Tax Planning

Tax Guide to Deducting Long-Term Care Insurance

Bradford Tax Institute

You may not have thought much about long-term care insurance—but you should. Chronic illness and disability are real possibilities. Consider this:(1)

- Medicare is not much help. It limits payments to no more than 100 days if you require skilled services or rehabilitation care.

- Medicaid could provide more help than Medicare, but you must have a low income to qualify.

The government is likely not the answer should you need long-term care. The private sector offers a solution: long- term care insurance.

And it’s possible to get the government to subsidize your long-term care insurance. Your subsidy comes in the form of a tax deduction, and that deduction depends on your business entity.

In this article, we focus on the business owner and how the owner can qualify for the maximum subsidy possible.

Three Possibilities

As a business owner, you have three tax-deduction result possibilities for the cost of your long-term care insurance:

- 100 percent deduction

- Tax code limited amount

- Crapshoot of an itemized deduction

100 Percent Deduction

C Corporation

Your C corporation can provide you with long-term care insurance as a tax-free employee benefit, and it can deduct the expense on the corporate return.(2)

The corporation does not have to provide long-term care insurance to all employees. Your corporation can discriminate and provide insurance to you without giving the insurance benefit to other employees.(3)

Spousal Employee

If you operate your business as a sole proprietor or a single-member LLC and have your spouse as your only employee, you can use Section 105-HRA (which is exempt from the Affordable Care Act) for your medical expenses.(4)

Section 105-HRA reimbursements of expenses are business reimbursements exempt from the individual limits that apply to long-term care insurance. Therefore, with this plan, you can cover both your spouse-employee and yourself as the employee’s spouse with 100 percent deductible long-term care insurance.

Tax Code Limited Amount

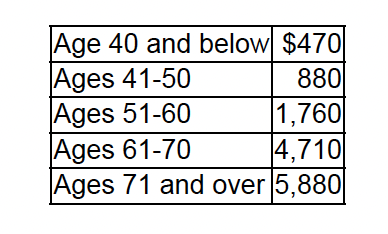

This tax code beatdown of your long-term care insurance tax deduction is a bummer. When subject to the limits, your allowable medical expense deduction for qualified long-term care premiums cannot exceed the applicable age-based limits.(5) For 2024, the age-based limits are as follows:(6)

Sole Proprietors and LLC Owners

If you operate your business as a sole proprietorship (or a single-member LLC taxed as a sole proprietorship), you deduct your long-term care insurance on IRS Form 7206, which imposes the above limits on your long-term care insurance deduction.(7)

Planning tip. Using a 105-HRA plan that covers the spouse as the sole employee of the sole proprietorship or single-member LLC taxed as a sole proprietorship defeats the limits, as we discussed above.

S Corporation Owners

As an employee who owns more than 2 percent of the S corporation, you can deduct your long-term care insurance expenses using Form 7206, subject to the personal deduction caps. But to qualify for this deduction, your S corporation and you must follow these three steps:(8)

- The corporation must pay directly for the insurance or reimburse you for the policy.

- The corporation must include on your W-2 the premium payments, which are not subject to employment taxes.(9)

- You must deduct the expense on Form 7206 (subject to the unfortunate limits above).

Partners in Partnerships

The partnership must pay directly for the long-term care insurance or reimburse the partners. The partnership then reports the long-term care insurance premiums paid as guaranteed payments to the partners.(10) The partners deduct the long-term care insurance premiums on Form 7206, subject to the deduction limits.

Crapshoot of an Itemized Deduction

If you don’t qualify for the 100 percent or limited long-term care insurance deduction, you have one last possibility

—the personal itemized deduction.

Note the word “possibility.” This is a bad, sad place for your medical expenses, because you can deduct them only:(11)

- to the extent they exceed 7.5 percent of your adjusted gross income (AGI), and

- if you elect to itemize your deductions.

