Retirement Planning: Securities

A Securities Market Update for You – May 2023

Joseph Maas, Synergy Asset Management

Financial Markets

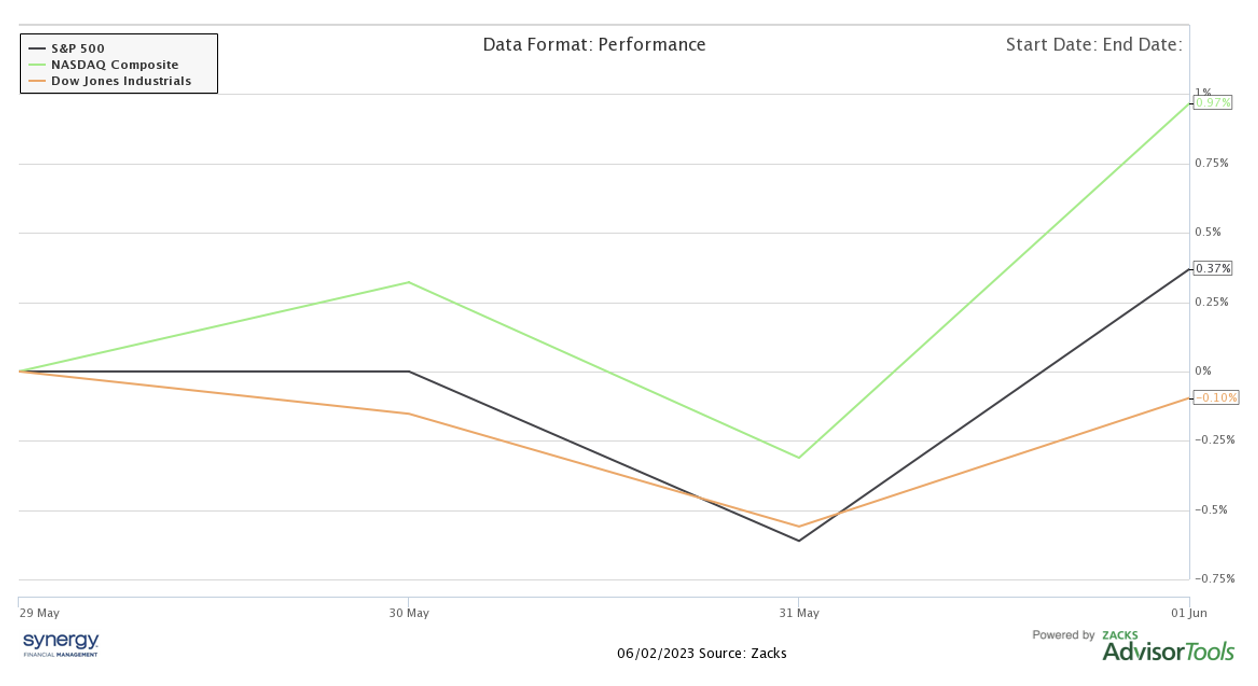

Last week ended with a resolution to the national debt ceiling issue and a unique May jobs report that sent equities higher for the week, all of which changed the outlook for the June Fed meeting. As of Thursday, June 1st, the Nasdaq Composite gained +0.97%, the S&P 500 gained +0.37%, and the Dow Jones Industrial Average down a muted -0.1%.

