Financial Guides

Last Chance Financial Planning Checklist 2023

Often our financial picture and plan changes from year to year. Changes in different areas of your life can impact that overall plan. It is important to note and discuss these changes each year to ensure you are still on track for your financial goals.

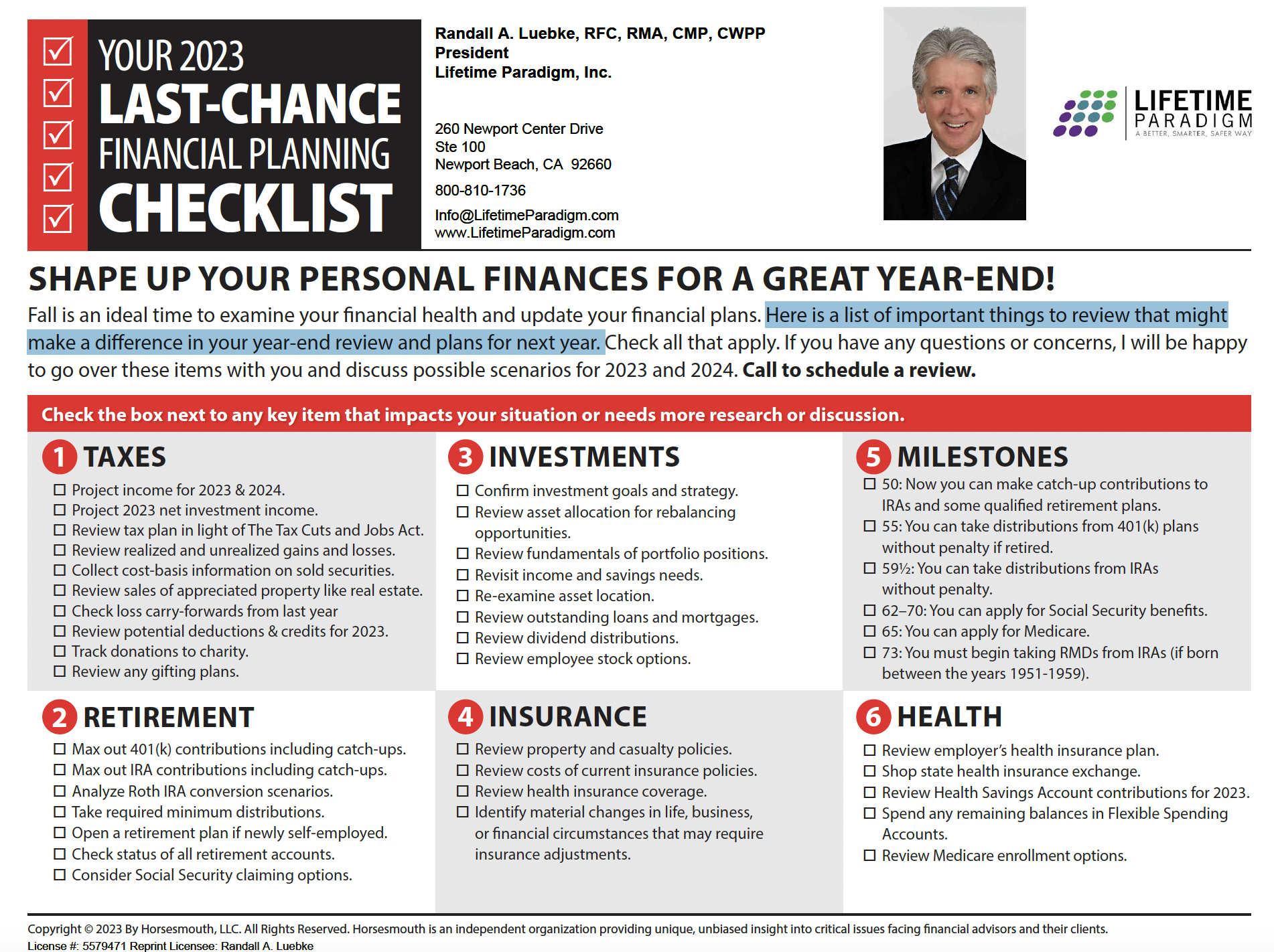

Below is our 2023 Last-Chance Checklist. We call this checklist “Last Chance” because it reminds us to take a look at some areas – like taxes, investments, health care, insurance, and retirement – that might need our attention before the end of the year.

As you’ll see, it’s quick and only should take about 5 minutes to complete.

I strongly encourage you to review this checklist as soon as possible. If you see areas that need attention, we should address them right away.

If you have a friend or family member who could benefit from this year-end checklist, please let me know and I’ll be happy to send them one as well with no obligation.

You can conveniently access the full guide by downloading it from the link provided below.

If you have any questions, need assistance, or seek further clarification on any of these areas, please don’t hesitate to reach out to us by phone or email. We are always here to provide the guidance and support you require.

Last-Chance Financial Planning Checklist 2023

Here is a list of important things to review that might make a difference in your year-end review and plans for next year.

SERVICES WE OFFER RELATED TO THIS TOPIC

The information contained in this post is for general use and educational purposes only. However, we do offer specific services to our clients to help them implement the strategies mentioned above. For specific information and to determine if these services may be a good fit for you, please select any of the services listed below.

The 4x4 Financial Independence Plan ℠

The Smart Tax Minimizer ℠ (for Consumer and Home-Based Businesses)

The Smart Tax Planning System for Business Owners ℠

Retirement Planning

Tax Planning

Coaching and Consulting

Need More Information?

If you require additional details regarding these services, please don’t hesitate to reach out to us via email or phone at (800) 810-1736. Alternatively, you can schedule a complimentary 15-minute consultation to inquire further and determine whether we align with your needs and expectations. We look forward to assisting you!

EP 0012. The Three Generations of Annuities

The Financial Independence Now Podcast Hosted by Randy LuebkeIn Episode 12 of the Financial Independence Now podcast,...

11 Financial Tips to Make Caregiving Easier

Tax Planning Caregivers generally tend to their elderly/ disabled family members as a labor of love, but it can also...

EP 0011. Budgeting for Dummies

The Financial Independence Now Podcast Hosted by Randy LuebkeIn this episode of Financial Independence Now, host Randy...

Investment Advisory Services are offered through Lifetime Financial, Inc., a Registered Investment Advisory. Insurance and other financial products and services are offered through Lifetime Paradigm, Inc. or Lifetime Paradigm Insurance Services. Neither Lifetime Financial, Inc. nor Lifetime Paradigm, Inc., or its associates and subsidiaries provide any specific tax or legal advice. Only guidance is provided in these areas. For specific recommendations please consult with a qualified, licensed Advisor. Past performance is no guarantee of future results. Your results can and will vary. Investments are subject to risk, including market and interest rate fluctuations. Investors can and do lose money and, unless otherwise noted, they are not guaranteed. Information provided is for educational purposes only and is not intended for the sale or purchase of any specific securities product, service or investment strategy. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER, TAX PROFESSIONAL, OR ATTORNEY BEFORE IMPLEMENTING ANY STRATEGY OR RECOMMENDATION DISCUSSED HEREIN.

This message is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient, any dissemination, distribution or copying of this communication is strictly prohibited. If you think you have received this communication in error, please notify us immediately by reply e-mail or by telephone (800) 810-1736 and delete the original message.

This notice is required by IRS Circular 230, which regulates written communications about federal tax matters between tax advisors and their clients. To the extent the preceding correspondence and/or any attachment is a written tax advice communication, it is not a full "covered opinion." Accordingly, this advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.