Tax Planning

Tax-Smart Strategies to Pay for College

A special report by the Bradford Tax Institute

How Are 529 College Savings Account Withdrawals Taxed?

Section 529 college savings plans have been around long enough that withdrawals are now commonplace.

You may be ready to take one.

The big advantage of 529 plans is that qualified withdrawals are always federal-income-tax free and usually state-income-tax-free too.

What you may not know is that not all 529 withdrawals are tax-free qualified withdrawals, even in years when you have heavy college costs.

This article explains what we think are the six most important things to know about 529 withdrawals. Here goes.

Point No. 1: You Usually Have Several Payment Options

Say you are the 529 account owner or plan participant. Plans commonly use both terms to describe the person who established and controls the account. In this article, we will use account owner.

As the account owner, you can generally have a withdrawal check cut in your own name or have an electronic deposit made into your own account.

Alternatively, you can have a withdrawal issued in the name of the account beneficiary (the college student for whom you set up the 529 account, usually a child or grandchild) or issued directly to the educational institution for the benefit of the account beneficiary.

You choose your payment option by submitting a withdrawal request to the 529 plan.

Point No. 2: Watch Out for Withdrawals from 529 Accounts Funded with Custodial Account Money

Say you funded the 529 account with money that came from a custodial account that was set up for the account beneficiary—your child or grandchild—under your state’s Uniform Gift to Minors Act (UGMA) or Uniform Transfer to Minors Act (UTMA).

In this situation, you must use any money taken from the custodial account for the benefit of the child or grandchild.

You can’t take a 529 account withdrawal for yourself if the 529 account was funded with money from a child’s or grandchild’s custodial account. Because the money in the 529 account came from the custodial account, the 529 account money legally belongs to your child or grandchild, not you.

On the other hand, if you funded the 529 account with your own money, the money in the account is fair game. You can take withdrawals and do whatever you want with them subject to the potential federal income tax implications explained later.

Point No. 3: The IRS Knows about Withdrawals

For any year that a 529 withdrawal is taken, the plan must issue a Form 1099-Q, Payments From Qualified Education Programs (Under Sections 529 and 530), by February 1 of the following year. If the withdrawal goes to the 529 account beneficiary (your child or grandchild), the 1099- Q goes to him or her. If the withdrawal goes to you as the account owner, the 1099-Q goes to you. Either way, the IRS gets a copy, so the IRS knows what happened.

Line 1 of Form 1099-Q shows the total amount withdrawn from the 529 account during the year. Assuming the account was worth more than the total contributions (i.e., the account made money), each withdrawal includes some earnings and some tax-free basis from contributions.

Withdrawn earnings are shown on line 2 of the 1099-Q.

As you will soon see, withdrawn earnings may or may not be tax-free, and they may or may not be subject to a 10 percent penalty tax.

Withdrawn basis amounts are shown on line 3 of Form 1099-Q, and they are always tax-free and penalty-free.

Point No. 4: Withdrawals May Be Taxable Even in Years When Substantial College Costs Are Incurred

When the Form 1099-Q shows withdrawn earnings, the IRS becomes interested in the 1099-Q recipient’s Form 1040 because some or all of the earnings might be taxable. Here’s the deal on that.

Withdrawn earnings are always federal-income-tax-free and penalty-free when total withdrawals for the year do not exceed what the IRS calls the account beneficiary’s adjusted qualified education expenses, or AQEE, for the year. (1)

AQEE equals the sum of the 529 account beneficiary’s (2)

- college tuition and related fees;

- room and board (but only if the beneficiary carries at least half of a full-time course load);

- required books, supplies, and equipment;

- computer hardware and peripherals, software, and internet access costs; and

- expenses for special needs services.

Next, you must subtract any federal-income-tax-free educational assistance to calculate the account beneficiary’s AQEE.(3)

According to the IRS, tax-free educational assistance includes costs covered by (4):

- tax-free Pell grants;

- tax-free scholarships, fellowships, and tuition discounts;

- tax-free veterans’ educational assistance;

- an employer’s tax-free educational assistance program under Internal Revenue Code Section 127; and

- any other tax-free educational assistance (other than assistance received in the form of a gift or an inheritance).

In addition, tax-free educational assistance includes any costs used to claim the American Opportunity tax credit or the Lifetime Learning tax credit.

Key point. You can also include in AQEE(5)

- up to $10,000 annually for the account beneficiary’s K-12 tuition costs;

- the account beneficiary’s fees, books, supplies, and equipment required to participate in a registered apprenticeship program; and

- interest and principal payments on qualified student loan debt owed by the account beneficiary or a sibling of the account beneficiary—subject to a $ 10,000-lifetime limit.

Bottom line. When withdrawals during the year exceed AQEE for the year, all or part of the withdrawn earnings will he taxable. When withdrawals don’t exceed AQEE, all the withdrawn earnings are federal-income-tax-free.

Example 1. Withdrawal is partly taxable.

Your daughter’s 2021 college expenses total $45,000.

She received $30,000 in tax-free scholarships and tuition discounts, so her AQEE for the year is only $15,000 ($45,000 – $30,000).

Your daughter is the beneficiary of a 529 college savings plan account that you set up years ago. In 2021, you arrange for a $45,000 withdrawal, which consists of $9,000 of earnings and $36,000 of basis. You use the money:

- to cover your daughter’s $15,000 of AQEE;

- plus transportation expenses and other incidentals;

- plus a spring break vacation for her:

- plus a car for her because you’re so happy about all the free money she received.

The $15,000 of AQEE is only one-third of the withdrawn amount. Therefore, only one-third of the $9,000 in withdrawn earnings, or $3,000, is federal-income-tax-free. The remaining $6,000 of earnings ($9,000 – $3,000) is taxable and should be reported as miscellaneous income on your daughter’s 2021 Form 1040.

The entire $36,000 of withdrawn basis is tax-free.

Depending on your daughter’s overall tax situation and whether the dreaded kiddie tax applies to her, the federal income tax hit on the $6,000 may or may not be significant. (The $6,000 counts as unearned income for kiddie tax purposes.)

