Tax Planning

Real Estate Rentals: Recent Tax Insights

An Exclusive Report from

Bradford Tax Institute

How to Project if a Property is a Winner

Let’s start with a premise—you want to buy a profitable rental property. How would you know if it is going to be profitable? Frankly, you don’t. Because whatever you think is going to happen may not happen. That’s true of everything.

So, let’s go to the next step. How can we take what we think we know and make a well-reasoned projection of a rental property’s profitability—after taxes?

Answer: read this article and use the calculator to find your projected after-tax adjusted rate of return.

Starting Point

What rate of return do you currently earn on investments that you consider safe? Let’s say you have an investment that grosses 5.17 percent before taxes and 3 percent after taxes.

Now, let’s say you find a rental property that you like and use our calculator to find that this rental will produce, if your projections are right, 279 percent more profits than your safe investment.

Wow! Yes! With the calculator, you can compare your 5.17 percent safe rate with a rental property rate of return. That’s what makes the calculator so cool. In fact, it’s so cool that we’re going to name it Analyzer.

With the Analyzer, you can take a complicated rental property investment and break it down into one single rate of return that you can compare with other investments. This way, you compare apples to apples—it’s a huge advantage.

The Secret to the Analyzer

The Analyzer uses the after-tax adjusted-rate-of-return formula to produce an after-tax number that we gross up to make it comparable to your pretax safe rate.

For example, in the analysis of a sample rental property investment that displays when you open the Analyzer, the Analyzer found that a net cash investment of $43,828 produced $72,080 in after-tax walkaway cash in seven years. That’s a 12.7 percent compound return.

Here’s how the Analyzer drills down to come up with the 12.7 percent comparable return.

- $43,828 is the after-tax present value of all the cash put into this investment over the seven-year period of ownership.

- $72,080 is the after-sale, after-tax, after-mortgage-payoff proceeds plus the after-tax future value of the annual positive cash flows as they occur. In other words, this is the cash in your pocket after the sale is complete.

- The Analyzer uses the present value, the future value, and an annuity due function to calculate the annual after-tax adjusted rate of return of 7.37 percent.

- Since the 7.37 percent is after tax, the Analyzer divides it by the after-tax rate to find the pretax return for comparison with the pretax safe investment rate. Thus, you can compare the 5.17 percent safe rate to the 12.7 percent rental property profit rate.

The Analyzer takes the hocus-pocus out of the comparison. You could make the rental property decision knowing that your rental property projections show a possible 245.64 percent better financial reward than you are getting with the safe investments.

The Analyzer does the heavy lifting on the rental property. It:

- calculates the depreciation on the building part,

- amortizes the mortgage acquisition costs,

- calculates the unrecaptured Section 1250 gain that’s subject to the 25 percent capital

- gains tax (special tax on your capital gains attributable to depreciation),

- calculates the capital gains tax on the sale,

- adjusts the calculations based on paying off the mortgages,

- calculates the present value,

- calculates the future value,

- considers appreciation of the property,

- considers inflation of all the costs,

- considers the time value of money, and

- gives one easy-to-understand result.

Crystal Ball Cleaner

You have to consider the Analyzer a crystal ball cleaner. To make a sound rental property purchase, you need logic and common sense. The Analyzer allows you to apply your logic and common sense quickly and almost magically to a property.

The Appreciation Factor

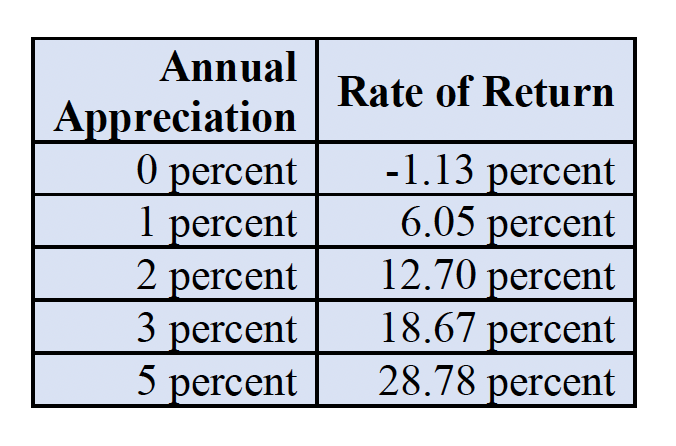

The 12.7 percent rate of return comes from a rental where the projected increase in value is 2 percent per year during the seven-year holding period. Let’s see what happens when you change your appreciation estimates:

The beauty of the Analyzer is that you can easily change the parameters. Suppose you are worried that your 2 percent is too high or too low. Simply change the rate to see the effects. If this property does not appreciate at all, you lose $1,968 after taxes. The Analyzer gives you this information.

Say you really expect something closer to 5 percent appreciation. At 5 percent property appreciation, the Analyzer tells you that on this property, you will earn 28.75 percent compounded annually, pretax. That’s 556.68 percent better than your 5.17 percent safe rate. If your input is accurate, the property gives you a net walkaway cash profit of $85,310. The Analyzer tells you so.

Interest Rate Factor

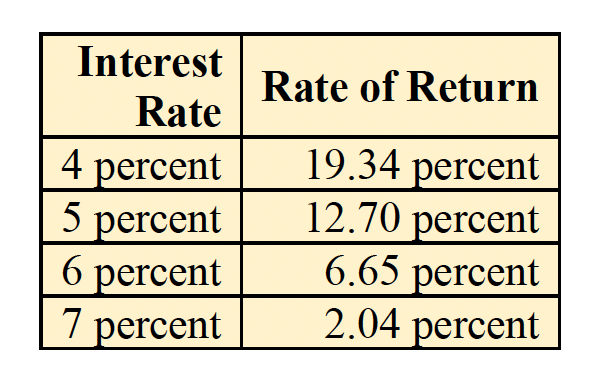

Leverage is a big deal when you buy rental properties because it can multiply your profits. But if the cost of leverage, the interest rate, is too high, your investment return can go sour.