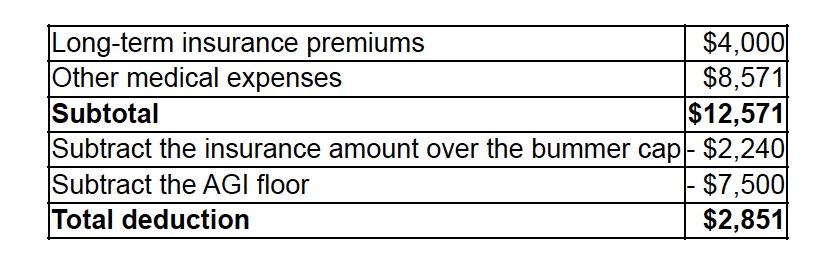

Example. Let’s say you are age 52 and have $100,000 of AGI. You pay $4,000 for long-term care insurance and have $8,571 in other medical expenses. Here’s what you can deduct after the application of these brutal rules.

After the limitations, your $12,571 of medical expenses produce a possible $2,851 deduction. Why possible? As before, you have to itemize to realize it.

Planning point. If you established a Section 105 plan for your employee-spouse or have the 105 plan inside your C corporation, you can use that plan to deduct the full $12,571 as a business expense.

Qualified Insurance Only

You must purchase “qualified” long-term care insurance to get your deduction under tax law. To be qualified, the insurance:12

- must provide coverage only for qualified long-term services;

- must guarantee renewal;

- must have no cash surrender value; and

- must not reimburse expenses covered by Medicare.

Employees

Having employees does not change the above rules for partners or for more-than-2-percent shareholder- employees of S corporations. And if the partnership or S corporation has fewer than 50 full-time employees, it is exempt from the Affordable Care Act and doesn’t have to provide any employee health insurance.

But if the partnership or S corporation has fewer than 50 employees and is going to provide health benefits to its employees, it should consider the following options:

- Individual coverage health reimbursement arrangement, or ICHRA (see ICHRA: Game Changer for Small Business Health Benefits for how this works.

- Qualified small-employer health reimbursement arrangement, or QSEHRA (see Get Your QSEHRA Health Plan in Place Now for how this works)

The same Affordable Care Act exemption applies to the sole proprietorship, single-member LLC, and C corporation when the entity has more than one employee and fewer than 50.

Takeaways

Long-term care insurance is a smart way to protect against the financial consequences of chronic illness or disability, but the premiums for this insurance can be costly. However, properly using the tax code can allow you to deduct that entire insurance expense or at least a good chunk of the cost.

Depending on how you operate your business, you must use different strategies to qualify for the deduction:

- Sole proprietorship or LLC taxed as a sole proprietorship. If your spouse is your sole employee and you have a 105-HRA, you deduct the full cost as a business expense. If not, you deduct the cost as self-employed health insurance subject to the limits.

- C corporation. To turn the insurance cost into a complete business deduction, have the corporation offer you the plan as a tax-free fringe benefit.

- S corporation. Have the corporation pay for or reimburse you for the premiums, and report the cost as compensation on your W-2. Then you deduct the premiums on IRS Form 7206.

- Partnership. Have the partnership reimburse you or pay the premiums, and include them as guaranteed payments on your K-1. Then you deduct the premiums on IRS Form 7206.

- LongTermCare.gov: Who Pays for Long-Term Care?

- IRC Section 162(a); Reg. Section 1.162-10(a).

- There is no non-discrimination provision for fully insured accident and health plans. The IRS does not enforce the nondiscrimination provision of the Affordable Care Act. Notice 2011-1.

- See Updated Blueprint for Employee-Spouse 105-HRA (Health Reimbursement Arrangement).

- IRC Section 213(d)(1).

- Rev. Proc. 2023-34; IRC Section 213(d)(10).

- IRS Form 7206, Self-Employed Health Insurance Deduction (2023).

- Notice 2008-1.

- See Q&A: No FICA on Health Insurance for the More-Than-2% Shareholder-Employee.

-

IRC 213(a); IRS Form 1040, Schedule A, Itemized Deductions (2023).

- IRC Section 7702B(b)(1)

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (For Consumers and Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ℠

Estate Planning

Retirement Planning

Tax Planning

Coaching and Consulting

Inherited an IRA? Four Things Every Beneficiary Should Know

Inherited IRA distribution rules have changed in ways that can significantly impact your taxes and tax...

Cybersecurity Monthly Newsletter August 2024

Asset Protection In this issue: National Public Data Breach: What You Need to Know About the Massive Cybersecurity...

The Smart Tax Planning Newsletter August 2024

Tax PlanningIn This Issue: Tax Guide to Deducting Long-Term Care Insurance Premiums Smart Solutions That Decrease...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.