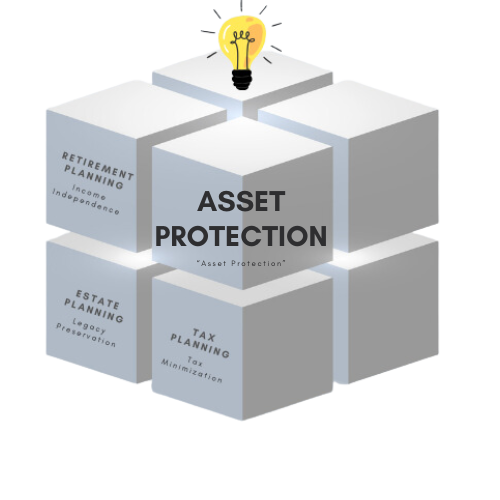

Asset Protection

Our asset protection strategy is to create barriers, boundaries, and safety nets to protect you and those your care about most. Most asset protection plans fall short because, while your assets include stocks, bonds and real estate, for many their single biggest asset will be their ability to earn an income over their lifetime. This asset needs to be protected too! Our complete asset protection plan is designed to protect all your assets to give you the peace of mind you really want and need.

Proprietary Services for Asset Protection

The Smart Asset Protection Planner ℠

The 4x4 Financial Independence Plan ℠

Products for Asset Protection

Annuities

Charitable Trusts & Annuities

Delaware Statutory Trusts

Insurance-Disability

Insurance-Life

Insurance-Long Term Care

Micro-Captive Insurance Companies

Mortgages-Forward

Mortgages-Reverse

No-Load Annuities

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Retirement Plans - Pension & Profit Sharing Plans - The Super(k)

Retirement Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Coaching and Consulting

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Asset Protection Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!

BLOG

Browse All Asset Protection Articles, Videos, Podcasts

Cybersecurity Monthly Newsletter October 2023

Asset ProtectionIn this issue: Staying One Step Ahead: How Seniors Can Avoid Cybersecurity Attacks Cybersecurity Shorts Software Updates Welcome to your October Savvy Cybersecurity newsletter. Read on to learn more about: An update on the major Las Vegas cyberattack...

Cybersecurity Monthly Newsletter September 2023

Asset ProtectionIn this issue: Three Scams Targeting College Students Cybersecurity Shorts Software Updates Welcome to your September Savvy Cybersecurity newsletter. Read on to learn more about: A major cyberattack hits Vegas The long list of software you should...

Cybersecurity Monthly Newsletter August 2023

Asset ProtectionIn this issue: AI and Phishing: The New Threats Cybersecurity Shorts Software Updates Welcome to your August Savvy Cybersecurity newsletter. Read on to learn more about: The new SEC cybersecurity rule Software you should update immediately And much...

Cybersecurity Monthly Newsletter July 2023

Asset ProtectionIn this issue: Building Powerful Cybersecurity Habits Cybersecurity Shorts Software Updates Welcome to your July Savvy Cybersecurity newsletter. Read on to learn more about: An Apple update you must install A data breach at one of the nation's largest...

One Ugly Rule for Owners of S Corporations Deducting Health Insurance

Tax PlanningBradford Tax InstituteAn ugly rule applies to how S corporation owners deduct the cost of health insurance that a corporation puts on its W-2s. The words that make this an ugly rule are “earned income,” and this is unusual because you generally think of...

Inflation Update May 2023

Asset ProtectionSynergy Asset Management, LLCSummary: Consumer-focused measures of inflation, such as CPI and PCE have been trending down but remain elevated, while the Producer Price Index points to a hopeful reality if producers chose to pass on lower inflation....

Cybersecurity Monthly Newsletter May 2023

Asset ProtectionIn this issue: Goodbye to the password? Cybersecurity Shorts Software Updates Welcome to your May Savvy Cybersecurity newsletter. Read on to learn more about: Salesforce websites leaking data New AI cybersecurity hacks And much more Goodbye to the...

Cybersecurity Monthly Newsletter April 2023

Asset ProtectionIn this issue: Cybersecurity and AI: The Bad Cybersecurity Shorts Software Updates Welcome to your April Savvy Cybersecurity newsletter. Read on to learn more about: Cybersecurity and AI: The Bad Artificial intelligence is being pushed to new limits...

Cybersecurity Monthly Newsletter February 2023

Asset ProtectionIn this issue: An Update on Tax Identity Theft Cybersecurity Shorts Software Updates Welcome to your February Savvy Cybersecurity newsletter. Read on to learn more about: An update on the Experian website glitch A cyberattack hits the FBI And more An...