The Smart Estate Planning Newsletter

The Top 7 Questions for an Effective Beneficiary Audit

The question of who inherits your assets becomes more important as you age. A good beneficiary audit can reassure you that the right people will inherit the right accounts and that the applicable tax and investment issues are carefully considered.

When was the last time you did a beneficiary audit for your retirement accounts? If you don’t remember, have never done one, or haven’t done one in more than a year, now might be a good time.

A beneficiary audit is one of the most critical check-up processes for IRAs and other retirement accounts, as it ensures that people you want to inherit your retirement accounts actually do

A good beneficiary audit can reassure you that your “designated beneficiaries” (i.e., individuals or qualified trusts named on the IRA agreement or employer plan document) avoid the limited distribution options available to “non-designated” beneficiaries (i.e., non-person entities or beneficiaries not named on the form).

The effectiveness of a beneficiary audit largely depends on the questions that are posed to you – the account owner.

Ask the right questions

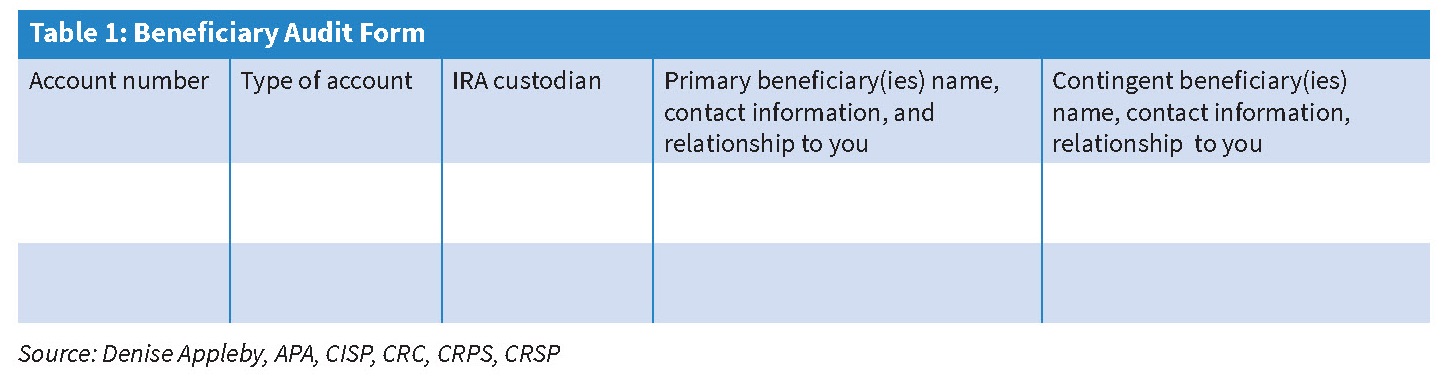

Sometimes it helps to use a Beneficiary Audit Form so you can easily identify your accounts and beneficiaries: (Table 1)

But identifying the accounts is only the beginning. This is also a good time to make any changes you’ve been considering. Ask yourself these questions:

1. Have you completed a beneficiary designation form for all of your retirement accounts?

Usually, you, as the account owner, would provide the beneficiary information when you established the IRA or retirement account.

But there are other factors to consider:

- Some IRA owners do not complete the beneficiary designation section of the IRA agreement because they intend to complete a separate beneficiary designation form at a later date.

- Some IRA owners mistakenly think that when they transfer an IRA to another IRA, the beneficiary designation carries over to the new IRA.

- When it comes to employer-sponsored retirement plans (qualified plans, 403(b) plans, and governmental 457(b) plans), the beneficiary designation is not part of the plan establishment or account-opening process. Instead, participants are usually provided with a “benefits package,” which includes forms and instructions for designating the beneficiaries of their retirement accounts and insurance policies.

If a beneficiary designation form is not completed for a retirement account, the default provisions of the IRA agreement or employer plan document apply.

The default provisions might not be consistent with your objectives and could adversely affect your beneficiary’s distribution options.

2. When was the last time you reviewed/updated your beneficiary forms?

Beneficiary designation forms should be reviewed often. The ideal frequency will vary based on your needs. For some, an annual review may be necessary, while a review every three years could be enough for others.

You should also review your beneficiary forms whenever there is a life event that could affect your beneficiaries. This includes marriages, divorces, new family additions (births and adoptions), and deaths.

Important note about divorce: Some plan documents include provisions that automatically remove a former spouse from the status of beneficiary when the divorce is effective. Some do not.

