— Services

The Smart Estate Plan Protector ℠

A Better, Smarter, Safer Way to ensure all your assets pass to your chosen beneficiaries, without a trust.

Beneficiary Documents

Create a set of verified beneficiary documents.

Get Organized

Create an organized document to help you and your heirs.

Estate Plan

Like a mini estate plan. Ensue all your assets pass quickly and easily, avoiding probate.

Overview

The Smart Estate Plan Protector ℠ is a self-directed system with financial oversight from an independent fiduciary advisor. The Smart Estate Plan Protector ℠ will provide you with instructions and details on how to ensure your assets get passed onto your chosen beneficiaries without a will or trust. If you have a will or trust, this service module is STILL for you, because your assets may be passing onto beneficiaries that don’t align with your current goals.

The Goal

The goal is simple, we will help to make sure all your financial assets pass to your chosen beneficiaries.

The Process

You will be guided through our self-directed online membership portal platform, where we provide video instructions on how to complete The Smart Estate Plan Protector ℠ system.

Initially, we will discuss the benefits of this review as well as the problems that can occur if your beneficiaries are not properly documented.

Then, we will work with you to review all of your financial assets that may or should have beneficiaries assigned to them, allowing these assets to pass on to your heirs quickly and easily, as well as avoiding probate court and eliminating costly attorney’s fees.

Finally, we will assist you in modifying your beneficiary designations with your assets, to ensure that your assets are passed on to your estate in the manner you want.

Benefits

Avoid unnecessary attorney fees and court costs by avoiding probate

Ensure your assets will pass quickly and easily onto the persons and charities you want

Like a Mini-Estate Plan and, in many ways, better than a will & trust (This process is no substitute for a well-planned trust strategy)

Create an organized document that will assist you and your heirs in locating your assets and contacting the right persons to transfer them

Create a set of verified beneficiary documents

Get Started

Enroll now to get started with The Smart Estate Plan Protector ˢᵐ. Discover a better, smarter, safer way to ensure your estate plan works as planned without using a trust.

What You Get:

Initial personalized consultation with a Fiduciary Advisor

Help avoiding unnecessary attorney fees and court costs by avoiding probate altogether

Like a mini-estate plan

Creates an organized document that will assist you and your heirs in locating assets and contacting the right persons

Provides you with a set of verified beneficiary documents that are on file with all your custodians

Let’s Get Moving!

Enroll Today

Check out to get started. If you follow the program, we can guarantee you will benefit from this service.

Helpful Guides and Newsletters

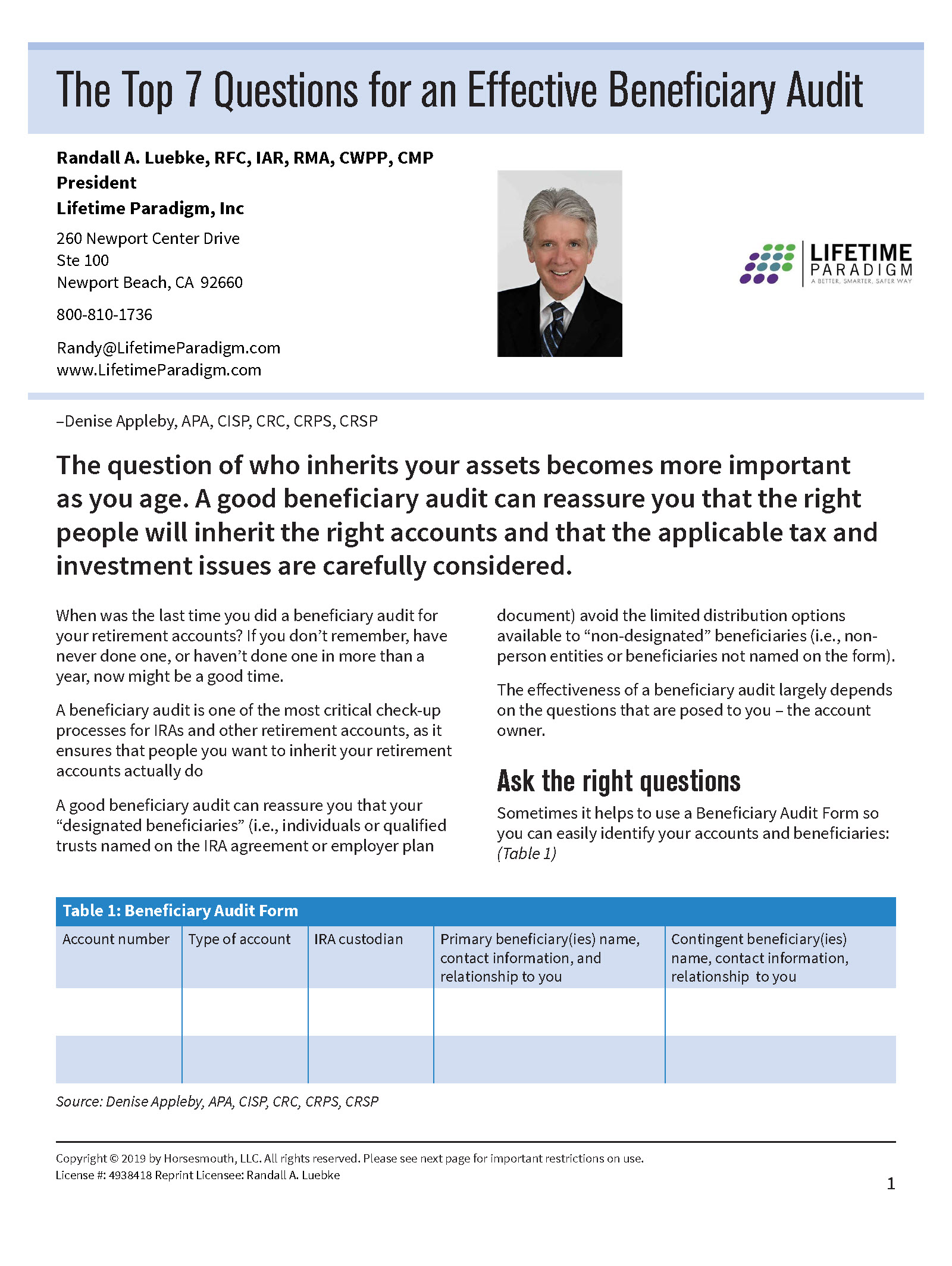

“Top 7 Questions for an Effective Beneficiary Audit”

When was the last time you did a beneficiary audit for your retirement accounts? Ask the right questions.