Point No. 5: When You Keep a Withdrawal, There Are Tax Consequences

Assuming the 529 account was funded with your own money (as opposed to money from a custodial account), you are free to change the 529 account beneficiary to yourself and then take federal-income-tax-free withdrawals to cover your own AQEE if you decide to go back to schoo1.(6)

But if you take a withdrawal that you use for purposes other than education, report the taxable portion of any related account earnings as miscellaneous income on your Form 1040. Taxable amounts may also get hit with a 10 percent penalty tax to boot (see below).

Finally, if you liquidate a loser 529 account (worth less than the total amount of contributions), there are no federal income tax consequences.(7) (The government stopped participating in your losses for tax years 2018-2025.)

Example 2. Income tax hit when you keep a withdrawal.

Assume the same basic facts as in Example 1, except this time your daughter’s tax-free scholarships and tuition discounts cover all $45,000 of her 2021 college expenses. Therefore, her AQEE for the year is zero.

Because one year of college was paid for with free money, you as the 529 account owner decide to take $45,000 out of the account to buy a new pickup truck for yourself. Fair enough! Who are we to judge?

Since your daughter (the account beneficiary) has no AQEE for the year, the entire $9,000 of earnings is taxable and apparently should be reported as miscellaneous income on your 2021 Form 1040.

Caveat. In this situation, it’s not entirely clear that you, as opposed to your daughter, are the one who must report the $9,000 as taxable income. But somebody has to do it, and it seems only fair that it should be you, since you spent the money on yourself.

Presumably, the IRS is not going to object as long as somebody reports the $9,000.

Point No. 6: Withdrawals Not Used for Education Can Also Be Hit with a 10 Percent Penalty Tax

As we explained earlier, some or all of the earnings included in a 529 withdrawal taken during the year must be included in gross income when the withdrawals exceed the account beneficiary’s AQEE for the year. But there’s more.

According to the general rule, the taxable amount of earnings is also hit with a 10 percent penalty tax.(8)

But the 10 percent penalty tax doesn’t apply to earnings that are taxable only because the account beneficiary’s AQEE was reduced by (9):

- tax-free Pell grants;

- tax-free scholarships, fellowships, and tuition discounts;

- tax-free veterans’ educational assistance;

- tax-free employer-provided educational assistance;

- any other tax-free educational assistance: or

- costs used to claim the American Opportunity or Lifetime Learning tax credit.

In addition, the 10 percent penalty tax doesn’t apply to earnings withdrawn when the account beneficiary attends one of the U.S. military academies (such as West Point, Annapolis, or the Air Force Academy). (10)

Finally, the 10 percent penalty tax doesn’t apply to earnings withdrawn after the account beneficiary dies or becomes disabled. (11)

Calculate the 10 percent penalty tax, if any, on IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, and include the penalty tax on the appropriate line of Form 1040. (12)

Example 3. Penalty tax when you keep a withdrawal.

Assume the same facts as in Example 2. You don’t owe the 10 percent penalty tax on the $9,000 of earnings because those earnings were only taxable due to your daughter (the account beneficiary) receiving $45,000 in tax-free scholarships and tuition discounts.

Variation. Now assume that your daughter joins a weird cult and decides not to attend college. You are totally disgusted with her, so you simply liquidate her 529 account and use the money to put in an expensive swimming pool and cabana to make yourself feel better. Your spouse approves.

Assume the liquidating withdrawal includes $27,000 of earnings. You must report the $27,000 as miscellaneous income on your Form 1040. In addition, you’ll owe the 10 percent penalty tax on the $27,000 ($2,700). Rats! But at least you got your money back. It could have been worse.

Takeaways

Don’t go to sleep on your Section 529 plan.

The last thing you ever want to see on your tax return is a surprise. It’s hard enough when you know what’s coming. But surprise taxes and penalties are downright unpleasant.

The first thing to remember is that Section 529 withdrawals are not as simple as you would like them to be. You need to pay attention to your basis, your earnings, and what you (or your student) receive in funding from other sources.

1 IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

2 IRC Section 529(e)(3)(A).

3 Ibid.

4 IRC Section 529(c)(3)(B)(iv); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb.

15, 2022.

5 IRC Sections 529(c)(7); 529(c)(8); 529(c)(9); 529(e)(3)(A).

6 IRC Section 529(c)(3)(C)(ii); Prop. Reg. Section 1.529-3(c)(1).

7 Before the Tax Cuts and Jobs Act (TCJA), you could throw a 529 account loss into the miscellaneous itemized deduction pot and claim a write-off to the extent your total miscellaneous itemized deductions exceeded 2 percent of your adjusted gross income. Unfortunately, for 2018- 2025, the TCJA suspended this type of itemized deduction.

8 IRC Section 529(c)(6).

9 See IRC Section 529(c)(6), via TRC Section 530(d)(4); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

10 See IRC Section 529(c)(6), via IRC Section 530(d)(4); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

11 See IRC Section 529(c)(6), via IRC Section 530(d)(4); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

12 IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax- Favored Accounts (2021).

Child’s College: Use a 529 Plan or Tap Your Roth IRA?

Funding your retirement and paying your child’s college education are two of the biggest financial challenges you’ll face in your life.

Conventional wisdom says that it’s best to (1) fund your retirement before your child’s college, and (2) use your retirement savings for your retirement and not your child’s college expenses.

The problem with conventional wisdom is that it’s like a general tax rule. There are exceptions. And you also face some complications, depending on how you and your child plan to pay for college.

One point of interest that you will like is that the tax code places no limits on what you can annually contribute to a Section 529 qualified tax-exempt tuition plan.’ This plan has to he one of the plans you consider as a means for paying your child’s college education. 1STOP

In this article, we are going to look at two possible sources for paying for your child’s college education:

- A Section 529 plan, and/or

- Your Roth IRA

Using a 529 Plan

IRC Section 529 provides tax incentives for qualified tuition programs, also known as 529 plans. The federal (and often state, too) tax advantaged 529 plan allows you to set up college accounts for your children before they reach college age.

