Retirement Planning

A 60/40 Portfolio Can Be Hazardous to Your Financial Health

For the last several decades, conventional wisdom in the financial services industry has been that a prudent way to invest money, one that will provide sufficient yield and a hedge against downside risk, is to use a mix of 60% stocks and 40% bonds. The problem with conventional wisdom is that, all too often, it’s not all that wise. I believe that this is case for the 60/40 portfolio and here are my reasons why.

A 60/40 Mix?

The 60% equity part of the portfolio is supposed to drive higher returns but, with potentially significant risk of loss. The 40% bond portion of the portfolio is supposed to protect you from large losses, however, investment returns should be more modest.

Also, the stocks and bonds are supposed to work against each other. Meaning, when the stock market is moving up, the bond market should be stable. The converse is also true so, if stocks move down, then bonds would remain stable or possibly increase in value.

This is the theory behind the 60/40 mix. People like this theory, and that’s why most financial advisors use this strategy for their clients’ investments. It’s a decent strategy that works most of the time, except of course, when it doesn’t.

For example, in 2008 this relationship did not hold true, at least initially. Because, when the real estate market crashed and brought the stock along for the ride, bonds lost money too. Eventually, things got back to normal. That said, by then, many people had lost a lot of money and they were now out of all markets completely.

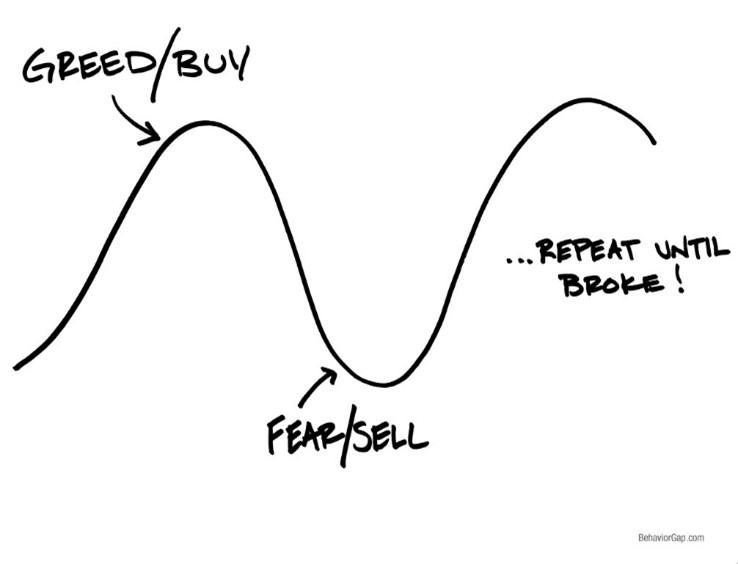

The “theory” is that the investor would just “ride out the storm” and, eventually, the storm clears. The “reality”, however, is that most investors become scared and cash out near the bottom of the market. This, of course, is when they should be buying, but they don’t. Instead, they lick their financial wounds and wait on the sidelines. They watch as the market ratchets its way back up, missing out on all those gains as they wait. Then, they repeat the process, and they buy back into the market near the next top.

Below is a simple illustration of these actions. As you look at it, think about how many people you know who behave exactly like this? Then ask yourself, “Is one of those people possibly you?

Correlation

High correlation means moving in the same direction at the same time, like a school of fish. Conversely, with low correlation, things move more independently. Historically, when equities go down bonds do not. That’s low correlation. Recently, the correlation between equities and bonds has been increasing, and many analysts think that trend is going to continue.

With higher correlation between equities and bonds, if/when the next stock market crash comes, there is a high possibility that both the equities and bonds in a portfolio will decline in unison as they did in 2008. If true, then this high correlation in the future would defeat the purpose of using a 60/40 mix of investments to hedge downside risk of the portfolio.

Evidence Of The 2008 Crash

In case you wondered, in the 2008 stock market crash, a typical 60/40 globally diversified portfolio lost approximately 38% of its value. Ouch! If you’d like to check for yourself, go to “Yahoo Finance” and search for the ticker symbol DGSIX (DFA Global Allocation 60/40). The evidence is there waiting for you.

What You Should Do Now

The question you should be asking now is, “Is it time to re-evaluate my investment mix?” Maybe a better question is, “What is “your mix?”

Most times, when we ask this question of our new clients, they are clueless. Even those who feel they are on top of their portfolio are surprised when we get under the hood and look at the details of their investments. This is especially true with those who invest in mutual funds as well as index funds.

