Tax Planning

Act Now! Get Your Safe-Harbor Expensing in Place

Bradford Institute

Here are two tax words that you have to love: “safe harbor.”

And here are five additional tax words to love: “tax-favored expensing with no recapture.”

To create and protect your safe-harbor expensing, you make-or your corporation or partnership makes-a formal election on your tax return to use the de minimis safe harbor to expense assets costing $2,500 or less (or $5,000 with applicable financial statements, as explained later).

This wonderful safe-harbor election eliminates the burdens of

- tracking those small-dollar assets,

- depreciating and/or Section 179 expensing them in your tax returns and account books, and

- remembering to remove them from your books when you remove the assets from your business.

The term “safe harbor” means that the IRS will accept your expensing of the qualified assets if you properly abided by the safe-harbor rules.

For asset purchases that don’t qualify for safe-harbor expensing-no problem: you have Section 179 expensing and Section 168(k) bonus depreciation available

Big Picture

It’s crucial to ensure your safe-harbor expensing is set up by January 1, 2024, for the upcoming tax year. This is why we’re sharing this article with you in October 2023, providing you with ample time to establish your safe harbor for 2024.

If you’ve employed safe-harbor expensing in previous years, you should have already included your safe-harbor election on your prior-year tax returns.

Overview of This Big Benefit

Let’s take a closer look at the significant advantage of this approach. Imagine you’re a small business that chooses the $2,500 safe-harbor expensing limit. Now, you purchase two desks, each costing $2,100. The invoice specifies a quantity of “two” and a total cost of $4,200, including $378 in sales tax and a $200 delivery and setup charge, totaling $4,778.

Without the safe harbor, you would have traditionally treated each desk as a capital expense, amounting to $2,389 each ($4,778 divided by 2). This would have necessitated Section 179 expensing or depreciation for both desks, and they would have remained on your depreciation schedule until you disposed of them.

However, with the safe harbor in place, you can simply expense the desks as office supplies, eliminating the need for cumbersome tracking of these assets in your accounting records.

Safe Harbor

The de minimis safe harbor, when implemented,

- requires you to immediately deduct as business expenses any assets with less than a specific dollar amount that you select (within limits), and

- gives you a regulatory advance agreement from the IRS that it will not, in an audit, challenge your election to expense. (1)

What’s Your Limit?

The regulations establish two safe harbor thresholds, and one of them is applicable to your situation. Your eligibility hinges on whether your business possesses an “applicable financial statement.” If your financial statements have undergone an audit by a certified public accountant (CPA) or a similar process, you qualify as having an applicable financial statement (AFS).(2)

The difference between having an AFS and not having one is this:

- When you have an AFS, you can opt for tax-deductible expensing of up to $5,000 per invoice or item.(3)

- In the absence of an AFS, you have the option to select a tax-deductible expensing limit of $2,500 per invoice or item.(4)

Creating the Safe Harbor

To leverage the advantages of the safe harbor provision, you should follow four essential steps.

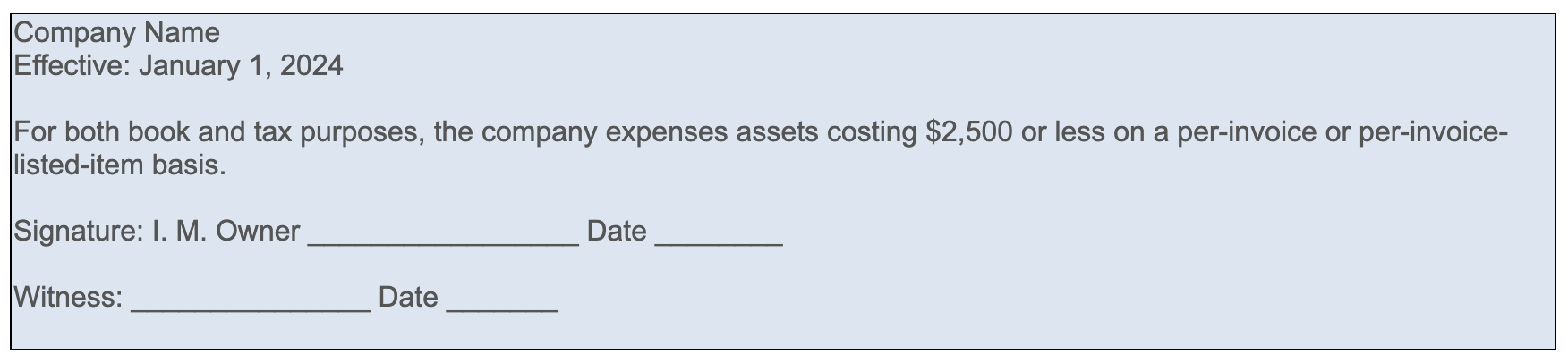

Step 1: Develop and Adhere to an Expense Policy

To ensure your eligibility for the safe harbor protection, you must institute an accounting policy at the commencement of the tax year, mandating the expensing of items within an amount of your choosing, up to either the $2,500 or $5,000 threshold.(5)