Income Taxes

The 529 plan works like this for income tax purposes:

- No tax deduction for the money you put into the plan

- Tax-free growth inside the plan

- Tax-free distribution when the money or prepaid tuition is used for college

Gift Taxes

Contributions to 529 plans are taxable gifts eligible for the $16,000 per donee annual gift tax exclusion (2022 amount), which doubles to $32,000 if your spouse consents to gift splitting. (2)

The tax code contains a special option for 529 plans that allows you to spread the contribution over a five-year period so as to take advantage of the $14,000 annual exclusion.(3) For example, you can contribute $70.000 to the 529 plan and use five years of the $14,000 exclusion to avoid any gift taxes. You and your spouse with combined consent could contribute $140,000 and use the five-year rule to avoid gift taxes.

You can contribute more than the gift-tax exclusions and simply use some of your combined lifetime $5,490,000 estate tax exclusion ($10,980,000 for you and your spouse if properly structured). For example, you contribute $214,000 to a 529 plan, claim $14,000 for the gift-tax exclusion, and apply $200,000 to your estate tax exclusion, reducing that to $5,290,000.

Two Basic Types of 529 Plans

There are two types of 529 plans:

- Prepaid tuition plan. Under this plan, you pay tuition at today’s tuition rates (possibly discounted some) and the plan assumes the financial risk. For example. your child is three years old and you pay for four years of college at today’s tuition. Regardless of what the tuition is 15 years from now, your child’s tuition is paid. You receive no tax deductions for the money you put into the prepaid tuition plan, but you also don’t pay any taxes on the financial benefit you receive when your child goes to college at the discounted tuition rates. (Because you live in the United States and the United States strives for an inflationary economy, you can pretty much count on today’s tuition being substantially less than the tuition 15 years from now.)

- Savings plan. In this plan, you don’t get a tax deduction for the money you put into the plan but the money grows tax free inside the plan, and there’s no tax when the money from the plan is used for college. For example, you invest $200,000 in the plan today when your child is three years old. When your child is age 18, the savings plan has grown tax-free to $420,000. You can now take that money from the savings plan tax-free if you use it for your child’s college.

With the prepaid plan, you’re betting that the increase in tuition will outpace what your investment in the 529 savings plan would produce. Also, there’s no effort needed to manage the investments after you invest. Prepaid plans exist with most 529 state plans and also with the Private College 529 Plan that has 300 private colleges as participants.(4)

Savings plans do not promise, as prepaid plans do, that a certain amount will fund a certain number of credit hours on a certain date. Instead, you’ve got to determine how much to contribute. When guesstimating your annual contribution, a good rule of thumb is that tuition increases at twice the rate of inflation.(5)

Expenses that Qualify

The 529 plan distributions are tax-free if used for qualified higher education expenses, which include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Room and board are included if your child attends at least half

time. So are computer-related expenses if primarily incurred during the time your child is enrolled in school.(6)

Using a Roth IRA

There are two types of IRAs traditional and Roth IRAs—which have many similar attributes but one big difference.

- Traditional IRA contributions are deductible, but the funds are taxable when withdrawn.

- Roth IRA contributions are not deductible, but qualifying distributions are tax-free.

This article focuses on Roth IRAs because of their tax-free withdrawal aspect.

Unlike 529 plans, there are dollar and adjusted gross income (AGI) based limits on your annual Roth IRA contributions.

For 2022, you can contribute up to $6.000 ($7.000 if you are age 50 or older). This limit phases out as your AGI, with modifications, exceeds certain thresholds. For 2022, the thresholds are $204,000 to $214,000 for married couples filing jointly, and $129,000 to $144,000 for single filers.(7)

Qualified distributions from the Roth IRA are tax-free and not subject to the 10 percent early withdrawal penalty when received both(8)

- after the five-year period beginning with the first year you made a contribution to the Roth IRA (e.g., the five-year period ends in 2022 if your first contribution was made in 2018): and

- after you turn age 591/2, die, or become disabled.

If you take money out of your Roth IRA in violation of the above rules and don’t meet one of the exceptions, such as that for education, you(9)

- escape taxes and penalties on monies you put into the Roth IRA but

- trigger both taxes and penalties on the earnings that you take out.

Roth IRA for Education

The money you withdraw from an IRA is not subject to the 10 percent penalty tax if used to pay your qualified education expenses, or your spouse’s, child’s, or grandchild’s qualified education expenses.(10)

Note. Withdrawals for education that violate the five-year rule incur income tax but not the 10 percent penalty tax. Make sure to avoid both the 10 percent penalty tax and the income tax by complying with the five-year rule.

IRA qualified higher education expenses include tuition, fees, books, supplies, equipment required for enrollment or attendance, and room and board if your child is attending at least halftime at an eligible educational institution. An eligible educational institution basically includes all accredited postsecondary institutions.(11)

With Education Withdrawals, How Badly Do You Damage Your Roth IRA?

The big benefit of your Roth retirement is that it grows tax-free and escapes taxes when you take the money out after age 59 1/2. If you have money you can use for education inside the Roth. you likely have a good base for bigger and better earnings. If you take some of that money out, you cut off some of the base that would have produced bigger and better tax-free growth.

Example. You have $200,000 in your Roth IRA. Let’s say the Roth is producing an 8 percent return. If you take out $100,000 for education, you cut deeply into your retirement:

- With the extraction of $100,000 for education, the base dollar amount for compounding drops to $100.000 at 8 percent per year, giving you $466.096 at retirement.

- With no extraction for education, the base remains at $200,000 and grows at 8 percent per year, giving you $932,191 for retirement.

Financial Aid

One final thought. Money in a Roth IRA does not count for college financial aid purposes, although withdrawals do count.

Money in a 529 plan, whether you or your child owns the account, does count when figuring the expected family contribution. This means that the 529 plan reduces the amount of financial aid. if any, available to your child.(12)

Takeaways

Ideally, you as the small business owner will make your business generate enough income to fully fund your retirement and also pay for your child’s education.

