— Services

The Smart College Cost Eliminator ℠

A turn-key college planning system. A better, smarter, safer way to fund your child’s college education, protect your assets, and minimize costs of obtaining a college degree.

Protect Assets

Protect your retirement assets from depletion in funding your child’s education expenses.

Minimize Costs

Minimize your costs associated with your child obtaining a college degree.

Guidance

Guide you and your child through a 4-year in-depth process of preparing for college, choosing a college and a career.

Benefits

The Smart College Cost Eliminator ˢᵐ provides both parents and students with tools and professional, comprehensive, organized, self-guided help to make the best choices in obtaining a college degree and in the most cost-effective way.

The Smart College Cost Eliminator ˢᵐ will help identify the net cost of obtaining a college degree, after receiving financial aid benefits, as well as determining if the process is likely a 4, 5, or 6-year term to complete.

The Smart College Cost Eliminator ˢᵐ will help your student prepare for college all the way through high school, with detailed action plans and checklists to guide them through the process.

The Smart College Cost Eliminator ˢᵐ will help both students and parents identify the potential career paths and costs associated with completing the necessary education. The system will then compare those costs to the likely earnings, so you can ensure you and your child are making the right choice.

You can trust that The Smart College Cost Eliminator ˢᵐ system was developed by an expert in college and career planning with a Doctorate specializing in high education.

With The Smart College Cost Eliminator ˢᵐ , you will be provided with tutorials, guides, checklists, calculators, forms, literally everything you need to plan for college, choose a college, choose a career path, all while obtaining a degree and minimizing your expenses.

Are these your concerns?

The cost of college continues to rise every year at a rate higher that is higher than inflation.

Most often, the costs for college are paid with after-tax savings. This hides the real costs.

Get Started

Enroll now to get started with The Smart College Cost Eliminimator ˢᵐ. Discover a better, smarter, safer way to fund your child’s college education.

If you have any questions about college planning, we are here to help. Contact us at [email protected].

What You Get:

Minimize expenses, and obtain a college degree in the most cost-effective way

Tutorials, guides, checklists, calculators, forms

Help planning for college

Guidance for choosing a college based on costs and career paths

Help with scholarships and Federal Student Aid

Installment payment option available

Let’s Get Moving!

Enroll Today

Checkout to get started. If you follow the program, we can guarantee you will benefit from this service.

[email protected]

