Financial Independence

Creating a Financially Organized Life

Here’s how to get a jump-start on creating a system to organize your bills, statements, policies, and other financial paperwork.

Financial organization is a cornerstone of a healthy financial life. At the most basic level, financial organization saves time and money because it aids in paying bills on time, finding needed documents during tax season, providing proof of payment, disputing credit cards or billing errors, and avoiding the stress of dealing with piles of unorganized bills and paperwork.

It also sets the stage for better decisions on investments, budgeting, debt, and investment planning. Financial organization helps your working relationship with your financial advisor because there will be less time spent looking for paperwork and more clarity around the overall financial situation, leading to more informed decisions about your investments and financial plans.

While having a system to organize financial paperwork is important, it is not so important which system is followed but that a system exists. In most cases, a combination of electronic and paper filing systems will do the trick.

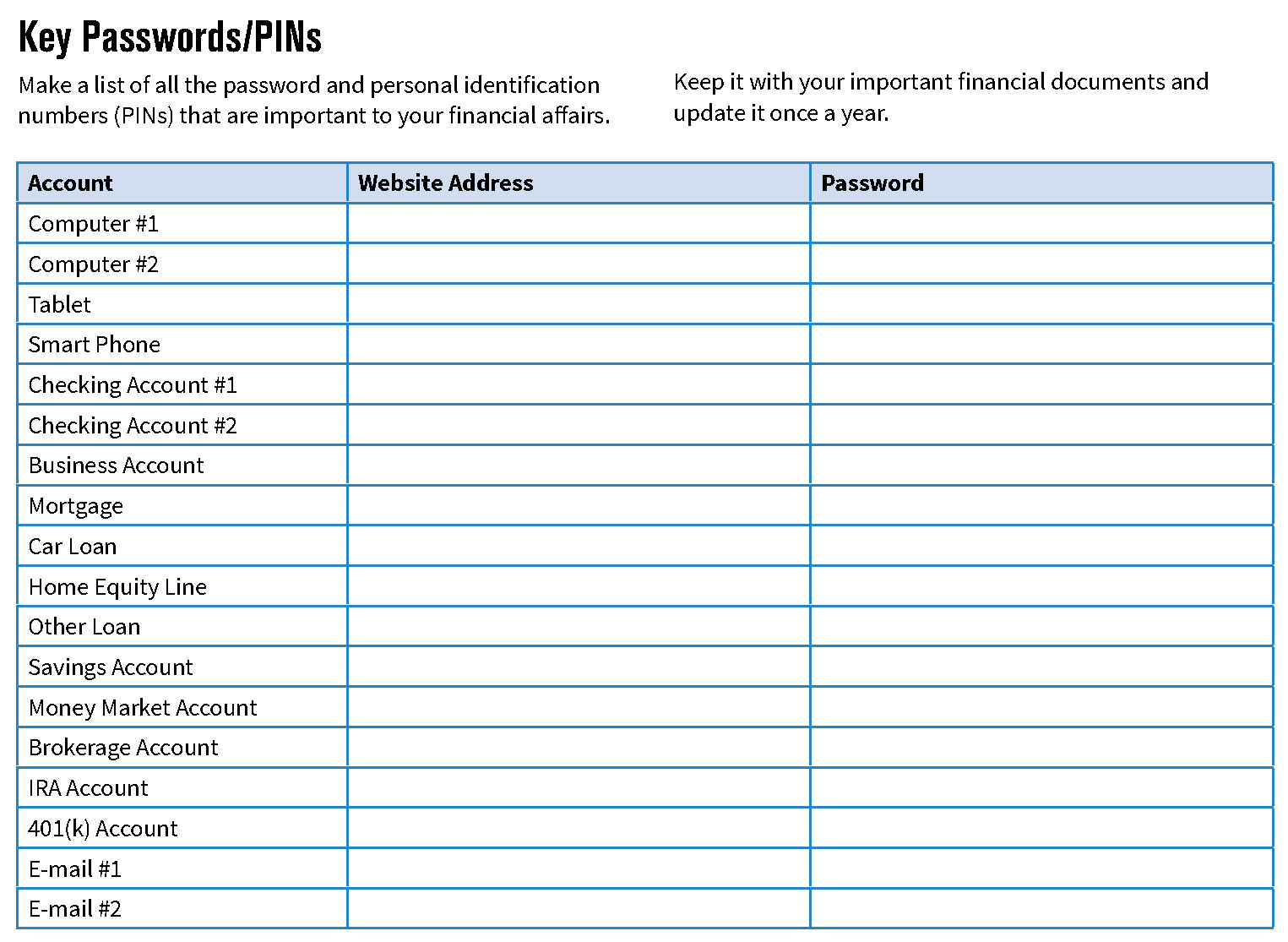

Bills, statements, policies, and other documents that are delivered online can be stored and backed up on a computer hard drive or through online banking websites, third party bill pay, and website document storage platforms. Some websites offer budgeting and spending information and advice.