Today’s interest rates are high compared with just a few years ago. The beauty of the Analyzer is that it takes the mystery out of the interest rate and other factors. Let’s take this property and examine how interest rates affect the rate of return:

Note the huge impact that interest rates have on this sample property. (We adjusted the interest rates on both the first and second mortgages.)

Tax Rates

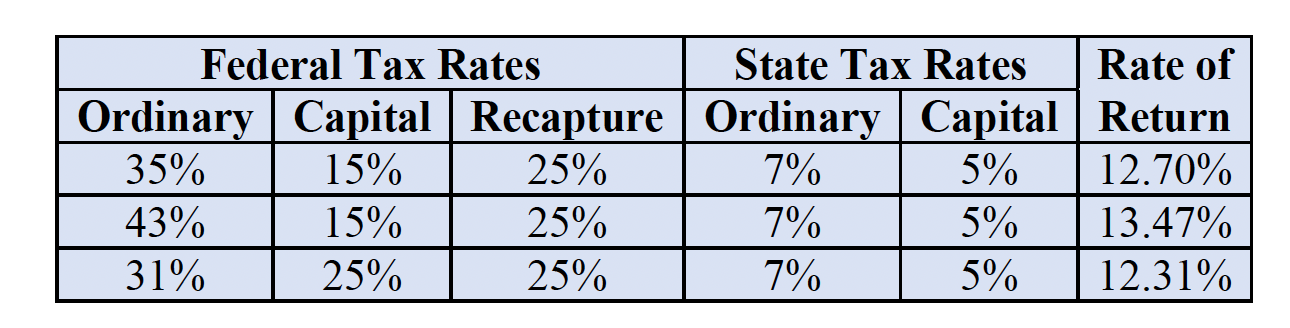

Tax rates, especially how much they will increase, are a hot topic every year. With the Analyzer, you can factor in tax increases and decreases. We did that below:

Incredible! An increase in the ordinary federal income tax rate produces an increase in the rate of return on this rental property. Wow! You would not think that. And those revelations add to the reasons that the Analyzer is a great tool.

Okay, fine, but what’s the logic? What makes a rental property rate of return increase when the government raises ordinary income tax rates?

Tax subsidies! It works like this. The property in this example produces a tax loss during the seven years before the sale. You deduct the losses either when incurred or when the property is sold depending on your passive-loss status. But either way, the higher ordinary income tax rate increases profits because it subsidizes your losses.

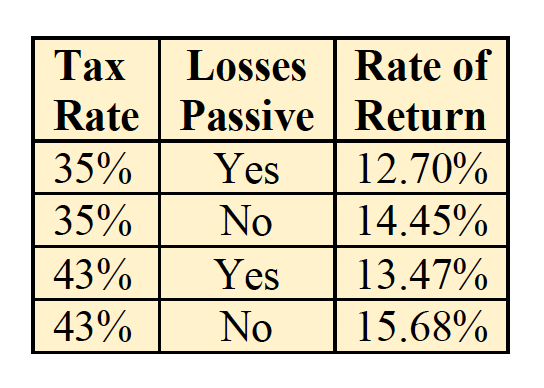

Passive Losses

You know from the above chart that the higher ordinary income tax rate increases your profits because of the tax subsidy. The passive-loss rules control the benefit of your subsidy. If you can deduct your rental property losses each year as you incur them, then your benefit from the losses increases because you have the money in hand—and it’s earning money. Note that this is true at both the 35 percent and 43 percent rates in the table above.

Quick Primer

Here’s a short video on using the Analyzer.

Time for You

Okay, we could go on and on, but it’s time for you to put your numbers in the Analyzer and watch with glee as your answers display.

Make a change and check the answers. Then, take the data from your rental properties and enter it in the Analyzer (click here). You will like knowing how your existing and potential rentals will fare under the various scenarios.

Note. For existing properties, enter property data as if you were buying that property today. Use as the down payment the difference between the fair value of the property and its existing mortgages.

Takeaways

The key to understanding whether a rental property is a viable investment hinges on making an accurate, well-reasoned projection of its potential profitability.

This article introduces a novel tool dubbed “the Analyzer” that calculates the after-tax adjusted rate of return, allowing you to understand how a particular property stacks up against other types of investments.

The Analyzer offers a comprehensive breakdown of multiple financial aspects associated with owning a rental property, including depreciation, mortgage acquisition costs, capital gains tax, and the potential impact of property appreciation, among others. It uses this data to give a clear, straightforward rate of return that can be compared directly to the rates for other investment opportunities.

Interestingly, the tool also allows for the adjustment of multiple variables, including changes in property appreciation rates, interest rates, and tax rates. This capacity for customization makes it a highly flexible and insightful tool for you as a property investor.

This article underscores the importance of factoring in tax subsidies when considering a rental property’s rate of return. Depending on your passive-loss status, these tax deductions can significantly increase profits.

In summary, the Analyzer enables you to predict the profitability of a rental property investment in a systematic, comprehensive, and easily understandable manner. Its unique comparative feature allows for an informed evaluation against other forms of investments, making it a valuable tool in your financial arsenal.

Defining “Real Estate Investor” and “Real Estate Dealer”

Let’s start with the big-time tax consequences of distinguishing between these two classifications.