800.810.1736

Helpful Guides and Newsletters

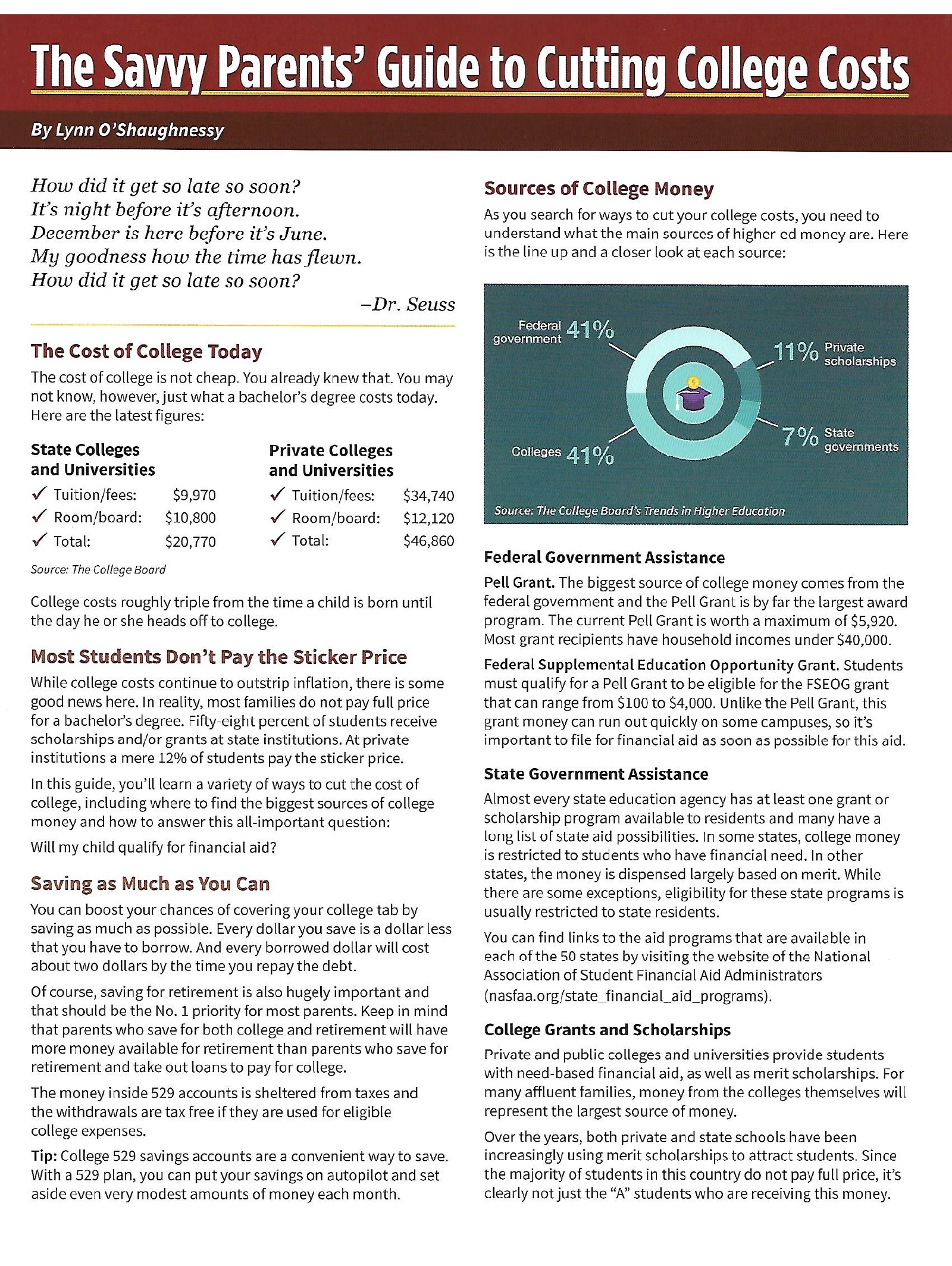

“The Savvy Parents Guide to Cutting College Costs”

Saving, 529 Accounts, Sources for College Money, Athletic Scholarships, Financial Aid, How Investments Impact Financial Aid, Discovering Real Costs, Borrowing.

“Tax Act Helps College Savers and Disabled Children”

The Tax Cuts and Jobs Act has made 529 plans more flexible, such that parents can access these funds for younger students and to benefit their children who are disabled.

“How Parent & Child Assets Impact Financial Aid”

Parents with big investments and home equity generally find it harder to get financial aid for their college-bound children. But if you understand how assets are assessed on the FAFSA and CSS Profile, you can improve your chances for getting the best financial aid package possible.

Do you know how your investments might reduce your chances for financial aid?

“Does Where You Go To College Matter?”

What really drives student outcomes, the truth about college rankings, and how to find the right college fit for a student.

“Schools that Offer Full Scholarships 2019”

State by state listing of over 500 schools.

“Schools that Don’t Provide Merit Scholarships”

Why these elite institutions don’t give out merit awards.

“The Ultimate College List Builder”

Looking for gems in a universe of 817 colleges and universities.

Plus, 6 smart steps to finding generous colleges.

“The Ultimate List of Most Generous Colleges 2019”

75 schools that meet 100% of financial need, and dozens more that come close.

PUBLIC RESOURCES

Financial Aid Forms

Financial Aid Help

- Federal Student Aid site

- Federal Student Loan Guru

- National Association of State Financial Aid Administrators

Researching Schools

- College Scoreboard

- College Board

- Niche

- COLLEGEdata

- College Navigator

- College Transitions

- 925+ “Top Tier” Schools Deemphasizing the ACT/SAT in Admissions Decisions for Fall 2021

- Colleges That Change Lives

Researching Graduation Rates and Job Outcomes

College Sport Information

- The National Collegiate Athletic Association

- ScholarshipStats.com

- How To Win an Athletic Scholarship by Lynn O’ Shaughnessy