Tax Planning

The Smart Tax Planning Newsletter May 2023

In this issue:

-

Tax Credits for Electric Vehicles: The Latest from the IRS

-

Using Family Loans to Secure Better Home Loan Interest Rates

-

Basic Estate Planning

-

One Ugly Rule for S Corp Owners Deducting Health Insurance

Tax Credits for Electric Vehicles: The Latest from the IRS

The IRS recently issued new guidance on electric vehicles. There are four ways you can potentially benefit from a federal tax credit for an EV you place in service in 2023 or later:

- Purchase an EV and claim the clean vehicle credit.

- Lease an EV and benefit from the lessor’s EV discount.

- Purchase a used EV that qualifies for the used EV tax credit.

- Purchase an EV for business use, and claim the new commercial clean vehicle tax credit.

The new clean vehicle credit is available through 2032, with a maximum credit of $7,500.

To qualify for the clean vehicle credit, you must meet specific criteria, including income limits, vehicle price caps, and domestic assembly requirements. The credit amount for vehicles delivered on or after April 18, 2023, depends on the vehicle meeting critical minerals sourcing and/or battery components sourcing requirements.

If you can’t find an EV that qualifies for the credit or your income is too high, you can lease an EV from a leasing company that can claim up to a $7,500 commercial clean vehicle tax credit. The leasing company may then pass on all or part of the credit to you through reduced leasing costs.

For used EV purchases, you can earn a credit of up to $4,000, but you must buy the vehicle from a dealer and meet the law’s income caps and other restrictions. To claim an EV credit, the seller must complete a seller’s report and provide a copy to you and the IRS. For the clean vehicle credit, you will file IRS Form 8936; for the commercial clean vehicle credit, you will file IRS Form 8936-A.

Finally, if you purchase an EV for business use, you can qualify for the commercial clean vehicle tax credit, which is not subject to critical minerals or battery components rules, making it easier to qualify for this credit starting April 18, 2023.

Using Family Loans to Secure Better Home Loan Interest Rates

Here’s some information on how you can help a family member buy a home by making a loan to them while ensuring that you and the family member benefit from a tax-smart loan structure.

With the current national average interest rates for 30-year and 15-year fixed-rate mortgages at 6.81 percent and 6.13 percent, respectively, family loans can offer a much more attractive borrowing alternative. By charging the Applicable Federal Rate (AFR) as interest, you can give your family member/borrower a good deal without giving yourself a tax headache.

The IRS issues new AFRs for term loans every month. The rates for April 2023 are as follows:

- Short-term loan (three years or less): 4.86 percent

- Mid-term loan (over three years but not more than nine years): 4.15 percent

- Long-term loan (over nine years): 4.02 percent

Charging at least the AFR for a term loan to a family member allows you to avoid federal income tax and federal gift tax complications. If you charge less than the AFR, then you may need to navigate some tax complications. Two tax-law exceptions, the $10,000 and $100,000 loopholes, can help you avoid these complications, although they may not be suitable for all home loans.

It is crucial to document the loan with a written promissory note and secure it with the borrower’s home for them to claim deductions for qualified residence interest expenses. Make sure the borrower signs the note and that the note includes details such as the interest rate, a schedule of interest and principal payments, and any security or collateral for the loan.

In conclusion, family loans can provide homebuyers with better interest rates than commercial lenders offer, especially if family members charge the AFR. Remember to consider the loan terms and tax consequences when structuring the loan.

Basic Estate Planning

You need an estate plan, regardless of whether or not you are among the ultra-rich. As recent news has shown, even those who have won the lottery or have substantial wealth can fall victim to poor estate planning. If you don’t create an estate plan of your own, your State and of course our Federal Government has a plan for you, one you and your heirs may not like.

While federal estate taxes may not concern you due to the current large estate tax exemption, at a minimum you need a will to have your wishes honored after your death. Without a will, state law dictates the distribution of your assets, which may not align with your intentions. Additionally, if you have minor children, a will allows you to name a guardian to care for them in the event of your untimely passing.

Your heirs will want to avoid probate because it can be a costly and time-consuming legal process. A living trust gives you a valuable tool to avoid probate. By transferring legal ownership of your assets to the trust, you can ensure that your beneficiaries receive them without suffering through probate. Keep in mind that, while almost any asset can be transferred into a trust, doing so may not be the best decision. This is generally true for retirement assets like 401(k)’s, IRA’s, etc. These types of assets may be efficiently passed on to your heirs via a direct Beneficiary Designation. The beneficiary designation is a very powerful too. So much so that, even if you were to name your trust as the beneficiary of an asset and there is a conflictling designated beneficiary document on file, the information on the designated beneficiary statement will supersede.

You should amend your living trust as circumstances change, providing flexibility and control over your assets. It is also essential to keep your beneficiary designations up-to-date, as they take precedence over wills and living trusts regarding asset distribution.

This concept is so important that we’ve actually developed a process for our clients to ensure that their designated beneficiaries are correct, and that their heirs can prove it when needed. It’s called The Smart Estate Plan Protector ℠, and it’s 1 or our 12 Smart Modules that make up our 4×4 Financial Independence Financial Plan ℠.

Additionally, if your estate will suffer from federal or state death taxes, you should plan to minimize your exposure. Estate planning is not a one-time event but a process that you should review and update regularly to accommodate life changes and fluctuations in estate and death tax rules. It is recommended that you check your estate plan annually to ensure it aligns with your wishes and circumstances.

One Ugly Rule for S Corp Owners Deducting Health Insurance

When your S corporation covers or reimburses your more-than-2-percent-shareholder-employee health insurance expenses, it classifies the payments as Box 1 W-2 wages, but not Box 3 or Box 5 wages. When calculating the amount eligible on your personal tax return, form 1040 self-employed health insurance deduction, you must use your Medicare wages (listed in Box 5 of Form W-2) as your “earned income” rather than the amount reported in Box 1.

Here are two examples that show you the impact of this rule:

- Ted’s S corporation pays him $0 in cash wages and reimburses him $18,000 for health insurance. His W-2 shows $18,000 as Box 1 wages and $0 as Box 3 and Box 5 wages. Although Ted has $18,000 in taxable wage income from the corporation’s reimbursement of his health insurance, his Form 1040 self-employed health insurance deduction is $0 due to his lack of Medicare wages.

- Janet’s corporation pays her $107,000 in cash wages and reimburses her $22,000 for health insurance. Janet’s W-2 from her S corporation shows Box 1 wages of $129,000, Box 3 wages of $107,000, and Box 5 wages of $107,000. The IRS allows her Form 1040 self-employed health insurance deduction of $22,000 because her Medicare wages exceed the insurance cost.

To avoid unfavorable tax outcomes, ensure that your S corporation reports Medicare wages (box 5) equal to or greater than the health insurance costs paid or reimbursed.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Social Security Benefits Maximizer/Retirement Healthcare Expense Estimator ℠

Estate Planning

Retirement Planning

Tax Planning

Coaching and Consulting

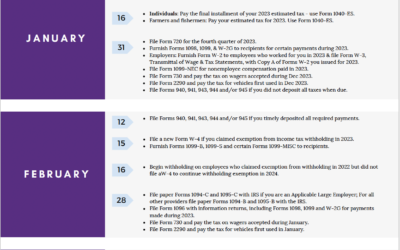

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of...

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.