Profits on dealer sales by individuals are generally subject to taxes at both:

- ordinary income rates of up to 37 percent,(1) and

- self-employment rates of up to 14.13 percent.(2)

In addition, dealers may not:

- depreciate property held for sale to customers,

- use the tax-favored installment method to report their property dispositions, or

- use Section 1031 to defer taxes.

Good Tax Breaks for Dealers

Profits on investor sales are:

- taxed at tax-favored capital gains rates of 23.8 percent or less, and

- not subject to self-employment taxes.

Say you have a $90,000 profit on the sale of a property.

- Dealer taxes could be as high as $46,017.(3)

- Investor taxes could be as high as $21,420.(4)

The investor living in the highest federal tax rate saves $24,597 in taxes (a goodly sum).

In addition, the investor:

- depreciates the property,

- may sell using the tax-favored installment sales method, and

- may defer the taxes by using the Section 1031 tax-deferred exchange.

Investors face the $3,000 limit on net capital losses (after offsetting gains against losses).

Investors also suffer the disadvantage of treating selling expenses as reductions in sales proceeds, meaning that selling expenses produce benefits only at capital-gains tax rates.

You Can Be Part Dealer and Part Investor

You, the individual taxpayer, can be both a dealer and an investor! The law looks at each property separately.(5)

To make this work to your advantage, you need to shine a light on your properties by making a clear distinction in your books and records as to which properties are investment properties and which are dealer properties.

Should you fail to make the distinction in your books, you place yourself at the mercy of the IRS. (The word “mercy” does not exist in the tax code—we know, because we searched—so expect a very unhappy result if you rely on mercy from the IRS.)

The courts look at your intent in buying and holding the property. Your books and records help establish intent.

Notice the word “help.” Your purpose in buying and holding does not control. It only helps. When push comes to shove, the courts examine the sale when they rule on your property and its dealer or investor status.(6)

Establish Intent

Set yourself up to make a strong case. Establish your intent:

- when you buy the property,

- while you own the property, and

- when you sell the property.

This article helps you do that.

True, circumstances can change. You may buy the property for one purpose, and then something may happen to change your intention. This article will help you realize what that change means and how you can plan for a better result.

The Critical Point-of-Sale Aspect

Before getting to the planning part of this article, which revolves around the attributes of a dealer and an investor, you need to focus on one major aspect: how your property looks at the time of sale. This point-of-sale look gets the full focus of the IRS and the courts, and often it determines the property’s classification as dealer or investor property.

Understanding the attributes of a dealer, described below, and the attributes of an investor that follow will help you look at your property in the correct light.

Determining Tax Attributes of Your Property

Remember, each property stands alone as a dealer or an investor property. Your property might possess some attributes of a dealer property and some attributes of an investor property. When your property exhibits mixed characteristics, the court will base its decision on its interpretation of your facts as to the property. Allowing the court to do this for you is a bad idea.

Most people who have trouble with the dealer and investor property classifications have that trouble after the fact, meaning they do not know what they are doing beforehand.

You will not have this problem, however, because you will learn how the tax rules can classify your property as dealer or investor property. Then, once you clearly understand the differences, you can plan appropriate attributes for your property.

The Real Estate Dealer’s Tax Attributes

“Dealer property” is property you hold for sale to customers in the ordinary course of a trade or business.(7) The more properties you buy and the more properties you sell during a calendar year, the greater the chances that you are a dealer with respect to those properties. (8)

If you are hoping that the courts or the IRS have set the number of transactions that classify property as dealer property, you are flat out of luck. No such number exists.

To make sure that you don’t even think of some magic number, the courts have ruled as follows:

- One sale earned S & H, Inc., dealer status because— before the property’s acquisition—S & H agreed to sell the property to a third party.(9)

- And yet the sale of 90 homes in one year did not earn dealer status for Nathan Goldberg. (10)

To show you how things can get confused, the Goldberg case was decided against Nathan Goldberg by the Tax Court and then overturned by the Fifth Circuit. In Goldberg, the homes were built as rentals during World War II. When the war ended, rentals ended, and thus the houses could be (and were) sold. Here, the homes were:

- built for rental,

- used for rental, and

- sold.

The homes were never built for resale to customers in the ordinary course of business.

From all this, you can rightly conclude that no right number of sales and purchases automatically makes property a dealer or an investor property. But the general rule you can recognize by reviewing a great number of court cases is that the greater the number of properties bought and sold, the greater the chances that these are dealer properties.

A property that you buy, fix up, and sell generally is a dealer property.(11) Also, a property that you subdivide has a great chance of being a dealer property,(12) except when the subdivision is done under the very limited rules of Section 1237.(13) Even the removal of a lien to make the property more salable can indicate dealer status.(14)

Sales efforts can indicate dealer status. The courts often declare a property to be a dealer property when the taxpayer engages in extensive marketing and sales efforts, especially compared with the taxpayer who takes a passive marketing approach.(15)

A property held for a short period indicates dealer status.(16) The courts know that good cash and profit management make the dealer want to turn over the property quickly. If you generally make your living from dealer income, your properties are more likely to be classified by the courts as dealer properties.(17)

Making a living is only one measure of dealer status. Time spent is also an important factor. If you spend most of your time buying and selling property for your own account, your properties look like dealer properties.(18)

If you sell a property and take the proceeds from the sale to purchase additional real estate, the court is more likely to conclude that you are a dealer rather than an investor.(19)

Tainted by a Dealer

Attribute We have just covered the attributes that could classify some or all of your properties as dealer properties. But the fact that a property carries the taint of one dealer attribute does not make that property a dealer property.

