Tax Planning

8 Reasons Not To Do a Roth Conversion

The Roth IRA is an incredibly effective tool that can save clients lots of taxes down the road. Nevertheless, a Roth is not right for every situation, all of the time. Consider these potential disadvantages before you make the move.

We love Roth IRAs and heartily recommend them in many instances. Roth IRAs come with some great tax advantages, but converting a traditional IRA to a Roth IRA doesn’t make sense for everyone, or all the time. The Roth IRA has eight disadvantages that could make it a far less appealing retirement tool than you realize. If you’re considering a Roth conversion, consider these eight scenarios first.

1. If your tax bracket will be lower in future years

Think about where you want to retire. If you’re a New Jersey resident and plan to retire to Florida, a Roth conversion may not make sense. For example, in New Jersey you have state income tax, but Florida does not. Even if you stay in New Jersey, up to $100,000 of retirement income is excluded from taxation.

This guideline applies to people outside the Northeast as well. Even if you think tax rates will be higher in the future, consider whether you will be in a higher tax bracket. It turns out that many people could be in a lower tax bracket in retirement than during their working years.

Remember that every year, every taxpayer gets to use the lower tax brackets. A large amount of income from RMDs can be pushed into the 10%, 12%, 22% and 24% brackets. If the lower tax brackets are not used, they are lost forever.

Indeed, it might pay to keep some traditional IRA funds to take maximum advantage of the lower tax bracket in the future. The low brackets combined with larger standard deductions may allow future IRA RMDs to be withdrawn at lower rates for many years, significantly reducing the long-term tax bill. This is the main reason that a very small traditional IRA balance is still acceptable and possibly preferred.

2. If you don’t have cash to pay the tax on the conversion

When you convert to a Roth IRA, you are paying tax on your IRA now instead of later in retirement. If you pay the taxes from the IRA, your new Roth IRA will have much less money in it, which is why you shouldn’t plan to use funds from the traditional IRA to pay the tax. Moreover, since money withheld from the conversion for taxes counts as an IRA distribution, if you are under age 59½, you will owe a 10% penalty on the withdrawal in addition to the income taxes.

3. If you might need the money within 5 years

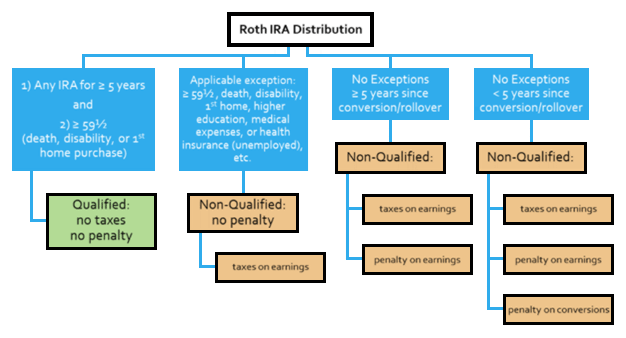

Roth conversions involve a couple of “five-year rules” that can generate taxes or penalties. Roth IRA withdrawal and penalty rules vary depending on the owner’s age, how long they have had the account and other factors. It’s important to note that each Roth conversion has its own five-year clock.

Penalties from early Roth conversions

You can withdraw contributions from a new Roth IRA at any time tax and penalty-free.

Tax-free distributions of Roth earnings

If you are over 59½ and you have met the five-year holding requirement, you can withdraw earnings from a Roth IRA with no taxes or penalties. Even if you have multiple Roth IRAs opened in different years, the five-year clock starts on January 1 of the first Roth IRA. You must be age 59½ or satisfy one of the other exceptions (see the flowchart below) to avoid a 10% early withdrawal penalty and taxes.

If you are 59½ and older but don’t meet the five-year holding period, you are subject to taxes but not penalties. But again, to be clear: every Roth conversion has its own five-year clock—in contrast to a Roth IRA where the five-year rule is satisfied by any Roth IRA that has been opened.

Source: Your Wealth Knowledge

4. If you plan to leave your IRA to a charity

Do you plan to give a portion of your money to a charity once you pass on? Nonprofit organizations are usually exempt from paying any taxes on the distribution of funds from any IRA. So, it wouldn’t make much sense to convert a traditional IRA, pay taxes and then leave the Roth IRA to a charity.

Since traditional IRA funds are pretax, they are the best assets to give to charity, particularly considering the SECURE Act. Since a charity receiving these assets will not pay taxes for selling the assets and withdrawing them, prepaying taxes by converting to a Roth IRA effectively means the charity would get fewer funds.

5. If the beneficiary will have a lower tax bracket

Did you know that if the IRA is large enough, it will likely be left to someone else at your client’s death? When it comes down to deciding whether to convert (or not), it may come down to which account owner—you or your beneficiary—is likely to be in a lower marginal tax bracket.

However, after death, traditional IRAs inherited by nonspouse beneficiaries (children or grandchildren) are now subject to a withdrawal period of 10 years since the passing of the SECURE ACT at the end of 2019. So you will want to keep the traditional IRA balance relatively low, but not necessarily to $0—see the first point above.

6. If the estate is not large enough

If assets aren’t near the estate lifetime exemption limit, a Roth conversion may not make as much sense for estate planning reasons. Doing a Roth conversion, taxes must be paid from assets, thereby reducing the size of the estate and thus the amount of estate assets potentially subject to federal or state estate tax.

If the value of the estate isn’t close to $5 million, it wouldn’t make sense to do a Roth conversion to save federal taxes, but it could make sense to save state taxes. Before making a decision to do a conversion, evaluate your situation from all angles.

7. If you are expecting big-ticket medical expenses

If all traditional IRA monies were converted to Roth IRAs, there would be no traditional IRA distributions left to absorb future medical deductions (or other itemized deductions), and the deductions would be lost. This includes nursing home costs and other big-ticket expenses related to medical conditions. Why pay taxes and then waste the deduction?

8. If you own a business

If you own a business now—or in the future—future losses could be used against IRA distributions, reducing (or even eliminating) the tax impact on those withdrawals. If there were no traditional IRA funds and little other income, those business losses might be wasted.

As mentioned above, the Roth IRA is an incredibly effective tool that will often allow you or your heirs to pay less taxes down the road. Having said that, it is not the perfect tool in every situation.

It’s a good life!

You May Also Like…

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...