For couples, clearly establishing responsibilities for financial matters is an important priority. If one spouse manages the finances, the other spouse should be informed about what is going on financially, where important documents are stored, and the passwords for all online accounts.

What documents to keep and what to toss is another important part of becoming better organized. The IRS recommends retaining tax returns and any documents that support tax returns for seven years. Other documents such as paper bank statements, investment account statements, and credit card statements can be shredded after a year, especially if they can be accessed online in the future if necessary.

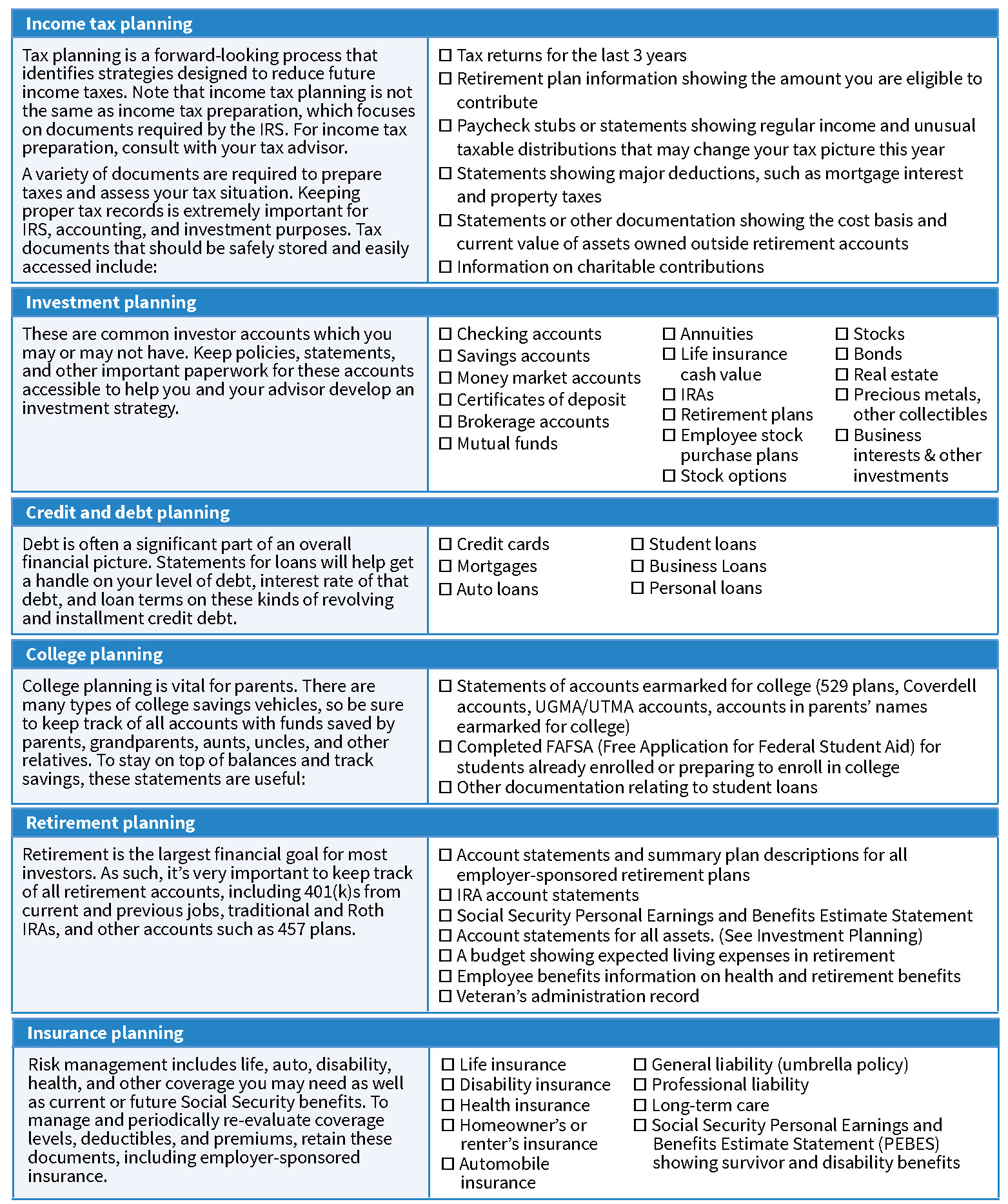

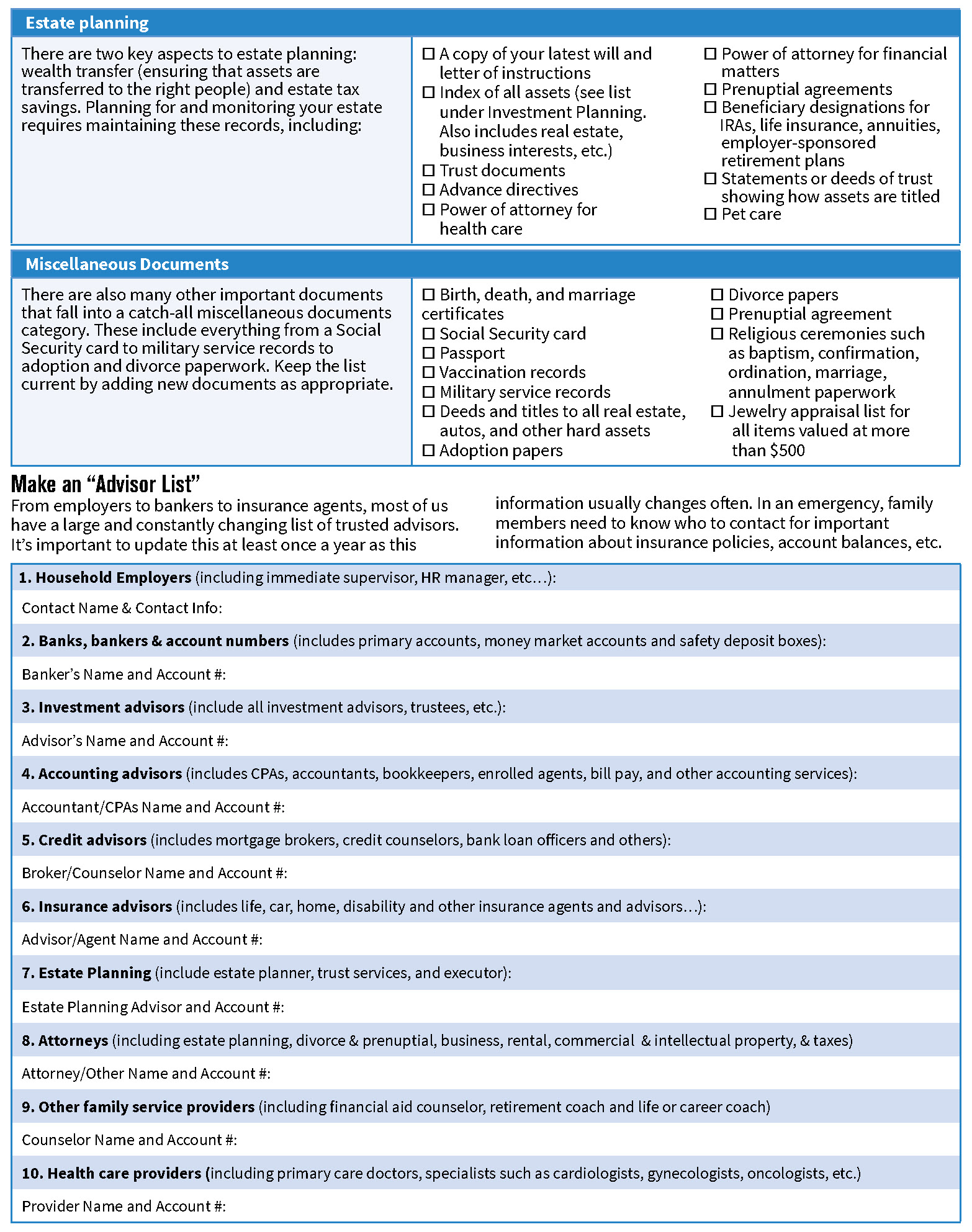

Financial paperwork generally falls into the following categories: investments, taxes, credit cards and loans, college savings, retirement savings, insurance, and estate planning. Let’s take a look at what documents you need to keep on hand in these areas.

Elaine Floyd, CFP®, is the Director of Retirement and Life Planning at Horsesmouth, where she focuses on helping people understand the practical and technical aspects of retirement income planning. Horsesmouth is an independent organization providing unique, unbiased insight into critical issues facing financial advisors and their clients.

Amy E. Buttell is an Erie, PA based freelancer writer. Her articles have appeared in leading publications including The Journal of Financial Planning, The Investment Professional, AARP: The Magazine and Consumer’s Digest.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

Coaching and Consulting

You May Also Like…

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...