Further, the fact that your portfolio contains dealer properties does not preclude your portfolio from also including investor properties. Remember, each property stands alone. When you look at the dealer attributes and how they apply to your property, think of them as signs on the road to help you reach your destination. Try to get the property attributes lined up from the time of purchase through the time of sale.

The Real Estate Investor’s Tax Attributes

Unlike with dealer property, where the dealer’s principal purpose for owning the property is to sell it to customers in the ordinary course of business, the investor’s purpose in owning property is to:

- have it appreciate and/or

- produce rental income.

Investor properties are sold infrequently.(20) Properties bought for the primary purpose of producing rental income are investor properties.(21)

Generally, the courts deem that you hold property as an investor when you acquire the property by:

- inheritance, (22)

- dissolution of a trust, (23) or

- foreclosure of a mortgage.(24)

You can even significantly improve a decedent’s real estate and still realize investor status. (25) But be careful here. Should you make substantial improvements and then sell the decedent’s real estate and reinvest the proceeds in other real estate, you will have a more challenging time convincing the court that you are merely an investor.

Further, should you now start subdividing the land and otherwise act as a dealer, the courts will make you a dealer.(26) But for how you can possibly do this, see Selling Appreciated Land? Use the S Corporation to Lock in Favorable Capital Gains Treatment. In general, investors hold the property longer than dealers do. And the longer you hold property, the better the chances that your property is investment property.(27) The investor does not buy, remodel, and then sell. Investors may remodel, but they do so to realize an increase in rental income. They do not remodel for the sole purpose of selling the property in the ordinary course of business.(28)

Takeaways

Keep two general rules in mind:

- The dealer buys property to resell the property to customers in the ordinary course of business.

- The investor buys property for appreciation, for rental income, or for both purposes. If your property does not fall at one end of the spectrum, make sure it meets as many of the attributes for your desired outcome as possible.

Each property stands alone regarding its status as a dealer or an investor property. Thus, you (the individual taxpayer) or your corporation may own both dealer and investor properties.(29) In such a case, make certain that you are classifying your properties correctly. The tax consequences of failing to do so are enormous.

If you have both types of properties, make a clear distinction in your books and records as to which properties are investment properties and which are dealer properties.

- 2023 Federal Tax Rates.

- Self-employment rate of 15.3 percent times the 92.65 percent Schedule SE adjustment equals the effective rate of 14.13 percent.

- For instance, if you were married to a spouse with good income, this was your only income taxed at the highest federal rate of 37 percent, and you also paid self-employment taxes at 14.13 percent.

- Here, you have the 20 percent capital-gains rate plus the 3.8 percent net-investment income tax.

- Tollis v Commr., T.C. Memo 1993-63.

- Sanders v U.S., 740 F.2d 886.

- IRC Section 1221(a)(1).

- Sanders v U.S., 740 F.2d 886; Suburban Realty Co. v U.S., 615 F.2d 171.

- S & H, Inc. v Commr., 78 T.C. 234.

- Goldberg v Commr., 223 F.2d 709, 55-1 USTC paragraph 9519 (5th Cir. 1955).

- Jarret v Commr., T.C. Memo 1993-516.

- Rev. Rul. 57-565 allowed capital gains treatment for the land not subdivided when the taxpayer had subdivided 40 percent into lots and sold those lots.

- IRC Section 1237.

- Miller v Commr., T.C. Memo 1962-198.

- Hancock v Commr., T.C. Memo 1999-336.

- Stanley Inc. v Schuster, aff’d per curiam, 421 F.2d 1360, 70-1 USTC paragraph 9276 (6th Cir.), cert. denied, 400 US 822 (1970); 295 F. Supp. 812 (S.D. Ohio 1969).

- Suburban Realty Co. v U.S., 615 F2d 171.

- Armstrong v Commr., T.C. Memo 1980-548.

- Mathews v Commr., 315 F2d 101.

- Rymer v Commr., T.C. Memo 1986-534.

- Planned Communities, Inc. v Commr., 41 T.C.M. 552.

- Estate of Mundy v Commr., 36 T.C. 703.

- U.S. v Rosebrook, 318 F.2d 316, 63-2 USTC paragraph 9500 (9th Cir. 1963).

- Cebrian v U.S., 181 F. Supp 412, 420 (Ct. Cl. 1960).

- 25 Yunker v Commr., 256 F.2d 130, 1 AFTR2d 1559 (6th Cir. 1958).

- U.S. v Winthrop, 417 F.2d 905, 69-2 USTC paragraph 9686 (5th Cir. 1969).

- Nash v Commr., 60 T.C. 503, acq. 1974-2 CB 3.

- Metz v Commr., T.C. Memo 1955-303.

- Harbour Properties, Inc. v Commr., T.C. Memo 1973-134; Howell v Commr., 57 T.C. 546; Real Estate Corp. v Commr., 35 T.C. 610 (1961), aff’d, 301 F.2d 423 (10th Cir. 1962); Mieg v Commr., 32 T.C. 1314 (1959).

Real Estate Investment Bootcamp

Question

I am a full-time real estate investor. In May, I paid about $15,000 for a one-week boot camp. I know that the law does not allow deductions for investment seminars. Does that mean I may not deduct my tuition and travel to the boot camp?

Answer

Your deductions for the boot camp hinge on the answer to this question: Are your real estate activities a business or an investment?

- If your real estate is a business, you may deduct all the costs of the boot camp, including travel to and from.

- If your real estate is simply an investment, the costs of the boot camp are not deductible.