The tax code grants similar breaks for both the Roth IRA and the 529 plan in that you:

- get no tax deductions for the monies you put into the plans and accounts,

- achieve tax-free investment growth inside the accounts, and

- withdraw the money or tuition from the plans and accounts tax-free.

With the 529 plan, the tax-free withdrawal requires use of the plan for education.

With the Roth IRA, the tax-free withdrawal requires either use for education or taking the money after age 59 1/2 and not violating the five-year rule.

If you have to choose between funding your retirement or a 529 plan, pick retirement. You don’t want to stunt the growth of your retirement fund.

1 JRC Section 529.

2 IRC Sections 529(c)(2)(A); 251 3(a).

3 IRC Section 529(c)(2)(B). If done, gift tax returns should be filed.

4 For further information, see www.privateco11ege529.com.

5 See http://www.finaid.org/savings/tuition-infiation.phtml.

6 IRC Sections 529(c)(3)(13); 529(e)(3).

7 News Release JR 2021-216; Notice 2021-61.

8 IRC Section 408A(d)(2).

9 IRC Section 408A(d)(4).

10 IRC Section 72(t)(2)(E).

11 IRC Section 72(t)(7)(A); Notice 97-60.

12 For more on federal student aid, go to https://studentaid.ed.gov/sa/fafsa/next-steps/howcalculated

Point No. 5: When You Keep a Withdrawal, There Are Tax Consequences

Assuming the 529 account was funded with your own money (as opposed to money from a custodial account), you are free to change the 529 account beneficiary to yourself and then take federal-income-tax-free withdrawals to cover your own AQEE if you decide to go back to schoo1.(6)

But if you take a withdrawal that you use for purposes other than education, report the taxable portion of any related account earnings as miscellaneous income on your Form 1040. Taxable amounts may also get hit with a 10 percent penalty tax to boot (see below).

Finally, if you liquidate a loser 529 account (worth less than the total amount of contributions), there are no federal income tax consequences.(7) (The government stopped participating in your losses for tax years 2018-2025.)

Takeaways

Don’t go to sleep on your Section 529 plan.

The last thing you ever want to see on your tax return is a surprise. It’s hard enough when you know what’s coming. But surprise taxes and penalties are downright unpleasant.

The first thing to remember is that Section 529 withdrawals are not as simple as you would like them to be. You need to pay attention to your basis, your earnings, and what you (or your student) receive in funding from other sources.

1 IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

2 IRC Section 529(e)(3)(A).

3 Ibid.

4 IRC Section 529(c)(3)(B)(iv); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb.

15, 2022.

5 IRC Sections 529(c)(7); 529(c)(8); 529(c)(9); 529(e)(3)(A).

6 IRC Section 529(c)(3)(C)(ii); Prop. Reg. Section 1.529-3(c)(1).

7 Before the Tax Cuts and Jobs Act (TCJA), you could throw a 529 account loss into the miscellaneous itemized deduction pot and claim a write-off to the extent your total miscellaneous itemized deductions exceeded 2 percent of your adjusted gross income. Unfortunately, for 2018- 2025, the TCJA suspended this type of itemized deduction.

8 IRC Section 529(c)(6).

9 See IRC Section 529(c)(6), via TRC Section 530(d)(4); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

10 See IRC Section 529(c)(6), via IRC Section 530(d)(4); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

11 See IRC Section 529(c)(6), via IRC Section 530(d)(4); IRS Pub. 970, Tax Benefits for Education (2021), dated Feb. 15, 2022.

12 IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax- Favored Accounts (2021).

Tax-Smart College Savings Strategies for Parents

College costs lots of money these days, so saving for your college-bound child is a big deal. Saving in a tax-smart fashion can really help.

In this article, we explain the most helpful federal income tax breaks that are potentially available to college savers. Here goes.

College Is Expensive!

Data for the 2019-2020 academic year indicates that the average cost of tuition, fees, room, and board was $32,500. Here are some average sticker-price numbers:

- $12,720 for a public two-year institution at the in-state rate ($3,730 for tuition and fees plus $8,990 for room and board

- $21,950 for a public four-year institution at the in-state rate ($10,440 for tuition and fees plus $11,510 for room and board)

- $38,330 for a public four-year institution at the out-of-state rate ($26,820 for tuition and fees plus $1 1.5 10 for room and board)

- $49.879 for a private non-profit four-year institution ($36,880 for tuition and fees plus $12,990 for room and board)

Consequently, the average total price for a four-year degree is approximately $122,000.

- $87,800 for a public four-year institution at the in-state rate

- $153,320 for a public four-year institution at the out-of-state rate

- $199,500 for a private non-profit four-year institution

These numbers assume that your child will finish his or her undergraduate education in four years, but only 39 percent of students actually do that. Nearly 60 percent take six years. Yikes!

That said, most students receive at least some financial aid to offset the sticker price of their degrees.

Key point. Tax-smart college savings strategies can make college costs more manageable. So, let’s talk about those.

Contribute to a Coverdell Education Savings Account

You can set up a Coverdell Education Savings Account (CESA) to pay qualified education expenses for the account beneficiary (your college-bound child).(1)

You can contribute up to $2,000 per year to the child’s CESA. If you have several children, you can set up a CESA for each of them.

Contributions are non-deductible, but earnings are allowed to accumulate free of any federal income tax. You can then take tax-free withdrawals to pay for the account beneficiary’s post-secondary tuition, fees, books, supplies, and room and board.(2)

Maybe not for you. Your right to contribute is phased out between modified adjusted gross income (MAGI) of $95,000 and $110,000 if you are unmarried, or between $190,000 and $220,000 if you are a married joint-filer.(3)

If your MAGI is too high to allow a contribution, another person (such as a grandparent) can contribute to your child’s CESA.

Contribution deadline. You have until April 15 of the following year (adjusted for weekends and holidays) to make your CESA contribution(s) for the current tax year.

Contribute to a Section 529 College Savings Plan

A Section 529 college savings plan account offers valuable tax benefits and is also highly flexible. Here’s the story on these tax-favored accounts.