Furthermore, you must comply with this expense policy in your financial records and books. If you opt to expense items with a cost of $2,500 or less, you must expense every such item in your books. Mixing expensing with capitalization is not allowed.

But why wouldn’t you set your expense policy threshold at the maximum safe harbor limit consistently? The reason lies in the fact that this threshold doesn’t just apply to your tax return; it also has implications for your financial statements. You might have valid reasons for wanting to present a different financial image to your bankers or shareholders than you do to the IRS.

Key Insight: It’s crucial to remember that the $2,500/$5,000 threshold acts as a cliff; any cost exceeding this limit will not qualify for the safe harbor provision.

Step 2: Document Your Expense Policy in Writing

If you possess an AFS, the IRS requires that your expense policy is in written form at the inception of the tax year.(6)

In cases where you lack an AFS, the IRS mandates that you have established accounting procedures in place at the start of the year, designating the safe-harbor amounts as expenses for non-tax purposes.(7)

Key Point: The “accounting procedures” requirement for non-AFS scenarios doesn’t have to be documented in writing. This implies that it encompasses what you practically implement and have been consistently following. Nonetheless, it is advisable to put this in writing to prevent potential IRS inquiries regarding the specifics or existence of your procedure.

Another rationale for documentation is provided in the IRS’s introductory statements regarding expensing regulations. The IRS clearly states that the de minimis safe harbor is designed to simplify record-keeping for taxpayers by permitting them to adhere to an established financial accounting policy for federal tax purposes, without allowing retroactive modifications, as this would contradict its intended purpose.(8)

Note the added proof that this policy is real and in place. It’s signed by the owner, dated, and also signed by a witness and dated. In fact, consider having the statement notarized, because that sets the date in stone.

Step 3: Save Your Invoices

The safe harbor provision applies only to items documented by invoices. It’s crucial to adhere to the following record-keeping guidelines:

- Invoices serve as evidence of the purchase.

- Canceled checks, bank transfers, or credit card charges confirm your payment.

You should maintain both proof of purchase and proof of payment within your tax documentation.

Itemized versus lump-sum invoices. To apply the safe harbor on a per-item basis, you want the invoice to identify the separate items.

Let’s consider a scenario where you purchase 20 computers, each priced at $2,000. If the invoice lists each computer separately or indicates the quantity and per-unit cost, the safe harbor allows you to deduct the entire $40,000.

However, if the invoice includes additional charges such as delivery fees or installation costs, you must allocate those expenses to the items in a reasonable manner. This allocation can be achieved using methods like specific identification, pro-rata allocation, or a weighted average based on the item prices.

Example: For instance, if the freight charge for the 20 computers amounts to $2,000, a reasonable allocation would be $100 per computer ($2,000 divided by 20), resulting in a total cost of $2,100 per computer.

It’s important to note that separately invoiced additional costs, such as fees paid to a different company for installing the computers on your office network, cannot be allocated to the 20 computers for the purposes of the safe harbor provision.