- Whether your real estate is an investment or a business is a question of fact.(1)

Indicators That You Are an Investor

Looking at some past decisions, real estate activities that did not rise to the level of a business included the following:

- Rental of real estate under a net lease. The court noted that the net lease did not rise to the level of a business because simply collecting rent is not a business.(2)

- Rental of real estate owned partly by a New Jersey person, but physically located in Tennessee and managed by the Tennessee owner.(3) The New Jersey person did not have any hands-on contact with the properties; therefore, the court ruled that he was not in the real estate business.

Indicators That You Are in Business

Real estate activities that have risen to the level of a business include the following:

- The rental of a single piece of real property for the production of income.(4)

- A taxpayer’s personal efforts to manage six rental units, including seeking new tenants, supplying furnishings, and cleaning and otherwise preparing the units for new tenants. The court found that the activities were sufficiently systematic and continuous to place him in the business of real estate rental.(5)

- A taxpayer’s activities regarding several parcels of land, such as managing the parcels through an agent; paying the mortgages, taxes, and expenses personally; and purchasing and selling the parcels as conditions dictated.(6)

Your answer lies in your facts: if you have a hands-on relationship with your real estate activities, odds are that those activities comprise a business for tax purposes.

Takeaways

To deduct a real estate investment seminar or boot camp, you need your real estate activity to rise to the level of a business. Your involvement generally determines how the tax rules will treat your real estate activities.

For instance, a hands-on relationship with the real estate activities—including managing properties personally, seeking tenants, and deciding when to buy or sell properties—is an indicator of a real estate business.

In contrast, simply collecting rent from net leases or owning properties managed by others could indicate a real estate investment.

- E.g., see Spermacet Whaling & Shipping Co. v Commr., 30 T.C. 618, 631 (1959), aff’d, 281 F.2d 646 (6th Cir. 1960); Edwin Curphey v Commr., 73 T.C. 766 (1980).

- Neill v Commr., 46 B.T.A. 197, 198 (1942).

- Steven J. Scagliotta v Commr., T.C. Memo 1996-498.

- Fegan v Commr., 71 T.C. 791, 814 (1979), on appeal (10th Cir., July 30, 1979), case involved a hotel; Elek v Commr., 30 T.C. 731 (1958), acq. 1958-2 C.B. 5, case involved an apartment house; Lagreide v Commr., 23 T.C. 508 (1954), case involved a single-family rental home; Hazard v Commr., 7 T.C. 372 (1946), acq. 1946-2 C.B. 3.

- Edwin Curphey v Commr., 73 T.C. 766 (1980).

- Pinchot v Commr., 113 F.2d 718, 719 (2d Cir. 1940).

Holding Real Property in a Corporation: Good or Bad Idea?

Real estate prices have cooled off in many parts of the country. In some areas, values are actually dropping after reaching all-time highs in the middle of last year. Gasp!

Even so, real property is still probably a wise investment over the long haul. But what about taxes? That’s always a question, right?

For tax reasons, you are generally well advised not to hold real property in a corporation. LLCs and revocable trusts are usually better alternatives. But there’s one scenario where using an S corporation to own property can pay off tax-wise. We will explain.

C Corporation Ownership Exposes Double Taxation Threat

Holding depreciable real property or land in a C corporation is generally a bad idea from a tax perspective. When you sell the property for a taxable gain (net sales proceeds in excess of the tax basis of the property), the gain could be taxed once at the corporate level and again at the shareholder level when the gain is distributed as all or part of a shareholder dividend. This is the dreaded double taxation scenario.

Under our current federal income tax regime, double taxation is not as deadly as it was before the 2017 Tax Cuts and Jobs Act (TCJA). That’s because the TCJA permanently (we hope) installed a flat 21 percent corporate federal income tax rate. The 21 percent rate applies to all corporate taxable income, including gains from selling real estate.

For corporate dividends received by individuals, the TCJA retained the favorable 15 percent and 20 percent federal income tax rates. You might also owe the 3.8 percent net investment income tax (NIIT) on dividends.(1) And you might owe state income tax too. Not great! But the double taxation threat was much worse in the past. Before the TCJA, the maximum corporate federal income tax rate was 35 percent instead of the current 21 percent.

Before the so-called Bush tax cuts, corporate dividends received by individuals were taxed at ordinary income tax rates versus tax-favored capital gains rates as they are now. Before the TCJA, ordinary income rates could reach 39.6 percent versus the current 37 percent maximum rate.

While the double taxation threat is diminished under the current federal income tax regime, our federal debt is now over $31 trillion and counting. At some point, the bleeding has to be stopped. So, there’s certainly a risk that (1) the corporate rate could be hiked and (2) dividends could once again be taxed at higher ordinary income rates.

Finally, the current 37 percent maximum individual rate on ordinary income is scheduled to revert to 39.6 percent when the TCJA individual rate regime sunsets after 2025. If these things happen, double taxation could once again be a deadly threat.

Key point. You can have a taxable gain when you sell depreciable real property even if the property has not gone up in value. That’s because depreciation deductions reduce the tax basis of the property. So, if your C corporation sells depreciable property for exactly what it cost, there will be a taxable gain equal to the cumulative depreciation deductions claimed over the years. And that gain could be hit with double taxation.

Example: Double Taxation Illustrated

Your solely owned C corporation business needs a building. You set up a single-member LLC owned solely by you or a revocable trust to buy the property and lease it to the corporation. More on single-member LLCs and revocable trusts later. After a few years, you sell the property for a $500,000 gain. The entire gain will be taxed on your personal return. Part of the gain (the amount attributable to depreciation deductions) will be taxed at 25 percent. The balance will be taxed at no more than 20 percent under the current rate regime. You may also owe the 3.8 percent NIIT on all or part of the gain—and maybe state income tax too.