Section 529 college savings plans are state-sponsored arrangements named after the section of our beloved Internal Revenue Code that authorizes very favorable treatment under the federal income and gift tax rules.

You as the parent of a college-bound child begin by making contributions into a trust fund set up by the state plan that you choose. The money goes into an account designated for the beneficiary whom you specify (your college-bound child).

You can then make contributions via a lump-sum pay-in or via installment pay-ins stretching over several years. The plan then invests the money using the investment direction option that you select.

When your child reaches college age, you can take federal-income-tax-free withdrawals to pay eligible college expenses. including room and board under most plans. Plans will generally cover expenses at any accredited college or university in the country (not just schools within the state sponsoring the plan). Community colleges qualify as well.

In essence, a Section 529 college savings plan account is a tax-advantaged way to build up a college fund for your child.

Understand These Things

- Your child is not guaranteed admittance to any particular college.

- The cost to attend whichever school that is ultimately chosen is not locked in by the arrangement. See the later discussion of the important distinction between 529 college savings plans and 529 prepaid tuition plans.

- You are generally not guaranteed any minimum rate of return.

- Most college savings plans permit lump-sum contributions of well over $300,000. So, you can really jump-start your child’s college fund if you have enough available cash to do so. If not, you can make installment pay-ins over a number of years. Of course, the sooner you can put substantial dollars into the account, the sooner the tax-free compounding benefits start accruing.

- Section 529 college savings plans generally offer several investment direction options, including equity mutual funds and more conservative options like bond and money market funds.

- Plans generally welcome out-of-state investors.

Income Tax Advantages

The primary tax advantage of 529 college savings plan accounts is that they allow earnings to build up free of any federal income tax. You can then take federal-income-tax-free withdrawals to pay qualified college costs for the account beneficiary (your child).

Usually, there’s no state income tax hit on withdrawals when both the contributor (you) and the account beneficiary (your child) reside in the state sponsoring the plan. State income tax deductions or credits may be available for contributions to your in-state plan.

If you contribute to an out-of-state plan, the state income tax consequences can vary. Check with your tax pro for help with any state tax questions.

Estate Planning Advantages

Contributions to a Section 529 account reduce your taxable estate. For federal gift tax purposes, contributions are treated as gifts eligible for the $16,000 (for 2022) annual federal gift tax exclusion. In addition, you can elect to spread a large lump-sum contribution over five years and thereby immediately benefit from five years’ worth of annual gift tax exclusions.(4)

For example, you can make a lump-sum contribution of up to $80,000 ($16,000 x 5) to a child’s 529 account without any federal gift tax consequences. Your spouse can do the same, so together you could contribute $160.000 ($80.000 x 2). Gifts up to these amounts will not reduce your $12.06 million (for 2022) unified federal gift and estate tax exemption or your spouse’s exemption, as long as you elect the five-year spread deal.(5)

Flexibility Advantages

When funding an account for a child’s college education, you should always consider what will happen to your money if things go tragically wrong. After all, your child could decide to become a professional disc (think Frisbee) golfer and skip college altogether. Then what? Thankfully, 529 accounts are flexible enough to handle such adverse outcomes.

You can change the account beneficiary without any federal tax consequences, as long as the new beneficiary is a member of the original beneficiary’s family and in the same generation (or a higher generation).

Your children, your stepchildren, their spouses, and your nieces and nephews are all considered members of the same family and same generation.(6) So, you can move money from an account set up for any one of these individuals into an account set up for any other of these persons with no federal income tax or gift tax consequences.(7)

You also have flexibility to change plans or the 529 account’s investment direction. If, for example, you decide another state’s plan is superior to the current one, you can simply switch plans by rolling over the account balance. This can be done as often as once a year without any federal tax consequences.(8) And plans can allow you to switch investment direction as often as twice in a calendar year.(9)

Finally, what happens if you want or need to get your money back from the Section 529 plan? The federal tax rules allow this too. You will be taxed on any withdrawn earnings, and you also will owe a 10 percent penalty tax on any such withdrawn earnings.(10) But that’s a relatively small price to pay for the privilege of being able to reverse a poor decision and recover your money.

Key point. The preceding discussion describes what the federal tax law allows. Section 529 plans usually conform to these guidelines, but they are not required to do so. Before investing, make sure any plan you are considering does conform.

Don’t Confuse Savings Plans with Prepaid Plans

Don’t mix up Section 529 college savings plans, which we have been explaining so far, with Section 529 prepaid college tuition plans—which we will give only a brief mention here. Both types of plans are properly called “Section 529 plans” because both are authorized by that section of the Internal Revenue Code. Both receive the same favorable federal tax treatment. But that’s where the resemblance ends.

The big distinction is that prepaid tuition plans lock in the cost to attend certain colleges. In other words, the rate of return on a prepaid tuition plan account is promised to match the inflation rate for costs to attend the designated school or schools—nothing more, nothing less. That’s okay if that’s what you really want.

In contrast, a 529 college savings plan allows you to benefit if the account earns more than the rate of inflation for costs to attend the college that our child ultimately chooses.

Earnings greater than the inflation rate mean less money needs to be invested to fully fund the child’s future college costs. Good! Of course, there’s no guarantee here.

You can actually lose money with a college savings plan, and that happened to some folks during the 2008-2009 financial crisis. But incurring an overall loss is probably unlikely if you make most of your contributions when your child is still years away from college.

With enough time on your side and the right investment strategy, you can reasonably hope that a 529 college savings account’s rate of return will exceed the rate of inflation for college costs. If you are wary of making that assumption, consider either a prepaid tuition plan or a savings plan that offers suitably conservative investment options.

Key point. When you read about Section 529 plans, you are almost certainly hearing about college savings plans and not about prepaid tuition plans. It’s important to understand the difference.

Which Section 529 Plan Is Best?

That’s for you to decide. The main consideration should be how closely a particular plan’s investment options conform to your preferences. Of course, a plan that charges low management fees is best, all other things being equal. If contributing to the in-state plan would deliver significant state tax benefits, that could be a deciding factor.