Market News

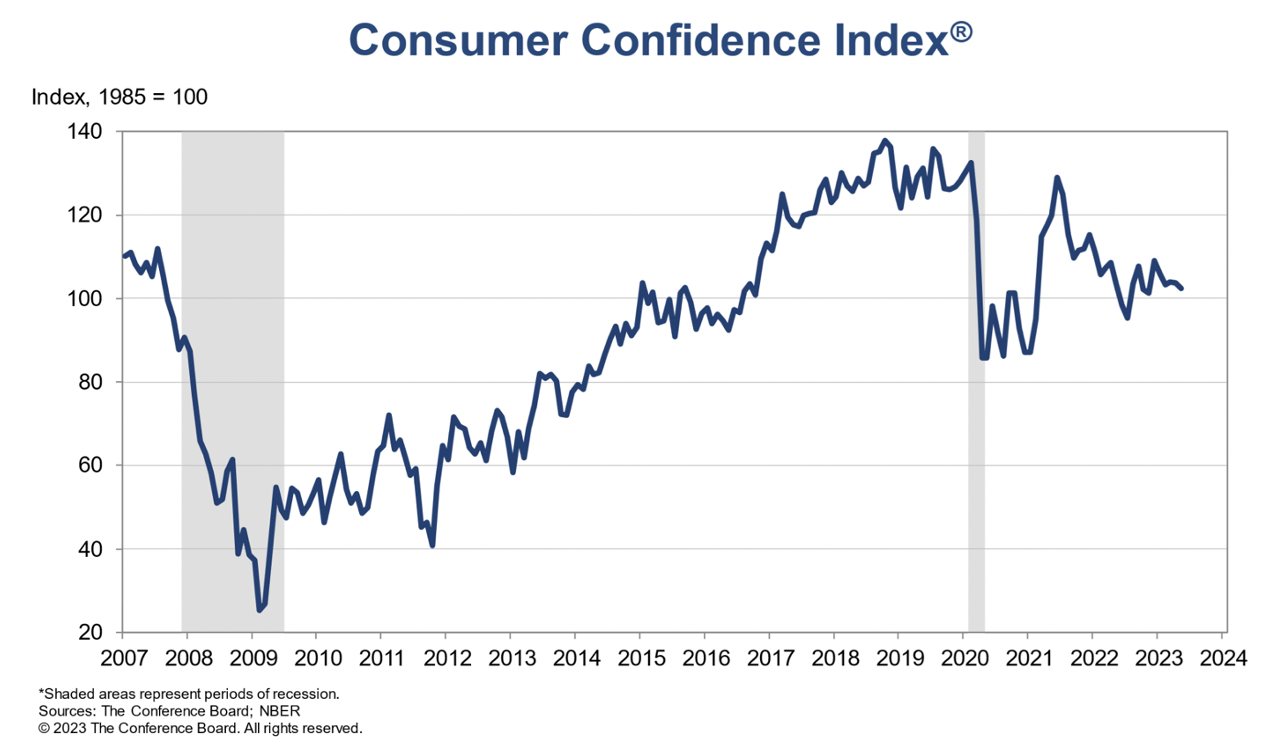

Consumer Confidence. May’s Consumer Confidence Index slipped to 102.3 from April’s 103.7, but perhaps the more interesting data comes from consumers’ responses to key economic questions, particularly regarding inflation and labor markets.

Inflation expectations in the May survey sit near an average inflation rate of 6.1% over the next twelve months, despite current inflation data pointing to inflation rates below this. At the same time, the percentage of consumers who perceived job opportunities as “plentiful” decreased from 47.5% to 43.5%, while consumers who found jobs “hard to get” increased from 10.6% to 12.5% in May.

All of this survey’s data demonstrates that consumers are increasingly aware of economic situations, are still feeling the pressures of inflation, and are experiencing a more difficult labor market than just a few months ago, despite the 3.4% unemployment rate in April.