Assume you pay a total of $130,000 to Uncle Sam for capital gains tax and the NIIT. Your after-tax profit is $370,000 ($500,000 – $130,000). We ignore any state income tax. Now let’s see what happens if your C corporation buys the same property. Under the current rate regime, the $500,000 gain will be taxed at the 21 percent corporate rate. The corporation pays the $105,000 federal income tax bill and distributes the remaining $395,000 to you (we ignore any corporate state income tax).

Assume the $395,000 constitutes a dividend that will be taxed at the maximum 20 percent individual rate under the current federal tax regime. Plus, we assume you’ll owe the 3.8 percent NIIT on the $395,000 gain. So, the tax hit at your personal level is $94,010 ($395,000 x 23.8 percent). After paying federal income taxes at both the corporate and personal levels, your after-tax cash equals $300,990 ($500,000 – $105,000 – $94,010). Compare the $300,990 to the $370,000 you would receive under the single-member LLC/trust ownership alternative. Your after-tax cash is 23 percent higher with the singlemember LLC or trust setup.

Key point. As stated earlier, it’s not necessary for property held by a C corporation to actually appreciate in value for a taxable gain on sale and resulting double taxation to occur. The conclusion in this example would be the same if the entire $500,000 gain was caused by depreciation—although your personal tax bill would be a bit higher under the single-member LLC/trust ownership alternative due to the 25 percent federal rate on gains attributable to depreciation.

Depreciation lowers the tax basis of the property, so a tax gain results whenever the sale price exceeds the depreciated basis.

Conclusion. Don’t hold real property in a C corporation. The risk of adverse tax results is too high. That is especially true for depreciable property.

The Single-Member LLC Option

A single-member LLC is an LLC with only one owner, who is called the “member.” Under the IRS’s so-called check-the-box entity classification regulations, you can generally ignore the existence of a single-member LLC for federal tax purposes. The exceptions are:

- when you elect to treat the single-member LLC as a corporation for tax purposes (relatively unusual), and

- for purposes of federal employment taxes and certain federal excise taxes where the single-member LLC is treated as a corporation.(2)

When you choose not to treat your single-member LLC as a corporation for federal income tax purposes, the single-member LLC has so-called disregarded entity status, which we will call a “disregarded single-member LLC.”

The federal income tax treatment of a disregarded single-member LLC is super simple, because its activities are considered to be conducted directly by the single-member LLC’s sole member. That would be you. So, when you use a disregarded single-member LLC to own real estate, you simply report the federal income tax results, including any gain on sale, on your Form 1040. You need not file a separate federal income tax return for the single member LLC.

Take Advantage of Single-Member LLC Liability Protection

Although you ignore a disregarded single-member LLC for federal income tax purposes, it is not ignored for general state-law purposes. Therefore, a disregarded single-member LLC will deliver to its sole member (that would be you) the liability protection benefits specified by the applicable state LLC statute. These liability protection benefits are usually similar to those offered by a corporation.

Bottom line. With a disregarded single-member LLC, you get super-simple tax treatment with corporation-like liability protection. And you don’t have to worry about the double taxation threat that would exist if you used a C corporation to own property.

The Revocable Trust Option

If real property will be owned solely by you, or only by you and your spouse, consider using a revocable trust to hold the property. Revocable trusts are also commonly called “grantor trusts,” “living trusts,” or “family trusts.” Because you can terminate a revocable trust at any time, any property owned by the trust is considered (for federal tax purposes) to be owned by the grantor(s) of the trust: the individual or spouses who established the trust. That would be you.

When you use a revocable trust to own real estate, you simply report the federal income tax results, including any gain on sale, on your Form 1040. You need not file a separate federal income tax return for the trust, and there’s no double taxation threat.

If you and your spouse set up a revocable trust, it will typically continue to exist as such when the first spouse passes away. The surviving spouse becomes the grantor, and the trust’s existence continues to be disregarded for federal tax purposes. So, the surviving spouse’s Forms 1040 are prepared without regard to the trust.

The advantage of holding property in a revocable trust is that probate is avoided if you pass away. The property will go to the beneficiary or beneficiaries of the trust—or to the surviving spouse, if applicable—with no muss and no fuss. In contrast, if you own property directly without a revocable trust, the probate process can be expensive and time-consuming.

Caveat. We are not practicing law here! Consult an attorney if you are interested in the revocable trust deal.

The Multi-Member LLC Option

Things get more complicated if you are a co-owner of real property. You and the other coowners are probably well advised to set up a multi-member LLC to hold the property. Under the IRS’s check-the-box regulations, multi-member LLCs are treated by default as partnerships for federal income tax purposes—unless you elect to treat the LLC as a corporation.(3) Under the default treatment, you must file an annual partnership federal income tax return on Form 1065—just as you would for a “regular” partnership. The LLC’s tax results are allocated to the members, who are treated as partners for federal income tax purposes. The LLC issues an annual Schedule K-1 to each member to report that member’s share of the LLC’s tax results for the year.

Each member then takes those numbers into account on the member’s own return (Form 1040 for a member who is an individual). The LLC itself does not pay federal income tax, so there is no double taxation threat. This scheme is called “pass-through taxation.”

Key point. Beyond the advantage of pass-through taxation, the partnership taxation rules that multi-member LLCs are allowed to follow have several other advantages that we won’t go into here. We don’t want this article to turn into a book!

The S Corporation Option for Developing Land and Selling It Off

In one scenario, using an S corporation to hold real property can be a tax-saver. Like LLCs and partnerships, S corporations don’t pay federal income tax at the corporate level. They are pass-through entities, which means their tax numbers are passed through to their shareholders. Income and gains are taxed at the shareholder level.