Section 529 plans are competitive, and states are constantly changing their plans by, for example, offering wider arrays of investment options. In evaluating plans, work with the most current information. A good source is www.savingforcollege.com.

No Kiddie Tax on Section 529 Plan

You don’t have to worry about the kiddie tax if you set up a custodial 529 plan in the child’s name. The 529 plan is an investment plan where the monies remain in the plan. You make contributions with after-tax dollars.

When the child takes the money out of the plan for college, he or she does so tax-free when the funds are used to pay for qualified higher education expenses.

Considering the Kiddie Tax in a Taxable Plan

Back in the “good old days,” it was possible to save taxes by investing your child’s college fund in the child’s name rather than in your own name. That way, you could benefit from the child’s lower federal income tax rates on the college fund’s investment income. This strategy is called “splitting income with your child.(11)

The concept of splitting income is simple. First, you make gifts to your college-bound child’s college fund custodial account (not a Section 529 account). Under the $1 6,000 annual gift tax exclusion (for 2022), you can give up to that amount each year to the college fund without paying any federal gift tax and without using up any of your $12.06 million (for 2022) unified federal gift and estate tax exemption. Your spouse can do the same.

You then, on behalf of your minor child, invest the college fund money. The resulting income and gains are taxed to your child at his or her lower tax rates. The college fund compounds that much quicker, because the after-tax rate of return is that much higher. So far, so good.

Beware of Kiddie Tax Threat

Unfortunately, you must watch out for the dreaded kiddie tax when you save for college in your child’s name. The kiddie tax can tax part of your child’s investment income at the parent’s (your) marginal federal income tax rate, which can be up to 37 percent for net short-term capital gains and interest income (for 2022) and up to 20 percent for net long-term capital gains and dividends (for 2022).

Your marginal rates are probably much higher than the rates that would otherwise apply to your child’s college fund investment income—typically 10 percent or 12 percent for net short-term capital gains (for 2022) and 0 percent for net long-term capital gains and dividends (for 2022).

The good news is that the kiddie tax calculated at your marginal rate applies to the amount of your child’s investment income that exceeds the annual kiddie tax threshold, which is $2,300 for 2022.(12)

Save for College with Your Taxable Investment Account

You can always choose to save and invest for a child’s college expenses by using a taxable brokerage firm account set up in your name as a college fund.

For 2022, the maximum federal income tax rate on net long-term capital gains and qualified dividends is 20 percent for higher-income folks, but most folks will pay no more than 15 percent.

If the 3.8 percent net investment income tax (NIT) applies, the effective federal income tax rate can rise to 23.8 percent (for 2022). Paying these relatively low tax rates on your college fund’s capital gains and dividends is a reasonable deal.

Takeaways

College is expensive. Data for the 2019-2020 academic year indicates that the average cost of tuition, fees, room, and board was $30,500.

If your MAGI is less than $95,000 (single) or $ 190.000 (married), the Coverdell plan is a good college savings plan for you to consider.

But the real hummer is the Section 529 savings plan, because it’s available to all taxpayers with no income limitation or phaseout as you face with the Coverdell plan. Special rules allow you to put up to $75,000 ($150,000 if married) to kick-start the tax-free earnings that you then withdraw from the plan tax-free to pay for college.

Remember that the Section 529 plan comes in two varieties: savings plans and prepaid plans.

Prepaid plans work in much the same manner as savings plans, except the prepaid tuition plan has its rate of return tied to the tuition rate of the designated school or schools.

The kiddie tax does not apply to Section 529 plans.

If you use the income-splitting technique with your child to increase the after-tax results of a non-tax-advantaged savings plan, make sure to consider and do what you can to avoid the kiddie tax.

And of course, you can always set up a standard brokerage account and label and maintain it as a college fund.

SIDEBAR: Deduct Student Loan Interest If Your Income Permits

Our beloved Internal Revenue Code allows an above-the-line deduction for interest on qualified education loans. “Above-the-line” means you need not itemize to benefit.

But the deduction is capped at a maximum annual amount of $2,500, and there are income limits.(13)

To qualify for the interest deduction, the debt must be incurred within a reasonable time before or after eligible higher education expenses are incurred. Eligible expenses are defined as tuition, fees, room and board, and related expenses (such as books and supplies) for the taxpayer, the spouse, or any dependent of the taxpayer (such as your college child) to attend an eligible educational institution.(14)

The deduction is allowed only for expenses attributable to a year during which the student carries, for at least one academic period beginning in that year, at least half of a full-time course load in a program that would ultimately result in an associate’s degree, a bachelor’s degree, or some other recognized credential.(15)

The deduction for 2022 is phased out for unmarried taxpayers with MAGI between $70,000 and $85,000. If you are a married joint-filer, the phaseout range for 2022 is between MAGI of $145,000 and $175,000.(16)

If you won’t qualify for the interest deduction because your income is too high, the next best thing is to arrange for your child—the student—to get the deduction by taking out the student loan in his or her own name.

But no deduction is allowed to your child if he or she is your dependent for the year—even if your child is totally on the hook for the loan and pays the interest with his or her own money. (17)

You can finesse this issue by scheduling the start date for loan repayments after graduation. By then, your child should be self-supporting and no longer your dependent. Fingers crossed!

1 CESAs exist thanks to IRC Section 530.

2 You cannot take a tax-free CESA withdrawal to cover the same expenses for which you claim the American Opportunity tax credit, the Lifetime Learning tax credit, or the IRC Section 222 tuition and fees deduction. See IRC Sections 530(d)(2)(C); 530(d)(2)(D).

3 For this purpose. MAGI means “regular AGI” from your Form 1040, increased by amounts excluded from federal income tax under IRC Sections 911; 931; and 933, which deal with income from outside the country and which most people are rather unlikely to have. See IRC Section 530(c)(2).