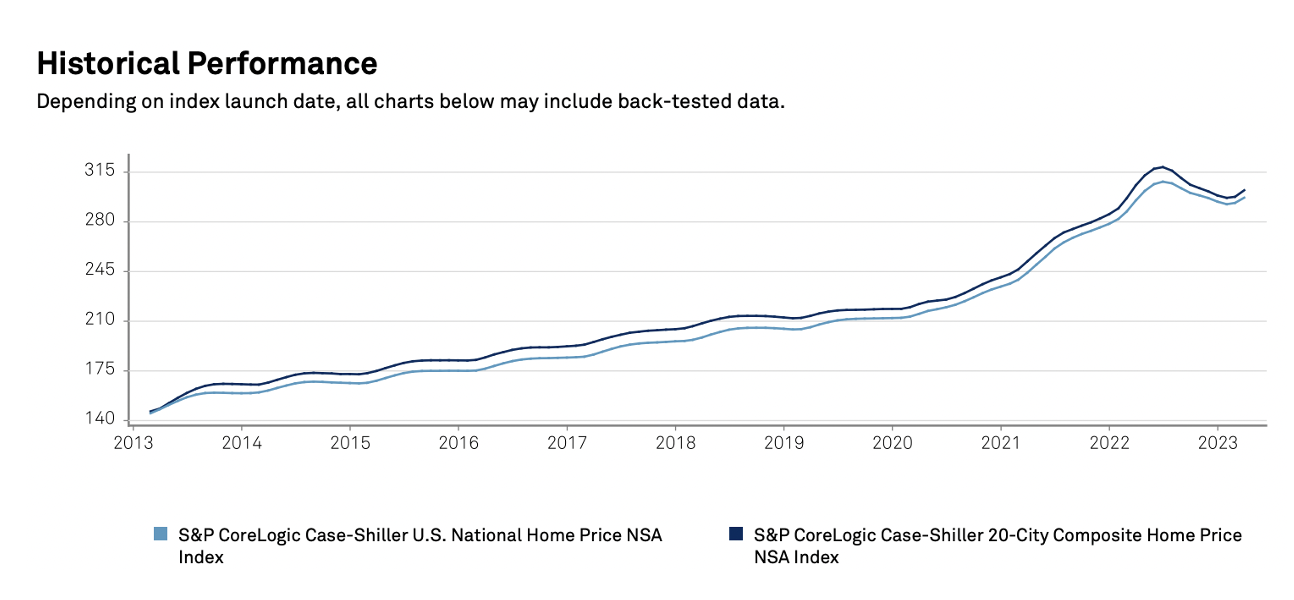

Case Shiller Home Price Index. March’s Case Shiller national home price index was released this week, revealing that nationwide home prices are only up +0.66% from one year ago. At the same time, home prices were up a monthly +1.26% in March, as the typical spring home buying trends come back amidst a backdrop of high mortgage rates, high prices, and lower inventory. One the most interest rate sensitive markets, real estate, has surprisingly remained resilient in this macro landscape, at least for now.