If you would like to mitigate your downside risks altogether, consider this. There are wealth building tools available that provide 100% protection from downturns in the market, and over time, should generate a 4-6% returns as well.

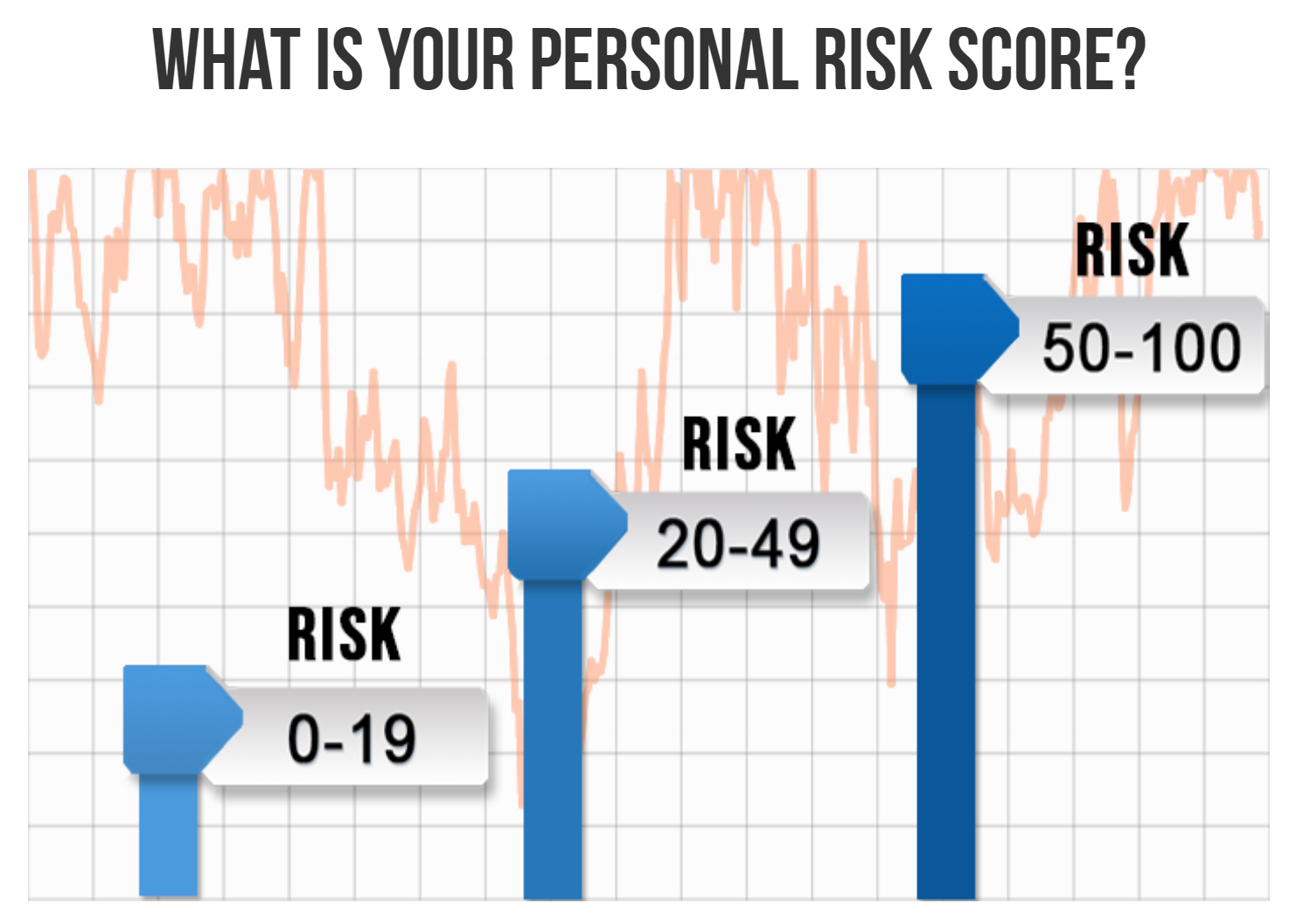

The bottom line is that, once you understand your mix, the next question you need to ask is, “How do your fix your mix?”. We have a great tool to start this process for you, and it will take just 5-minutes your time. Here’s the link to our website so you can get started today.

Link to: OnPointe Risk Analyzer

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The Smart 401(k) Supercharger ˢᵐ

The Smart College Cost Eliminator ˢᵐ

The Smart Debt Eliminator/Credit Builder System ˢᵐ

The Smart Investment Property Evaluator ˢᵐ

The Smart Mortgage Paydown Accelerator ˢᵐ

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...