Tax Planning

At the core of our financial philosophy lies the awareness that taxes represent life’s most significant expense. Although paying taxes is not optional, the power to optimize how you manage them lies in your hands. This principle, known as “The Net,” underscores the importance of what you keep, not just what you make. Making better, smarter, and safer tax-efficient financial decisions is key to preserving your hard-earned wealth. We are here to empower you with the knowledge and expertise to navigate the complexities of taxation, ensuring you make informed choices that lead to a brighter financial future. Let us guide you on this journey of financial optimization, helping you secure a more prosperous and fulfilling life.

Proprietary Services for Tax Planning

The Smart Tax Minimizer (For Consumer and Home-Based Businesses) ℠

The 4x4 Financial Independence Plan ℠

Specialty Proprietary Services for Tax Planning

The Smart Tax Planning System for Business Owners ℠

Products for Tax Planning

Annuities

Charitable Trusts & Annuities

Delaware Statutory Trusts

Employee Retention Tax Credit (ERTC)

In-Service Alternative Rollovers

Insurance-Disability

Insurance-Life

Insurance-Long Term Care

Micro-Captive Insurance Companies

Mortgages-Forward

Mortgages-Reverse

No-Load Annuities

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Research & Development Tax Credits (R&D, etc.)

Retirement Plans - Pension & Profit Sharing Plans - The Super(k)

Retirement Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Self-Directed Brokerage Accounts

Coaching and Consulting

BLOG

Browse All Tax Planning Articles, Videos, Podcasts

Deducting Meals and Entertainment in 2021 -2022

Tax PlanningA special report by the Bradford Tax InstituteHow much can you deduct for business meals and entertainment? 100 percent? 50 percent? 0 percent? The answer is YES! (Or more precisely, depending on the circumstances, it may be all of the above.)In this...

The Smart Tax Planning Newsletter January 2022

Tax PlanningEvery month we provide you with a fairly detailed review of several Important Tax Topics. Scan through the highlighted topics noted below. In This Month's Newsletter We Review: Is Your Sideline Activity a Business or a Hobby? Self-Directed IRAs Using a...

Principal Residence Gain Exclusion Break

Tax PlanningBradford Tax InstituteIn this newsletter: Gain Exclusion Basics Pass the Ownership and Use Tests What Counts as a Principal Residence Special Considerations If You're Married Special Rule for Unmarried Surviving Spouse Beware of Anti-Recycling Rule When to...

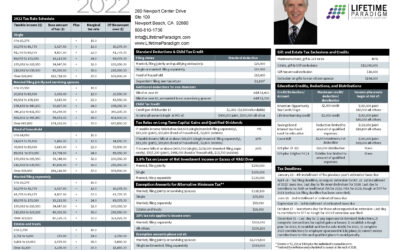

2022 Key Financial Data Guide

Financial GuidesThe 2022 Key Financial Data reference guide puts many important financial numbers right at your fingertips—in a simple graphic format. Organize your finances at your convenience without having to search the internet for numbers on tax brackets,...

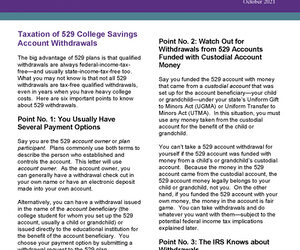

The Smart Tax Planning Newsletter October 2021

Tax-Saving TipsTaxation of 529 College Savings Account Withdrawals The big advantage of 529 plans is that qualified withdrawals are always federal-income-tax-free—and usually state-income-tax-free too. What you may not know is that not all 529 withdrawals are...

The Smart Tax Planning Newsletter September 2021

Tax PlanningEvery month we provide you with a fairly detailed review of several Important Tax Topics. Scan through the highlighted topics noted below. In This Month's Newsletter We Review: Save Your Employee Retention Credit Vaccinated? Claim Tax Credits for Your...

14 Tax Reduction Strategies for the Self-Employed

Tax PlanningIn June's Monthly Tax Newsletter, there was a checklist with 14 tax planning ideas for the self-employed. The ideas expressed were simply one-lines. Below you will find related articles with the nuts and bolts of implementing those tax planning strategies....

How S Corporation Owners Can Cut Taxes by Keeping a Lid on Their Salaries

Tax PlanningBradford Tax InstituteEstimated Tax Tip Savings: Depending on your own salary and profit distribution levels, we're typically seeing cases in which the S corp. owner can legally slash personal payroll taxes by $8,000 - $20, 000 over the coming year. The...

Blueprint for Employee-Spouse 105-HRA (Health Reimbursement Arrangement)

Tax PlanningBradford Tax InstituteThe Affordable Care Act does not apply to a business that has only one employee.1 This opens the door for what we are going to call the 105-HRA. We created this name from its two predecessors: The Section 105 medical reimbursement...

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Tax Planning Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!

SPECIAL REPORT for 2023

Crucial tax changes and updates that will impact individuals and businesses in 2023.

Key Topics We Cover in this Special Report:

- Alert: A Massive New FinCEN Filing Requirement Is Coming

- $80 Billion to the IRS: What It Means for You

- New Law Improves Energy Tax Benefits for Business Owners and Landlords

- Buying an Electric Vehicle? Know These Tax Law Changes

- Get Ready to Say Goodbye to 100 Percent Bonus Depreciation