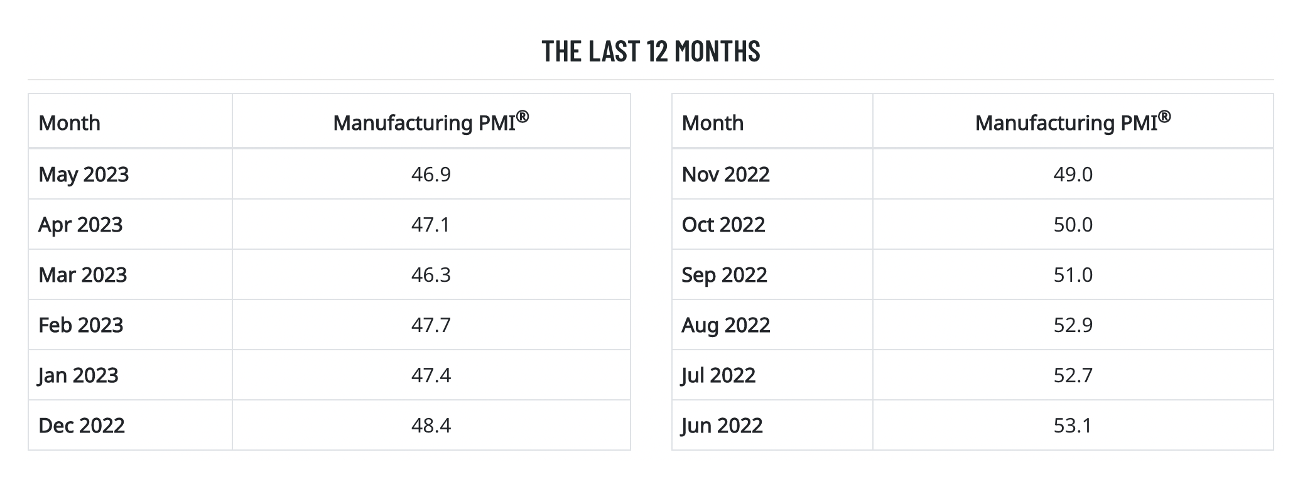

ISM Manufacturing Index. This week, May’s ISM Manufacturing Index slipped more than expected, now at 46.9%, down from April’s 47.1%, also pulling the 12-month average to 49.2%. Since October of 2022, this index has shown a contracting and near recessionary manufacturing industry, as demand for the goods side of the economy slows on a backdrop of higher interest rates.

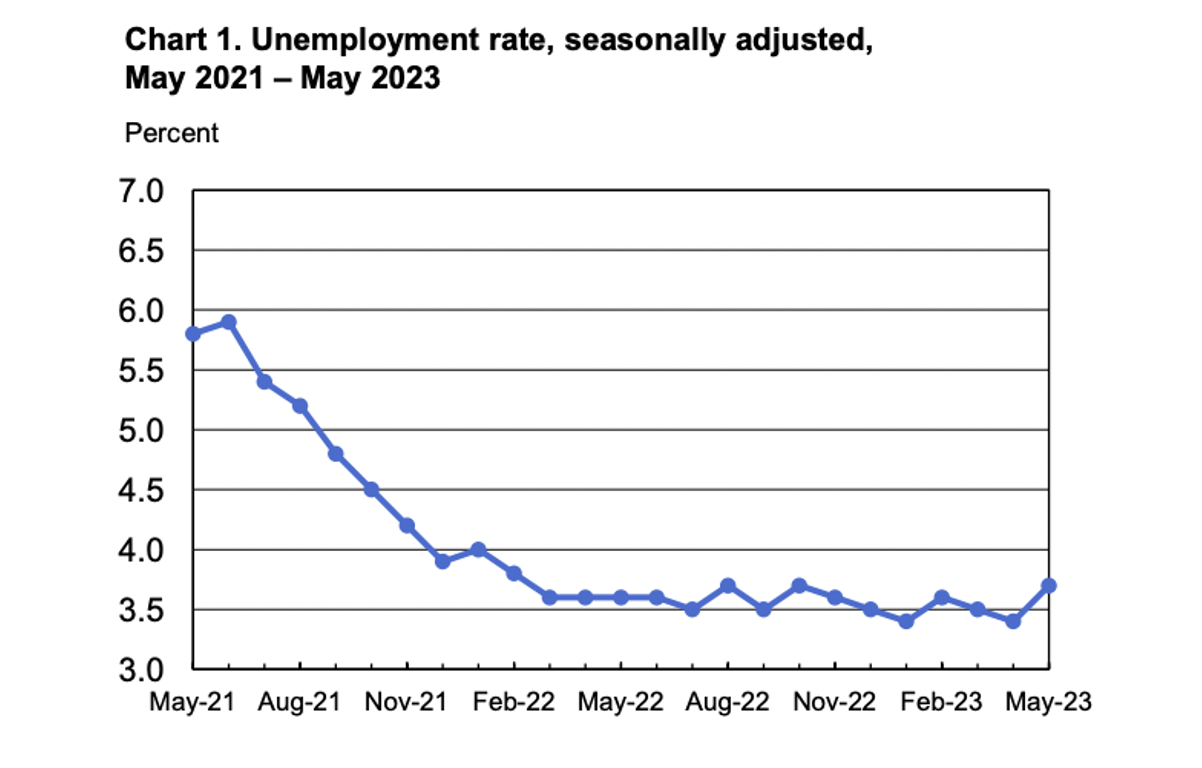

May Employment Report. Friday morning brought us the employment situation report for the month of May, where the unemployment rate rose to 3.7%, higher than estimates of 3.5% and a jump from April’s 3.4% unemployment rate. Despite the jump in unemployment in May, one uptick does not demonstrate a trend and 3.7% is still historically low unemployment. Average hourly earnings grew as expected at +0.3%, while the average workweek fell 0.1 from April to 34.3 hours.

