SECURITIES

With evidence of inflation all around us mortgage rates are, predictably, up. Does this mean home prices will now decline? I don’t think so and here are 9 reasons why.

9 Reasons Why This is Not 2008 All Over Again & Why a Big Correction in Home Values is Not Likely to Occur Soon

- Echo boomers, 75 million of them (5 million more than baby boomers) are no longer renting and want to buy homes. (Increased Demand)

- No construction financing since 2008 = No building except for big stock companies like K&B. (Reduced Supply)

- Low rates make buying more and more expensive homes, affordable. (Increased Demand)

- Local building regulations have made it more difficult and more expensive to build new homes. (Reduced Supply + Increased Costs)

- Older population is not downsizing and want to age in place, making normally available inventory, unavailable. (Supply)

- Cost of building materials are up. (Increased Costs)

- Labor supply is down. (Increased Costs)

- Best quality of loans in history, since 2008. (Reduced Supply, via low foreclosure rates)

- Lots of equity, the opposite of 2008. (Reduced Supply)

That said, the Fed has raised its targeted rates and the stock markets are reacting. Tax 5-minutes to read our CIO’s (Joe Maas) opinion on how those increases to mortgage rates will affect our securities investments too.

Synergy Financial Management

Mortgage Rates Rise to 10-Year Record Levels

Friday April 22, 2022

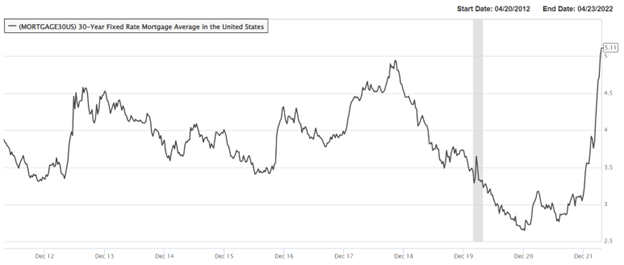

While worries about slowing corporate earnings and rising interest rates led the broader markets to three straight weeks of losses this week, 30-year fixed rate mortgage rates accelerated to their highest levels in over 10 years.

While credit and equity markets are trading and front running all the anticipated 2022 rate hikes by the Federal Reserve, homebuyers are being caught in a riptide of rising mortgage rates that have breached 5% in April after starting the year at only 3.22%. Consider the following $500,000 home loan:

Monthly principal and Interest payment for 30-year fixed rate mortgage @ 5.11% = $2,718

Monthly principal and Interest payment for 30-year fixed rate mortgage @ 3.22% = $2,168

For the same $500,000 loan, the year to date increase in rates represents a 25% increase in monthly principal and interest payments. The increase in rates has forced many homebuyers to the sidelines and serves as a leading indicator of a housing market preparing to slow down.

When you consider housing as a percentage of GDP, you must question how much the Federal Reserve is really going to have to raise rates given the fact that the credit markets have already done much of the heavy lifting. In January 2022, the National Statistics Office released the Q4 2021 GDP numbers showing housing represents 16.4% of GDP which is near historical normal levels.

The Q4 2021 housing share of the U.S. economy represents a taper from 14-year highs set in Q2 of 2020 at 17.8% as other sector of the economy have begun recovering.

As interest rate increases of 2022 begin working their way through the U.S. economy against a backdrop of record high housing prices, look to an overall decline in demand for housing, to do its part in the Federal Reserve objective of an economic “soft landing”. Question remains, is a soft landing still possible at this point? How far will the Fed really have to go to temper the flames of inflation? Whatever the case may be, count on housing to be a major player contributing 1/6th of U.S. GDP.

Summary

Since real-estate is a major asset to most people, it should be integrated into a sound financial plan with special consideration given to how it fits in your investment policy statement (IPS). At Synergy, we can account for your real-estate in our unique fiduciary process because we are both registered investment advisors, and real-estate brokers. Moreover, our team consists of Certified Financial Planners who are available to oversee your entire financial plan with special emphasis on your real estate needs. Especially in the aera of tax planning.

If you have questions, please give us a call 800-810-1736 or email us [email protected]

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ˢᵐ

Securities

Coaching and Consulting

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...