Estate Planning

8 Ideas That Help You Manage a Financial Windfall

Have you ever dreamed of winning the lottery or inheriting a large sum of money? Most people have, at a minimum, thought about it. The interesting thing is that, even if you were to “hit the jackpot”, often riches that fall into our hands can sometimes quickly slip through our fingers.

One study found that one third of the people who received an inheritance had negative savings within two years of the event.

Alex Lasarev grew up in a modest household. Thanks to her frugal mother, she inherited over $1 million as a teenager. However, a lifestyle filled with luxury and bad investments drained her fortune and financially, she ended up back where she started in a relatively short period of time.

Maureen O’Conner married the founder of Jack in the Box. His passing left her with an inheritance valued at over $50 million. Yet, after a series of unfortunate events she became destitute.

“Dishonest money dwindles away, but whoever gathers money little by little makes it grow,” according to the Book of Proverbs.

While a windfall need not be viewed as ‘dishonest money,’ the wisdom from the proverb serves as a warning that a sudden inflow of cash can quickly disappear if proper planning is shunned.

Over the next decade, millennials are expected to inherit $68 trillion, according to a study by Coldwell Banker. While the actual amount will vary wildly, a 2015 HSBC survey suggested that the average inheritance will run about $177,000.

There are, of course, other ways you might come into a large sum all at once. The sale of a property, the settlement of a lawsuit, a year-end bonus, and yes, a winning lottery ticket can create unexpected riches that could enhance your overall well-being or turn into an unexpected nightmare.

How to manage and sustain your windfall

Advice we provide is always tailored to your specific goals and circumstances and what we recommend to one person, or couple, isn’t always the counsel we provide to someone else. That said, there are time-tested financial principles that are the foundation of the advice we provide. The recommendations below are general and are based on long-term data and our experience.

- First things first: don’t do anything – That’s right, do nothing. Place the funds in a safe short-term account such as a money market or savings account for safe keeping. This reduces the temptation to make a big purchase that you may come to regret. It will also give you the time and space to develop a sound financial plan that meets shorter term and longer-term needs and goals.

- Get help – We are always available to entertain your questions and ideas. We’ll assist you in making any adjustments that incorporate the windfall into your financial plan and plug any shortfalls. We can also suggest a tax advisor or CPA, who will help you navigate the tax code and estimate any taxes due. Further, an estate planning attorney will help you create an estate plan.

- Pay off debt – As you develop a plan, consider paying down debt. Do you have credit card debt? Are some of your loans at high rates? If so, wipe out that debts! Not only is it the right thing to do financially, you will also feel an enormous sense of satisfaction eliminating burdensome liabilities.

- Bulk up your rainy-day fund – It’s a great idea to knock out debt, but emergency reserves are an important component of your financial foundation, too. We typically recommend 6-12 months of living expenses in an emergency fund that is safe, liquid and that you can easily access.

- Let’s visit your retirement – Are you on track to comfortably retire? According to the Federal Reserve, only half of American families have a retirement account. Making sure you have enough for retirement is one of the pillars of a sound financial plan.

- Taxes – Did you sell a large property that will incur a capital gain? What are the federal and local taxes that might be due? A conversation with your tax advisor is in order so that you can set aside funds to pay the government. Getting caught flat-footed at tax time is something you want to avoid.

- Support causes that are important to you – Your windfall gives you the freedom to help others. It may also decrease your tax liability. Consider giving directly or through a donor-advised fund. But be leery of friends or family members that warm to you after your newfound wealth or those that present business ideas to you. Having a trusted team of advisors can help you weigh the pros and cons of offers that suddenly come your way.

- Take care of yourself – There is nothing wrong with spending a little bit of money on yourself. Earmark some of your windfall for fun. It may be a short vacation getaway or a few toys that enhance the enjoyment of your hobby. Just be careful you don’t turn one small expenditure into a series of splurges that whittle away at your windfall.

Stocks cruise at a high altitude

Investors that have taken a principled approach to investing and have adhered to a long-term investment plan reaped gains in 2020 and have continued to be rewarded in 2021. More importantly, they are making progress toward their financial goals.