Here’s the story on when using an S corporation to own real property can be a major tax saver. When a taxpayer subdivides, develops, and sells land, the taxpayer is generally deemed for federal income tax purposes to be acting as a dealer in real property who is selling off inventory (developed parcels) to customers.(4)

That’s not good, because when you (an individual taxpayer) are classified as a dealer for tax purposes, all of your profit from land sales—including the part attributable to predevelopment appreciation in the value of the land—is considered ordinary income.

So, that profit is taxed at your ordinary income federal rate, which under the current regime can be up to 37 percent. You may also owe the 3.8 percent NIIT, which can push the effective federal rate up to as high as 40.8 percent (37 percent + 3.8 percent). Ugh!

Seeking a Better Tax Result

It would be much better if you could pay lower long-term capital gains rates on at least part of your land sale profit. The current maximum federal rate on long-term gains is 20 percent. With the 3.8 percent NIIT added on, the maximum effective rate is “only” 23.8 percent (20 percent + 3.8 percent). That’s a lot better than 40.8 percent.

Fortunately, there’s a way to qualify for favorable long-term capital gain treatment for the predevelopment land appreciation, assuming you have really and truly held the land for investment. But profits attributable to the later subdividing, development, and marketing activities will be considered higher-tax ordinary income collected in your capacity as a real property dealer. Oh well. Since pre-development appreciation is often the biggest part of the total profit, however, you should be thrilled to pay “only” 20 percent or 23.8 percent on that piece of the action.

Form an S Corporation to Serve as Developer Entity

Form an S corporation. You can be the sole shareholder, or there can be other co-owners. You can be the sole owner of appreciated land, or there can be other co-owners. Sell the appreciated land to the S corporation for its pre-development fair market value. This is a good option as long as:

- you’ve held the land for investment rather than as inventory as a real property dealer,

- you’ve held it for more than one year, and

- the sale to the S corporation will qualify for lower-taxed long-term capital gain treatment

You—and the other shareholders, if applicable—will lose at most “only” 23.8 percent of your gain to Uncle Sam. The S corporation then subdivides and develops the property and sells it off. The profit from those activities will be classified as ordinary income that’s passed through to you (and the other shareholders, if applicable) and taxed at your personal rates on your Form 1040.

The S corporation itself does not pay federal income tax, so the double taxation threat that afflicts C corporations is not a problem. Even though part of your profit will be taxed at higher ordinary income rates, this is still a great tax-saving deal when the land is highly appreciated to start with.

To sum up: the S corporation developer entity strategy allows you to lock in favorable long-term capital gain treatment for the pre-development appreciation while paying higher ordinary income rates only on the additional profits from development and related activities. Again, that’s much better than paying higher ordinary income rates on the entire profit.(5)

Make Sure to Use an S Corporation

Make sure your developer entity is an S corporation rather than a controlled partnership or a controlled multi-member LLC that’s treated as a partnership for federal tax purposes. Why? Because a little-known provision mandates high-taxed ordinary income treatment for gains from sales to a controlled partnership or a controlled LLC that’s treated as a partnership for tax purposes, when the asset in question is not a capital asset in the hands of the partnership or LLC.(6)

Since the land in your situation would be inventory and not a capital asset in the hands of a controlled partnership or LLC—the partnership or LLC would be classified as a dealer in real property—the sale to the partnership or LLC would result in high-taxed ordinary income for you.

Solution. Use an S corporation as the developer entity. Don’t use a controlled partnership or an LLC treated as a partnership. Also, don’t use a C corporation as the developer entity, because that could result in double taxation, as explained earlier.

Takeaways

As a general rule, don’t use a C corporation to own real property, because of the double taxation threat. When owning real property for investment, single-member LLCs, revocable trusts, and multimember LLCs are better alternatives from a tax perspective. And don’t overlook this possibility: using an S corporation to develop raw land and sell off parcels can be a big tax saver in the right circumstances.

- IRC Section 1411.

- Reg. Sections 301.7701-1; 301.7701-2; 301.7701-3.

- Reg. Sections 301.7701-1; 301.7701-2; 301.7701-3.

- IRC Section 1221(a)(1); U.S. v Winthrop, 24 AFTR 2d 69-5760 (5th Cir. 1969).

- Here are two court decisions where taxpayers successfully fought off IRS challenges to the S corporation developer entity strategy: Jolana Bradshaw, 50 AFTR 2d 82-5238 (Claims Court 1982) and Richard Bramblett, 69 AFTR 2d 92-1344 (5th Cir. 1992).

- IRC Section 707(b)(2).

Plan Your Passive Activity Losses for Tax-Deduction Relevance

In 1986, lawmakers drove a stake through the heart of your rental property tax deductions. That stake, called the passive-loss rules, causes myriad complications that now, 38 years later, are still commonly misunderstood.

The Trap

In 1986, lawmakers made you shovel your taxable activities into three basic tax buckets. Looking at the buckets from a business perspective, you find the following:

- Portfolio bucket for your 1. stocks and bonds

- Active business bucket for your material participation business activities

- Passive-loss bucket for your rentals plus other activities in which you do not materially participate

This article explains three escapes from the passive-loss trap so that you can realize the tax benefits from your rental losses.

Escape 1: Get Out of Jail Free

Lawmakers allow taxpayers with modified adjusted gross incomes of $100,000 or less to deduct up to $25,000 of rental property losses.(1) Once your income goes above $100,000, the get-out-of-jail-free loss deduction drops by 50 cents on the dollar and disappears altogether at $150,000 of modified adjusted gross income.(2)

Example. You have $90,000 of modified adjusted gross income, all of which comes from your business. You also have a $23,000 rental property loss for the year. Good news. You apply the $23,000 of rental losses against all your income and you realize your full rental-taxloss benefits this year thanks to the $25,000 rule.

