SECURITIES

Peter Lynch once said “I always thought if you looked at ten companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at hundred you’ll find ten. The person that turns over the most rocks wins the game.”

Synergy Financial Management

Q1 Earnings Season

Shifting into High Gear – Profit Margins in Focus

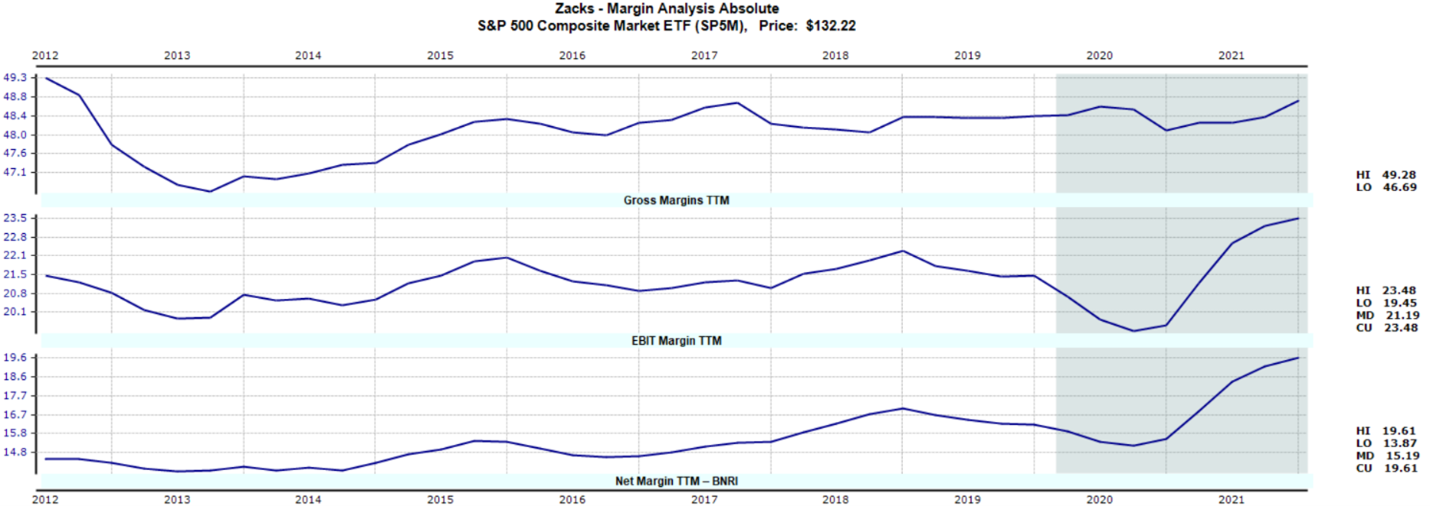

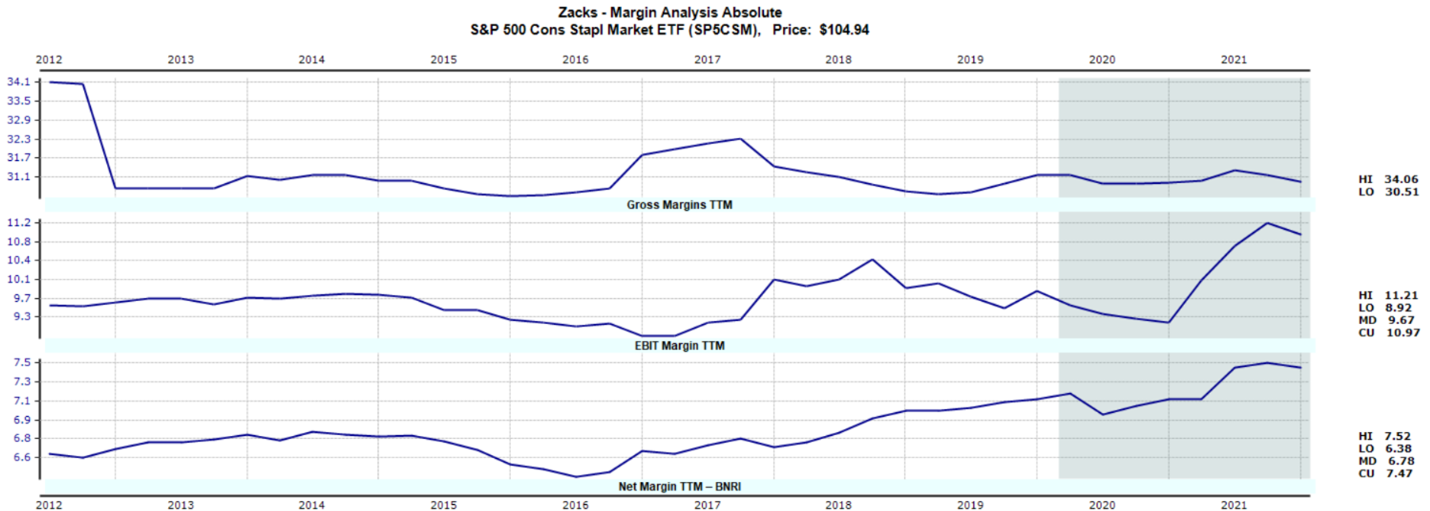

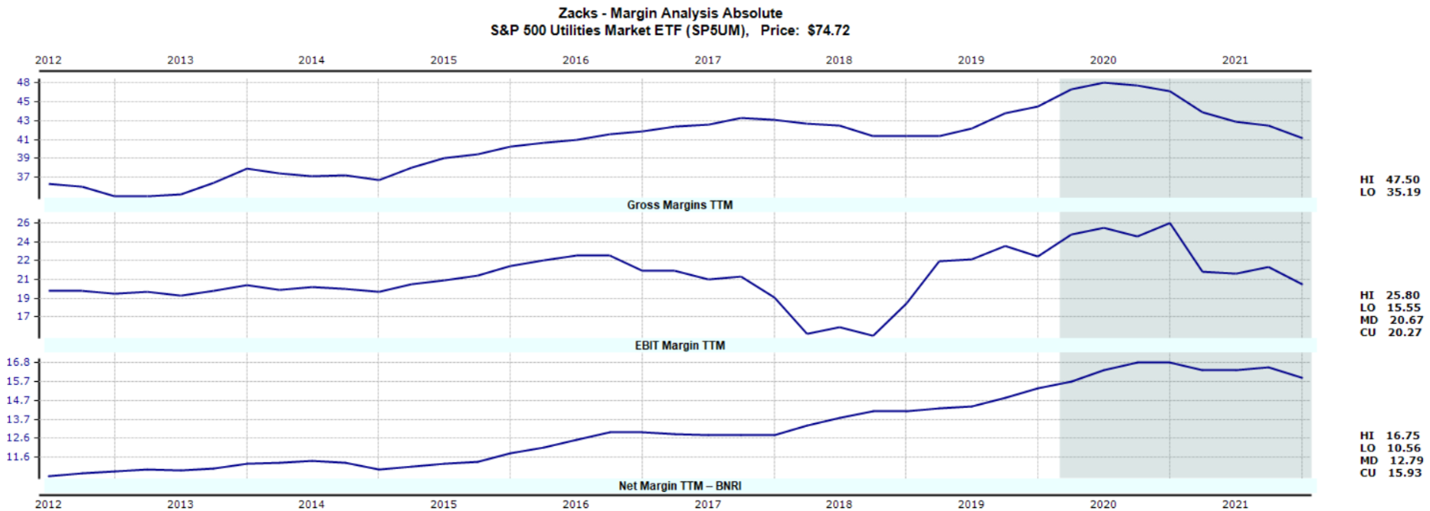

As the rate at which companies begin reporting Q1 results this week increases, it hard not to notice that the S&P 500 market weighted composite is approaching cyclically high profit margins. Rising costs are forcing investors to focus on the profit margins that companies can squeeze out of their operations. Companies like Nike (NKE) have recently reported higher sales but lower earnings from a year ago as higher costs of freight, labor, and logistics weight on margins.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

Securities

Coaching and Consulting

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...