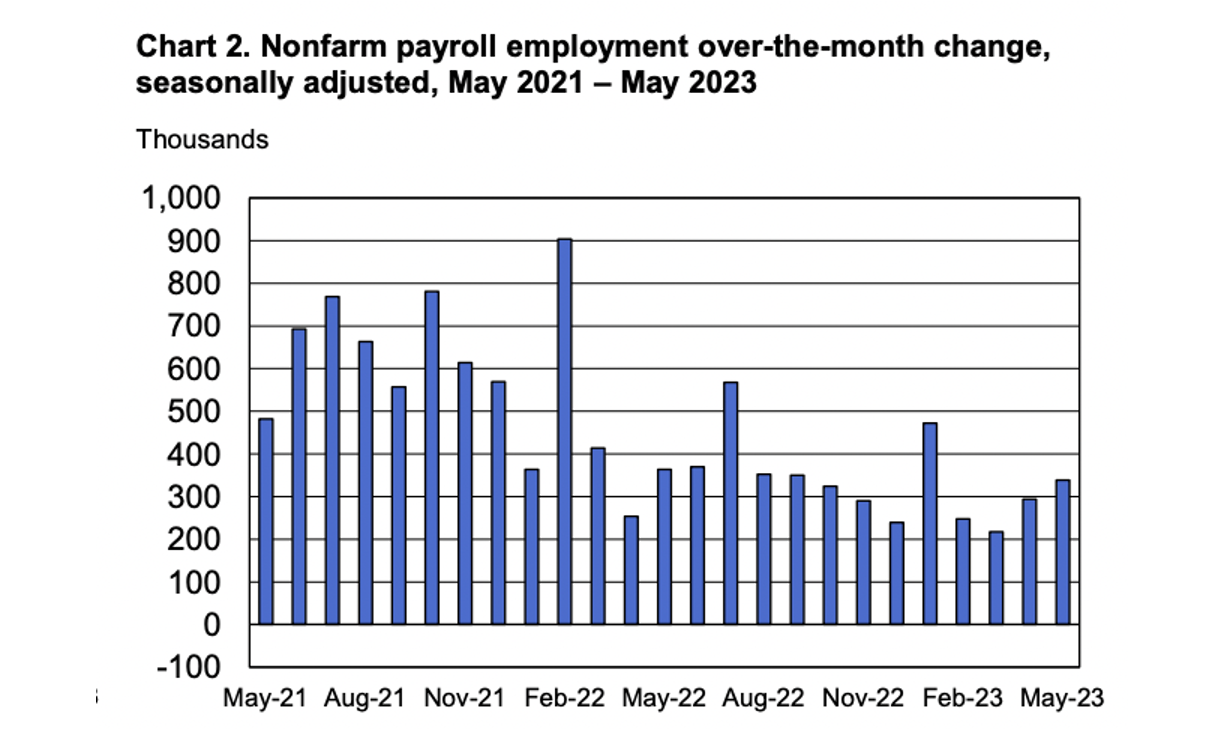

At the same time, the US added +339,000 jobs on nonfarm payroll, much higher than the +205,000 expected and the largest gain since January. Sectors with the most gains include professional/business services (+64,000), government (+56,000), and healthcare (+52,000). Despite the slightly higher unemployment rate, all of this points to a fairly robust labor market still, something that will play a role in the Fed’s thinking on monetary policy.