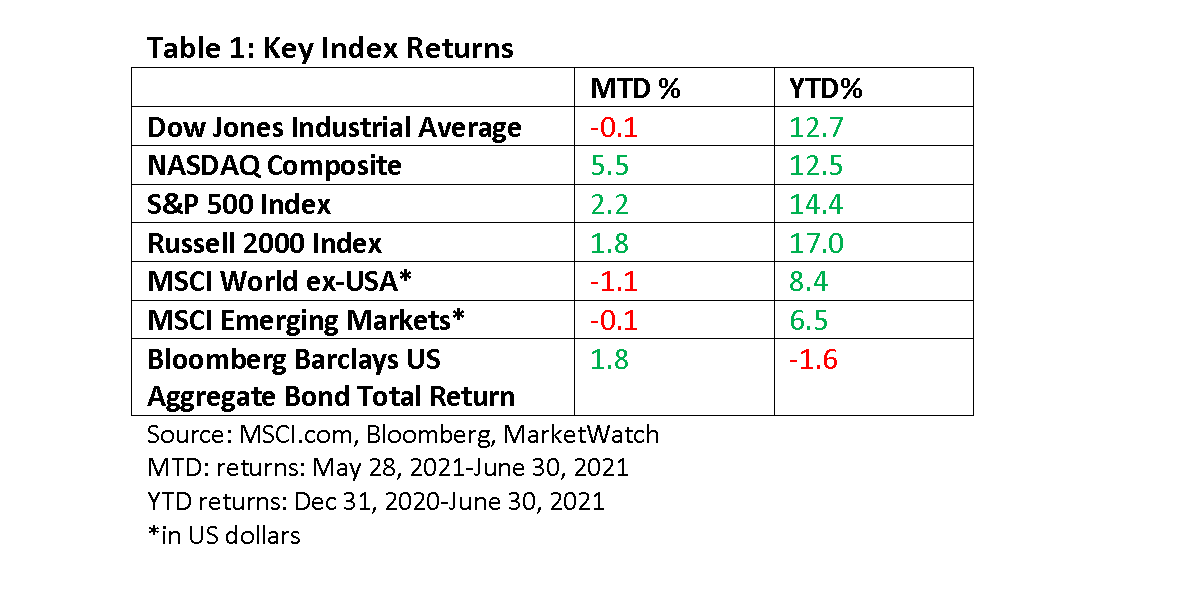

As the first half of the year ended, the S&P 500 Index, which is a broad-based index of 500 larger U.S. companies, ended June at a record high. The better known Dow Jones Industrials, which is made up of 30 large firms, finished the first half with a strong gain of nearly 13%.

Meanwhile, the Russell 2000 Index of smaller companies is up an impressive 17% for the first six months of the year.

Where might we be headed for the rest of the year? While we can use history as a guide, let’s also acknowledge that past performance is no guarantee of how we might perform going forward. I think that is something we all understand, but it bears repeating. That said, please follow me as I briefly dive into the numbers.

Using data from our friends at LPL Research, we learn that bull markets that have emerged from a bear market of at least a 30% decline have had strong returns in the first year. The rally that followed 2020’s bear market (a 34% decline) is no exception.

The average increase in the six bull markets since WWII that followed a 30% or greater decline was 41% in the first year. It’s an impressive one-year return and is a reminder that bear markets usually end unexpectedly. Those who are safely in cash during the decline can find themselves chasing returns.

The first-year increase of 75% from 2020’s bottom ranks as number 1, exceeding 2009’s second place return of 69%. On average, all the bull markets in question have been positive in year two, with an average return for the S&P 500 of 17%.

However, year number two has not been without volatility, with an average pullback during the second year of 10%. Thus far, we have yet to see a meaningful pullback in the broader market indexes, but we are only three months into year two.

What helps drive returns? Momentum, an expanding economy, higher corporate profits, and a generally accommodative policy from the Federal Reserve. Those variables are in place today. But every cycle has its own peculiarities. This year is no different.

The economy has never experienced the kind of lockdown and reopening we are seeing today. It’s uncharted economic territory. So far, growth has been much stronger than most forecasters expected. We can credit massive fiscal stimulus, the reopening of various sectors of the economy, pent-up demand, and the easing and end of social distancing restrictions. But the benefits have been spread out unevenly.

Inflation also remains a concern, though the recent drop in Treasury bond yields suggests that most investors seem to view the recent surge in prices as temporary. We could also see the rate of growth peak in the second quarter as fiscal stimulus begins to wane.

It’s why we default back to the financial plan. It’s the cornerstone of our approach. The short-term traders will react to unexpected events, both positive and negative. But let’s be careful about following their lead. What can impact stocks today can be forgotten by investors tomorrow.

I trust you’ve found this review to be educational and informative. Let me emphasize that it is my job to assist you. If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor.

It’s a good life!

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

You May Also Like…

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...