4 The election is made on IRS Form 709. United States Gift (and Generation-Skipping Transfer) Tax Return.

5 If you pass away during the live-year spread period, a pro-rata portion of the contribution is added back to your estate for federal estate tax purposes. See Prop. Reg. Section 1.529-5 for the gift and estate tax rules.

6 IRC Section 529(e)(2).

7 IRC Sections 529(c)(3)(C); 529(c)(5)(B).

8 IRC Section 529(c)(3)(C).

9 IRC Section 529(b)(4).

10 IRC Sections 529(c)(3); 529(c)(6). IRC Section 2503(b).

12 IRC Section 1(g); Rev. Proc. 2021-45.

13 IRC Section 221.

14 IRC Section 221(d)(2). If an eligible education loan is refinanced, the refinanced loan will also qualify as such per IRC Section 221 (d)(1). Dependent status is determined under the IRC Section 152 rules, without regard to certain restrictions on the taxpayer’s ability to claim a dependent exemption deduction for that person per IRC Section 221 (d)(4).

15 IRC Sections 221(d)(3); 25A(b)(3); Reg. Section 1.25A-3 )(d)(1).

16 IRC Section 221(b)(2); Rev. Proc. 2019-44. For this purpose. MAGI means regular AOl from Form 1040 after adding back the IRC Section 222 tuition and fees deduction and the income exclusions under IRC Sections 911, 931, and 933. Married individuals who file separate returns can forget about this break, regardless of their income level. They are completely ineligible.

17 IRC Section 221(c).

Paying for College—a Handy-Dandy Strategy

As you likely know, at this website there are about 40 articles with some discussion of your business hiring your children as W-2 employees.

The hire-your-child strategy works best for the Schedule C proprietorship because when the proprietor hires his or her under-age 18 child, the tax code exempts both the child and the proprietorship from payroll taxes.

That’s great for proprietorship owners who have children under age 18. But if you hire your child and operate as a corporation or your child is age 18 or older, both you and the child suffer payroll taxes.

This article gives you a strategy to avoid payroll taxes on children over age 18 and on children doing work for your corporation.

Let’s say that you could pay your child $23,225 with this strategy:

- You deduct the $23,225 in your high tax bracket.

- Your child pays $1,028 in taxes.(1)

That’s a good return on investment.

Net Earnings from Self-Employment

The tax code says, “The term ‘net earnings from self-employment’ means the gross income derived by an individual from any trade or business carried on by such individual…”(2)

The Supreme Court ruled that to be in a trade or business, you need to be involved with continuity and regularity and that a sporadic activity does not qualify.(3)

Putting the Strategy in Play

If you contract with your child to perform a one-time task such as build your business a website, create several business videos, install office windows, or paint the office or building, your child is not in a trade or business.

Also, that one-time task is not likely to make your child an employee. Make sure you don’t cross the line and make your child an employee.(4)

And since this is not a trade or business and only a for-profit endeavor,(5) you don’t want your child to incur any expenses, because the Tax Cuts and Jobs Act disallows for tax years 2018- 2025 miscellaneous itemized deductions subject to the 2 percent of adjusted gross income floor. (6)

If you need windows installed, your best bet is to have your business buy the windows and installation material.

If you goof this up, it’s likely that your child can deduct the windows and installation materials as a cost of sales.(7) But that creates paperwork for the child and possible disagreeable discussions with the IRS.

Batok Case

In Batok, the court ruled that John Batok’s installation of windows did not rise to the level of a trade or business. Mr. Batok’s activity, although engaged in for profit, was neither continuous nor regular. He had never installed windows prior to this effort nor at any time thereafter.

The court ruled that Mr. Batok’s activity was a “one-time job” not subject to self-employment taxes.(8)

Member of Congress

Rev. Rul. 77-356 states the following:(9)

Although the Member of Congress is a public official in the performance of congressional duties, the income from the speaking engagements is not derived from performing those duties. The income from giving speeches is derived from the separate trade or business of speech making.

As a separate activity from congressional duties, speech making may or may not rise to the level of a business.

In Rev. Rul. 55-43 1, the IRS concludes that an individual who accepts an occasional invitation to make a speech for which he or she receives an honorarium is not engaged in a trade or business for self-employment tax purposes.(10)

On the other hand, the IRS ruled that the member of Congress who gave 10 speeches where he accepted honorariums was in the trade or business of speech making, and therefore was liable for self-employment taxes on that speech-making income.(11)

You likely noticed the gray area between “occasional” and “10” paid speeches where speech making may or may not be a trade or business subject to the self-employment tax. This simply points out that this is a facts-and-circumstances area where the IRS looks at the degree of recurrence. continuity, and availability for speech making, along with the amounts received during the year.

With your child’s effort, look to a one-time activity as a great bet for avoiding the self- employment tax.

Takeaways

The one-time project can avoid having your child on the payroll, and it can give you the best of all worlds.

For example, say you are in the 40 percent federal bracket and you pay your 20-year-old college student $23,225. You deduct the $23,225 and save $9,290 on your taxes.

Your child pays $1,028 in taxes.

Think of it this way: the family unit (you and your child) are in the green by $8,262 ($9,290 -$ 1,028).

1 The $23,225 comes from the $12,950 standard deduction and the first 2022 unmarried tax bracket of $10,275. Rev. Proc. 2021-45.

2 IRC Section 1402.

3 Commr. v Groetzinger, 480 U.S. 23, 30 [59 AFTR 2d 87-532] (1987).

4 For tips on avoiding employee status, see Avoid Employment Taxes and Penalties: Sail into Section 530’s Safe Harbor.

5 IRC Section 212.

6 IRC Section 67(g).

7 We did not find a direct citation that you exclude cost of sales from gross sales in a Section 212 production of income activity, but we believe subtracting the cost of goods sold from the gross sales in a Section 212 activity is proper because you do so with a business [Reg. Section 1.61 – 3(a)] and a not-for-profit hobby [Reg. Section 1.183-1(e)].

