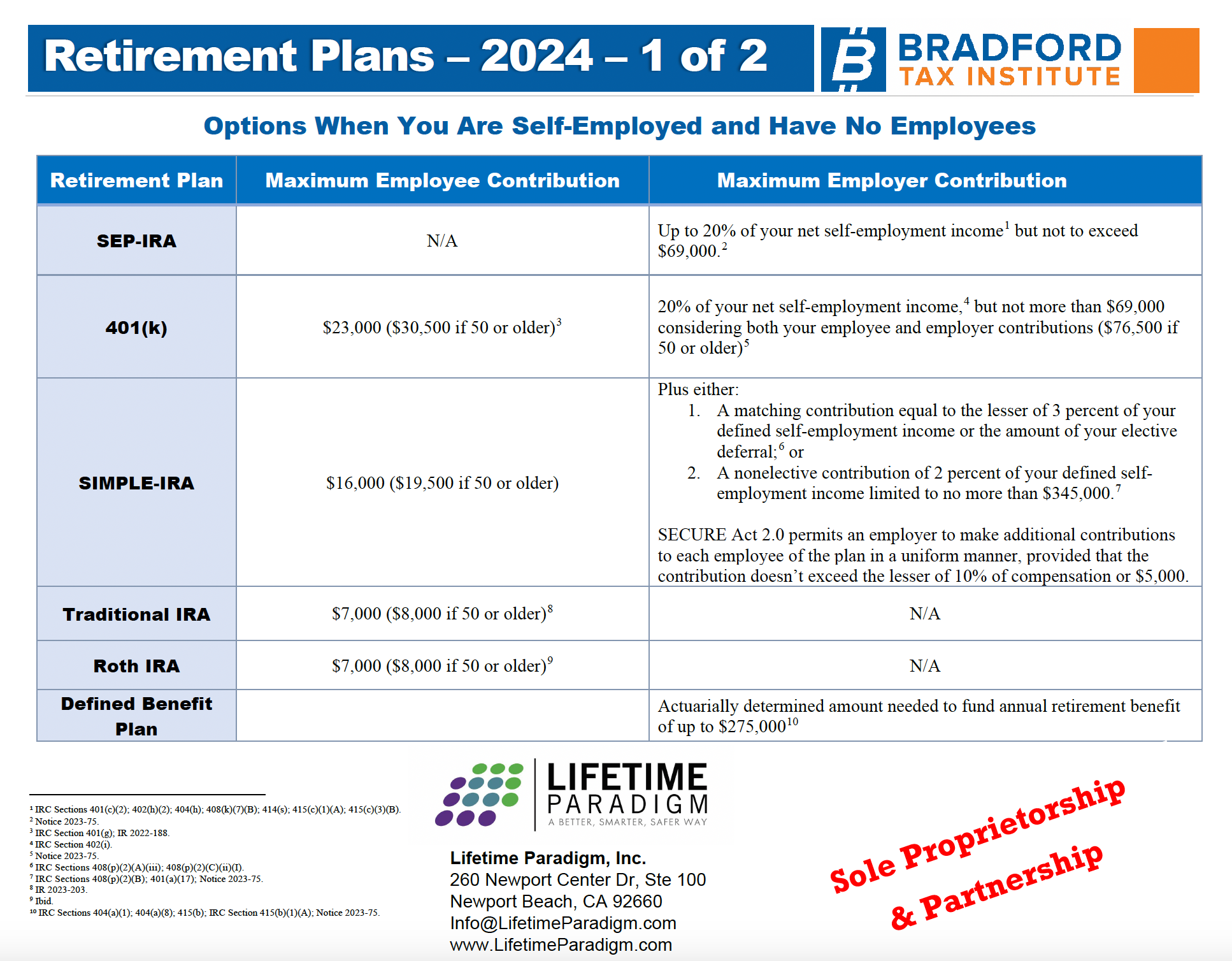

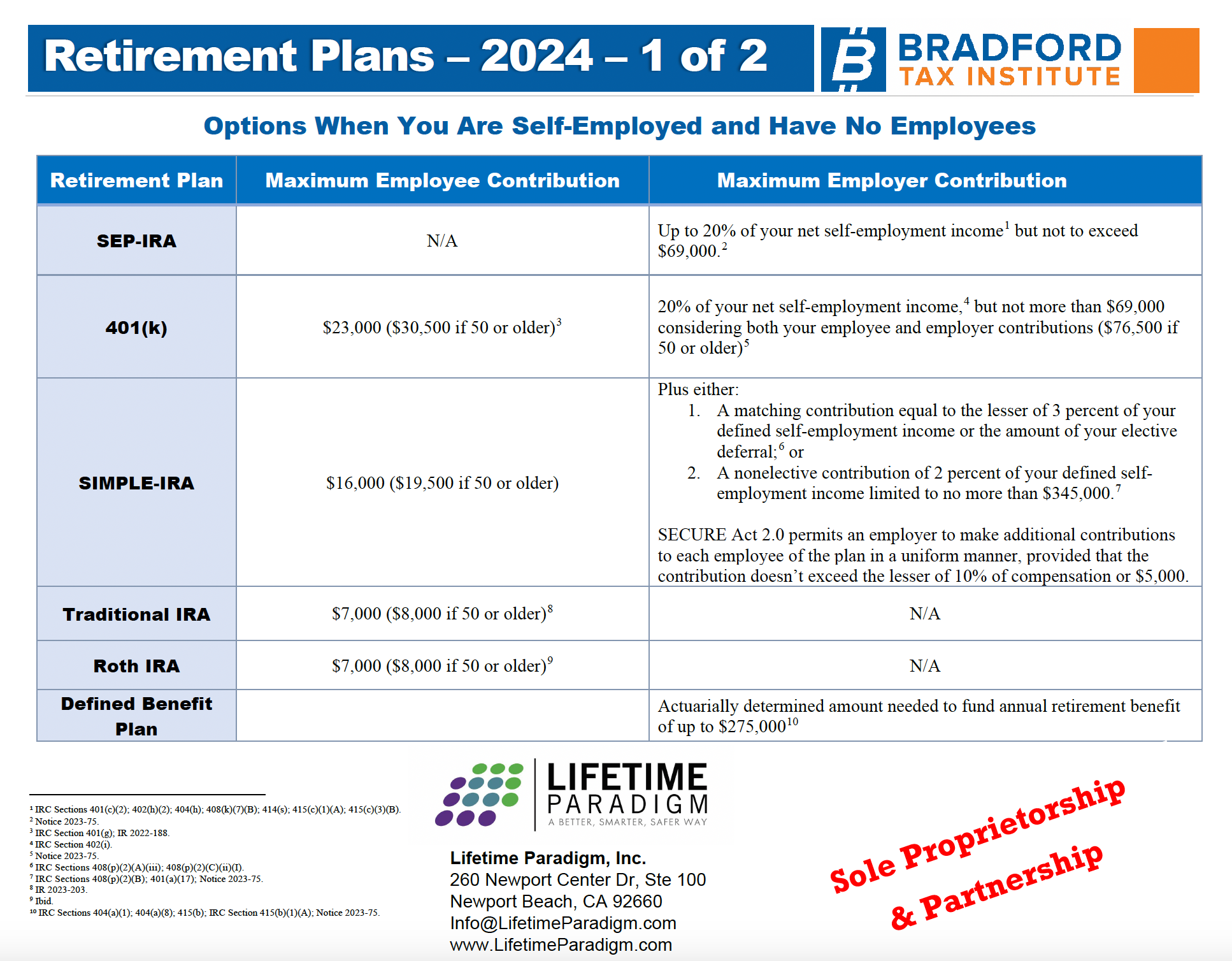

2024 Retirement Plans Reference Guide

Gain instant access to this invaluable reference guide by downloading and saving the PDF directly to your computer or smartphone.

In just two concise pages, you’ll discover essential information regarding contributions and elective deferrals for a variety of one-person retirement plans tailored for both corporate owners and proprietorships, including:

- SEP-IRA

- 401(k)

- SIMPLE IRA

- Traditional IRA

- Roth IRA

- Defined Benefit Plan

Download now to streamline your retirement planning process and make informed decisions about your financial future.

“Quick Guide to Retirement Plans for Small Business Owners”

Learn about the major features of each kind of retirement plan, including SIMPLE, SEP, 401(k), defined-benefit, and profit-sharing plans.

“Choosing a Retirement Solution for Your Small Business”

This publication is a joint project of the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) and the Internal Revenue Service.

BLOG

Browse All Retirement Planning Articles, Videos, Podcasts

5 Tax Gotchas In Retirement

Tax PlanningIf you are wealthy and reaching your distribution phase, your high-balance retirement accounts can create some burdensome tax situations, particularly when it comes to legacy planning. Here are five potential pitfalls you should be aware of. Most people...

Rules for Divorced-Spouse Benefits

Retirement Planning: Social SecurityRules for Divorced-Spouse Benefits In order to qualify for a divorced-spouse benefit a person must: Be finally divorced from the worker on whose record benefits are being claimed Have been married for over 10 years Be currently...

Inflation Update February 2023

Retirement Planning: SecuritiesJoseph Maas, Synergy Asset ManagementCPI Components Before diving deeper into what CPI means beyond an increase (or decrease) in prices, it’s important to understand exactly what CPI tracks. The three largest categories, which account...

