Estate Planning

We look at our financial life in two phases; one while we are living and the other when we are not. We refer to these two phases as, your life and your legacy. Think of estate planning as asset protection once you are no longer physically able to make choices and decisions. The goal of estate planning is to ensure that you will always be in control of your wealth, while you are living and to create your legacy.

Proprietary Services for Estate Planning

The Smart Legacy Plan Organizer ℠

The 4x4 Financial Independence Plan ℠

Products for Estate Planning

Annuities

Charitable Trusts & Annuities

Delaware Statutory Trusts

Insurance-Disability

Insurance-Life

Insurance-Long Term Care

Micro-Captive Insurance Companies

Mortgages-Forward

Mortgages-Reverse

No-Load Annuities

Real Estate Rentals (Direct)

Real Estate Rentals (Partnerships & Syndications)

Retirement Plans (Company Sponsored) Pension & Profit Sharing Plans - The Super(k) ℠

Retirement Plans (Self-Directed) IRA's, 401(k)'s, SEP's, SIMPLE's, Roth's

Coaching and Consulting

Why You Need an Estate Plan

You need an estate plan, regardless of whether or not you are among the ultra-rich. As recent news has shown, even those who have won the lottery or have substantial wealth can fall victim to poor estate planning.

While federal estate taxes may not concern you, you need a will to have your wishes honored after your death. Without a will, state law dictates the distribution of your assets, which may not align with your intentions. Additionally, if you have minor children, a will allows you to name a guardian to care for them in the event of your untimely passing.

Your heirs will want to avoid probate because it can be a costly and time-consuming legal process. A living trust gives you a valuable tool to avoid probate. By transferring legal ownership of your assets to the trust, you can ensure that your beneficiaries receive them without suffering through probate.

You can amend your living trust as circumstances change, providing flexibility and control over your assets.

It is also essential to keep your beneficiary designations up-to-date, as they take precedence over wills and living trusts regarding asset distribution. (Our Smart Estate Plan Protector ℠ will help you with this).

Additionally, if your estate will suffer from federal or state death taxes, you should plan to minimize your exposure.

Estate planning is not a one-time event but a process that you should review and update regularly to accommodate life changes and fluctuations in estate and death tax rules. We recommend checking your estate plan annually to ensure it aligns with your wishes and circumstances.

If you have any questions or concerns about estate planning, please do not hesitate to contact us.

Schedule a FREE 15-Minute

Initial Consultation to Discuss Your

Estate Planning Needs

This initial interview will help us understand your unique situation and, for you to learn about us; to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!

BLOG

Browse All Estate Planning Articles, Videos, Podcasts

Tax Considerations When a Loved One Passes Away (Part 2)

Estate PlanningA financially comfortable loved one has passed away. In this year of seemingly endless bad news, that's not an uncommon situation—sad but true. The now-deceased loved one may have been single or married and may have been a relative or not. In any case,...

Tax Considerations When a Loved One Passes Away (Part 1)

Estate PlanningA financially comfortable loved one has passed away. In this year of seemingly endless bad news, sadly, that’s not an uncommon situation. The now-deceased loved one may have been single or married, and may or may not have been a relative. In any case,...

Monthly Client Newsletter December 2020

Wrapping up 2020 It’s a new year! How did you do with your year-end tax planning? Let’s review some questions and important tax strategies that you might still be able to take advantage of now and start the new year off right by implementing these tax strategies...

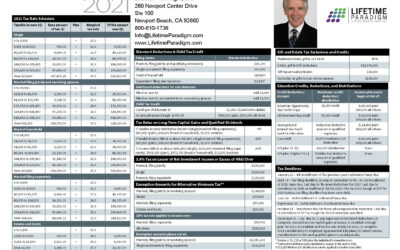

2021 Key Financial Data

Financial Guides Happy New Year to you and your family! I hope you and your family had a safe and healthy holiday season, leaving you recharged to move full steam ahead into 2021. As we enter a new year, it’s a good time to review your tax plan in light of changes to...

Estate PlanningIf you get sick and require hospitalization due to COVID-19, you will be immediately isolated from family. So the time to finish up any unresolved advance planning and organization is now.Self-isolation and quarantines have given rise to unique problems...

Last Will & Testament: Add A Letter Covering These 14 Wishes

Having a will is necessary, but there is a great deal of information the legal document does not include. Here’s what to cover in a supplemental letter that specifies preferences, discloses critical logistic info, and will save your family significant stress during a...

Home Equity Conversion

If you own your home, and you have at least 50% equity to market value, watch this video to learn how you can (and why you should) convert that home equity into a contract that will allow you to withdraw annual tax free income at retirement. Click here or click image...

A Widow’s Worst Nightmare

The Smart Estate Planning NewsletterWhat can be worse than losing a spouse—especially with young children to raise? How about being forced to go through probate and losing needed assets to ex-spouses and estranged family members? If only there had been a will....

Estate Tax Liquidity

If you have a current net worth of at least $5,000,000 growing faster than inflation, and want to minimize the estate tax your family will need to pay when you pass on, watch this short video to learn how you can protect the value of your estate from the IRS. In...