8 John A. Batok, T.C. Memo 1992-727.

9 Rev. Rul. 77-356 amplifying Rev. Rul. 55-431.

10 Rev. Rul. 55-431 as amplified by Rev. Rul. 77-356.

11 Rev. Rul. 77-356 amplifying Rev. Rul. 55-43 1.

Three More Answers on “Paying for College—A Handy-Dandy Strategy”

In the last chapter, you learned that you could pay your college student, for example, $23,255 for a one-time job that was not subject to self-employment taxes.

With this strategy, you deducted the $23,255 and your child paid $1,028 in 2021 taxes.(1)

This is terrific, but you might ask:

- Do I need to give my student a 1099? Which one—the NEC or the MISC? What box do I check on the 1099?

- Since the $23,255 is not subject to the self-employment tax, how do I help my college student (if he is still my dependent) avoid the kiddie tax?

- Would this one-time income enable an IRA—Roth and/or traditional?

The 1099

The 1099 reporting is somewhat of a surprise. You report most payments to individuals for services performed on IRS Form 1099-NEC. But that’s not where you report the $23,255 onetime payment to your child.

In the instructions for IRS Form 1099-NEC, you find that you report in box 1 of Form 1099- NEC amounts that are subject to the self-employment tax.(2)

For payments to individuals that are not subject to the self-employment tax, you report them in box 3 of Form 1099-MISC.(3)

As you know from the article linked above, you paid your college student for a one-time job that was not subject to the self-employment tax; therefore, you report the payment in box 3 of Form 1099-MISC.

Kiddie Tax

The kiddie tax does not apply to this one-time payment to your college student. Why? Because the student received earned income for his personal services.

The kiddie tax applies to unearned income such as investment income.(4) The kiddie tax does not apply to earned income.

The kiddie tax rules use JRC Section 911 (d)(2) to define earned income as “wages, salaries, or professional fees, and other amounts received as compensation for personal services actually rendered.”(5) The key words for the college student are ‘personal services actually rendered.”

Some tax professionals have trouble getting their software to stop applying the kiddie tax to this one-time payment. This may require an override, but first make sure that you have this one-time payment on Form 1040, Schedule 1, line 8z.(6) Per the IRS instructions, this is where you put income from a sporadic activity that’s not subject to the self-employment tax.(7)

And then there’s a question: Is this student a dependent in the year he received the $23.255? If the student provides more than one-half of his own support for the year, he is not a dependent for the year.

As a dependent, the student pays tax of $2,495, whereas if the student is not a dependent, the tax is $1,028. And, of course, you have to consider the effect (or lack thereof) of the dependent on the parent’s taxes.

Contribute to an IRA

The tax code limits the IRA deduction to the lesser of (a) the deductible amount or (b) the compensation included in the taxpayer’s income.(8)

The first question: Is this one-time payment to the college student “compensation” in the eyes of the tax code?

Section 219(f) states that the term “compensation” includes earned income as defined in Section 401 (c)(2). (9) That definition is not as expansive as we need, so let’s look to the IRS for more info.

The IRS in its regulations interprets compensation to mean wages, salaries, professional fees, and other amounts derived from or received for personal services actually rendered.(10) In this proposed regulation, the IRS goes on to state that compensation includes earned income as defined in IRC Section 401 (c)(2).(11)

Here, although it is different from the path for the kiddie tax, we focus on “other amounts derived from or received for personal services actually rendered.” Without question, our college student earned the $23,255 from his personal services.

As you may remember from above, the student’s IRA deduction is limited to the lesser of the deductible amount or his taxable compensation. The deductible amount is $6,000 for tax years 2021 and 2022, so our student’s contribution to a traditional or Roth IRA is limited to $6,000.(12)

Again, as with avoiding the kiddie tax, your tax preparer is likely going to have to use an override to get his or her tax preparation software to allow either (a) the $6,000 traditional IRA tax deduction or (b) the $6,000 contribution to the Roth.

Takeaways

The one-time payment your business makes to your college student for work on a project triggers little-known rules that have a big impact on the tax benefits.

For IRS Form 1099, you should put the one-time payment in box 3 of Form 1 099-MISC, even though that may not be where you would’ve expected to put that payment.

Regarding the kiddie tax, it’s important to recognize that most tax preparation software treats the box 3 income as non-earned income, which triggers the kiddie tax—and which is incorrect for this payment to your collect student. To fix this problem, your tax preparer has to override the tax preparation software entry.

And when you get to the tax deduction for the traditional IRA, your college student has earnings that qualify, but your tax preparer has software that requires an override to get this tax deduction in place.

1 $1.028 is the 2021 tax as if the child is no longer a dependent.

2 2021 Instructions for Forms 1099-MISC and 1099-NEC, dated Dec. 27, 2021, p. 10.

3 Ibid.

4 IRC Section 1(g)(4)(A).

5 IRC Section 911 (d)(2)(A).

6 Form 1040 Schedule I, Additional Income and Adjustments to Income (2021). 2021 1040 (and 7 1040-SR) Instructions, dated Dec. 21, 2021, p. 86.

8 IRC Section 219(b)(1).

9 IRC Section 219(f).

10 Prop. Reg. 1.219(a)-1(b)(3). Also, see Reg. 1.219-1(c)(1); TD 7714; Internal Revenue Manual Section 4.19.3.9.6.1 (Last Revised Sept. 24, 2021).

11 IRC Section 401(c)(2); Prop. Reg. 1.219(a)-1(b)(3). Also, see Reg. 1.219-1(c)(1); ID 7714; Internal Revenue Manual Section 4.19.3.9.6.1 (Last Revised Sept. 24, 2021).

12 Notice 2021-61.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

The Smart Tax Minimizer (For Consumer and Home-Based Businesses) ˢᵐ

The Smart Tax Planning System for Business Owners ˢᵐ

Coaching and Consulting

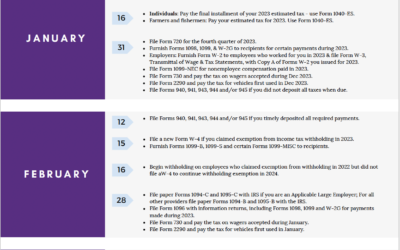

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of...

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...