A new beneficiary form should be completed regardless of whether you want your former spouse to remain as beneficiary of the account. Completing a new beneficiary form will ensure your wishes are clear, which could help prevent friction among your heirs.

3. Do all of your retirement accounts have designated beneficiaries?

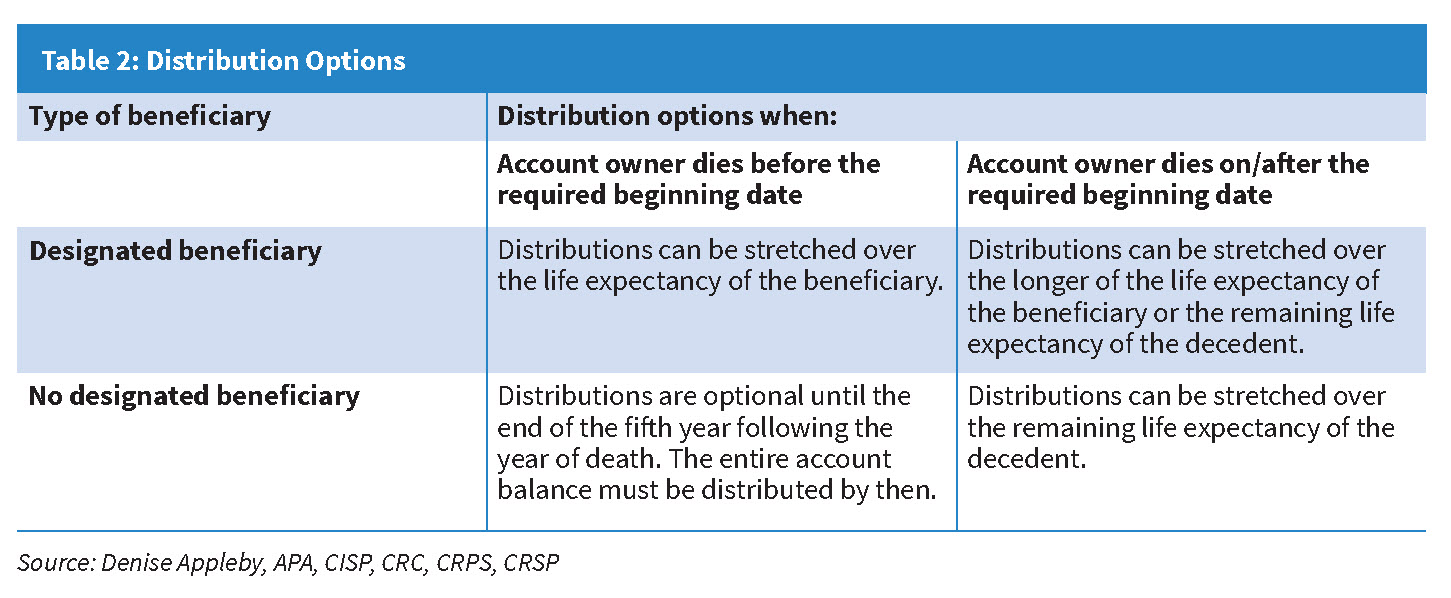

While every designated beneficiary is a beneficiary, not every beneficiary is a designated beneficiary. This distinction is important for purposes of determining the life expectancy over which distributions from an inherited account can be stretched.

An account has a designated beneficiary if the primary beneficiary is a person or a qualified trust named on the form. This determination is made on Sept. 30 of the year that follows the year of your death.

If only individuals and/or qualified trusts are beneficiaries on the Sept. 30 deadline, the account is treated as having a designated beneficiary.

If a nonperson, such as an estate, charity, or nonqualified trust, remains as a primary beneficiary on the Sept. 30 deadline, the account is treated as not having a designated beneficiary.

If a retirement account does not have a designated beneficiary, it could shorten the period over which distributions from the retirement account can be stretched. The following is a summary of the distribution options available to the various types of beneficiaries: (Table 2)

An individual can be a designated beneficiary only if she is a beneficiary on record at the time of your death or becomes a beneficiary under the default provisions of the plan document.

4. Have you named contingent beneficiaries for all of your retirement accounts?

A contingent beneficiary steps into the role of primary beneficiary in the event the primary beneficiary dies before you do, or if the primary beneficiary properly disclaims the retirement account. If the primary beneficiary disclaims only a portion of the account, the contingent beneficiary becomes the primary beneficiary for that amount.