A Securities Market Update for You – January 2023

Retirement Planning: SecuritiesJoseph Maas, Synergy Asset ManagementMarket highlights Inflation appears to be diminishing, but the FOMC is expected to raise interest rates a quarter-point at this month's meeting. Because lending rates have increased, housing sales...

2023 Retirement Calendar Checklist

Financial Guides Have you ever stopped to think about all of the paperwork and deadlines involved in retirement? Most of us assume we will be traveling and enjoying our grandkids, not recognizing the work that needs to be done beforehand. So, I want to provide you...

Winter 2023 Key Financial Deadlines

Financial Guides Do you know what days the market closes for 2023? Or when different tax forms are due? Or when the various enrollment periods for Medicare and health insurance begin and end? Each year brings with it a host of new dates, deadlines, and observances to...

2023 Key Financial Data Guide

Financial Guides Happy New Year to you and your family! I hope you and your family had a safe and healthy holiday season. I hope 2023 brings good fortune and health to you all. Today, I'm providing you with a very handy reference guide to help with your finances for...

Last-Minute Year-End Tax Deductions for Existing Vehicles

Tax PlanningIt's time to examine your existing business and personal (yes, personal) cars, SUVs, trucks, and vans for some profitable year-end business tax deductions.In this article, first we will look at your prior and existing business vehicles that you or your...

A Handy Checklist for Year-End Planning

Retirement PlanningThe holidays are a busy time of year. Shopping, family events, company holiday parties and more may dot your calendar. But we strongly suggest that you carve out some time for year-end financial planning so that you will be better positioned as the...

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Retirement Planning Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!