Escape 2: Changes in Operations

If you, or you and your spouse, have modified adjusted gross income that exceeds the threshold, you need a different plan to obtain immediate benefit from your rental property tax losses.

To begin, let’s review how the tax-benefit dollars get trapped in the first place. As you may remember from prior articles, to benefit from your rental property tax loss, you must:(3)

- either have passive income from other properties or another source, or

- both qualify as a real estate professional and materially participate in the rental property.

Example. Say the taxable income on your Form 1040 is $200,000 and you have one rental property. Say further that rental has produced a tax loss of $10,000 a year for the past six years, none of which you have been able to deduct because you have no other passive income and you do not qualify as a tax-law-defined real estate professional.

So here you sit: $60,000 in tax deductions trapped in the passive-loss bucket—not available for deduction against the income from the other buckets.

Not Lost, Just Waiting

This is sad, no doubt, but there’s some good news even in this bucket as you now see it. The $60,000 is not going to drown, disappear, or otherwise lose its tax-deduction attributes. That $60,000 simply waits in the bucket for you to give it an escape route.

Here are four possibilities for the escape route:

- Generate passive income.

- Change the character of the rental to non-passive.

- Change your status to that of a real estate professional and pass the material participation test for this property. 3.

- Sell the property, as explained in Escape 3 below.

Generate passive income. Say you change the structure of your rental and it now produces $7,000 of passive income. Thank you, thank you; $7,000 of trapped passive losses now escape and offset that passive income. The $53,000 that remains trapped in the bucket is simply waiting for more passive income to enable its escape.

Change character of rental. Say you own 100 percent of your rental and 100 percent of your business and you now move your business into half of the rental property. The 50 percent business use of this former rental property frees $30,000 (50 percent) of those trapped losses for use against the business income.(4) You have to think, “Is this cool or what?”

S corporation. If the rental or the business is in a separate legal entity (say an S corporation), you will need to make the self-rental election to apply that $30,000 against your business income.(5)

Change your status. First, a short refresher: You establish your participation in the rental each year.(6) For example, your rental could be passive in one year and non-passive in another.(7) Say that today, perhaps by marriage or changing what you do, you are able to both qualify as a real estate professional and materially participate in your property.(8)

Achieving real estate professional status does not automatically free the $60,000 trapped in the bucket—that takes passive income or a disposition (discussed next). But it does mean that the current-year loss of $10,000 escapes the passive-loss bucket and offsets your business and portfolio income.

Escape 3: Total Release

The $60,000 that’s trapped in the passive-loss bucket is like money in the bank. You can tap the trap when you want to release the deductions. It’s really quite easy. Here we are talking about releasing the entire $60,000 at once (a major jailbreak). You might want to do this right now. or you can wait. You have many options, and the good news is that you are the one in charge of this total release of your passive losses.

To release the losses, you need to make a complete disposition. For example, say you sell 100 percent of the property to a third party. Presto! You now deduct the entire $60,000 in trapped passive losses.

Let’s examine how this sale might look on your tax return:(9)

- Your capital gain or loss goes on IRS Form 4797 as a Section 1231 capital gain or loss, where it combines with other gains and losses. If you have a net gain, your gain is taxed at tax-favored capital gains rates. If a loss, the loss is limited to $3,000, with any excess carried over to future years.

- Your gain attributable to real-property depreciation also goes on IRS Form 4797, where it ultimately lands on Schedule D and gets taxed at real-property depreciation recapture rates of up to 25 percent (officially, this recapture tax is called a tax on your unrecaptured Section 1250 gain).

- Your current-year tax loss of $10,000 3. goes on Schedule E.

- Your prior-year tax losses of $60,000 go on Schedule E and combine with the $10,000. Then the $70,000 travels to the front of your IRS Form 1040, where it offsets all forms of income (hurray, hurray!).

In other words, at the time of complete disposition, you treat the gain or loss on the sale of this property as you would any gain or loss—that is, as if no passive-loss rules existed. And then that $60,000 of passive losses that were trapped in prior years and your current year passive loss combine and become totally deductible against all your other income.

Takeaways

The passive-loss rules are bad news, no question about it. Also true, this article uses only one property in its examples. We did that for a reason: clarity. But put this in your mind: if you have multiple properties, you can make a tax-law election to group the properties and then apply the identical strategies above to the group. The one thing to know is that if you have rental property losses that are trapped by the passive loss rules, you can use the strategies you just learned to create an escape for those trapped losses.

- IRC Section 469(i).

- IRC Section 469(i)(3)(A).

- For prior articles on passive losses, check out the Topics list, then click on the passive income and loss link.

- The former passive activity rules track the losses to the uses of the property as described in Reg. Sections 1.469-9(e)(4), Example (ii); 1.469-1(f)(4)(iii), Example 4.

- See our article titled “Avoid the Self-Rental Trap”.

- IRC Section 469(d)(1).

- Ibid.

- IRC Section 469(c)(7).

- Instructions for Form 8582 (2022), posted Oct. 6, 2022.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (for Consumer and Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Retirement Planning

Tax Planning

Coaching and Consulting

Need More Information?

If you require additional details regarding these services, please don’t hesitate to reach out to us at [email protected]. Alternatively, you can schedule a complimentary 15-minute consultation to inquire further and determine whether we align with your needs and expectations. We look forward to assisting you!

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.