Generally, a contingent beneficiary becomes a primary beneficiary only if there are no remaining primary beneficiaries. If there are two primary beneficiaries and one dies before you or disclaims his share, the remaining primary beneficiary usually becomes the primary beneficiary for that share.

If a retirement account does not have a contingent beneficiary and the primary beneficiary predeceases the account or disclaims the account, the default provisions of the governing plan document apply.

5. Are the default beneficiary provisions for your retirement accounts consistent with your objectives?

Ideally, all retirement accounts would have primary and contingent beneficiaries when the account owners die.

But, in the real world, beneficiaries are often determined under the default provisions of retirement accounts. The default provision would also apply if all primary and contingent beneficiaries properly disclaim their share of the account. The default provisions should be considered as part of the beneficiary audit because they activate when “what if” scenarios become “what is.” For example:

- What if you did not get around to replacing primary beneficiaries who died and you are not survived by any other named primary or contingent beneficiaries?

- What if your account is part of a mass transfer, under which the new beneficiary’s forms are mailed to you, but you missed a line or forgot to return them to the custodian/plan sponsor?

- What if the beneficiary designation form is determined to be invalid?

For these and other what-if scenarios, consider whether the default beneficiary provisions are acceptable. They include, but are not limited to:

- Surviving spouse. If none, the surviving children

- Per stirpes. If none, the decedent’s estate

- Surviving spouse. If none, the surviving children; if none, the decedent’s estate

- Surviving spouse. If none, the decedent’s estate

- Decedent’s estate.

For IRA owners with multiple options, the default beneficiary provisions should be one of the factors that determine which IRA is chosen.

Because employer-sponsored retirement plans are governed by one plan document, there is no flexibility. It is even more critical, therefore, that beneficiary forms for these accounts are updated when needed.

6. If you named a trust as your beneficiary, is the trust qualified?

Generally, only an individual can be a designated beneficiary. An exception applies to a trust, if the trust is qualified. Under this exception, the life expectancy of the oldest beneficiary of the trust is used for required minimum distribution (RMD) purposes, including calculating RMD amounts for beneficiaries. The following is a list of the requirements:

- The trust must be a valid trust under state law or one that would be valid if that there is no corpus.

- The trust must be irrevocable or become irrevocable upon the death of the account owner.

- The beneficiaries of the trust who are beneficiaries with respect to the trust’s interest in the retirement account are identifiable.

- A copy of the trust instrument is provided to the administrator of the retirement plan (IRA custodian), and the trustee agrees that if the trust instrument is amended at any time in the future, the account owner will, in a reasonable time, give the IRA custodian a copy of each amendment. If certain requirements are met, a list of trust beneficiaries can be given instead.

If the trust is not qualified, the account is treated as not having a designated beneficiary.

7. Does the beneficiary form include anything that could result in it being invalid?

A seemingly innocuous mistake can, at worst, invalidate a beneficiary designation form. At best, it can cause frustration for your beneficiaries and other involved parties. These mistakes include, but are not limited to:

- Percentages do not add up to 100. Generally, the percentage allocated to each beneficiary must be indicated on the beneficiary form. Some documents default to a pro-rata share if no percentages are indicated. However, the matter gets complicated if percentages are provided and they do not equal 100.

- The form is not signed.

- Absence of spousal consent. Spousal consent is required if a married participant designates someone other or in addition to his spouse as primary beneficiary for a retirement account under certain employer-sponsored plans, and for some IRAs where the owner’s residence is in a community or marital property state.

- A witness is a beneficiary.

Some beneficiary forms and governing plan documents include language to indicate whether and what type of mistakes will result in invalidation. Generally, an invalid beneficiary form will result in the default provisions of the IRA agreement being applied.

Ideally, the beneficiary form should be reviewed annually, with steps taken to ensure that your beneficiaries inherit what you intended. An annual beneficiary review with your financial advisor can ensure your heirs are taken care of as you had planned.

–Denise Appleby, APA, CISP, CRC, CRPS, CRSP

Denise Appleby runs a firm that provides a wide range of retirement products and services to financial, tax, and legal professionals. She also founded the consumer education website: retirementdictionary.com.

For help with your estate plan or to create verified beneficiary documents, check out The Smart Estate Plan Protector. It’s like a mini-estate that will ensure your assets pass quickly and easily to your heirs.

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...