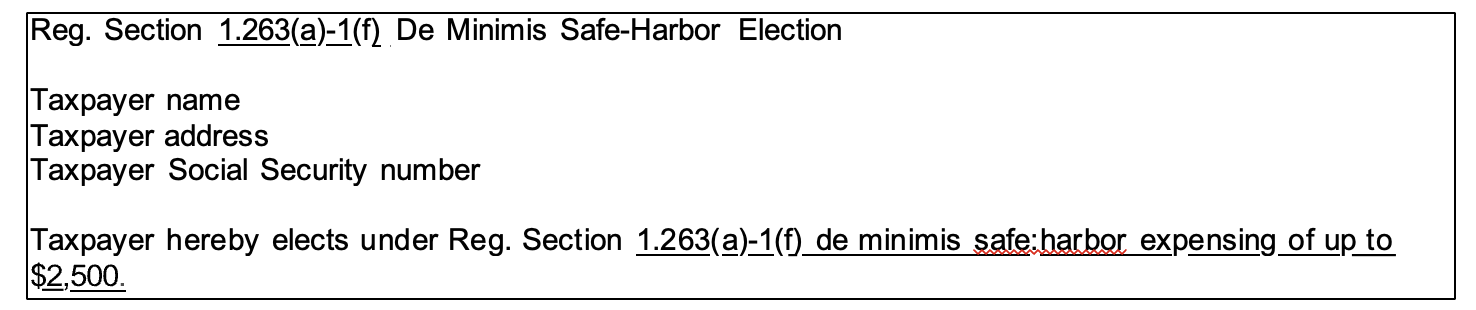

Step 4: Make the Election on Your Tax Return

If you wish to take advantage of the safe harbor provision, you need to officially declare your election on your annual tax return. This declaration must be made every year you intend to utilize the safe harbor.(11) To make the election, you should attach a statement to your federal tax return and ensure that you file your tax return by the due date, including any extensions.(12)

The statement must be titled “Section 1.263(a)-1(f) De Minimis Safe-Harbor Election” and must include your name, address, and Social Security number, plus a statement that you are making the de minimis safe-harbor election under Reg. Section 1.263(a)-1(f).

Here’s some language to use for the safe-harbor election:

There are two important points to keep in mind. Firstly, the election associated with your tax return is something you must do annually. Secondly, you have the flexibility to modify your accounting policy for expensing in any given year. However, when making such changes, it’s vital to document them in a new or updated expense policy or statement at the beginning of the year.

In general, you may not file an amended return either to make or to revoke the election.(13)

Sale or Disposition of Safe-Harbor Property

When you sell or dispose of safe-harbor property, it’s important to note that you do not classify it as a capital asset according to Section 1221, nor as property used in a trade or business as defined by Section 1231.(14)

The funds generated from the sale result in ordinary income, and this income is not subject to self-employment taxes.(15)

Takeaways

Safe-harbor expensing is the preferred choice for its time and convenience benefits, and here’s why:

- Safe-harbor expensing is superior to Section 179 expensing because you don’t have the recapture period that can complicate your taxes.

- Safe-harbor expensing takes depreciation out of the equation.

- Safe-harbor expensing simplifies your tax and business records because you don’t have the assets cluttering your books.

- Safe-harbor expensed assets do not reduce your overall ceiling on Section 179 expensing.

To implement safe-harbor expensing effectively:

- Establish an expense policy at the start of each year.

- Document this expense policy in writing and adhere to it consistently.

- Retain your invoices for proper record-keeping.

- Ensure you make the annual election to expense on your federal income tax return.

- Reg. Section 1.263(a)-1(f).

- Reg. Section 1.263(a)-1(f)(1)(i); an AFS is either (a) a financial statement filed with the Securities and Exchange Commission (SEC) (the 10-K or the Annual Statement toShareholders); (b) a certified audited financial statement that is accompanied by the report of an independent CPA (or in the case of a foreign entity, by the report of a similarlyqualified independent professional) that is used for credit purposes, for reporting to shareholders, partners, or similar persons, or for any other substantial non-tax purpose; or (c) a financial statement (other than a tax return) required to be provided to the federal or a state government or to any federal or state agency (other than the SEC or the IRS).

- Reg. Section 1.263(a)-1(f)(1)(i).

- Notice 2015-82.

- Reg. Sections 1.263(a)-1(f)(1)(i)(B); 1.263(a)-1(f)(1)(ii)(B); Notice 2015-82.

- Reg. Section 1.263(a)-1(f)(1)(i).

- 1.263(a)-1(f)(1)(ii)(B).

- T.D. 9636.

- Reg. Sections 1.263(a)-1(f)(1)(i)(D); 1.263(a)-1(f)(1)(ii)(D).

- Reg. Section 1.263(a)-1(f)(3)(i).

- Reg. Section 1.263(a)-1(f)(5).

- Ibid.

- Reg. Section 1.263(a)-1(f)(5).

- Reg. Section 1.263(a)-1(f)(3)(iii).

- IRC Section 1402(a)(3)(c).

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (for Consumer and Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Retirement Planning

Tax Planning

Coaching and Consulting

Need More Information?

If you require additional details regarding these services, please don’t hesitate to reach out to us via email or phone at (800) 810-1736. Alternatively, you can schedule a complimentary 15-minute consultation to inquire further and determine whether we align with your needs and expectations. We look forward to assisting you!

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.