Professionals

Financial & Legal Professionals

We collaborate with financial and legal professionals to provide tailored support for their clientele. Our team offers expert advice and strategic guidance aimed at optimizing tax savings and facilitating the journey towards financial independence.

If you are interested in learning about the ways we can assist, we invite you to schedule a complimentary 15-minute consultation. During this session, we can discuss your specific needs and those of your clients.

If you have any questions regarding our services, please don’t hesitate to reach out to us at [email protected].

Latest News

Browse All Articles, Videos, Podcasts for Professionals

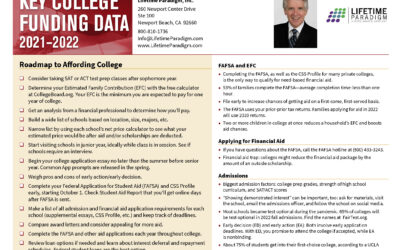

Key College Funding Data 2021-2022

Retirement PlanningI know that figuring out how to pay for college is one of the biggest challenges families face today. I've seen many overpay for college and hurt their savings and retirement plans. I don't want that to happen to you. Below you will find a link to...

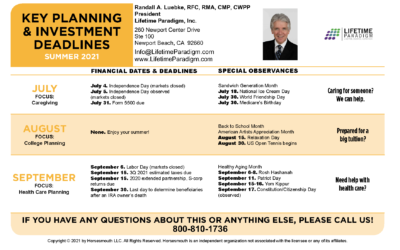

Key Planning & Investment Deadlines Summer 2021

Financial GuidesSummer is here! And it's time for your Summer Key Planning & Investment Deadlines reference card. Every quarter, I like to send clients, family, and friends a reminder reference card of all the key financial deadlines heading our way over the next...

A Quick Guide to Retirement Plans for Small Business Owners

ProfessionalsAs a business owner, you may be surprised to find that offering the right retirement plan may significantly benefit both you and your employees. Here’s an overview of all the major features of each kind of retirement plan, including SIMPLE, SEP, 401(k),...

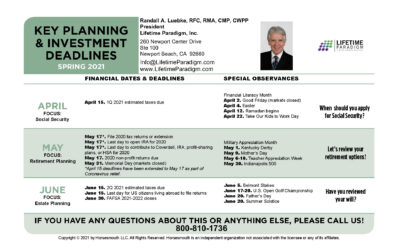

Key Planning & Investment Deadlines Spring 2021

Financial GuidesFor this reason, I want to share our reference card entitled, "Key Changes from the Tax Cuts and Jobs Act”. This chart touches on aspects of your tax plan that you will want to look at every year with your accountant. Naturally, I am just a phone call...

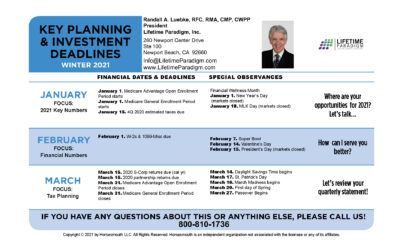

Key Planning & Investment Deadlines Winter 2021

Financial GuidesDo you know what days the market closes for 2021? Or when different tax forms are due? Or when the various enrollment periods for Medicare and health insurance begin and end? Each year brings with it a host of new dates, deadlines, and observances to...

Monthly Client Newsletter December 2020

Wrapping up 2020 It’s a new year! How did you do with your year-end tax planning? Let’s review some questions and important tax strategies that you might still be able to take advantage of now and start the new year off right by implementing these tax strategies...

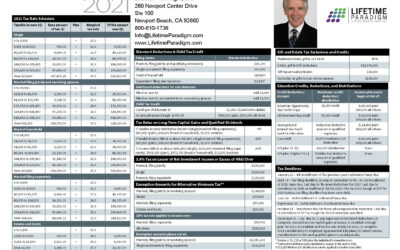

2021 Key Financial Data

Financial Guides Happy New Year to you and your family! I hope you and your family had a safe and healthy holiday season, leaving you recharged to move full steam ahead into 2021. As we enter a new year, it’s a good time to review your tax plan in light of changes to...

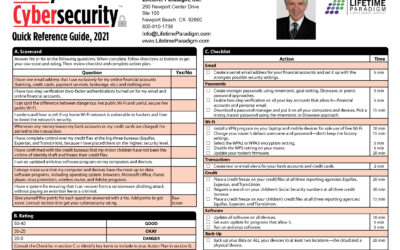

Savvy Cybersecurity Quick Reference Guide 2021

Asset Protection A scorecard to measure your cybersecurity levels, a checklist for actions to take to boost your security, and a "My Action Plan" so you'll know the next steps to take to immediately boost protection against fraud. IMPORTANT The information contained...

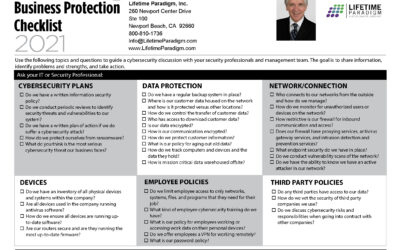

Savvy Cybersecurity Business Protection Checklist 2021

Asset ProtectionUse the following topics and questions to guide a cybersecurity discussion with your security professionals and management team. The goal is to share information, identify problems and strengths, and take action. IMPORTANT The information contained in...