Overview of Services & Products

Overview of

Services & Products

We focus on helping successful business owners, real estate investors, and late-stage pre-retirees with their retirement plans, asset protection, estate planning, and tax planning. However, regardless of who you are or what you do, we can help. We can make a difference in your life and we encourage you to explore this opportunity.

Our unique and proprietary financial planning strategies will take you from wherever you are today, to your “Financial Independence” tomorrow. Select any of the headings below to learn more about our services and begin to live the life you really want. Start here. Start today. Start now!

Services

We offer unique and proprietary services tailored to assist our clients in comprehensive retirement planning, asset protection, estate planning, and tax planning.

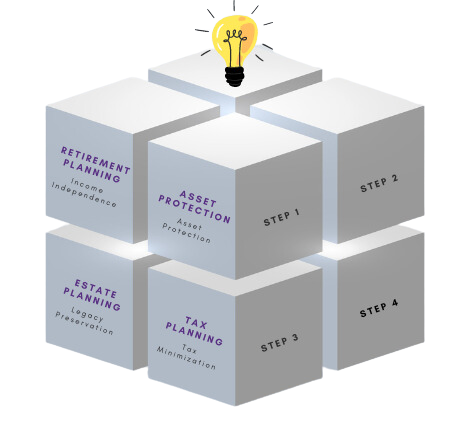

The 4×4 Financial Independence Plan ℠

— 4 Essential Elements x 4 Sequential Steps

Our unique and proprietary master plan, real estate-integrated and self-directed financial planning, consulting and coaching system.

Retirement Planning

The Smart Financial Independence Blueprint ℠

Plan for your retirement.

Asset Protection

The Smart Asset Protection Planner ℠

Protect all your assets and income.

Estate Planning

The Smart Legacy Plan Organizer ℠

Improve and organize your current estate plan or create a new one.

Tax Planning

The Smart Tax Minimizer ℠ (For Consumer and Home-Based Businesses)

Create a reduction plan and pay less in taxes.

Specialty Services

We offer unique and proprietary specialty services for our clients. This includes comprehensive tax planning for business owners, as well as coaching & consulting services for other professionals, business owners, real estate investors, and consumers.

The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator℠

Maximize the Social Security benefits you receive, and implement a way to pay for the costs of your healthcare during retirement.

The Smart Mortgage Minimizer℠

Monitor your mortgage rate, save money on the interest you pay, and build wealth with your home.

The Smart Planning System for Business Owners℠

Minimize the taxes your business pays.

Coaching and Consulting

Financial Products & Solutions

Annuities

Charitable Trusts & Annuities

Coaching & Consulting

Cost Segregation

Delaware Statutory Trusts

In-Service Alternative Rollovers

Insurance-Disability

Insurance-Life

Insurance-Long Term Care

Micro-Captive Insurance Companies

Mortgages-Forward

Mortgages-Reverse

No-Load Annuities

Notes

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Research & Development Tax Credits (R&D, etc.)

Retirement Plans - Pension & Profit Sharing Plans - The Super(k) ℠

Retirement Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Retirement Savings Plan Consulting

Securities (Provided via Lifetime Financial)

Self-Directed Brokerage Accounts

Consulting, Coaching,

& Comprehensive Oversight

We offer, consulting, coaching, and comprehensive financial oversight. Learn more about how we can help. Contact us to schedule an appointment with an Independent Fiduciary Advisor.

Want to Discuss How We Can Help?

Contact us to schedule a complimentary initial consultation with one of our advisors. It’s your opportunity to learn more about our unique services and ask questions about what we do and how we can help.