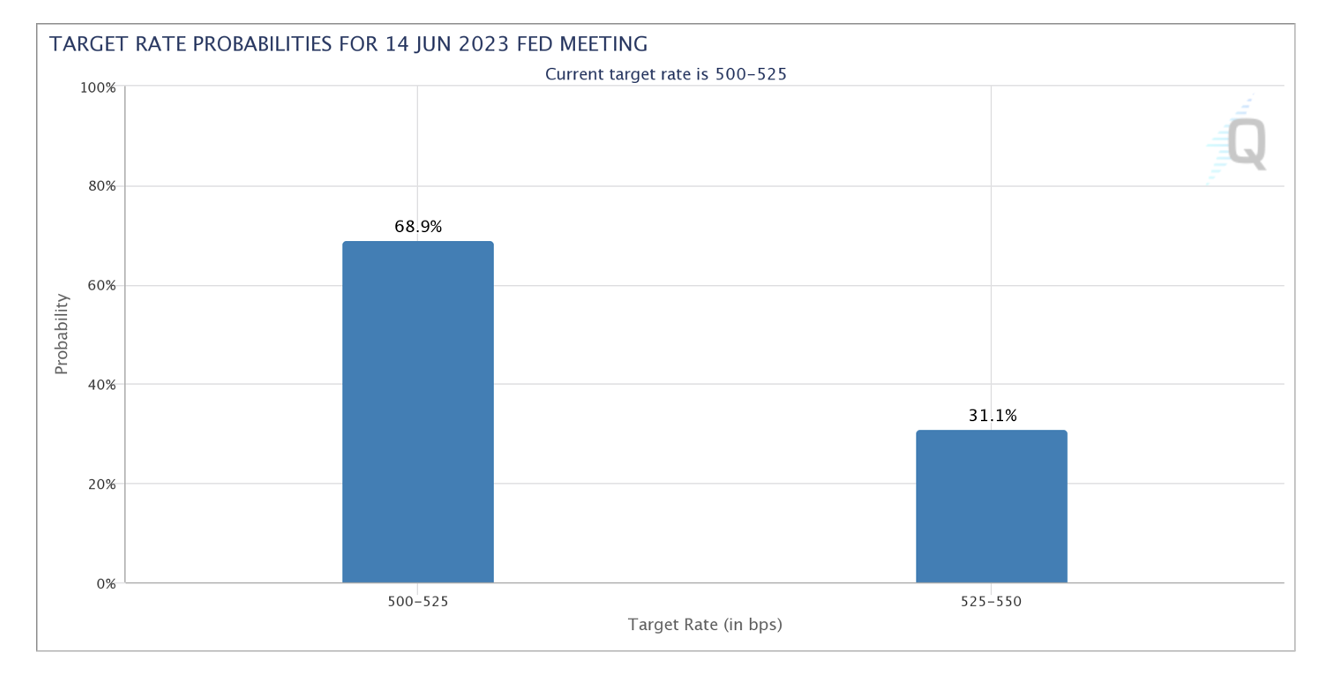

Fed Funds Rate. In just this shortened week, Fed Funds rate probabilities flipped from pricing in a 70% chance of another 25-bps hike at the June 14 FOMC meeting, to the complete opposite scenario, with a 68.9% chance of a pause (as of June 2nd). This comes as economic data points hold the power to flip a rate hike outcome, with key CPI inflation data being released just the day before the big decision.

Summary

One thing we have seen this week, is that uncertainty is certain in this economy, with the US avoiding a default on their debt at the last minute. At the same time, manufacturing indexes show that we may already be in a near recessionary environment, while over +300k monthly job gains in May tell a very different story. Every day of economic data seems to provide a different narrative of how the US economy is doing.

In any case, we look forward to continuing to monitor economy data and adjust portfolios as appropriate given this interesting macro landscape we find ourselves in.

Thank you for your trust.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

Asset Protection

Retirement Planning

Securities

Tax Planning

Coaching and Consulting

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...